Gold And Silver – Asylum Globalists Still Prevail

Commodities / Gold and Silver 2017 May 06, 2017 - 03:29 PM GMTBy: Michael_Noonan

Usually, we endeavor to tie in our commentaries to gold and silver, sometimes straining the association, but in reality, there is much more affecting the price of PMs than meets the obvious. There can be no question that the globalists running the federal government of the United States have been actively suppressing the price of gold directly since 1933,

when the moneychangers shut down the US banking system and reopened it five days later, totally under the control of the Federal Reserve, owned specifically by foreign banking interests. [The Federal Reserve has never been a part of the US government. The globalists have let the world think that it is. Deception is one of their main ruses.]

Usually, we endeavor to tie in our commentaries to gold and silver, sometimes straining the association, but in reality, there is much more affecting the price of PMs than meets the obvious. There can be no question that the globalists running the federal government of the United States have been actively suppressing the price of gold directly since 1933,

when the moneychangers shut down the US banking system and reopened it five days later, totally under the control of the Federal Reserve, owned specifically by foreign banking interests. [The Federal Reserve has never been a part of the US government. The globalists have let the world think that it is. Deception is one of their main ruses.]

The insidious extent to which the globalists have been undermining the US and gaining control has been going on since the days of the Revolutionary War [1775 – 1783]. That may surprise many, but fighting the war against foreign financial control has been ongoing, and the globalists have been in charge, one way or another, ever since. The Civil War [1861 – 1865], was not about slavery, it was about money, gaining financial control. The English Rothschilds financed the North, while the French Rothschilds financed the South. The one clear winner of that war, [indeed, all wars] was the Rothschild bankers.

Sadly, today around 65% of US citizens believe the government should have control over their lives, all American lives. When the level of ignorance is so high, one can understand why little hope is held for escaping from the globalist’s control. BREXIT offered a glimpse of hope. The election of Donald Trump also offered a glimmer of hope, yet the free-wheeling “Let’s give America back to the Americans” Trump experienced a total reversal of almost all of his stated objectives which have been utterly overturned via a live coup by the Deep State within Trumps’ first 100 days.

It is not to often one gets to see a coup happen before their very eyes, but most were asleep with thier eyes wide open.

Far from “draining the swamp,” Trump has been enveloped by the same Wall Street swamp participants. Like Obama before him, and despite his rhetoric, Trump has installed the same ilk of Wall Street globalist executioners to run the country as they so choose, and it ain’t for the benefit of the American people, or any other country that gets in the way.

The future price of gold and silver is not a function of the natural forces of supply and demand, a position we have stated in the past. Other, unseen or not so obvious forces are in control. The globalists are in the process of dismantling the US by slowly destroying the US “dollar” as the world’s reserve currency. This fact was advertised by the globalist’s publication, The Economist, back in 1988 when it was making the claim to “Get Ready For A World Currency by 2018.”

So far, that call for a new world currency, made 30 years ago, is running on schedule. The globalists plan decades ahead, just as they stated in the 1990s that there were five countries in the Middle East to be overtaken over the next few decades. That, too, remains on schedule.

When one begins to appreciate the scope of how the world has been dominated by a group hidden from all public scrutiny, it becomes apparent that the resources available to them, in addition to those they control, manipulating the price of gold is child’s play. The rest of the world tries to figure out logical reasoning for determining the price of gold in an otherwise illogical world that remains unseen.

That the globalists are unseen does not mean their actions are not visible. They rely on the gullibility of people all over the world, and the avarice of heads of government so willing to serve them in order to become wealthy. Easy current examples are the Clintons with not enough money to own their own home while slick Willie was governor of Arkansas, and now they are billionaires…not by accident or good luck. Obama, a virtual nobody civil activist politician from Chicago that became the willing puppet of the globalists in running their agenda. He is just beginning to reap rewards, starting with his first one hour speaking fee of $400,000. In all likelihood, billions await him, as well.

It is unfathomable for most people to accept how ruthlessly the globalists run their agenda, letting nobody or anything to get in their way. A simple example is the one we cited above, calling for a new world currency 30 years ahead of time. Hard to believe the accuracy of their timing, but it seems like an innocuous call, [if one chooses not to know how much death and destruction occurred by creating the Fed’s “dollar” as a world reserve currency.

To the notion of letting nobody get in their way…Both Lincoln and Kennedy were presidents, and both were assassinated. The common thread between them? Both wanted to issue US currency not under the control of the Rothschild banking cartel. There are no accidents. Not a lot of people know or believe this. The globalists like it that way.

