The Dow Jones is a Catalyst for Misplaced Stock Market Optimism

Stock-Markets / Stock Markets 2016 Apr 24, 2016 - 06:01 PM GMTBy: Dylan_Waller

The Curious Recovery of the Dow Jones

The Curious Recovery of the Dow Jones

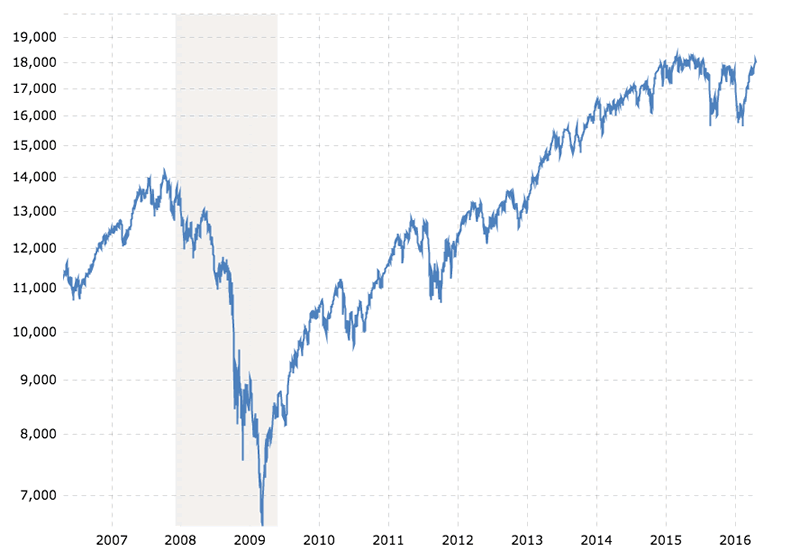

After delivering stellar gains after America’s economic recovery in 2008, the Dow Jones Industrial Average has stalled, with a 1 year decline of 0.19%. A further examination of the components of the Dow Jones, and most importantly how stronger performing components have replaced some of the sub par links, reveals that its strong benchmark of success after 2008 has been a catalyst for misplaced optimism for America’s stock market. Its current mediocre performance is further troublesome, as one can holistically examine a flurry of sell offs this year in multiple sectors, such as the energy, biotechnology, and banking sectors. The Dow Jones stands as a misleading rosy shaded picture of how America, and most specifically its stock market, has recovered and continues to prevail. Weak fundamentals can easily be seen by examining areas of America’s economy, particularly areas the middle class is most vulnerable to, as well as the stock price losses experienced in other crucial sectors of America’s economy. A list of 30 companies is certainly too small of a sample size to holistically represent America’s stock market, yet I think the modifications and strategic exclusion of vulnerable areas makes the impact of its distortion of reality much stronger than one would initially assume.

9 Year Gain of the Dow Jones Industrial Average

Source: Macrotrends

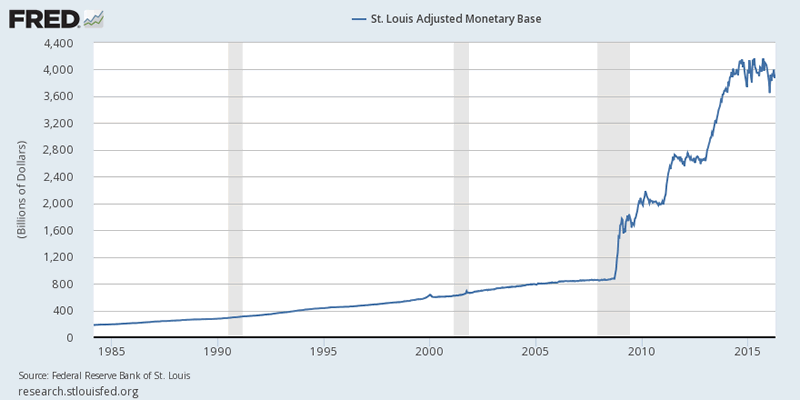

QE is a Hoax

Quantitative easing, and America’s status as having the world’s reserve currency, has been correlated to the questionable recovery of America’s economy, and Wall Street has most certainly been an unnecessarily strong beneficiary of the Fed’s QE policies. The Fed has nearly quintupled the monetary base since 2008, a severely relegated factor of consideration for those that still stand optimistic of the Fed’s policies. The most relevant question is, how much further can you go after you have quintupled the monetary base?

