Monetary Liquifaction, Gold And The Time Of The Vulture

Commodities / Gold and Silver 2016 May 05, 2016 - 11:37 AM GMTBy: Darryl_R_Schoon

Liquifaction: … 3: conversion of soil into a fluidlike mass during an earthquake or other seismic event, 4: inability of flooded capital markets to absorb additional capital without destabilizing paper assets, e.g. stocks, bonds, currencies, etc., 5. a monetary phenomena associated with the collapse of capital markets.

Liquifaction: … 3: conversion of soil into a fluidlike mass during an earthquake or other seismic event, 4: inability of flooded capital markets to absorb additional capital without destabilizing paper assets, e.g. stocks, bonds, currencies, etc., 5. a monetary phenomena associated with the collapse of capital markets.

Inflation is always and everywhere a monetary phenomena caused by an increase in the money supply, the greater the increase, the greater the inflation. If the money supply expands with sufficient rapidity, inflation becomes hyperinflation and paper money loses all value.

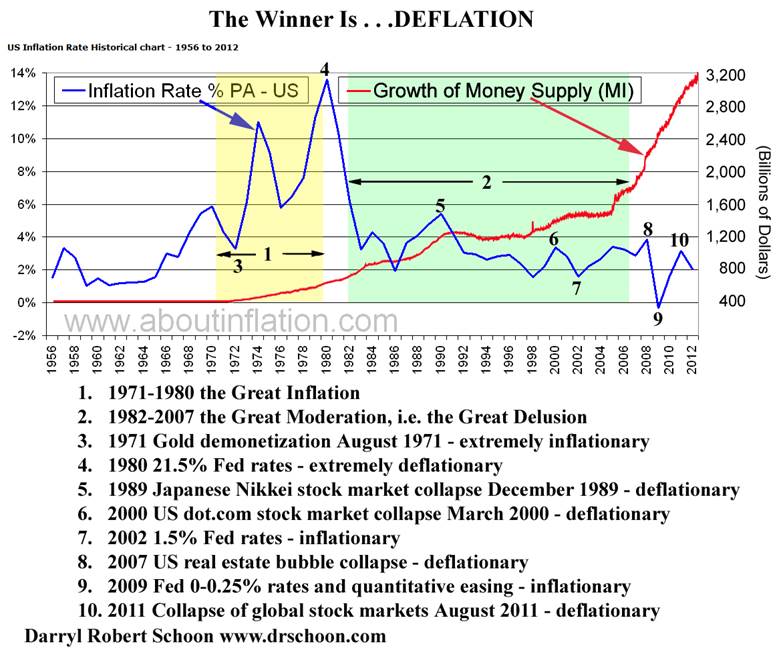

CHART #1: GROWTH OF THE US MONEY SUPPLY 1970-2015

SLOW MODERATE FAST

THE GREAT MODERATION i.e. THE GREAT DELUSION

What you don’t know explains what you don’t understand

In 1971, when the US ended the convertibility of the US dollar to gold, the only limit on the bankers’ ability to print money ad infinitum—monetary gold reserves—was removed. This led to an immediate spike in inflation ending in an inflationary surge—from 3.3% in 1971 to 14.4% in 1980, a 436% increase. Economists called it the Great Inflation.

Paul Volker, who along with Milton Friedman advised Nixon to cut the ties between the US dollar and gold in 1971, was forced as Fed chairman to end the inflationary surge by raising interest rates to a draconian 21.5 %, in 1980.

After Volker’s deflationary interest rate hike, inflation would not again be an issue despite the still expanding money supply. This anomalous absence of inflation would give rise to the erroneous conclusion that the Fed had somehow engineered a monetary miracle, a never-before-seen phenomena where continuing money growth did not lead to inflation but to a period of relative stability that economists called the Great Moderation.

The Great Moderation from the mid-1980s to 2007 was a welcome period of relative calm after the volatility of the Great Inflation. Under the chairmanships of Volcker (ending in 1987), Greenspan (1987-2006) and Bernanke (starting in 2006), inflation was low and relatively stable, while the period contained the longest economic expansion since World War II. Looking back, economists may differ on what roles were played by the different factors in contributing to the Great Moderation, but one thing is sure: Better monetary policy was key.

http://www.federalreservehistory.org/Events/DetailView/65

‘The Great Moderation’ was, in fact, merely ‘The Great Delusion’. The absence of inflation was not due to “better monetary policy”, but to a series of cataclysmic deflationary events i.e. Volker’s 21.5% interest rates followed by the collapse of massive speculative bubbles which unleashed powerful deflationary forces offsetting the inflationary rise in prices that would have otherwise occurred with excessive money printing.

