European Migrants Crisis - Be Careful What You Wish For, Angela

Politics / Refugee Crisis Mar 09, 2016 - 05:26 PM GMTBy: Raul_I_Meijer

What is perhaps most remarkable about the deal the EU is trying to seal with Turkey to push back ALL refugees who come to Greece is that the driving force behind it turns out to be Angela Merkel. Reports say that she and temp EU chairman Dutch PM Mark Rutte ‘pushed back’ the entire EU delegation that had been working on the case, including Juncker and Tusk, and came with proposals that go much further than even Brussels had in mind.

What is perhaps most remarkable about the deal the EU is trying to seal with Turkey to push back ALL refugees who come to Greece is that the driving force behind it turns out to be Angela Merkel. Reports say that she and temp EU chairman Dutch PM Mark Rutte ‘pushed back’ the entire EU delegation that had been working on the case, including Juncker and Tusk, and came with proposals that go much further than even Brussels had in mind.

Why? Angela has elections this weekend she’s afraid to lose.

It’s also remarkable that the deal with the devil they came up with is fraught with so many legal uncertainties -it not outright impossibilities- that it’s highly unlikely the deal will ever be closed, let alone implemented. One thing they will have achieved is that refugees will arrive in much larger numbers over the next ten days, before a sequel meeting will be held, afraid as they will be to be pushed back after that date.

They may not have to be so scared of that, because anything remotely like what was agreed on will face so many legal challenges it may be DOA. Moreover, in the one-for-one format that is on the table, Europe would be forced to accept as many refugees from Turkey as it pushes back to that country. Have Merkel and Rutte realized this? Or do they think they can refuse that later, or slow it down?

Under the deal, Turkey seems to have little incentive to prevent refugees from sailing to Greece. Because for every one who sails and returns, Turkey can send one to Europe. What if that comes to a million, or two, three? The numbers of refugees in Turkey will remain the same, while the number in Europe will keep growing ad infinitum.

Sweet Jesus, Angela, we understand you have problems with the refugee situation, and that you have elections coming up this weekend, but what made you think the answer can be found in playing fast and loose with the law? And what, for that matter, do you expect to gain from negotiating a Faustian deal with the devil? Surely you know that makes you lose your soul?

You said yesterday that history won’t look kindly on the EU if it fails on refugees, but how do you think history will look on you for trying to sign a deal that violates various international laws, including the Geneva Conventions? You have this aura of being kinder than most of Europe to the refugees, but then you go and sell them out to a guy who aids ISIS, massacres Kurds, shuts down all the media he doesn’t like and makes a killing smuggling refugees to Greece?

Or are we getting this backwards, and are you shrewdly aware that the elections come before the next meeting with Turkey, and are you already planning to ditch the entire deal once the elections are done, or have your legal team assured you that there’s no way it will pass the court challenges it will inevitably provoke?

It would be smart if that’s the case, but it’s also quite dark: we are still talking about human beings here, of which hundreds of thousands have already died in the countries the living are fleeing, or during their flight (and we don’t mean by plane), and tens of thousands -and counting, fast- are already stuck in Greece, with one country after the other closing their borders after the -potential- deal became public knowledge.

So now Greece has to accommodate ever more refugees because all borders close, something Greece cannot afford since the bailout talks left it incapable of even looking after its own people, while over the next ten days it can expect a surge of ‘new’ refugees to arrive from Turkey, afraid they’ll be stuck there after a deal is done. Greece will become a “holding pen”, and the refugees will be the livestock. A warehouse of souls, a concentration camp.

The circumstances under which these human beings have been forced to flee their homes, to travel thousands of miles, and now to try and stay alive in Greece, are already way below morally acceptable. Just look at Idomeni! You should do all you can to improve their conditions, not to risk making them worse. Where and how you do that is another matter, but the principle should stand.

You should be in Greece right now, Angela, asking Tsipras how you can help him with this unfolding mayhem, how much money he needs and what other resources you can offer. Instead, Athens today hosts the Troika and Victoria “F**k the EU” Nuland. That is so completely insane it can’t escape the protagonists themselves either.

Refugees from war -torn countries are per definition not ‘illegal’. What is illegal, on the other hand, is to refuse them asylum. So all the talk about ‘illegal migrants’ emanating from shills like Donald Tusk is at best highly questionable. The freshly introduced term ‘irregular migrants’ is beyond the moral pale.

As is the emphasis on using the term ‘migrant’ versus ‘refugee’ that both European politicians and the international press are increasingly exhibiting, because it is nothing but a cheap attempt to influence public opinion while at the same time throwing desperate people’s legal status into doubt.

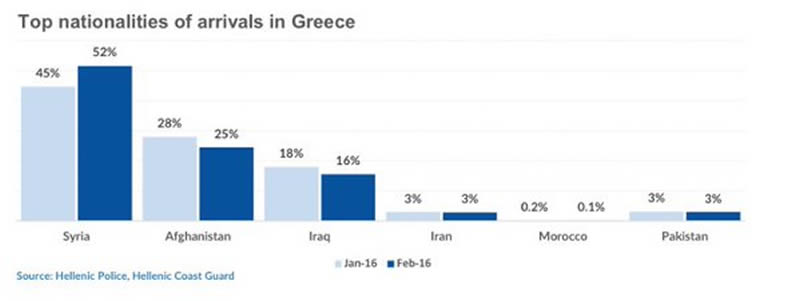

What their status is must be decided by appropriate legal entities, not by reporters or politicians seeking to use the confusion of the terms for their own personal benefit. And numbers show time and again that most of the people (93% in February GRAPH) arriving in Greece come from Syria, Iraq and Afghanistan, all war-torn, and must therefore be defined as ‘refugees’ under international law. It is really that simple. Anything else is hot air. Trying to redefine the terminology on the fly is immoral.

In that same terminology vein, the idea that Turkey is a ‘safe third country’, as the EU so desperately wants to claim, is downright crazy. That is not for the EU to decide, if only because it has -again, immoral- skin in the game.

All this terminology manipulation, ironically, plays into the hands of the very right wing movements that Angela Merkel fears losing this weekend’s elections to. They create a false picture and atmosphere incumbent ‘leaders’ try to use to hold on to power, but it will end up making them lose that power.

The funniest, though also potentially most disruptive, consequence of the proposed deal may well be that the visa requirements for the 75 million Turks to travel to Europe are to be abandoned in June, just 3 months away, giving them full Schengen privileges. Funny, because that raises the option of millions of Turkish people fleeing the Erdogan regime travelling to Europe as refugees, and doing it in a way that no-one can call illegal.

There may be as many as 20 million Kurds living in Turkey, and Erdogan has for all intents and purposes declared war on all of them. How about if half of them decide to start a new life in Europe? Can’t very well send them back to ‘safe third country’ Turkey.

Be careful what you wish for, Angela.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.