Is the Stock Market Ready to Rally Now?

Stock-Markets / Stock Markets 2015 Nov 16, 2015 - 09:45 AM GMTBy: Brad_Gudgeon

The last time I wrote, I said I was looking for a bottom in the US stock market around the 12th of November. I honestly thought we would pull back harder than we have. As of Friday November 13th, the SPX has tagged the .382 Fibonacci retracement of the September 29-November 3rd rally near 2022, less than a 5% pull back.

The last time I wrote, I said I was looking for a bottom in the US stock market around the 12th of November. I honestly thought we would pull back harder than we have. As of Friday November 13th, the SPX has tagged the .382 Fibonacci retracement of the September 29-November 3rd rally near 2022, less than a 5% pull back.

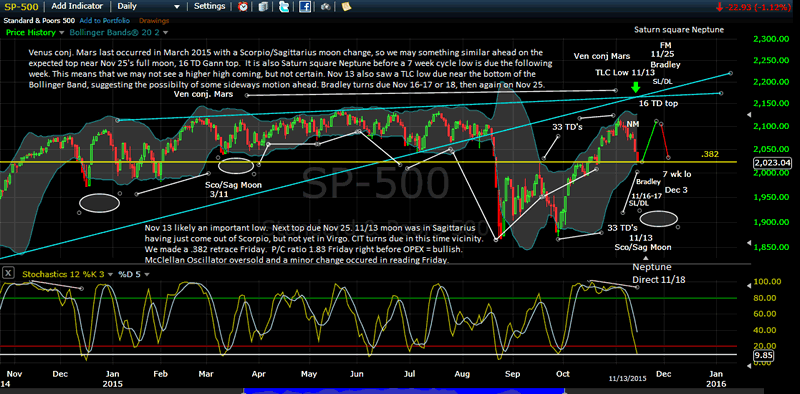

The chart below explains why I believe we have bottomed or are close to bottoming. The cycles suggest a rally into around November 25 from here. I don't know if this will be a failing rally or a new recovery high is on the way. After Thanksgiving we should have another pull back into early December to satisfy the 7/14 week low.

As of this writing on Sunday, November 15, the SPX futures are down about 6 points in Europe. If we make a lower low Monday, this will be the first time this year that a low will be made while the moon has transitioned into Capricorn. Most of time it has made the buy low right after the moon has transitioned out of Scorpio into Sagittarius, but not into Capricorn (the chart wrongly states Virgo). The moon transitioned into Capricorn on November 14th.

Also, I had two TLC lows due on the 13th, and the perfect 33 TD top to bottom symmetry representing the 16/32 TD low +1 and the 8 TD low +2. Rarely does an 8 TD low go into TD 11. The 4 TD low is due no later than Monday at +1, but ideally late Friday from November 9.

There are important CIT's due today and early next week with the Bradley Siderograph dates of Nov 16-18 . P/C Ratios were high going into OPEX week and this normally suggests a bullish OPEX week. If the market goes lower Monday morning, it will be an anomaly caused by the unfortunate events in Paris on Friday, in my humble opinion, and a buying opportunity.

S&P500 Daily Chart

As far as gold and the gold mining sector are concerned, we could see weakness Monday followed by some strength into late week, but I don't see a bottom yet. Accumulation/ Distribution shows a new low coming and the 18-22 week low is still 2-4 weeks away. The current sideways action looks like a bear flag to me. I'll elaborate more on gold this next weekend.

Bottom line: gold looks sideways this week but then down again into late November/early December and the US stock market either has bottomed in the cash market or is about ready to bottom, with a rally into around November 25 and then some weakness into early December expected.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.