Another Pull Back in the Stock Market Due?

Stock-Markets / Stock Markets 2016 Feb 29, 2016 - 03:10 AM GMTBy: Brad_Gudgeon

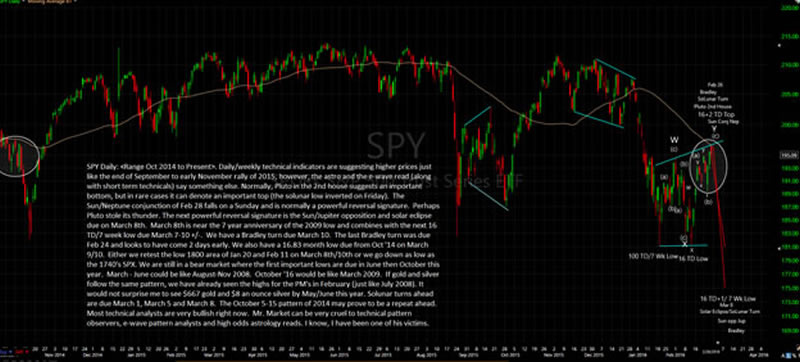

Last week, I was doing what most traders were doing, being swayed by the momentum indicators. Last time we saw the momentum indicators where they are now we pulled back a little and then continued on up. That was early October 2015. The problem is, the current e-wave formation has an irregular bottom that formed after the February 8 low and that was on February 11, which suggests a move below the last low of SPX 1810 and soon. And here we have the astros confirming along with the very short term momentum indicators agreeing.

Last week, I was doing what most traders were doing, being swayed by the momentum indicators. Last time we saw the momentum indicators where they are now we pulled back a little and then continued on up. That was early October 2015. The problem is, the current e-wave formation has an irregular bottom that formed after the February 8 low and that was on February 11, which suggests a move below the last low of SPX 1810 and soon. And here we have the astros confirming along with the very short term momentum indicators agreeing.

Astro-wise, we saw Pluto move into the 2nd house of business on Feb 26 (this is normally an important bottom). Today we have the SUN conjunct Neptune which normally marks an important turning point in the markets followed by the SUN opposite to Jupiter along with a solar eclipse on March 8th (another important astro turning point). If I was swayed simply by the technicals, I might be tempted to stay long like many still are. A move to new lows then a move to the .618 retracement just under 2000 by the end of March seems feasible. The 50% retracement area was tagged on the SPX Friday.

As far as gold and the mining stocks are concerned, I think they had their play to the upside and more down side is coming. The first target I’ll call wave (a) should make its low toward the end of March, then a (b) wave bounce, then a (c) wave decline into May/June. The current e-wave pattern is suggestive of a hard throw down ahead for both gold and XAU/GDX. I noticed that Deuche Bank was recommending gold to its clients just at the wrong time, at least in my opinion. Eventually, according to the 8 year cycle, gold and silver cycle will shine again and that time is rapidly approaching. For now, I believe it’s a trader’s market.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.