When the United States Owned Most of the Gold on Earth

Commodities / Gold and Silver 2017 Sep 08, 2017 - 04:12 AM GMT Few Americans know that, just after World War II, the United States owned most of the gold bullion on earth – about 22,000 metric tonnes. In fact by 1945, it owned over 80% of the gold held by nation-states and central banks – an impressive display of economic power. Now it owns just over 8000 metric tonnes, which represents about 42% of the total global reserve.

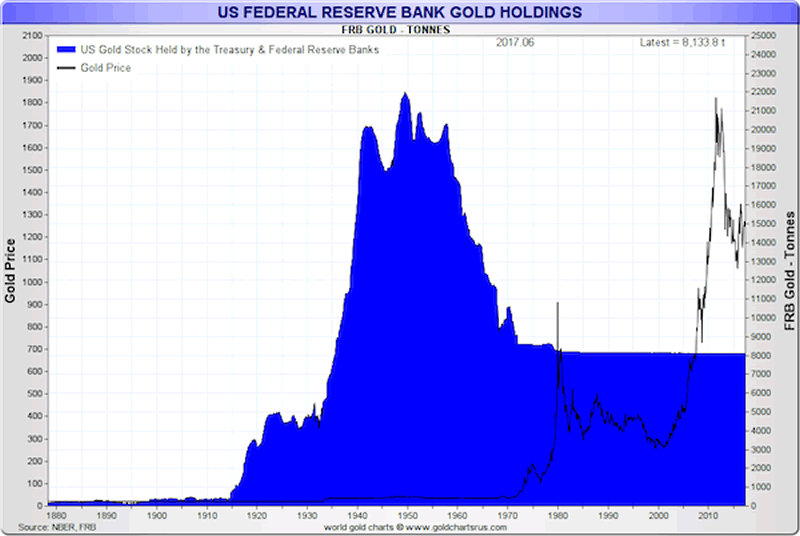

Few Americans know that, just after World War II, the United States owned most of the gold bullion on earth – about 22,000 metric tonnes. In fact by 1945, it owned over 80% of the gold held by nation-states and central banks – an impressive display of economic power. Now it owns just over 8000 metric tonnes, which represents about 42% of the total global reserve.

The lost 14,000 tonnes were expended in defense of the $35 per ounce gold benchmark price established under the 1944 Bretton Woods Agreement. In addition to the fixed price of gold, the U.S dollar came to represent a fixed weight of gold, i.e., 1/35th of a troy ounce, and the rest of the world’s currencies were then pegged to the dollar. The United States agreed under Bretton Woods to redeem gold from the other signatories at the rate of $35 per ounce should any of the participants determine that gold might be a better alternative for a portion of their reserves than U.S. dollars. “The dollar,” American policy makers were wont to say, “was as good as gold.”

Germany, France get the idea dollar not as good as gold

All proceeded in orderly fashion with little in the way of redemptions from the massive U.S. stockpile until the 1960s. Then a group of European nation-states, led by Germany and France, got the idea that U.S. inflationist economic policies had undermined the dollar, making gold a bargain at $35 per ounce. In other words, they came to the conclusion that the dollar was not as good as gold. Steadily, over a decade long period, they exchanged dollars for gold at the U.S. Treasury’s gold window. By the early 1970s, 14,000 tonnes of gold – or 64% of the stockpile – had departed the U.S. Treasury for European shores never to return.

In 1971 President Richard Nixon finally decided enough was enough. He closed the so-called gold window, devalued the dollar against gold, and freed the greenback to trade at market prices against other currencies. Fully abrogating the Bretton Woods Agreement, Nixon declared, in one of the more famous quotes of his presidency, “we are all Keynsians now.” The era of global fiat money, with a fiat U.S. dollar as its centerpiece, had begun.

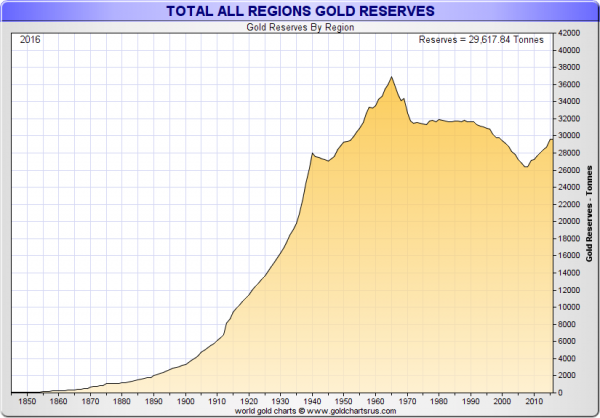

Had the United States refrained from its defense of the $35 benchmark, it would still own about 75% of the present 29,000 tonne global gold reserve. As it is, Nixon’s revocation of the Bretton Woods architecture set the stage for the modern gold market. You can see the result in the chart immediately below. From it, I can draw three conclusions:

–– First, we are now in the 46th year of a super-cycle, secular bull market in gold that began in 1971 – a bull market directly tied to the fate of the now fiat U.S. dollar.

–– Second, the very same conditions which created that bull market are still in place today – nothing has changed fundamentally.

–– Third, as long as the same cause and effect remain in place, we can assume gold will continue to make sense as a long-term portfolio hedge.

Some will agree with those conclusions. Some will not. Some are on the learning curve, and it is to that group this piece is largely addressed.

Chart courtesy of GoldChartsRUs/Nick Laird with thanks

In the end, it is the times that need to be hedged

Those who do not agree with those conclusions, it has been my experience, will continue to put their faith in the stock and bond markets and ignore the precious metals. There is no amount of persuasion that will convince them to do otherwise, and to try is pretty much a waste of time. Most importantly, whether they care to acknowledge it or not, they will put their faith ultimately in the federal government and the Federal Reserve.

Those who do agree will continue to hedge their portfolios with the precious metals, just in case the long history of economic breakdowns beginning with 1971 repeats itself yet again. To this group, the proper diversification is a small price to pay, a matter of practical financial planning that, in these times, provides some much-needed peace of mind. As for an end game to all this, they will keep in mind one of history’s immutable lessons – sometimes the problems become too large for the government and central bank to control.

For those on the learning curve, a post I made at the USAGOLD blog recently titled “Historical inevitability and gold and silver ownership – In the end it’s the times that need to be hedged” would be an informative follow-up to what you just read, another piece in the puzzle. It got significant play on the wider internet and speaks to the possibilities of an end game from the perspective of Strauss and Howe’s fourth turning.

![]() You have just read the lead article for the September edition of News & Views – USAGOLD’s monthly newsletter. To gain immediate, FREE access to the rest of the newsletter, we invite you to to sign-up here. In this month’s chart rich edition, we cover the ‘quiet’ summer rally in gold and silver; the dramatic shift in central banks’ role in the gold market since the 2008 financial crisis; the relevance of the upcoming Shanghai Exchange oil futures contract convertible to gold. . . .and more. All from the perspective of the gold owner.

You have just read the lead article for the September edition of News & Views – USAGOLD’s monthly newsletter. To gain immediate, FREE access to the rest of the newsletter, we invite you to to sign-up here. In this month’s chart rich edition, we cover the ‘quiet’ summer rally in gold and silver; the dramatic shift in central banks’ role in the gold market since the 2008 financial crisis; the relevance of the upcoming Shanghai Exchange oil futures contract convertible to gold. . . .and more. All from the perspective of the gold owner.

One more chart for those who want the complete picture:

Chart courtesy of GoldChartsRUs/Nick Laird with thanks

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.