A Bullish Case for Gold 2017

Commodities / Gold and Silver 2017 Jan 13, 2017 - 05:20 PM GMTBy: David_Galland

Dear Parader,

Dear Parader,

This week, I am happy to present an article by dear friend and business partner Olivier Garret, who makes the case for gold under President Trump.

While Olivier is biased, given he founded the Hard Assets Alliance, I think you’ll find his logic is sound.

My personal concern remains the strength of the US dollar. “The Super-Dollar” is the lead story in the current edition of Compelling Investments Quantified, our premium—and very profitable—monthly investment letter.

At this point, there is virtually no viable competition to the US dollar. In addition, with the Fed (temporarily) out of the quantitative-easing business, the US government supports a stronger dollar, as it ensures that foreign investors continue to show up at Treasury auctions.

While the trend toward dollar strengthening will not unfold in a straight line, for the balance of 2017, that trend should generally be upward. And a strengthening dollar is historically not a good thing for commodities.

That said, the global economy is an insanely complex system, which means no one can predict the future. And in my opinion, that makes gold a prerequisite as an insurance policy for every portfolio. Sometimes, the stars can align in such a way that it is also a great investment, which is the case Olivier makes in his article below.

Your Free Marketplace Lending Report

A follow-up on my article on Marketplace Lending (MPL).

As you may recall, in my article “Be the Bank” in the December 29, 2016 edition of this weekly letter, I talked about Marketplace Lending, or P2P lending, as some call it. I also mentioned we were working on a special report on the topic.

That special report, Welcome to the Bank of You: How to Use the Revolution in Personal Lending to Earn Market-Beating Yields, is now finished.

As a subscriber to this service, you can download your copy for free, without obligation. Consider it a belated holiday gift.

Here’s the link to Welcome to the Bank of You.

Feel free to forward this edition with the link to the free report—or any edition, for that matter—to others you think might be interested.

And with that, the Parade moves on to Olivier’s bullish case for gold.

A Bullish Case for Gold Under Trump—Even If He Fails

By Olivier Garret, Garret/Galland Research

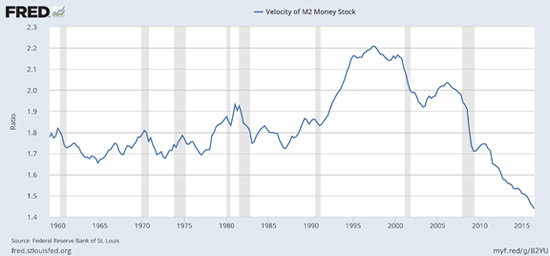

Velocity of money is an important component of economic forecasting. In the simplest terms, the velocity of money measures how many times a dollar flows through the economy. As a result, it is a useful—though not perfect—measure of a nation’s economic activity.

To illustrate, consider a micro-economy with three citizens: a farmer, a grocer, and a businessman. In this micro-economy, the total money supply is $10.

The farmer has lemons, which he sells to the grocer for $5. The grocer marks up the lemons and sells them to the businessman for $10. The businessman turns around and sells a glass of lemonade for $2.50 to both the farmer and grocer.

The total value of the above transactions comes to $20. As there is $10 of money in circulation, the velocity of money would be said to be 2. This measure indicates how efficient $1 of money supply is at creating economic activity. In general, the faster money moves—that means, the more transactions a dollar is used in—the healthier the economy.

As you can see in the chart below, the velocity of money in the US has been going down steadily for most of the last two decades. After the Great Recession, it has dropped to a historic low.

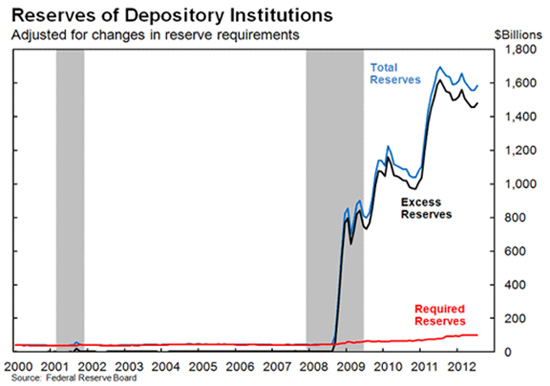

In response to the financial crisis, central banks all around the world resorted to unconventional measures (i.e., quantitative easing) that increased the money supply in hopes of generating economic activity and offsetting deflationary forces.

