Gold And Silver – Qrtly, Monthly Charts. Last Weekly Commentary

Commodities / Gold and Silver 2016 Oct 02, 2016 - 09:18 AM GMTBy: Michael_Noonan

This will be our last weekly commentary on the markets. What we know for certain is that the globalists have a stranglehold on the markets, and more importantly, a stranglehold on all Western nations to the point where life has become a theater of the absurd, negatively and without an end in sight.

This will be our last weekly commentary on the markets. What we know for certain is that the globalists have a stranglehold on the markets, and more importantly, a stranglehold on all Western nations to the point where life has become a theater of the absurd, negatively and without an end in sight.

We have been leaning in this direction for some time. Time off at the end of August, when access to a computer and news was limited to an hour a day, and we chose to use only a small portion of the allotted time, drove home the point, or more appropriately the pointlessness of what is going on all around the world.

Two anecdotal stories put our sense of senseless activities into a context. 1. The boiling frog, and 2. Rip Van Winkle. The frog analogy compares how when put into a pot of boiling water the frog will immediately jump out to escape from the danger of being boiled alive. When a frog is placed into a pot of tepid water, there is no sense of any danger. The temperature of the water is then gradually increased and the frog adjusts to the change until the point where the frog eventually becomes boiled alive. With Rip Van Winkle, when he awakens after a 20 year sleep, all of the changes that have taken place after his two decade absence are so glaringly obvious to him.

The boiling frog analogy seems more apt as the majority of people have acclimated themselves to the onslaught of changes that have been almost nonstop over the last Rip Van Winkle 20 years. Adaptation to all of the sometimes not so gradual, and many times so detrimental to the living standards and living conditions/circumstances to just about everyone, has placed most of the world in an unacceptable over-boiling situation. By contrast, had today’s ongoing daily occurrences been introduced to the population that had been asleep for the past 20 years, [which has been the case despite what has been going on], everyone would be in a state of shock at how badly deteriorated life has become at the hands of the globalists and their puppet governments ruling over the masses.

It should be noted that the globalists are masters at creating the boiling frog syndrome because they plan events often decades in advance and just as often take them much time to implement them. This is how the creation of the Federal Reserve and theft of all the US gold and silver took place…over many decades. It fooled most of the world very successfully.

We could make a laundry list of so many events that give life to these two analogies, which had been our intent, but repeating what has already been accepted to an inured world population that fails to see or fails to defend against being stripped of all liberties and in many cases loss of personal dignity and economic sustainability is as senseless as the world is today.

Our weekly repeating the situation for gold and silver, waiting for the changes that have been kept suppressed by the globalists in order to preserve their fictional fiat world and ruining it for everyone else in the process, has become too tedious when there is no apparent end of the absurd, for who knows how much longer, but end it will and for the worse, at least in our opinion. Of course, we would love to be proven wrong.

With a US population of around 325 million, it is beyond absurd that the best this country can produce for presidential candidates is a psychopathic liar beset by a deteriorating, sick body, the poster child for carrying out the elite’s dictates at the expense of everyone else, opposed by a bombastic businessman with questionable standards and integrity, but still head-and-shoulders above his opposition, sadly to say. [We withdrew from all voting rights a few decades ago, so we support no candidate[s] for anything in all US elections that are a farce and have never changed the course of events on well over 100 years.]

Even after no change brought about by constantly electing new politicians over the past century, people have not caught on and still think elections will make a difference!

Promises made should always be kept, so we make no promises for any future writings or market recommendations. While the focus over the past few years has been only on the long side of the gold and silver markets, refusing to abet the manipulated short side in the paper market, we also used to write only on the S&P relative to the stock market but stopped when those markets were taken over by the lunatics who run the asylum the world as become.

Reality has become distorted to the point of nonexistence, at least for us, which is why we choose silence as opposed to trying to rationalize the corruption that rules the world. It is possible we may write something on a monthly or quarterly basis, but like the markets, the future is unknown. Time and events will tell.

