Gold Price Higher In Most Currencies in 2015 – Up 4% This Week

Commodities / Gold and Silver 2016 Jan 08, 2016 - 12:19 PM GMTBy: GoldCore

- Gold acts as safe haven in 2015 … for those who need safe haven

- Gold acts as safe haven in 2015 … for those who need safe haven

- Gold gains in CAD, AUD, NZD, ZAR, RUB & most emerging market currencies

- Gold essentially flat in EUR (-0.3%) as ECB QE supports gold

- Gold lower in USD, GBP, CNY, INR, JPY, CHF

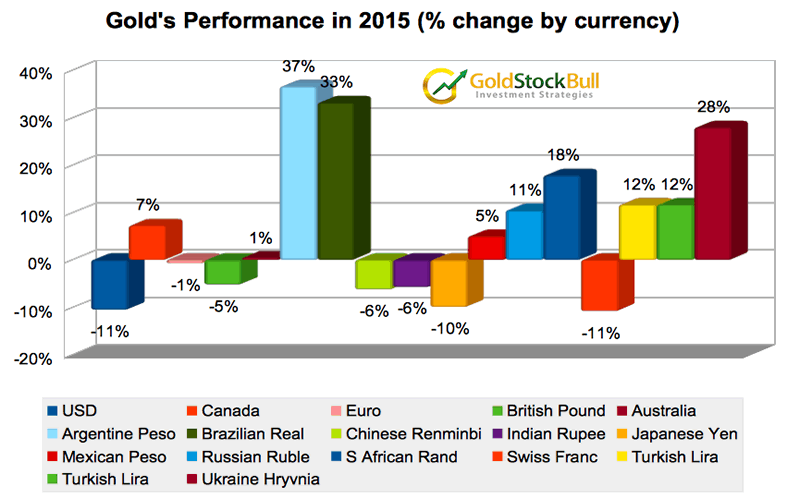

- Of 18 major currencies, gold was higher in 11 currencies and lower in 7

- Hallmarks of market bottoming and bodes well for 2016

- Gold over 4% higher in USD, EUR and GBP so far in January

Gold Price Performance in Global Currencies in 2015 (Goldstockbull.com)

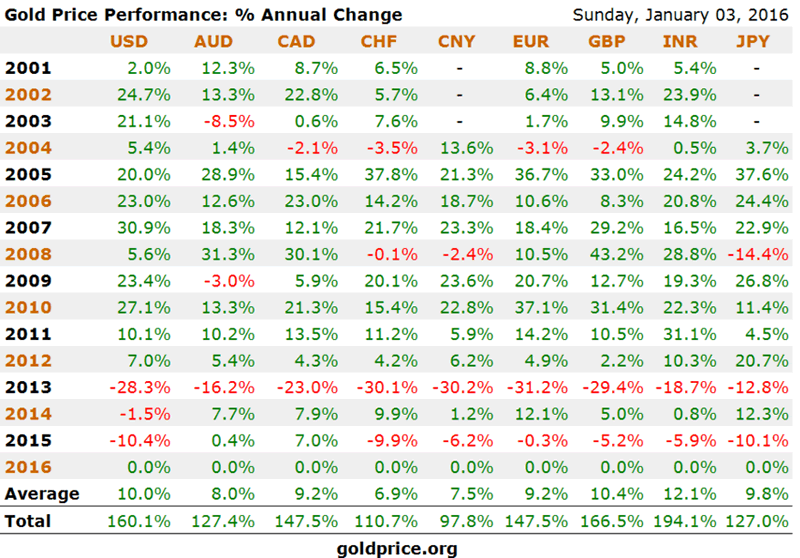

Gold performed its traditional role as hedge against currency depreciation again in 2015. Many currencies saw sharp losses and concurrent gold price gains. This trend has continued in the first week of 2016, with gold up by more than 4% in most currencies.

In 2015, gold fell in dollars (USD), sterling (GBP), Chinese yuan (CNY) , Indian rupee (INR), Japanese yen (JPY) and Swiss francs (CHF).

However, gold was higher in Canadian dollars (CAD), Australian dollars (AUD), New Zealand dollars (NZD), South African rand (ZAR) and of course the Russian rouble (RUB). Indeed, gold was higher against nearly all emerging market currencies.