In 1971, global monetary aggregates, MO, totaled $8 billion; by January 2016, global MO totaled $80.9 trillion, an astounding increase of 1,000,000 %. Such an exponential growth of the global money supply would have either ended in extreme inflation or hyperinflation were it not for powerful contravening deflationary forces.

After Volker’s 21.5% deflationary interest rates in 1980, the next major deflationary event was the bursting of the Japanese stock bubble on December 31, 1989. The Japanese Nikkei fell from a high of 38,957 down to 7,607; its collapse awakening deflationary forces not seen since 1929 crash which caused the Great Depression of the 1930s. Today, Japan is still trapped in a moribund downward deflationary spiral.

…It has been over two decades since the popping of Japan’s economic bubble and the country is still actively battling with deflationary forces that are so powerful that near-zero interest rates (zero-interest rate policy or ZIRP), repeated bouts of quantitative easing (some call it “money printing”) and constant Yen-weakening currency interventions have barely made a dent.

http://www.thebubblebubble.com/japan-bubble/

After the Nikkei’s collapse, the US dot.com bubble burst in March 2000. Next, came the US real estate bubble whose collapse in 2007 lead to the Wall Street crisis of 2008; and, in August 2011, global markets plunged when the European sovereign debt crisis erupted.

With each bursting bubble, demand collapsed and deflation gained additional momentum which central bankers attempted to overcome with more credit, more monetary stimulus, e.g. QE1, QE2,QE3, and more money printing; but despite central bank efforts to artificially induce inflation-indexed growth with monetary policy, deflation—capitalism’s fatal wasting disease—triumphed.

.

On February 1, 2016, Professor R. Taggert Murphy, co-author with Akio Mikuni of Japan’s Policy Trap noted the global significance of Japan’s 26-year losing battle with deflation:

[Japan] has increasingly come to function as a kind of canary in the mine of the global economy. Japan was the first to demonstrate something that is now obvious worldwide: …Monetary policy alone cannot loosen the shackles of a deflationary trap. We have seen orgies of credit creation by the world's leading central banks, and yet the global economy sits on the edge of a deflationary abyss as commodity prices tumble and country after country spirals downwards….

Rethinking Japan’s Deflation Trap: On the Failure to Reach Kuroda Haruhiko’s 2% Inflation Target, Asia-Pacific Journal, February 1, 2016

COMMODITY PRICES TUMBLE

http://wallstreetexaminer.com/2015/12/commodity-prices-nightmare-2015/

Deflation is capitalism’s fatal wasting disease, a sinkhole of defaulting debt into which all attempts to induce inflationary-indexed demand by monetary means—low interest rates, quantitative easing, money printing—disappear.

In a chronic deflationary trap, accelerating money growth leads to monetary liquefaction where asset prices—stocks, bonds, commodities, real estate, currencies—become increasingly distorted due to increasing levels of excess liquidity ending in the collapse of capital market, i.e. parcus nex,economic death.

Banking is a parasite on the body economic that eventually destroys that upon which it feeds

CENTRAL BANKERS’ LAST RESORT - HELICOPTER MONEY

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated… [ex falso quodlibet, i.e. from a falsehood, anything follows]

Milton Friedman, The Optimum Quantity of Money, 1969

On April 11th former Fed Chairman Ben Bernanke in What tools does the Fed have left? Part 3: Helicopter moneywrote that Friedman’s ‘helicopter money’ should be considered:

…Money-financed fiscal programs (MFFPs), known colloquially as helicopter drops, are very unlikely to be needed in the United States in the foreseeable future…However, under certain extreme circumstances—sharply deficient aggregate demand, exhausted monetary policy, and unwillingness of the legislature to use debt-financed fiscal policies—such programs may be the best available alternative.

On April 12th, David Stockman, author of The Great Deformation: The Corruption of Capitalism in Americaand Ronald Reagan’s former Director of the Budget posted a scathing reply:

Bernanke’s New Helicopter Money Plan – Sheer Destructive Lunacy: …Bernanke has actually made a career out of claiming..that he alone had the insight and acumen to diagnose the purported onrushing depression and the “courage” to, well, run the printing presses white hot in order to stop it in its tracks.

The fact is, Bernanke has been a charlatan and intellectual lightweight all along—–going back to his alleged scholarship on the Great Depression. He was no such thing. He simply zeroxed Milton Friedman’s mistaken theory that the Fed failed to go on a bond-buying spree during 1930-1932 and that this supposed error turned the post-1929 contraction into a deep, sustained depression.

