Once in 100 Years Credit Crisis, World Heads for Deflationary Collapse

Stock-Markets / Credit Crisis 2008 Sep 03, 2008 - 01:58 AM GMT “The credit crunch of the past year has not followed the path of recent economically debilitating episodes characterized by a temporary freezing up of liquidity ─ 1982, 1989, 1997-8 come to mind. This crisis is different ─ a once or twice in a century event deeply rooted in fears of insolvency of major financial institutions.

“The credit crunch of the past year has not followed the path of recent economically debilitating episodes characterized by a temporary freezing up of liquidity ─ 1982, 1989, 1997-8 come to mind. This crisis is different ─ a once or twice in a century event deeply rooted in fears of insolvency of major financial institutions.

This crisis was not brought to a closure by the world's central banks' injection of huge doses of short-term liquidity.

The insolvency crisis will come to an end only as home prices in the US begin to stabilise and clarify the level of equity in homes, the ultimate collateral support for much of the financial world's mortgage-backed securities. ” ALAN GREENSPAN.

So thinks ex-Fed Chairman the “Maestro” Alan Greenspan. And he should know. After all, he was largely responsible for leading us to this point in time since from 1987 to 2006 he was at the helm of the world's largest economy. Without doubt, his policies influenced Central Bankers around the globe leading some analysts to describe him as a “serial bubble blower” (the NASDAQ bubble, housing bubble, credit bubble, structured financial instruments bubble, commodities bubble, etc) whose easy money stance and “ laissez faire” approachlies at the root of our current crisis. This loose-money policy, together with the deregulation of banking and financial markets, simply fuelled unabated speculation and asset bubbles.

The sentence above where Greenspan admits that we will only see the “insolvency crisis...stabilise” once we “clarify the level of equity in homes” (is that his way of saying prices need to fall more but he's not sure how much?) before we can determine “the ultimate collateral support for much of the financial world's mortgage-backed securities” (or lack thereof) confirms the gravity of the present situation.

I wonder if Bernanke derives any insight or comfort from the “Maestro's” words of wisdom, or whether he yet understands the magnitude of the disaster that he inherited upon accepting the position of Federal Reserve Chairman? It must be a little unsettling for him to see US Treasury Secretary Henry Paulson getting ready to jump ship and leave his post behind when the new administration takes office in January.

The Next Leg Down.

Robert Prechter (Elliott Wave Financial Forecast) is adamant that the stock market leads the economy , not vice versa. What Prechter sees in the charts has him warning that we are most likely on the verge of a new, more savage leg down in the markets as “Cycle wave c” down wreaks havoc.

“...once a B-wave top is past, there is just no hiding anywhere...C waves...This is when people can no longer fool themselves that it's an old bull market or that the market is going back to new highs. The fundamentals start falling apart in a C wave, and that is just what is beginning to happen now.

...in Cycle wave C there will be “no place to hide”, and that warning applies to precious metals and their stocks as well.”

(Silver has recently fallen 43% from a March high of $21, while gold is down from its March high of $1,040 and threatening to retest support at $775).

In July 2007 US Treasury Secretary Henry Paulson postulated

“This is far and away the strongest global economy I've seen in my business lifetime”.

Now we're told that five of the G7 nations (which account for half of the world's output )...Japan, Germany, France, Italy and Canada... contracted in the last quarter.

Professor Nouriel Roubini believes

“Official data suggests that the US economy entered a recession in the first quarter of this year. The UK, Spain and Ireland are experiencing similar developments with housing bubbles deflating and excessive consumer debt undercutting retail sales, thus leading to recession”.

And Bank of England governor Mervyn King has warned that the British economy is on the verge of recession and will start to shrink by year's end for the first time since the early 1990's.

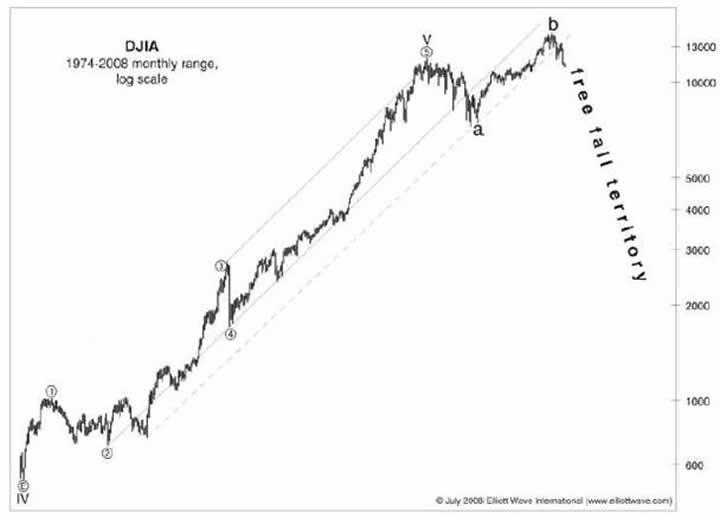

In January this year the DJIA dropped through a major 34-year trendline dating back to 1974 and is now in danger of going into freefall.

