Western Central Banks Playing with Hyper Inflationary Fire

Interest-Rates / Central Banks Nov 09, 2015 - 06:12 PM GMTBy: Mario_Innecco

There are various examples in history of when national currencies have been debased so much that confidence in those currencies have been lost to such an extent that the nominal value of hard assets and productive assets in those currencies have gone up in a parabolic fashion. The grandaddy of currency debasement was the reichsmark during the Weimar Republic period in the early 1920s Germany. There are present day examples of currency debasement and rising local stock prices like Argentina and Venezuela but we will focus on the German example.

There are various examples in history of when national currencies have been debased so much that confidence in those currencies have been lost to such an extent that the nominal value of hard assets and productive assets in those currencies have gone up in a parabolic fashion. The grandaddy of currency debasement was the reichsmark during the Weimar Republic period in the early 1920s Germany. There are present day examples of currency debasement and rising local stock prices like Argentina and Venezuela but we will focus on the German example.

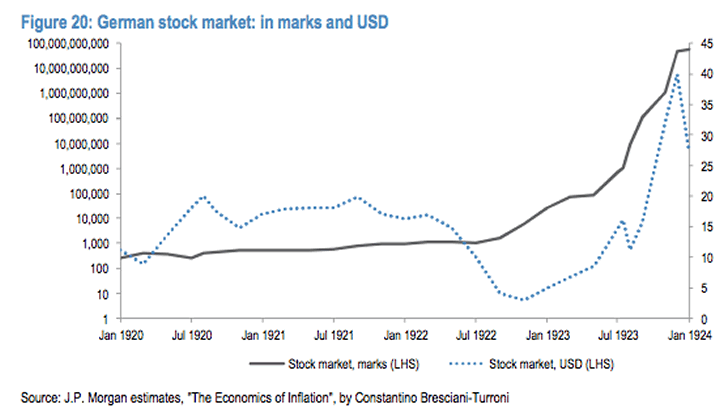

Have a look below at how the stock market performed during the Weimar period in recihsmark and U.S. dollar terms (which at the time was as good as gold). Notice how from 1920 to the middle of 1922 the stock market in Germany was going sideways in both currencies and then it started to move up very quickly in reichsmark terms and drift lower in dollar terms. By the end of 1923 or about eighteen months later the stock market went from an index value of below reichsmark 1000 to reichsmark 100’000’000’000 (100 billion). In dollar terms the move was up but not parabolic, as the index was valued under $30 at the end of 1923 after having traded just above $20 in the middle of 1920.

This example of the bull market in Weimar Germany clearly illustrates the difference between price and value as one can see that productive assets represented by the stock market index held their value fairly well in terms of gold or U.S. dollar while the nominal value in reichsmark might have gone up parabolically one has to have a look at how the reichsmark performed versus gold or the U.S. dollar. In February of 1920 $1 bought rmark 100.5 and then at the height of the hyper inflation $1 was buying close to rmark 5 billion! Looking at the data from that period though, one will notice that the reichsmark did not plummet in a straight line from 1920 to 1924 as back in January of 1921 the dollar had actually dropped from rmark 100.5 the previous February to rmark 74. We suspect this period of reichsmark strength must have driven a great deal of German dollar holders back to their home currency but it was nothing but a brief respite for the reichsmark as the heavy burden of war reparations made it virtually impossible for Germany to ever repay its debt in real terms. The Inter-Allied Reparations Commission decided that Germany had to pay back 269 billion gold marks in reparations to the Allied nations. 269 billion gold marks at the time was the equivalent of 110’000 metric tonnes or half of all the gold mined in history. It is not surprising that a massive money printing policy was implemented by Reichsbank president Rudolf Havenstein.

So almost one hundred years later and almost a decade after the Great Financial Crisis of 2008 the West has racked up enormous amounts of government debt, welfare state liabilities, corporate debt, student debt and derivatives debt. To be sure there has not been a devastating global war and all the debt that has been incurred in the last few decades since the break up of the Bretton Woods system on August 15th, 1971 is purely the result of monetary and fiscal recklessness. With global debt calculated roughly around $230 trillion or 300% of global GDP one has to wonder if we are witnessing a similar kind of situation that Mr Havenstein faced back in the early 1920s. One worrying aspect about this debt montain is that the $230 trillion figure does not include unfunded liabilities of Western welfare states. The U.S., for example, is claimed to have $211trillion of unfunded liabilities and that does not include the official public or national debt of $18.5 trillion. And what about financial institutions risk exposure to financial derivatives? According to Egon von Greyerz financial derivatives exposures amounts to $1’400 trillion or $1.4 quadrillion and the great bulk of this exposure is held by a handful the Too-Big-To-Fail systemically important financial institutions (SIFI) of the Western world.