Instead, for reasons we won’t go into here, most of that money went from the central banks to financial institutions and stayed there. It did not enter the real economy.

(This is one reason, by the way, why marketplace lending (MPL) has become so popular. Read all about it, and why it makes such a great investment, in our new report, Welcome to the Bank of You.)

As a result, economic growth has stagnated and today, over $50 trillion in cash is sitting on the sidelines waiting to be used.

Why Does It Matter?

Global economies are overloaded with debt and still dealing with the repercussions from the financial crisis. Unprecedented central bank policies may have stopped the bleeding, but much of the global economy is still in triage.

As indicated by the stock market, many investors are hopeful that the Trump administration will be able to jumpstart the US economy. In order for that to happen, the new team will have to create an environment where US banks once again begin lending.

Should they succeed, we will see the excess reserves now sitting in the banks start to flow back into the real economy, resulting in a quick change in the economic landscape.

For example, if banks lend money to corporations for productive investments, they will create jobs. That, in turn, will cause higher consumer spending and higher velocity of money.

Higher velocity will mean more money chasing a limited supply of goods and services, potentially triggering the inflation the Fed has tried so hard to rev up over the past 10 years.

Real Interest Rates and Gold

Under normal conditions, the return of inflation would give the Fed room to raise interest rates. However, under President Obama the federal government’s debt has doubled to $20 trillion. As a result, roughly 6% of the federal budget now goes to paying interest on that debt. An even modest increase in rates could cause the interest payments to double over the next decade.

Simply, the government can’t afford higher interest costs on its debt. Nor can its heavily indebted citizens: American households have $14.6 trillion in mortgage, student loan, auto loan, and credit card debt.

Add to that another $13.4 trillion in US business debt, and the problem of rising interest rates becomes clear.

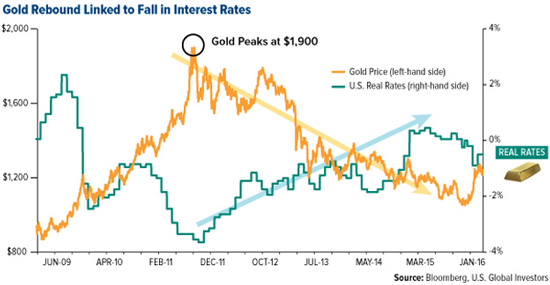

A more likely scenario is a gradual pace of rate hikes by the Fed, even if inflation runs hot. In that case, we will see negative real interest rates for some time. This is just the setting for investors to hold gold. (Download the free ebook, Investing in Precious Metals 101, to learn more.)

Critics of gold point to its negative cost of carry. Owning a bond earns an investor yield through periodic coupon payments. Gold doesn’t earn a yield. In fact, you may have to pay to store your gold in a vault.

However, when inflation is running above nominal bond yields (i.e., negative real rates), that negative carry isn’t a factor, and gold starts to look far more attractive.

If the Trump administration can successfully reform the US economy, we will see the velocity of money go back to at least its historic average level of 1.8.

Combine the potential for higher money velocity with a timid Fed willing to stay behind the inflation curve, and gold is sure to shine.

What If the Foundation of Hope Crumbles?

Trump’s win was met with an optimistic rally in the stock market. There is no doubt Trump will bring change to DC politics. But the stock market rally so far has been built on a foundation of hope that Trump’s tax and regulatory reforms in the US could stimulate investment and boost the economy.

However, repositioning the world’s largest economy for positive, sustainable economic growth is no small feat. Economic reform will face many headwinds, including a strong dollar.

While a strong dollar may not sound like a bad thing for Americans, it carries significant consequences. For one, a strong dollar will make exports less competitive, a sector that accounts for roughly 12.6% of the US economy.

