Misunderstanding GDXJ: Why It’s Actually Great News For Junior Miners

Commodities / Gold & Silver Stocks 2017 Apr 28, 2017 - 05:55 AM GMTBy: John_Rubino

Something extraordinarily good for junior precious metals miners just happened. But for some reason it’s being misinterpreted as a bad thing. Here’s the general story:

Something extraordinarily good for junior precious metals miners just happened. But for some reason it’s being misinterpreted as a bad thing. Here’s the general story:

A Small-Cap Gold Mining ETF Streaks Lower As Big Index Change Looms

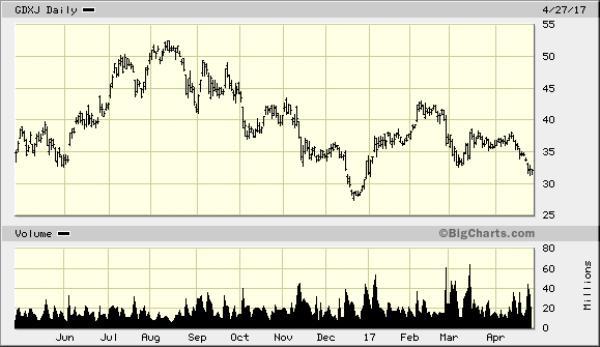

(Investors.com) – Mining stocks blazed a bright trail of returns since the start of 2016 as gold saw a renaissance and geopolitical uncertainties rose. That popularity has been double-edged for one gold mining ETF, which is now streaking lower.VanEck Vectors Junior Gold Miners (GDXJ) is set for a major revamp of the underlying index, which will broaden the exchange traded fund’s market-cap range and raise the average size of its stocks.

Torrid asset growth has led to concerns that GDXJ is too big for its index, with massive stakes in some stock holdings making the overhaul necessary, as ETF.com first reported.

For investors in this popular and heavily traded ETF, the changes may mean less small-cap exposure than they have come to expect.

Under the new indexing method, the ETF’s largest company by market cap could be $2.9 billion — vs. $1.8 billion under the current method — putting it over the traditional $2.5 billion limit for small caps.

The index change is set to take effect June 17, but the Junior Gold Miners ETF already has started buying stocks not in the underlying index.

The new names include Alamos Gold (AGI), B2Gold (BTG), Iamgold (IAG), Pretium Resources (PVG), Real Gold Mining and Patagonia Gold, besides a hefty stake in its large-cap sibling, VanEck Vectors Gold Miners (GDX).

They now constitute the ETF’s top holdings and account for more than a quarter of portfolio assets combined.

Asset Haul

Assets in GDXJ have ballooned 270% from $1.3 billion at the start of 2016, making it a $5 billion ETF “attempting to invest in (an approximately) 30 billion gold universe,” as one analyst told ETF.com. As money flowed in, GDXJ ended up owning more than 18% of some Canadian stocks.That called into question its adherence to diversification rules.

Both tax and securities laws provide diversification standards for funds registered under the Investment Company Act. They limit, in part, the amount of a company’s outstanding shares that a fund may own — no more than 10%, in the case of securities law.

When this story broke, a couple of things happened. First, GDXJ fell as investors concluded that it’s now a lot less exciting.

Second, the stocks it was forced to sell to get back below statutory ownership limits plunged. Here’s Klondex Mines, a representative example:

This has understandably dismayed the owners of these shares, and led to a lot of handwringing about dark times for junior miners.

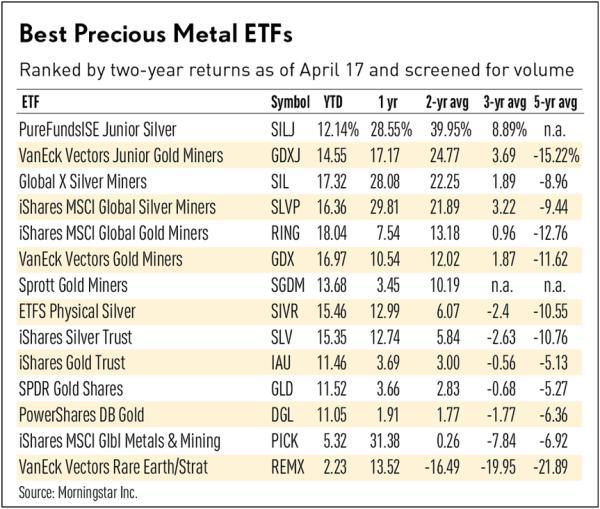

But the truth is very different. To understand why, pretend you’re running a company that creates and markets ETFs. From your point of view, is the GDXJ saga a cautionary tale of a mismanaged fund? Nope. What you see is massive investor interest in a segment where you’re not represented. Then you look at the precious metals ETFs now on the market (the following chart is from the above investors.com article) and notice that GDXJ is the only one focused on junior gold miners.

You also notice that the best performing ETF on the list holds junior silver miners. Since your job is to attract investors’ money, how do you respond to this multi-billion-dollar unfilled need? You fill it, of course, by bringing out copycat funds.

In years to come there will be a wave of GDXJ and SILJ wanna-be ETFs. They’ll be smaller than the incumbent funds so initially at least won’t have to worry about owing too much of any one stock. But in the aggregate they’ll end up being bigger than GDXJ, which means they’ll swamp the junior mining sector — which is, as noted above, tiny and illiquid.

The result: a serious, ongoing tailwind for a sector that’s already seeing increased interest from both investors and speculators. Going forward, the juniors will be the hottest part of what should be a very hot precious metals market.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.