Our heartfelt thanks to those who have signed up to receive our commentaries each week, and our thanks to the many others from around the world who have taken the time to read them on the various sites kind enough to carry our posted commentaries.

To the best reality we know, beyond our own, we turn to the charts…

As a prelude to what follows, we remain strong advocates of buying and personally holding both physical gold and silver. If readers have learned nothing else, if you do not actually have possession, you may never likely have any of the PMs you bought, based on results on a world-wide scope. Everyone has to decide for themselves. What the governments may do to make the future use of precious metals in any form of transactions is up for grabs. More than likely, all control will be placed in the hands of those who rule, [they want your gold and silver, as well as your guns, and that message is the strongest reason for your having and holding them]. Those who have none will suffer the worst.

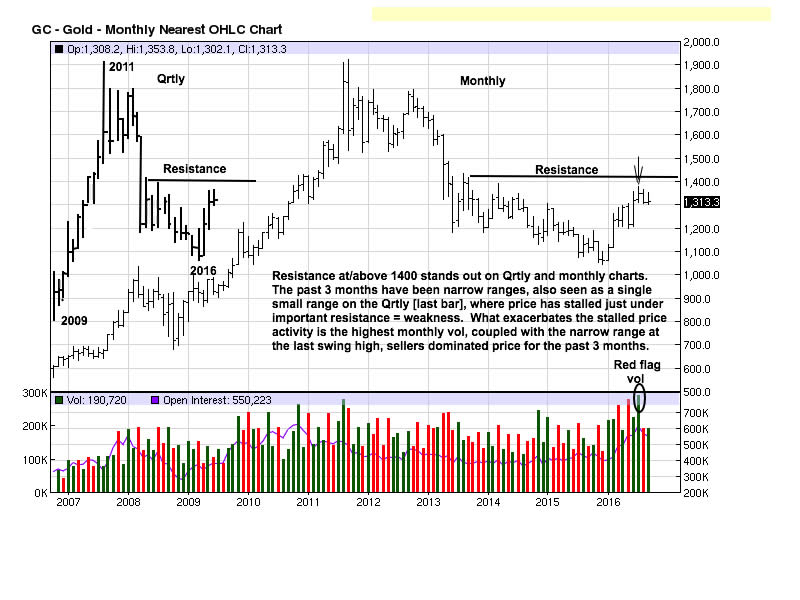

1400+ resistance is the stand out key on the two charts in one below. When and how gold breaks through that price level will be an important watermark for gold’s next upside directional move. Until that happens, and the “when” factor remains unknown, gold remains in a bottoming process.

The other standout feature is the record high monthly volume for July and the accompanying small range bar. The fact that the range of the bar is so small, relative to the great volume effort, tells us sellers put another [temporary] cap on the market. The small range on the Qrtly chart [last bar] and poor close location supports that conclusion. You can see the rally throughout 2016 [Qrtly] ended with a go-nowhere swing high and slightly higher net close. Further, all of the volume effort failed to reach the resistance level before stalling out, another sign of near-term weakness.

These larger time frame chart references say gold is nowhere near breaking out to the upside. Read whatever you want into the news and constant barrage of strong “fundamental” factors, which are overwhelmingly real, the charts, as now determined by reading the activity of those in charge [central bankers controlling the market], the charts reveal it will take still more time before gold breaks out to the upside with any conviction.