Emerging-market countries have also borrowed trillions of US dollar-denominated debt. Repaying that debt gets more expensive as the dollar appreciates. It’s worth remembering that the Asian Financial Crisis of 1997 was in no small part triggered by a strengthening dollar.

The challenges are vast, but Margaret Thatcher managed to transform Britain when it was in much worse shape than the US economy is today. Cautious optimism is probably the best way to approach the incoming administration.

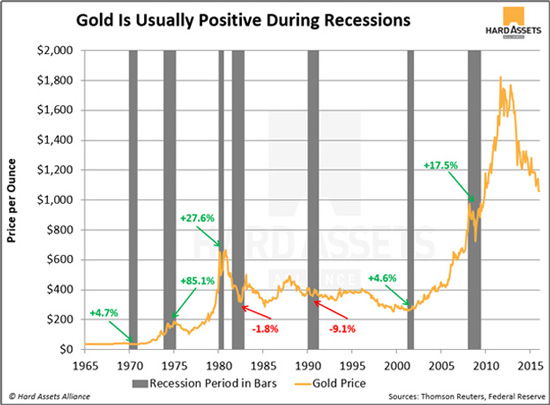

The good news for gold investors is that even if the Trump administration fails, gold has historically been a reliable source of insurance against a recession.

Source: Hard Assets Alliance

In five of the past seven recessions, the gold price rose. And three of those times, it soared by double digits. In only one recession did gold suffer a noticeable decline (-9.1% in 1990). Even in the midst of the 2008–2009 financial crisis, gold moved higher.

Like many investors, I am hopeful the incoming administration can return the US economy to a sustainable path of strong economic growth. But hope isn’t a good investment strategy. That’s why I own gold.

If, in the best-case scenario, Trump successfully reverses the downward spiral in the velocity of money, creating inflation in the process, gold should shine. If not and the worst-case scenario materializes with a fall back into recession (or worse), gold should benefit as well.

Either way, there is a compelling case to be made that every investor should own gold as an insurance policy.

Free ebook: Investing in Precious Metals 101—Everything You Need to Know About Buying and Storing Physical Gold and Silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

Here Come the Clowns

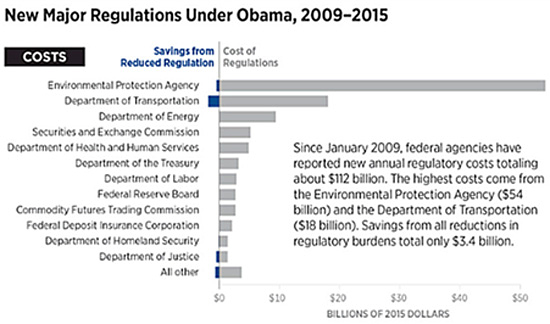

Save the Planet—Freeze to Death! Of all of Obama’s legacies, perhaps the most economically destructive is his massive expansion of regulation. As we explained in our article, Regulation Strangulation in Compelling Investments Quantified, no regulatory agency expanded more than the Environmental Protection Agency (EPA). The chart here from the Heritage Foundation pretty much says it all.

It is that agency that is threatening certain areas of Alaska with punitive fines and a withholding of federal funds unless the citizens stop using wood-burning stoves.

As the author of this well-written article on the EPA’s latest folly points out, the areas impacted by the EPA directive include those that are remote and can experience temperatures of minus 60 degrees during the worst parts of winter.

Out of necessity, Alaskans tend to be a tough lot, and sufficiently far removed from Washington, DC to think independently about such things—so I don’t think the EPA threats will amount to much. Certainly not before Trump is sworn in, after which it wouldn’t surprise me to see the regulation inflation under his predecessor go into reverse. One can only hope.

As an aside, in the same edition as our article Regulation Strangulation, at the end of September 2016, we recommended buying shares in a deeply undervalued consumer staple company that makes bread. Our readers have already made gains of 29% on that recommendation. Learn more.

And with that shameless but accurate plug, I will bid you farewell for the week.

Thanks for reading!

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.