Also hard to accept is what follows…

The video below discusses a topic about the globalists of which we have been aware for several years but have refrained from mentioning because the information was second- hand. In this instance, it appears to come from one who was a part the Illuminati and talks about Satanism and sacrificing children, as practiced among those a part of the globalists seeking to rule the world.

Many hearing this information for the first time, about how the global banking system works, and more, may have a hard time accepting what is. It puts into a context how most of the world’s inhabitants are under the boots of the globalists, much like George Orwell described. What was surprising, and the reason why we are presenting it here, is this individual provides an unexpected glimmer of hope to escape from the inexorable suppression of the masses by the globalists.

Rather than give the time in which the statement is made in this almost 40 minute video, it is worth a listen in its entirety. What we can say about what is candidly discussed, we have heard similar kinds information on too many previous occasions to not believe it.

The Deep History of US, Britain’s Never-Ending Cold War On Russia.

This next article covers the complicity of the US and UK in financial bed with the Nazis during WWII and their willingness to turn a blind eye to the Jewish camps, all with the end goal of using Hitler and his Nazis to hopefully defeat Russia, the objective of the globalists for over 100 years. Worth a read for a different perspective.

“This is not a mere historical academic exercise. Western complicity with Nazi Germany also finds a corollary in the present-day ongoing hostility from Washington, Britain and their NATO allies towards Moscow. The relentless build up of NATO offensive forces around Russia’s borders, the endless Russophobia in Western propagandistic news media, the economic blockade in the form of sanctions based on tenuous claims, are all deeply rooted in history.”

The world as presented by the US is fiction and fantasy. The reality is quite different. The world of pricing gold and silver is also fiction, for their pricing are solely determined by those in charge of the globalist asylum.

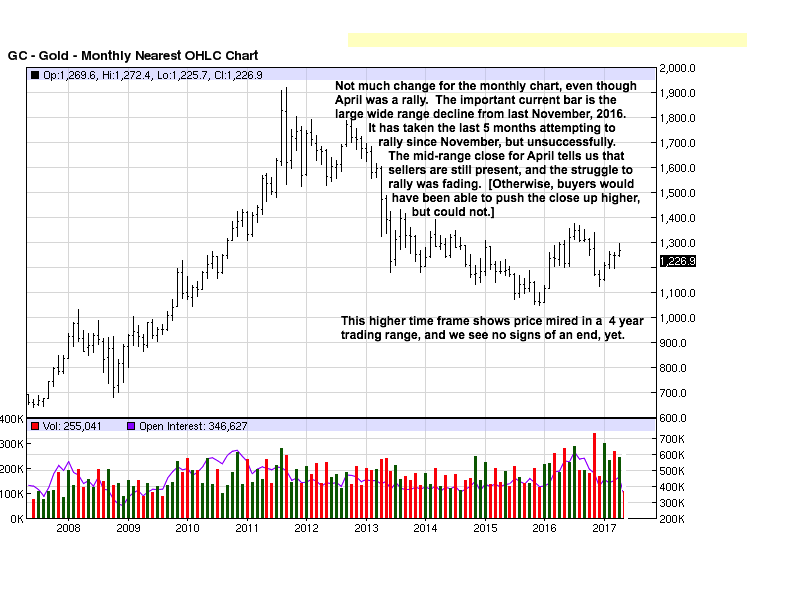

A current look at the charts…

Monthly chart comments cover what is going on, which is not much in the way of any change. Sideways markets can last for incredibly long periods of time, this one now in its fourth year. The current ennui characterizing gold has to be accepted for those long the physical. While no change to the upside appears imminent, we are dealing in markets of perception [with no sound basis in reality]. Perceptions can change quickly, and all bets are off. This is what we think can happen in gold. One day, or over one weekend, price all of a sudden takes off with little respite to the upside.

It may seem tedious to repeat: Better a year [now a few] early than a day late.