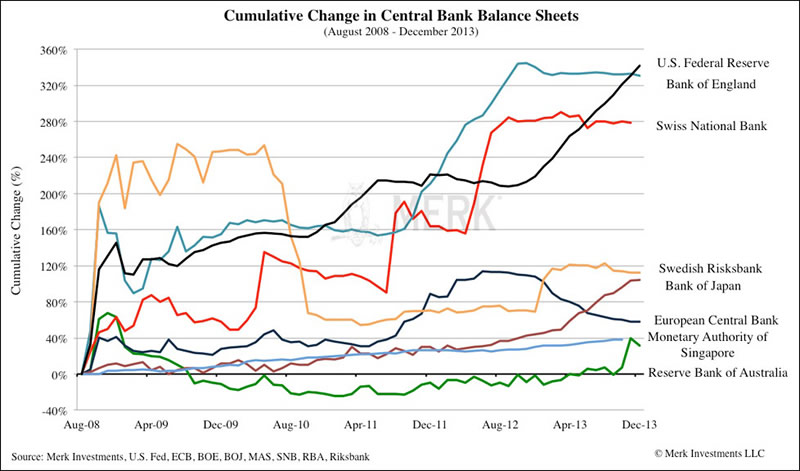

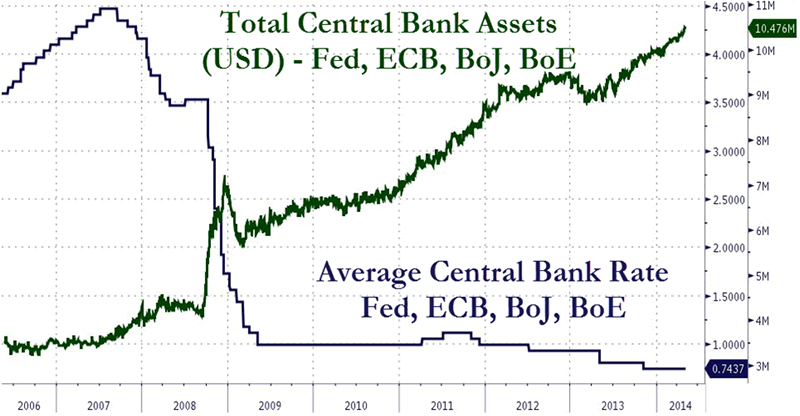

When we look at these scary numbers is it any wonder that the major central banks of the world have embarked on a policy of monetary debasement and zero interest rates? We are told by the Federal Reserve and its peers that it is not debasement but a policy of quantitative easing and that it is not money printing because they will eventually raise interest rates and then sell off or sterilise the trillions of toxic assets that they have added to their balance sheets since the Great Financial Crisis of 2008. The ECB or European Central Bank is even talking about making their official interest rates even more negative!

Source: Zerohedge

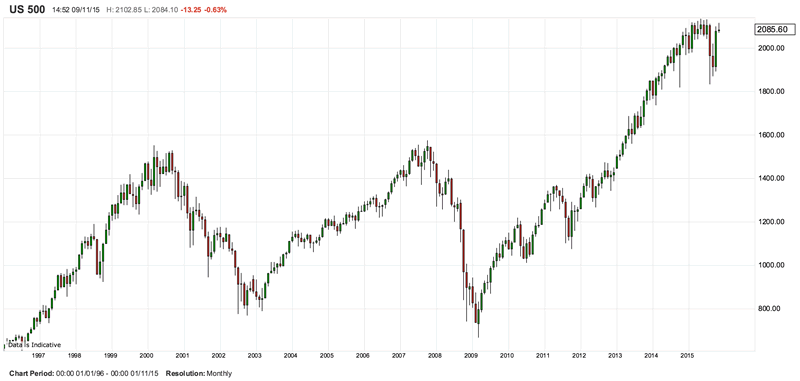

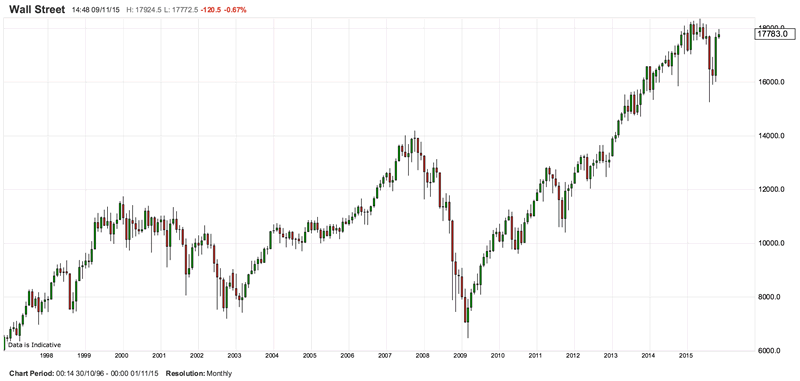

So the question we at Forsoundmoney ask is the following. Are we in 1921 when gold or the U.S. dollar had dropped from reichsmark 100.50 one year earlier to 75 reichsmark and a hyperinflation of the German currency seemed an outlandish idea? For the last few years the fiat dollar has strengthened versus gold as the gold price has dropped from a high of $1923 in 2011 to a present level of around $1100 so is it time to get rid of gold just like many Germans probably sold their dollars back in July of 1921? Aside from gold we think people also need to keep an eye on the Dow Jones Industrial Average and the Standard and Poors 500 Index as we have seen these indexes rebound from a significant drop earlier this year in August and we are now within striking distance of the all-time highs reached in May of 2015. Could we see U.S. stock markets embark on a Weimar ride?

S & P 500 Index. Source: IG Markets

Dow Jones Industrial Average Index. Source: IG Markets Ltd

Best regards,

By Mario Innecco

http://forsoundmoney.com

A Futures and Options broker in London for twenty years

Mario Innecco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.