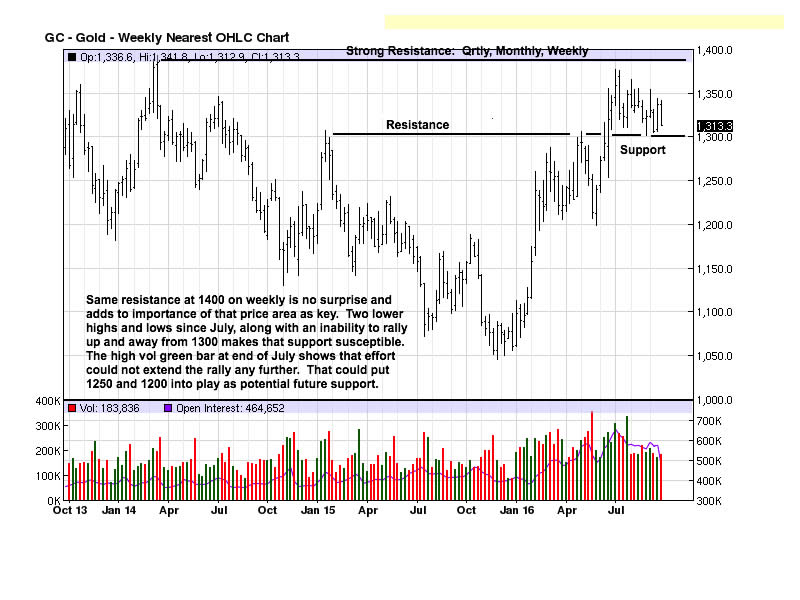

The strongest resistance is seen at the top of the chart, near 1400. The lesser levels of support and resistance are being played out between 1300 and 1375. 1300 looks susceptible. The chart comments give lower support targets if 1300 gives way.

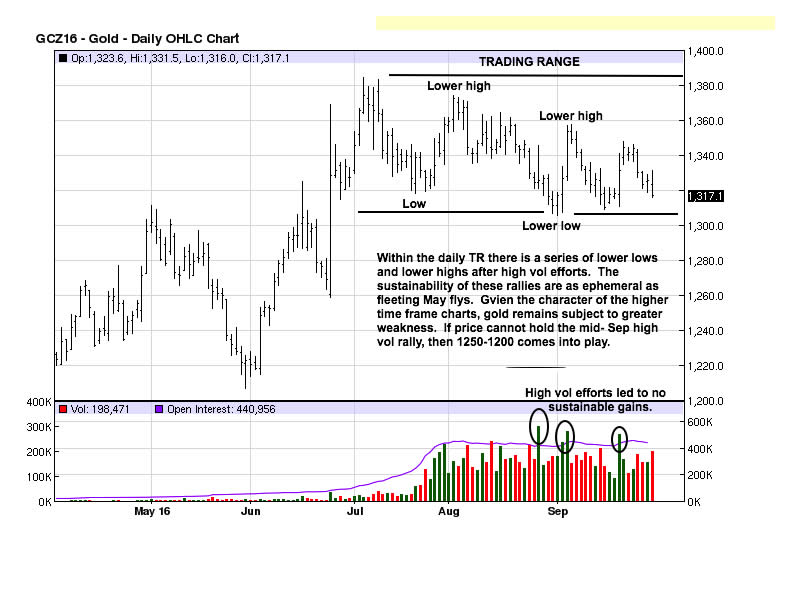

The two most important components in reading developing market activity are price and volume. Volume is the fuel to drive price directionally. You can see all of the highest volume days did nothing to move price even into the upper half of the TR, let alone break above resistance.

The resulting “message from the market” is sellers are more than matching the effort of buyers, and when buyers cannot overcome sellers, price will move lower. That is the probability factor for the market, still.