Even Alan Greenspan recently stated that monetary policy has reached the outward bounds of its effectiveness, without another round of quantitative easing, and that another QE would result in a higher P/E for America’s stock market. Most recently the profit of the S&P 500 declined to 9.8% in Q1 2016, the lowest level experienced since the financial crisis. We can certainly see a flurry of companies that are beginning to fall on earnings growth, and further positive stock price movement would be troublesome, in terms of valuation.

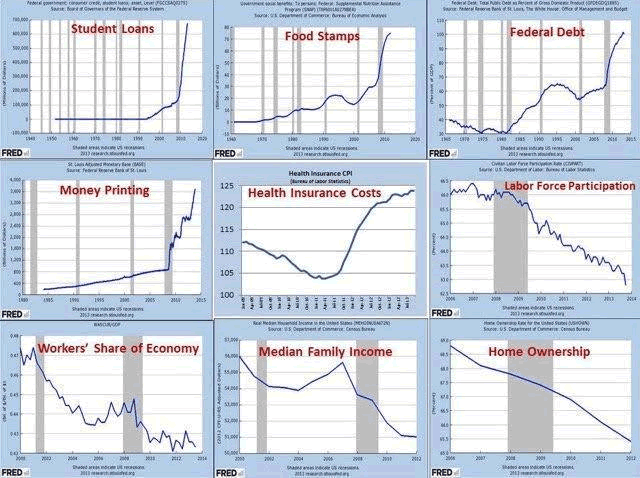

Other Weak Fundamentals

While America continues to deliver moderate GDP growth, and records inflation at 0.9% , the impact on the American population post 2008 has certainly been adverse, and recession like impacts can be felt throughout America. This can serve as an initial point of skepticism as to why the Dow Jones Industrial Average has curiously risen upwards, while other economic fundamentals post 2008 have become far worse. This is not to mention America’s military industrial complex, which drives the government further into debt, and produces economic adversity for America’s population. Government expenditure from tax revenue is not properly spent on crucial areas that would develop America’s economy and be altruistic for its population, including areas such as healthcare, education, and R&D.

Of the above areas, the emergence of the student loan bubble post 2008 is most questionable and disturbing. Student loans now comprise nearly 37% of the government’s total assets. The struggle of America’s population is labeled as an asset of the government, and a whopping portion of it.

Strategically Replacing Components: Skepticism is Befitting

Wall Street can be prosperous, while America’s middle class struggles. This is by no means a new phenomenon, and is merely my starting point for skepticism. What is most curious to note, is that Wall Street can begin to fail to be prosperous in multiple areas, yet produce the illusion of prosperity or neutrality, which can be seen in an in depth examination of the Dow Jones Industrial Average.

Wim Grommen’s article from 2014 entitled “The Dow Jones is Hoax” outlines one relevant concern with the Dow Jones Industrial Average, namely the replacing of weaker components with stronger stock picks. The Dow Jones has made some very strategic modifications to its components in recent years, which can easily be classified as cherry picking to produce the illusion of greater success. This modification of an existing small sample size is quite troublesome.

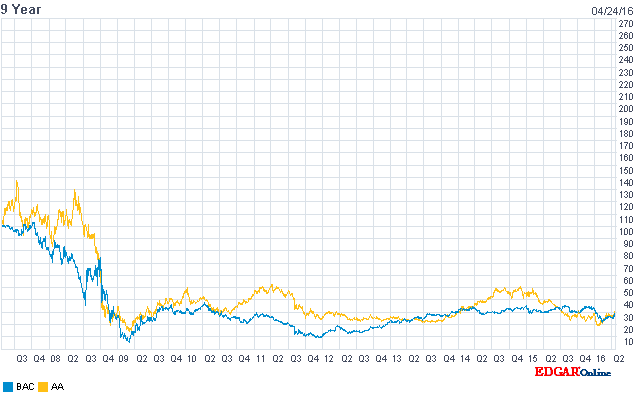

The Decline of Alcoa and Bank of America, Which are Now Excluded Components

During 2013, Alcoa, Bank of America, and Hewlett Packard were replaced with Goldman Sach’s, Nike, and Visa. We can particularly see that Alcoa(AA) and Bank of America(BAC) have not recovered well since the 2008 crash, and that their exclusion from the average is misleading.