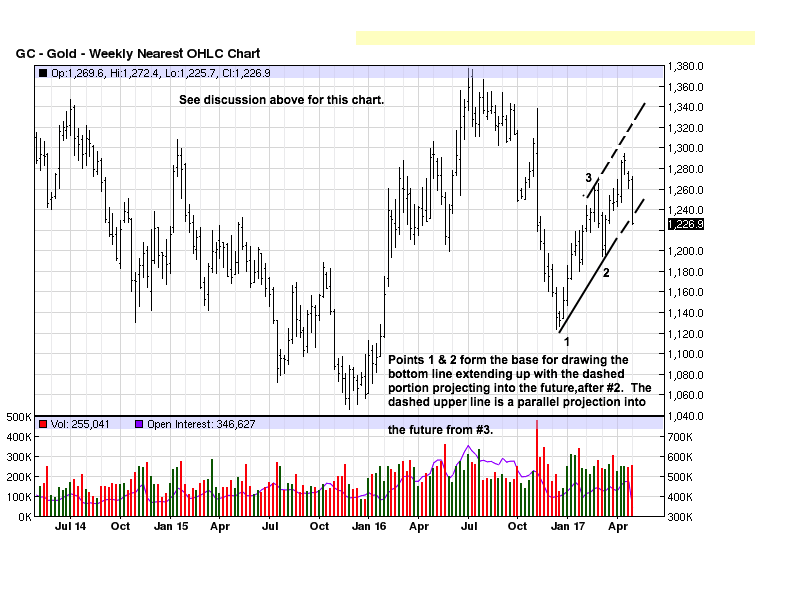

This is similar to the chart from last month, just updated. Price failed to reach the upper channel bar on the rally to the 1290 area, and that portended weakness, as in a drying up of buying power. The small range, 3 bars ago, and marginally higher close was the tell to expect a possible sell-off.

As of last week’s close, price broke and closed just under the lower channel line [usually meaning support, but price prevails over such lines]. The wide-range November decline bar, [Trump election week] still controls as resistance. Not much else to see here.

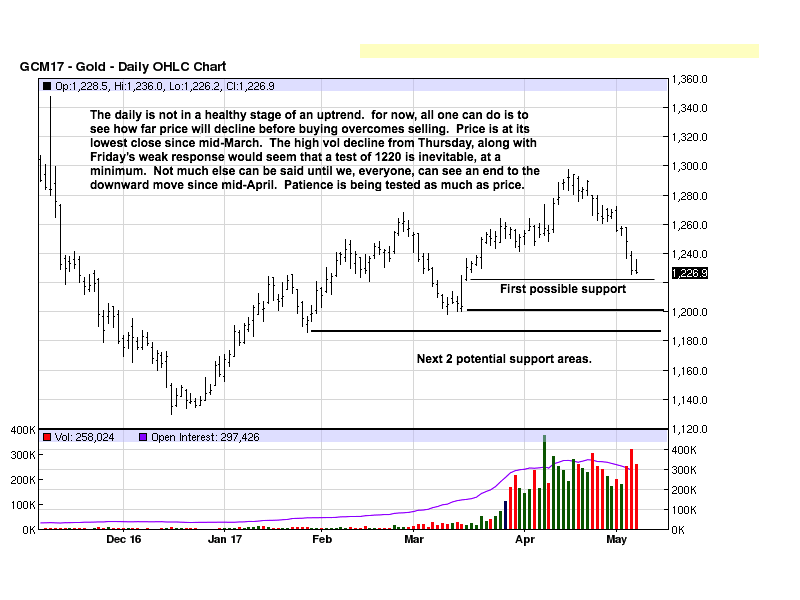

What had been a laboring uptrend just slowly turned over and down. Just have to wait and see where support shows up.

Why labor over the obvious?