It is important to note that more than 90% of global demand for gold comes from outside the U.S.

Gold was essentially flat in euro terms (EUR), down 0.3%) as ECB money printing supported gold in “single currency” terms.

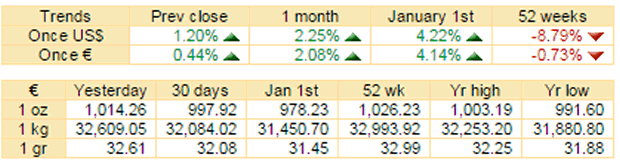

24hgold.com

It is important to again emphasise that gold bullion buyers buy gold in local currencies and have exposure in and to local currencies. UK investors buy gold in sterling, Australians in Australian dollars, Swiss investors buy in Swiss francs, Germans in euros and so on. Therefore, it is important for non-U.S. investors to focus on gold in local currency terms. Indeed, it can be of value for U.S. investors to consider gold in non dollar terms as periods of gains in other currencies often presage gains in U.S. dollar terms.

The sole focus of gold in dollar terms and the 10% fall of gold priced in dollars has led to some negative comment about gold’s annual fall, the “third year of losses.” This is contributing to poor and indeed negative sentiment towards gold in some western markets – particularly in the UK and Ireland. This is bullish from a contrarian perspective and suggests we may be bottoming.

Even after the falls seen in these currencies in 2015, contrary to popular opinion, gold remains one of the best performing assets in the last 10 and indeed 15 years. In annual average percentage terms, gold is between 7% and 12% per annum higher since 2001 as the world has embarked on competitive currency devaluations and currency wars. Gold has seen even larger average annual percentage gains in other currencies.

In the short term, gold has had a difficult time and has experienced what we believe has been a healthy period of correction. This has been frustrating for gold owners but will be beneficial to the gold market in the long term. It has washed out the speculative froth that was entering the market in 2011 and 2012.

It is testament to gold and silver’s inherent strength that they have outperformed many paper assets in local currency terms, even assets which have been positively targeted by the Fed and other central banks and boosted by loose monetary policy – such as major stock indices and bond markets.

Much economic analysis continues to focus solely on gold in dollar terms and discusses gold with the continuing assumption of a U.S. and global economic recovery and economic growth. Recent data calls this into question and suggests that the recovery in the real economy is poor at best.

The resilience of gold in 2015 and gains seen in many currencies against the backdrop of a strong dollar, record highs in stock markets, the collapse of oil and commodity prices and negative sentiment in the U.S. and UK towards the precious metals is encouraging.

The assets that performed well in recent years – stocks and bonds – are by and large those that have been bloated by monetary stimulus on a scale that the world has never seen before.

These bubbles are increasingly vulnerable and will likely burst – the question is when rather than if. Indeed, the turmoil that we have seen on international markets appears a foretaste of a very volatile 2016. We have been warning that today we see conditions akin to those seen in 2007 and 2008. George Soros echoed those concerns this week.

It is worth remembering – as many seem to have forgotten – that gold was one of the few assets to rise in the financial crash of 2008 and in the debt crisis 2007 to 2012 period. It has underperformed since as stocks and bonds roared to artificially induced record highs. It is due a period of outperformance soon and we believe it will outperform in the 2016 to 2020 period.

Gold’s financial insurance attributes will again protect those who have diversified into it in 2016.

8 Jan LBMA Gold Prices: USD 1097.45, EUR 1,009.86 and GBP 750.67 per ounce

7 Jan LBMA Gold Prices: USD 1096, EUR 1,009.45 and GBP 752.51 per ounce

6 Jan LBMA Gold Prices: USD 1083.85, EUR 1,009.66 and GBP 739.84 per ounce

5 Jan LBMA Gold Prices: USD 1078.00, EUR 1,000.75 and GBP 734.31 per ounce

4 Jan LBMA Gold Prices: USD 1072.70, EUR 982.30 and GBP 725.02 per ounce

31 Dec LBMA Gold Prices: USD 1062.25, EUR 974.32 and GBP 716.36 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.