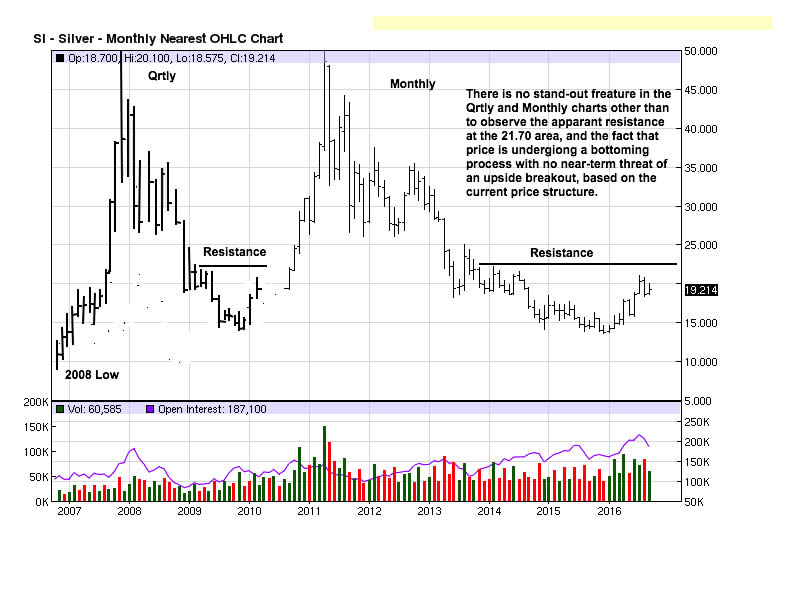

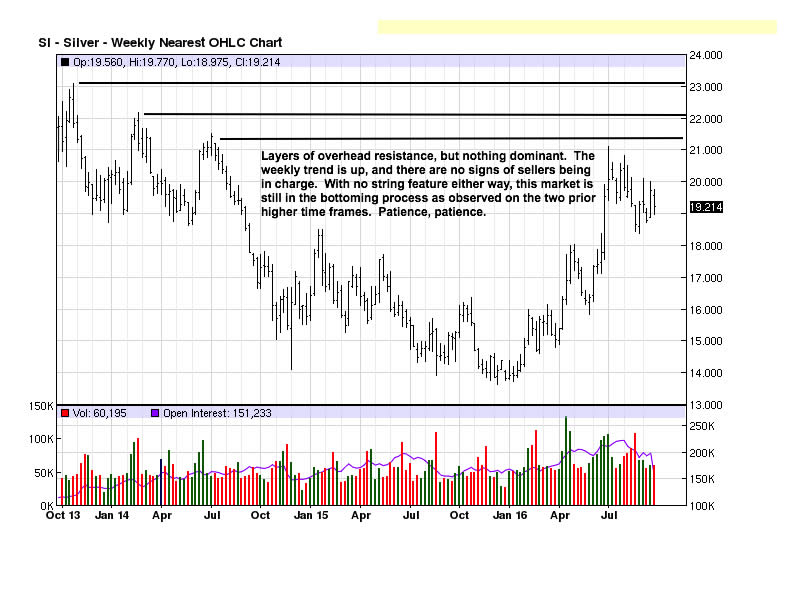

The higher time frames for silver are similar to gold yet simpler in their “read.” With no standout feature, silver’s simplest interpretation is that it continues to be bottoming, and that process remains ongoing. The KISS principle at work.

The end of the June wide range bars rally failed to reach even the lowest of the failed swing high resistance. You can see how volume increased as the swing high at 21 was reached. This is the opposite of how volume functions in a rally. Strong-handed buyers get in at the low of a range where volume should be higher and then diminish as a swing high is reached. You can see the mid-range close on the swing high bar that also attracted the highest volume. This scenario tells us that sellers overcame buyers and kept price from closing higher. Price has been correcting ever since.

That is how the market “speaks,” price and volume.

The daily TR looks to be one of weakness in its development. The higher time frames say the bottom is still in process. This is not to say the December ’15 lows are not the final low, for they well could be, but that there is more work to be done at these lower levels before a strong and sustained bull market can get underway.

Again, you can believe the news and all of the fanfare on how bullish the factors are for silver, especially, and how silver is poised for an astonishing rally, but the charts, at least for now, tell us that this market ain’t going higher any time soon.

Precious metals remain within the eye of a deceptively manipulated economic hurricane.

Cheers…

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.