9 Year Decline of Alcoa and Bank of America

Source: Nasdaq

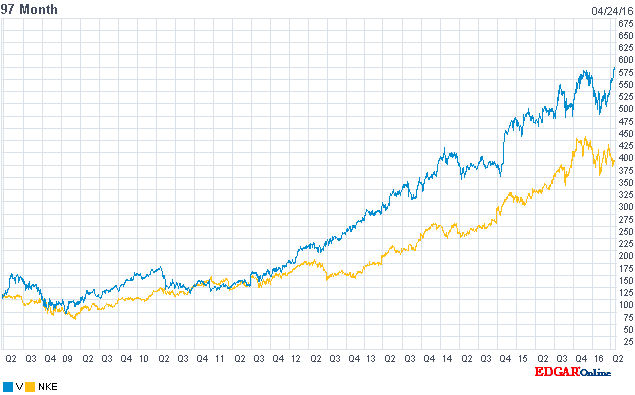

Addition of Nike and Visa, which are Positive Outliers

Meanwhile, Nike(NKE) and Visa(V) have fared very well post 2008, and the strategic addition of these stocks serves as a catalyst for misplaced optimism in the Dow Jones Industrial Average. The P/E for these two stocks in 27.6 and 28.9, well above the average for the Dow Jones Industrial Average. The addition of these companies, coupled with the removal of Bank of America and Alcoa, unnecessarily elevated the success of the Dow Jones Industrial Average.

9 Year Gain of Nike and Visa

Source: Nasdaq

The combined addition of Nike and Visa, and the removal of Alcoa and Bank of America, distorts the reality of the Dow Jones Industrial Average.

Exclusion of America’s Greatest Thorns: Misplaced Optimism

These replacements are troublesome to note, as a modification for a small number of companies can have a strong impact on a sample size of 30 companies. What is perhaps a greater source of skepticism for me is the exclusion of the following areas: biotechnology, oil and gas, and FANG stocks.

In addition to some of the replacements made, one can also grow skeptical by examining that the Dow Jones Industrial Average excludes crucial parts of America’s economy, which have been most salient in ongoing political discourse. Beyond looked at fundamentals, one must take a behavioral economics approach on stock market price movement, and acknowledge that political sentiment is one of the greatest catalyst for herding.

Biotechnology companies have experienced a strong sell off amid recent political debates, and even Janet Yellen has been willing to criticize the biotechnology industry for price gouging and poor fundamentals. On top of this, banking profits have dropped to disappointing lows this quarter, and there have also been strong sell offs in the energy sector amid the declining price of oil. Yet these significant components of America’s stock market are not fully reflected in the Dow Jones, which further produces misplaced optimism.

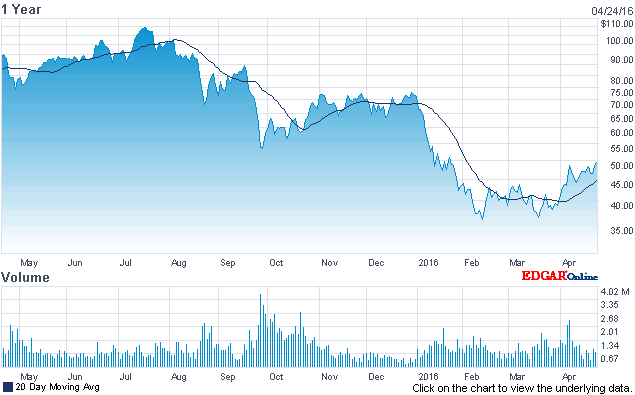

Biotech: Bubble has been Popped from Political Sentiment

Nasdaq Biotech(BIB) has consequently taken quite a fall this year, and quite strangely, there are none of these components included in the Dow Jones Industrial Average. Biotechnology has been one of the major sectors discussed in political debates, receiving criticism from multiple presidential candidates.

