Do Fundamentals Drive Bitcoin? Are You Kidding Me?

Currencies / Bitcoin Nov 02, 2017 - 05:04 PM GMTBy: Avi_Gilburt

Is Bitcoin worth over $6600? Well, that is the price traders are bidding for it when this article was written.

Is Bitcoin worth over $6600? Well, that is the price traders are bidding for it when this article was written.

Every MBA student is taught many means of evaluating or valuing securities. Discounted cash-flow and Capital Asset Pricing Models are a couple of valuation methods. Moreover, fundamental oriented stock traders tend to use ratios like Price to Sales, Price to Earnings or Price to Book to value stocks.

Do any of these methods apply to Bitcoin, or any crypto currency for that matter? Well, if you attempt to apply any of the above mentioned methods, you are missing values to insert to your formula, as assets, earnings, cash-flow don’t exist. So, basically, you’re out of luck.

What about using a means of valuing traditional currency? Balance of payments, interest rate differentials, and current accounts of sovereigns are all methods we read about.. Again, they are all useless here.

Let’s move to behavioral economics. Does bitcoin have ‘utility’, that somewhat esoteric concept that gives an asset or good a value? Ryan thinks so and could give a long talk on the issues blockchain can solve, but that is subjective.

Therefore we propose to you that since there is no means by which to value bitcoin, or any crypto currency, it is possibly the most purely sentiment driven market in existence. While participants may give subjective reasons for its value, there is no valuation model in wide acceptance. There are attempts, but even if accepted, would they work? Probably not.

While there is no objective means of valuing crypto currency, there is no shortage of bubble calls and claims that the crypto mania is akin to the tulip mania of 1636-7. And, likewise, there is no shortage of calls that bitcoin will one day be astronomical in value, including John MacAfee’s claim it will reach $500K or he’ll make a violent spectacle of himself on TV. Yet he uses subjective arguments to make this claim.

So, how does one trade something purely sentiment driven, with no means to valuation? Elliott Wave analysis, coupled with our Fibonacci Pinball method, provides reliable objective price ranges, targets and supports for sentiment driven markets.

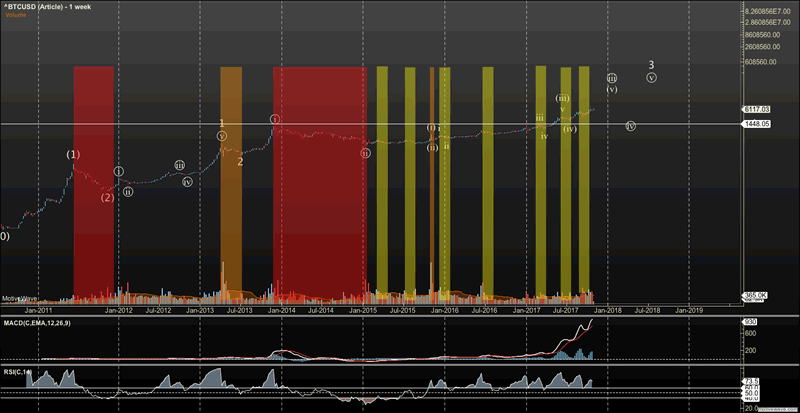

Let’s back up a second and look at the history of bitcoin and its already tremendous boom and bust cycles. We’ve ‘color coded’ past corrections with red, signifying 80%+ price corrections. Orange signifies 50-79% corrections, and yellow are corrections that are 25-49%.

Therefore, if history is a guide, those calling for Bitcoin to see six and seven figures in the future should expect brutal corrections. In fact the normal correction in Bitcoin makes an equity bear market look like child’s play. Likewise, those calling for the bitcoin bubble to pop should not assume that if bitcoin gets a 90% haircut it is the beginning of its demise.

Booms and busts in any market are normal, but those in crypto are particularly volatile, and you should expect it to happen again. The question is when? Everyday retail investors would do well to avoid these large drops, which can sometimes be prolonged. Likewise, they would do well to take profit at times of high risk to lock in gains.

Our Short Term Outlook

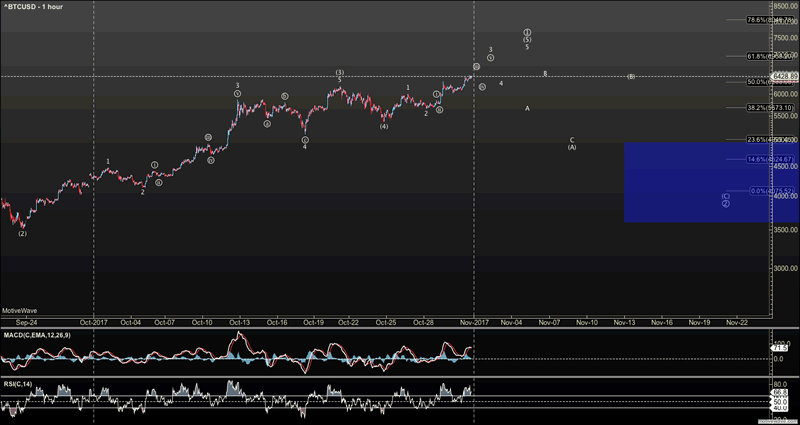

While the media has been full of discussions regarding bitcoin bubbles, and crypto-tulips, we’ve been looking higher and see $14,000 plus over the next few months provided the September 15th low holds. We can even make an argument for extensions to just over $20,000. But before we see five figures, we are looking for an interim top in the $6700-$7200 region. This will gives us an entry point in the $4-5000 region. But, please remember that these are general guidelines, whereas we look for more specific targets in real time as we analyze the market through the day.

It should be no surprise for those that track sentiment that a market can rally while bubble talk fills the news. At the same time, the masses are slowly adopting bitcoin, and new crypto investors are born every day. Some of the latest rumors include Amazon accepting Bitcoin, and Apple and Google building crypto payment systems into their browsers. Speculation is building upon expected mass adoption even while the ‘bubble callers’ warn.

Who is right? We could care less.

Rather, we try not to be participators in sentiment but analyze it objectively, using Elliott Wave analysis, with which we measure that sentiment with objective price measures.. And, so far, this has kept us on the right side the bitcoin market, taking profit at key long term fibonacci targets, so we have funds to benefit during those inevitable deep corrections.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2017 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.