No it didn’t. The 1930s depression was the consequence of 15 years of wild credit expansion—-first during the “Great War” [WWI] to fund the massive expansion of US food and arms production and then during the Roaring Twenties to finance the greatest capital spending binge in history prior to that time.

The depression was not a consequence of too little money printing during 1930-1932, but too much speculative borrowing and investment by business and households after the Fed discovered its capacity to print money during the war and the decade thereafter.

BERNANKE IN BLUNDERLAND

AND THE ROAD YOU’RE ON

The time has come, Bernanke said

To talk of many things

Of crashes – cash – and the lack thereof

Of inflation taking wing

And why a helicopter’s needed

And why credit’s no longer king

But wait a bit, the crowd did cry

We’ve had enough of that

The froth’s too high and everywhere

And the one percent’s too fat

Bernanke, however, was undeterred

Remembering Friedman’s chat

That if a helicopter flew overhead

Dropping thousands from the sky

Combined, of course, with tax cuts

Then deflation would surely die

But try as they might in the real world

Those theories just don’t fly

But nebbish minions with learned minds

Are not so easily persuaded

To submit to truths and light sublime

When power and fame they’ve wedded

So keep your counsel in these darkest of days

And watch with whom you’re bedded

For the crowd you’re with determines much

Whether to darkness or light you’re drawn

The present world’s passing away

And the coming has yet to dawn

So twixt tomorrow and today

Tread carefully the road you’re on

--drschoon, 4/15/2016

THE TIME OF THE VULTURE

On April 16th, Szu Ping Chan and Ben Wrightin The Telegraph UK wrote, Can Anything Stop This Global Cycle of Doom?

The patient is in a critical condition. The International Monetary Fund is concerned that the global economic recovery has taken too long. Kaushik Basu, chief economist of the World Bank, says the financial crisis has left a “festering wound” that is “refusing to heal”. Growth is too weak, resulting in the equivalent of a compromised immune system that has left the economy vulnerable to fresh diseases.

The question now facing the global economy’s physicians: is the ailment chronic or acute?

ANSWER: It’s fatal; a prognosis no one wants to hear or accept.

The most common form of blindness is denial

Because of its ubiquity, it is seldom seen for what it is

On April 27th, Bill Gross said, “..this quarter, for almost the second quarter in a row, we’re close to the flatline [i.e. parcus nex,economic death] in terms of economic growth.’

In 1991, I wrote:

In times of expansion, it is to the hare the prizes go. Quick, risk taking, and bold, his qualities are exactly suited to the times. In periods of contraction, the tortoise is favored. Slow and conservative, quick only to retract his vulnerable head and neck, his is the wisest bet when the slow and sure is preferable to the quick and easy. Every so often, however, there comes a time when neither the hare nor the tortoise is the victor. This is when both the bear and the bull have been vanquished, when the pastures upon which the bull once grazed are long gone and the bear's lair itself lies buried deep beneath the rubble of economic collapse. This is the time of the vulture, for the vulture feeds neither upon the pastures of the bull nor the stored up wealth of the bear. The vulture feeds instead upon the blind ignorance and denial of the ostrich. The time of the vulture is at hand.

25-years ago, a deflationary collapse greater than the Great Depression seemed impossible; but, today, signs of such a collapse are everywhere; obvious to all except to the ostriches still carefully picking through the decaying remains being discharged from the bankers’ charnel house of credit and debt.

In a deflationary depression cash is king

In a runaway inflation cash is worthless

In each, gold is priceless

On April 29th, gold reached $1296.56, rising $54 (+4.26%) in two days; in stark contrast to June 2103 when gold fell (pushed by the paper money cartel) from $1400 to $1190 (-15 %). Today, gold is again rising and while its trajectory is unknown, its ascent is certain. Gold was the cotter pin in the bankers’ ponzi-scheme of credit and debt. Without it, the ponzi-scheme is collapsing.

In my new youtube series, Time of the Vulture I will review the 36 topics covered in my book, Time of the Vulture which I wrote 10 years ago. I will discuss what happened, what didn’t happen and what is yet to happen. The first episode will be on Fed interest rates, see https://www.youtube.com/edit?video_referrer=watch&video_id=aAw8jqsfEFU

In January 2016, the crisis entered its final stage. The time of the vulture is here, when the vulture feeds on the blind ignorance and denial of the ostrich.

A better world will follow.

Buy gold, buy silver, have faith.By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.