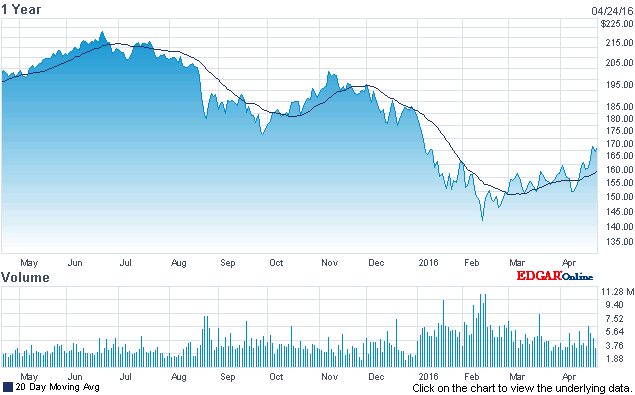

1 Year Decline of Nasdaq Biotechnology(BIB)

Source: Nasdaq

Political sentiment finally drove the market to become rational, as seen by the strong sell off in the sector this year.

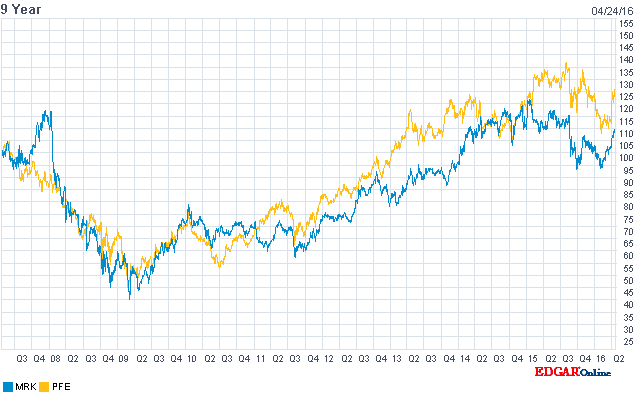

The Dow Jones Only Includes Pharmaceutical Manufacturers, Cleverly Evading this Thorn

The Dow Jones does include two pharmaceutical companies, Pfizer and Merck, which have had stable stock price movements amid the recent industry sell off. Therefore, the Dow Jones does not fully reflect America’s economy, as it strategically evades the issues of the biotechnology industry, by focusing on pharmaceutical manufacturers that have had stable stock price movements. Moreover, the valuation for these pharmaceutical companies is 30.0 and 36.3 respectively, making a drop in price plausible, and perhaps even befitting.

9 Year Price of Pfizer and Merck

Source: Nasdaq

Both companies have delivered impressive gains post 2008, and a key point to note is that their price has been stable in the past year, while biotechnology stocks have been strongly sold off.

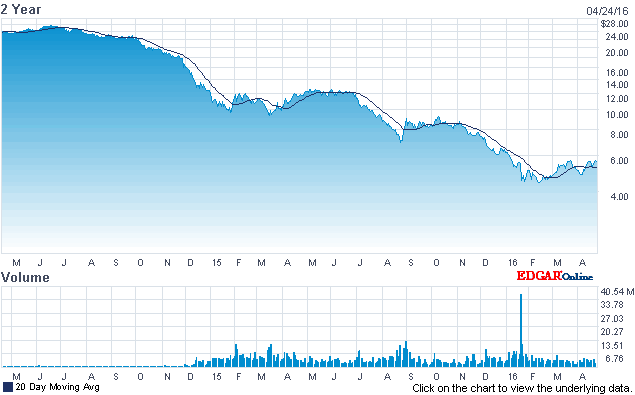

Oil

The oil sector is an obvious area where massive sell offs have been experienced, yet the substantial sell off in this area is excluded from the Dow Jones Industrial Average. A flurry of investors have suffered greatly from investments in oil companies, with the only consequence the Dow Jones faces from this is indirect, namely the adverse performance of banks due to investments in this sector. Exxon Mobil and Chevron’s stock prices only declined by 16% and 20% in 2015, a far cry from the sell off experienced in this industry.

