Here’s A Strong Case For A Strong Yen

Currencies / Japanese Yen Sep 12, 2017 - 09:39 AM GMTBy: John_Mauldin

I am well-known for suggesting that Japan was a bug in search of a windshield and in predicting that the yen would go 200 to the dollar.

I am well-known for suggesting that Japan was a bug in search of a windshield and in predicting that the yen would go 200 to the dollar.

About four years ago, when the yen was at 100, I even purchased 10-year options, which were ridiculously cheap, with strike prices 20 to 30 yen higher. I was willing to be patient and wait for 10 years, if I had to.

I may have to wait for a lot longer if my friend Charles Gave is right.

Charles is arguing that the yen, far from going lower in value, is likely to go quite a bit higher. He begins laying out his rationale with a wonderful summary exposition of Irving Fisher's seminal 1933 article “The Debt-Deflation Theory of Great Depressions.”

Then Charles applies that thinking to the last 45 years of Japanese history. If he is right, and he may be, my yen options are going to expire pretty much worthless in six years. I'm not going to sell them at this point, but I am very seriously considering changing my mind.

Irving Fisher and Japan

By Charles Gave

August 23, 2017

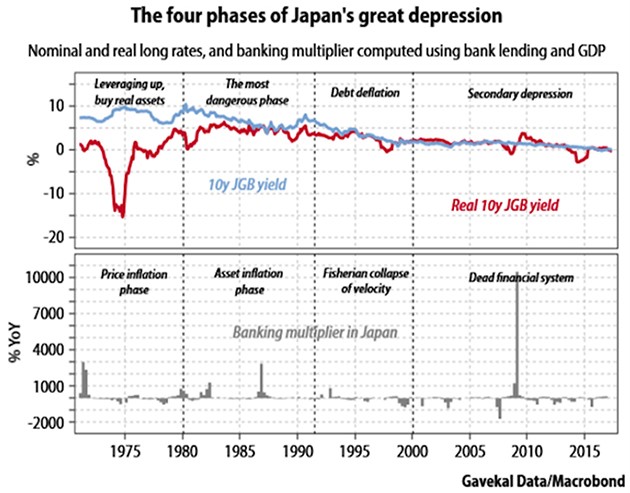

Few papers written by defunct economists have had as much influence on my way of looking at markets as Irving Fisher’s seminal 1933 article “The Debt-Deflation Theory Of Great Depressions.” In it, Fisher hypothesized the patterns that great depressions go through. In a nutshell, great depressions go through four phases.

1) The phase of price inflation. Nominal rates go up, while real rates go down. It thus pays to borrow in order to buy real assets. Servicing debt may be difficult should there be a temporary liquidity crisis. But repaying principal when loans mature is not a problem. During this phase nominal interest rates can reach very high levels. In this period there is a high velocity of money.

2) The phase of asset inflation. Nominal interest rates go down structurally, but real interest rates go up. This monetary illusion gives borrowers the false impression that borrowing is very cheap, since the nominal cost keeps going down. However, the reality is that while servicing debt is cheap, rising real rates make repaying principal tougher and tougher. During this period the velocity of money remains strong, with most of the money going to buy existing assets. One day the return on invested capital falls below the cost of capital, and the economy moves into the next stage.

3) The phase of debt deflation. Every borrower struggles to repay debt. The velocity of money collapses, which causes prices to collapse, which leads to higher real rates. Historically it takes around 10 years for the banking system to finish going bust, which naturally keeps the velocity of money suppressed.

4) The final phase is what 19th century economists called the secondary depression, which can last as long as 20 years. During this phase not much happens for as long as the generations who suffered from the financial collapse and the debt deflation are still around. In this period, the velocity of money remains close to zero, with nominal interest rates also close to zero but offering a positive real yield. This makes plenty of sense.

If by now you are marveling at how closely Japan’s economic trajectory over the last 45 years or so has fitted Fisher’s theoretical framework, you are not alone. As the chart below shows, Japan is now approaching the 18th year of its secondary depression. So as the economy continues to follow the path mapped by Fisher, investors should start to look for signs that Japan is beginning slowly to emerge from this secondary depression phase.

One sign would be a rise in the velocity of money as commercial banks start to lend again. And guess what? If you use a microscope, you can see that the velocity of money in Japan is indeed starting to creep up. Admittedly, the increase is small, just 2% year-on-year, but everyone has to start somewhere.

I am starting to wonder if Japan, having been the first economy to enter debt deflation, will now be the first to emerge from it. After all, companies in Japan have close to US$4trn in cash. They are trading on a “normal” P/E ratio. Corporate profits have been growing at a faster rate in Japan than in the US for the last five years. And during that time the Japanese stock market has massively underperformed US shares. On top of that, Japan is the world leader in everything to do with labor shortages. And according to Will and Udith a labor shortage is exactly what much of the developed world is facing (see It Is Not Slack Weighing On Wages).

My investment conclusions are thus very simple:

- Money managers own too few Japanese equities, especially in sectors where Japanese companies are world leaders.

- The yen is grotesquely undervalued on a purchasing power parity basis versus most other currencies. The best performing currency in the next five years should therefore be the yen. If a manager wants to hold cash, in my opinion he should hold cash in yen.

- For an international bond portfolio, owning the short-dated part of the yen yield curve could make a lot of sense.

Get Varying Expert Opinions in One Publication with John Mauldin’s Outside the Box

Every week, celebrated economic commentator John Mauldin highlights a well-researched, controversial essay from a fellow economic expert. Whether you find them inspiring, upsetting, or outrageous… they’ll all make you think Outside the Box. Get the newsletter free in your inbox every Wednesday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.