Is the Stock Market "Courting Catastrophe?"

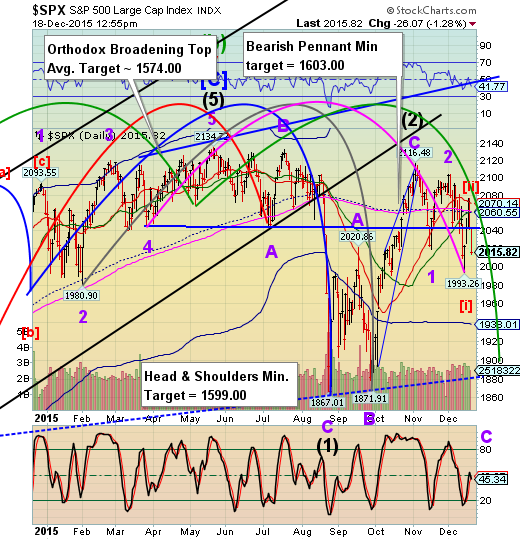

Stock-Markets / Stock Markets 2015 Dec 18, 2015 - 07:44 PM GMT On the surface, it seems like a “normal” trading day in the SPX. It is not. The chart gives it away by showing the daily volume already at the to of its daily range and it’s not yet 1:00 pm.

On the surface, it seems like a “normal” trading day in the SPX. It is not. The chart gives it away by showing the daily volume already at the to of its daily range and it’s not yet 1:00 pm.

Back in 2006 I had the privilege of talking with Andrew Smithers, who was part of the investigation team to determine what caused the Crash in 1987. He had been interviewed by Barrons Magazine in a now famous article entitled, “Courting Catastrophe.”

Subsequent to that, I also had a series of interviews with Andrew in 2006-2007 prior to the market crash. I cannot find the article, but can summarize what was said.

The first point was that, no matter how overvalued the market may be, it will continue to rise as long as publicly traded corporations continue to plow their excess cash into stock buybacks. As you well know, for the past several years, not only have corporations used all of their free cash flow, but also borrowed extensively to buy back shares. That practice is now coming to an abrupt close as their main source of financing through junk bonds has suffered a major reversal and earings are in decline. Even investment grade bonds are seeing outflows.

The second main point has to do with the options market. Typically there are always bulls and bears. Options sellers are always happy to sell calls because they will use their own long positions as a buffer when calls mature in the money and their shares usually sell at a premium since markets close higher after options expiration.

In addition, many institutional options sellers will sell both puts and calls in a technique called “delta hedging.” As long as both puts and calls stay within two standard deviations of the mean daily price, this practice will at least break even.

The problem with options rises when there are currently too many put buyers. There is no way this situation can be delta hedged. This is why the market is being “defended” at 2000.00 SPX. Should SPX drop below 2000.00, the only way to pay for the “in the money” puts is to sell short, or gamma hedge. The problem is, when short selling begins, it builds on itself. With computers always monitoring the situation, you have the potential for an instantaneous meltdown. There is simply no way for everyone to hedge in this predicament.

That is why so much attention is being paid to SKEW. SKEW is a condition where speculators load up on out-of-the-money puts in an amount that cannot be handled on a normal basis. Thus, the sentiment as recently reported by SKEW is very bearish. Either nothing happens, as it did in September and October, or a complete meltdown occurs. Although SKEW has come down in the past few days, it is still above its mid-Cycle support at 127.49 so this is still a dangerous condition until this options period expires.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.