If You Miss Buying Gold – You Will Regret, it Later

Commodities / Gold and Silver 2016 Feb 10, 2016 - 12:19 PM GMTBy: Chris_Vermeulen

If you held LinkedIn, in your portfolio, you have lost more than 43% of your investment within a single day, and it is most likely to decline even further. In the current situation of flux, it is difficult to find an asset class where you can safely deposit your money. The stock market is dropping and has entered a bear market, the crude oil market continues to hit new yearly lows while, base metals have no buyers, making it difficult to find an asset class where one can invest. But in the sea of red, the oasis will be Gold.

If you held LinkedIn, in your portfolio, you have lost more than 43% of your investment within a single day, and it is most likely to decline even further. In the current situation of flux, it is difficult to find an asset class where you can safely deposit your money. The stock market is dropping and has entered a bear market, the crude oil market continues to hit new yearly lows while, base metals have no buyers, making it difficult to find an asset class where one can invest. But in the sea of red, the oasis will be Gold.

However, most of the experts in the media, as well as financial advisors, have advised you against buying the yellow metal. They claim it does not pay you a dividend yield, and that is just an asset whose value is determined by the market place. This may be true, but there are times when you want to safeguard your capital.

History of Gold:

Though Gold coins have been used since the 8th century, in China, accounts of their usage can be found throughout India’s history, which is many centuries older. Gold has been in existence for millenniums; it is not new. It is believed that 90%-95% of all the Gold that was ever mined, still exists in one form or another. Despite increased mining operations, Gold continues to generates interest amongst its’ buyers.

The Gold Standard:

The world was officially in a Gold standard from 1881-1913. This was one of the best periods of stability Globally and would have continued to do so in much the same way had it not been for WWI. Even during the Bretton Wood’s System, the world witnessed a fast-paced growth and inflation was contained and under control. With increased central bank interventions, the world is on the cusp of a major global financial crisis.

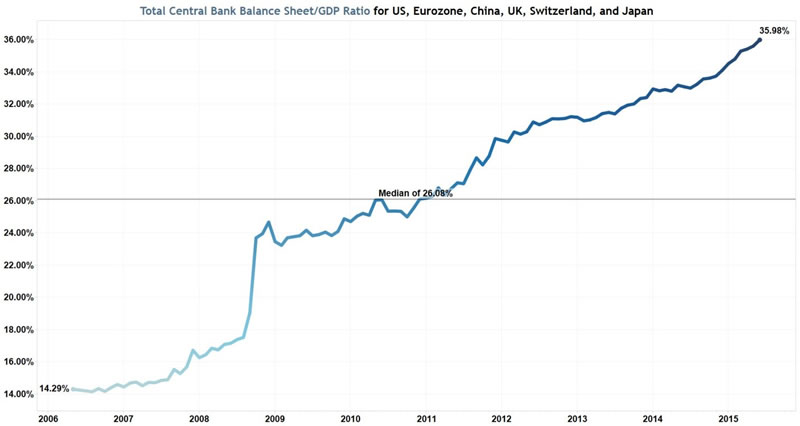

The world is currently witnessing unprecedented Central Bank interventions. The chart below displays a graph of the rise in the Central Banks’ assets to GDP of all of the major economies globally. With yet another fresh round of QE, as announced by Japan and the EU, it appears that there is no end to the “madness”.

How can we protect ourselves from the impending debacle?

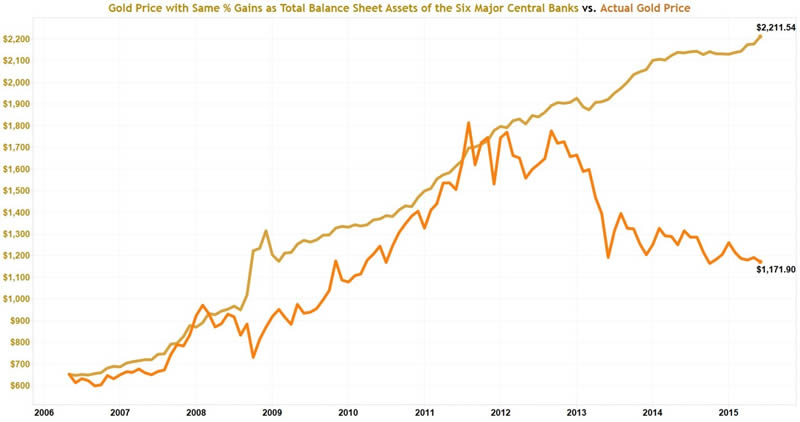

Even if Gold were to experience the same growth as the Central Banks’ assets, it should be trading much higher. The chart below shows the valuation gap. With the world economy on tenterhooks, currency wars between nations are rapidly increasing. We have seen glimpses of such occurrences, when the Swiss Central Bank unpegged the Franc to the Euro, which in turn, led to massive bankruptcies.

With talks of a Brexit and the European Union on a slippery slope, it has all the makings of the next big crisis. The famous commodity Guru, Jim Rogers, often states that ‘The US dollar is a terribly flawed currency’.

Performance of Gold against the recent fall in equity prices:

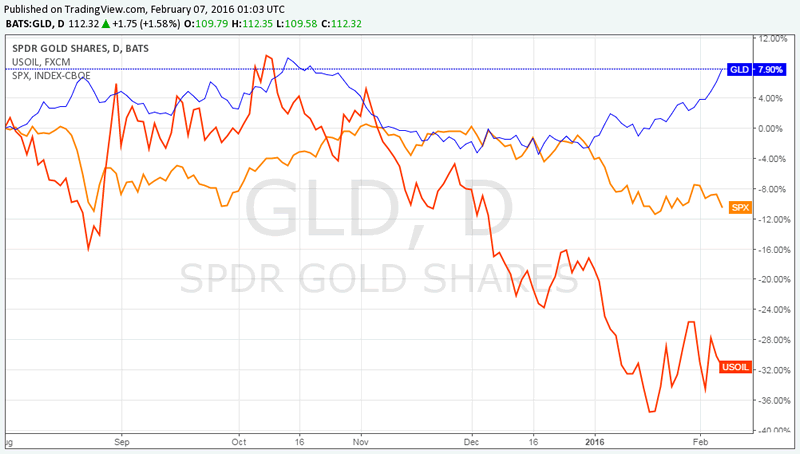

History suggests a bullish future for Gold, but how has Gold performed during the current drop in equity prices.?

The below chart displays the comparative performance of the three important asset classes: Gold, SPX and Crude Oil. Gold is an outperformer while the other two are struggling to put in a bottom. Moving forward, with the US equity markets entering into a bear market. The confirmation of the bear market will be complete once the markets break their recent lows. Gold is the only “financial standard” in which you should invest during the current financial crisis.

Watch this video analysis from Feb 10th that explains where gold is headed in the next few days: https://youtu.be/yWPT_3Huxhk

Conclusion:

In short, Stanley Druckenmiller, amongst other informed investors, are purchasing Gold. In fact, Druckenmiller sees Gold as a ‘run’. I am not advocating that you should follow them blindly, but the data and the economic conditions suggest that this is the new. In order to benefit the Bull Market in gold.

I will further advise you of the proper timing of the correct entry price. Be sure to join my free newsletter for future updates and trade alerts! In the past two months I have closed 11 trades with 9 of those being winners.

Join Us Today & Make 2016 Winning A Year For Your Trading Account: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.