Is a Major Stock Market Top Forming?

Stock-Markets / Stock Markets 2015 Nov 17, 2015 - 03:09 PM GMTBy: Harry_Dent

I warned in early October that stocks looked like they were setting up for another sharp crash into the height of the “crash season” in mid-October.

I warned in early October that stocks looked like they were setting up for another sharp crash into the height of the “crash season” in mid-October.

Instead, we got rate cuts in China, rumblings of stronger QE in Europe, and a continued rally at home.

In other words – central banks delayed the inevitable. Again.

So let’s look at where the markets are today…

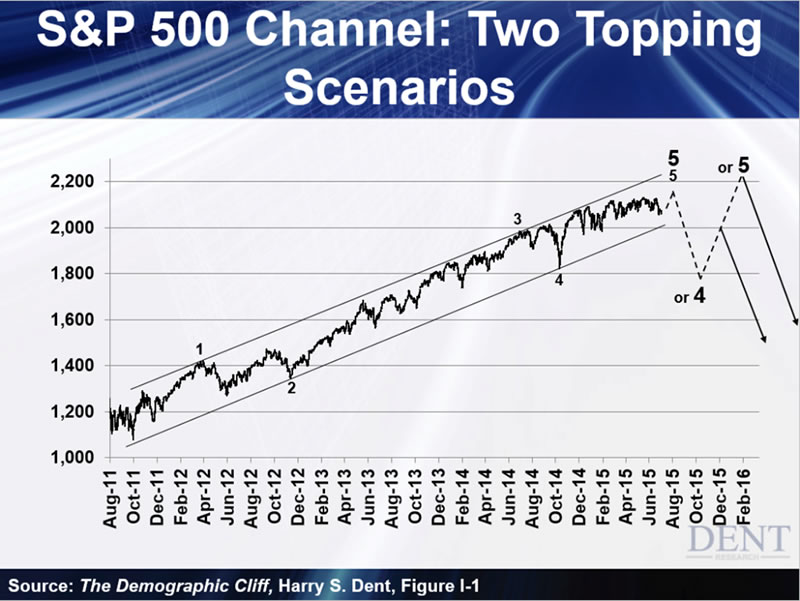

In the revised paperback version of The Demographic Cliff back in the summer, I gave two scenarios for an impending peak in stocks. The chart gave leeway for a potential new high, which is why you see two large “5’s” at the top there:

In both scenarios, we would see a break of the narrow and bubbly channel that had been rising since late 2011.

We got that.

The question was… how high would they bounce after that initial breakthrough?

The first scenario was the S&P 500 would fall toward 1,800 and then have a two-wave rally back toward 2,000.

That still looked likely at the beginning of October... back when oil and China’s Shanghai Composite Index were trading in a narrow range. That suggested another short crash to follow.

Clearly that wasn’t the case. The S&P 500 breached 2,100 and came to within a percent of its peak.

So, scenario two took the cake… wherein the large cap markets would make slight news highs, or at least come close to retesting those highs. The Nasdaq 100 actually did make a very slight new high last week before pulling back.

If the markets outside of that index fail to make new highs – folks, that’s a bearish signal if I ever saw one.

But even if they do make slight new highs… that would very likely set up a number of major divergences as Adam has been pointing out.

Damned if we do, damned if we don’t.

Either way, it doesn’t look good.

And we’re already seeing such divergences. Over 50% of S&P 500 stocks are trading below their 200-day moving average. Investors have grown very selective, favoring only the largest stocks.

And for the Dow Industrials to make a new high without Dow Transports or Utilities – that’s another divergence! A major one, at that.

Then there’s the advance/decline line – showing how many stocks are rising versus those that are falling. And guess what? Another divergence there! This rally has been very selective to large-cap stocks. To point, the Russell 2000 which lists small-cap stocks is 8% off its high. And it’s increasingly doubtful it’ll make a new one even if the S&P finally does.

Here’s the bigger picture…

It looks like a major top is forming.

Rodney just wrote yesterday about the business cycle of mergers, acquisitions, and borrowing that appears to be peaking…

At our Irrational Economic Summit in Vancouver I presented on a series of what looked like major tops forming consecutively in the major world markets…

Junk or high yield bonds peaked in November of 2013. We warned about it right on the day of the top.

Dow Transports clearly peaked in November 2014, with Dow Utilities two months later in January. (Transports especially are very unlikely to make a new high in the coming months.)

Then in April we saw the DAX peak in Germany and the FTSE in England – down 24% and 19% at their worst, respectively, and new highs look very doubtful there as well.

Then the Shanghai peaked in June – which we also called the day of – and has been down as much as 45%.

“But Harry, that index is up over 20% from its recent low.”

It’s still down almost 30%!

And the only reason it’s popped up is because China’s government has poured hundreds of billions of their currency into propping it up!

Trust me – that bubble is still in burst mode and has almost zero chance of making a new high!

Finally the Nasdaq peaked in late July. Again, the Nasdaq 100 has been the only index to make a slight new high, but not enough to change the course of the future.

Adam has been warning of at least of a short-term pullback, and that is happening. So keep alert to Adam’s comments in the coming days and weeks.

It’s likely we see a slight new high in the S&P 500 – around 2,135 if not higher – by late this month, and possibly a slight new high in the Dow.

But even if that were the case… there would be divergences galore. And that would signal even more strongly a major long-term top – and a 2008-like crash, only stronger in 2016.

If only the largest cap U.S. markets are able to make slight new highs…

At this point, that would be very bearish.

The odds are that the Fed will raise rates a quarter point in December, and that could be bad for stocks and bonds.

I think something will go wrong in the world by then instead.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.