2 Year Decline of the iPath S&P GSCI Crude Oil TR ETN

Source: Nasdaq

An inclusion of some major oil companies in the Dow Jones Industrial Average would easily result in a major shift in its performance, yet the average evades this major thorn with relatively negligent stock prices declines from companies in this area.

The Exclusion of FANG Stocks

The Dow Jones excludes Facebook, Amazon, Netflix, and Google, a fact which should most certainly be assessed. Unlike other previously mentioned Dow Jones components that experienced booms, such as Nike and Visa, the collective valuation for these companies is irrationally high. Amazon and Netflix in particular were two of four stock credited for accounting for 95% of the gain for the S&P 500 Retailing Industry Group, amid the gloomy growth of retail retail sales in America. The P/E for both of these companies is unacceptably high, which displays further distortion of indexes. Facebook’s valuation is also very high, and even Google trades at a premium to the Dow Jones Industrial Average.

After delivering massive gains post 2008, the collective P/E for these four companies is currently 238.7. If these components were included in the Dow Jones Industrial Average, it would raise the P/E to approximately 50.2, a far cry from its current level. The exclusion of FANG stocks produces the illusion that massive stock price gains in America can be coupled with reasonable valuation and earnings growth. Amid the recent record drop in corporate earnings, investors should be cautious of positive stock price movement that is not coupled with earnings growth.

Sociocultural Angst Against Multinational Corporations

The negative political sentiment for banks and biotechnology companies has already resulted in a strong sell off in the past year. On top of this, the recent controversy of the Panama Papers can certainly serve as an increased catalyst for heightened political disapproval for multinational corporations evading taxes through their offshore practices, although sociocultural disapproval has already been strong in the past year. Similar to what we have seen in other industries, we could also see a strong sell off for a large number of multinational corporations if this political discontent continues, which would make the Dow Jones Industrial Average most vulnerable to a sell off.

Investment Banking Sell Off: No Free Lunch

Unfortunately, the Dow Jones is not able to cleverly evade all of America’s thorns, as seen by its exposure to the banking sector. Goldman Sachs was introduced into the Dow Jones Industrial Average in 2013, and has witnessed a strong decline in its stock price in the past year, while other components have cross subsidized with strong, and most likely unsustainable, stock price gains.

Source: Nasdaq

Goldman Sachs stock price has experienced a substantial sell off in the past year, and the company’s poor financial performance this quarter can further elevate the decline of its stock price. Its profit declined by 56% this quarter, and other banks have recorded strong losses as well. This poor news comes at most unfavorable timing, as many companies in this sector have already witnessed a strong sell off, and the sector is highly vulnerable to political criticism. Poor financial performance, coupled with increased political discontent with the reckless behavior of investment banking, can all serve as catalysts for a continued sell off in this sector.

Misplaced Optimism

The Dow Jones boom is ending, and currently standing at a neutral point, the Dow Jones still in many ways misleads Americans as to how its stock market is performing. Strategic cherry picking has still resulted in a small loss this year. For a true, deeper picture of America’s economy and stock market, one must dive deep into investigating individual sectors, and come up with a conclusion in this manner. Fundamentals become increasingly important during dark times, and it is essential to look at fundamentals such as financial growth and valuation when making investment decisions, and to not be misguided by general bullish sentiment. I see darkness down the line.

Dylan Waller is a Contributor for Seeking Alpha and Smartkarma, and a Macroeconomic Researcher for the crowdsourced consultancy Wikistrat. His research focuses on frontier and emerging markets, with a primary focus on the strategic advantages of Vietnam, Pakistan, India, The Philippines, and Mongolia.

Email: dylan@nomadicequity.com

Website: www.nomadicequity.com

Copyright © 2016 Dylan Waller - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.