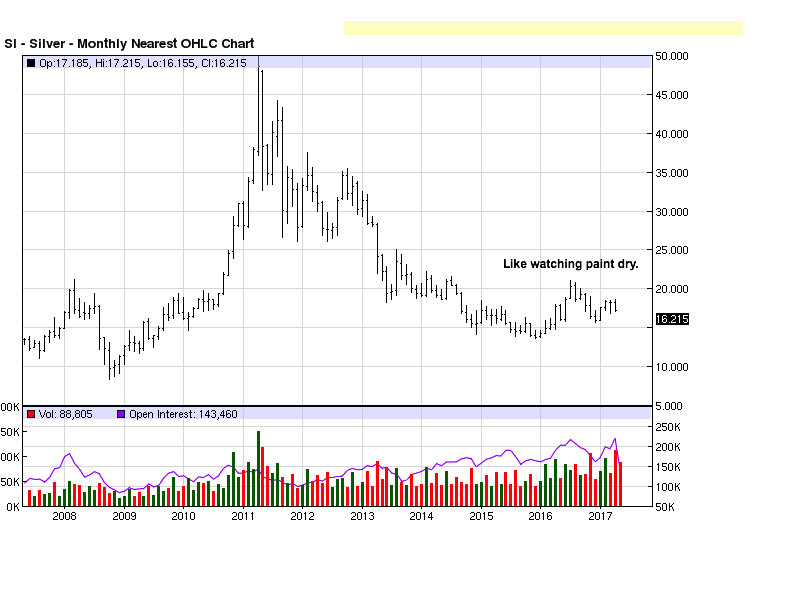

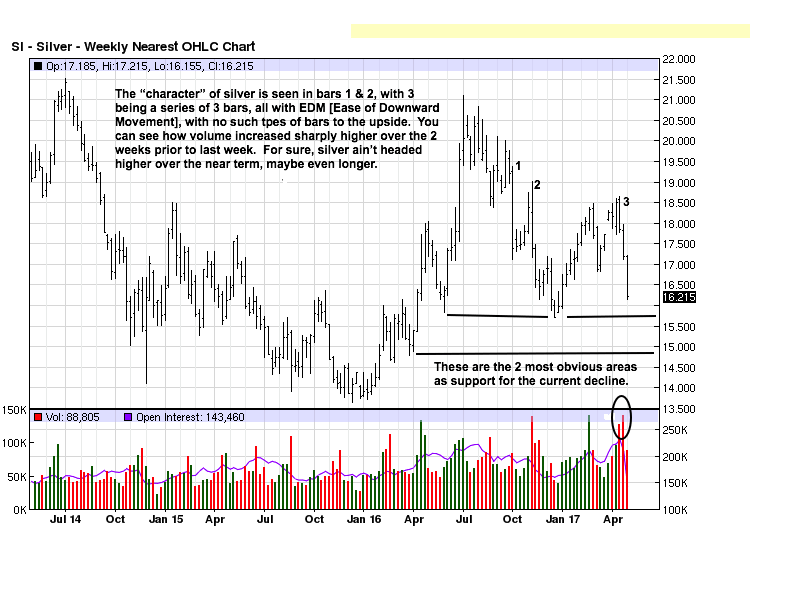

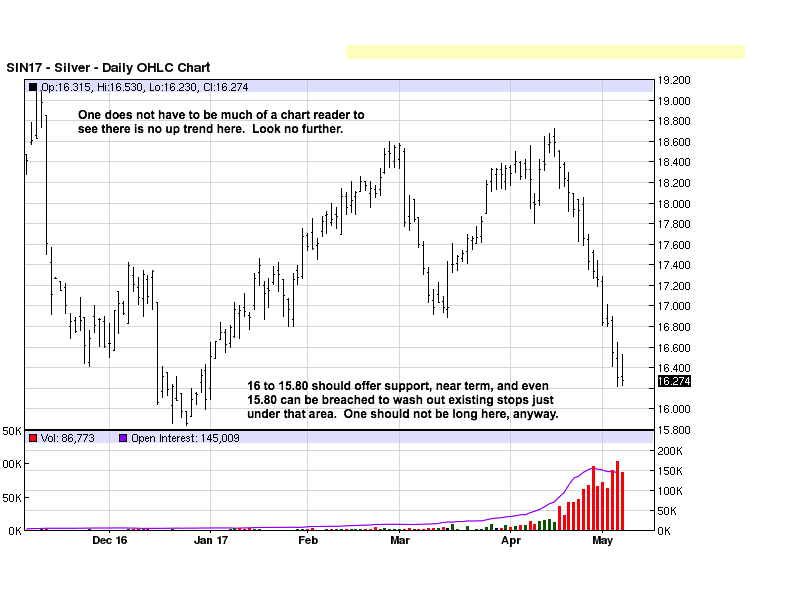

Silver has underperformed relative to gold, with the Gold:Silver ratio, now around 75:1, 75 ounces to buy one ounce of gold, where it recently has been 67:1. The relative weakness to gold is obvious in the charts.

Holding physical silver has no bearing on the manipulated paper futures prices, other than to continue to test one’s resolve in being a stacker. One aspect many of the critics have against those owning physical PMs and fails to point out is that the purchasing power of the dollar has been declining unabated, one inflation year after another. With no third-party counter risk and a proven store of value over centuries, physical holders can endure the slings and arrows aimed in their direction. Pragmatically, if the testing of one’s patience is the worst one has to confront, bring it on.

The globalists are doing everything possible to remove all credibility, and sensibility, for owing gold and silver. Why else would they spend so much time and energy suppressing it, while at the same time, acquiring it for themselves?

With the war on cash now underway, would you rather own gold and silver, soon to disappear worthless fiat, or imaginary digits that bankers can make disappear if they do not like your political attitude? The globalists are trying to set a trap for gold and silver holders. Only a fool would fall for it.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2017 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.