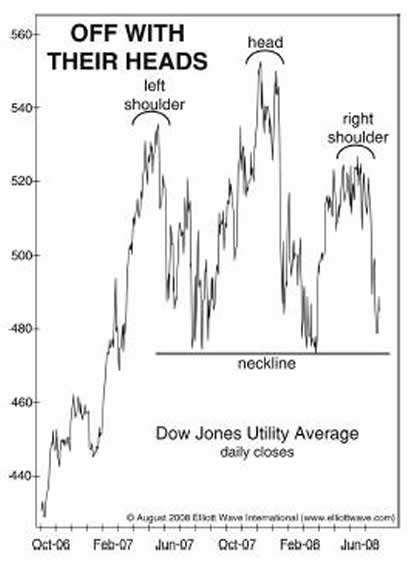

The Dow Jones Utilities Average looks to be tracing out a head-and shoulders top and indicating the next move will be strongly down.

Graphs courtesy of Robert Prechter's Elliott Wave International.

www.elliottwave.com

It only remains to be seen if the gravity-defying Dow Jones Transportation Average , which has so far defied soaring oil prices remarkably well, will continue to hold up in the face of a severe global recession, or will finally capitulate and turn down reconfirming Dow Theory.

Meanwhile, China's Shanghai Stock Exchange has slumped some 60% and plummeted from a high of 6,124 in October 2007 to around 2,400 to become the worst performing in the world so far this year!

SHANGHAI STOCK EXCHANGE...SSE.

If stock indices do indeed lead the economy then this manufacturer to the world also looks to be facing troubled times ahead. And if China's economy falters then countries like Australia which have been riding on the back of the commodities boom will also be hit hard. The front page of The Australian (August 18th 2008) featured the headline... “FEARS GROW OF AN END TO (commodities) BOOM”, where Access Economics director Chris Richardson warns...

"Commodity booms end ugly, they always do and there has never been an exception”.

All the while, property prices around the globe are either dropping or softening.

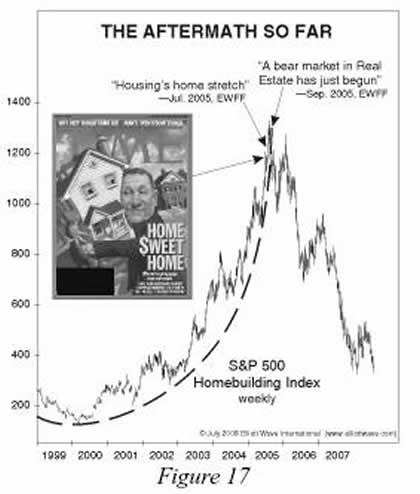

Graph courtesy of Robert Prechter's Elliott Wave International.

www.elliottwave.com

The S&P 500 Homebuilding Index has certainly shown the direction in which house prices were going to head as well as being a mirror image of Fannie Mae's stock price (which has now collapsed 93% ).

How much lower can Fannie Mae's stock price fall? Philippa Malmgren (a former senior financial advisor to President Bush in his first term) was recently quoted in Sydney, Australia as saying

... “Everybody agrees they (Fannie Mae and Freddie Mac) are basically finished, that they are basically bust”.

She also warned that

... “The FDIC (Federal Deposit Insurance Corporation) is now anticipating that they are going to have 95 (US bank) failures this year alone”. Australian Financial Review, 27th August 2008.

We've already seen nine US banks fail so far this year with Columbian Bank & Trust Co being the latest. The prospect of another 80-something US banks collapsing in coming months is scary stuff indeed.

Last but not least, Ms Malmgren had another very interesting tit-bit of information to offer

... “I do believe that if (Barack) Obama is our next president that there is already a discussion under way about whether they want the current chairman of the Federal Reserve (Ben Bernanke) to remain”.

Ummm...very interesting. Perhaps they might want to try and coax Alan Greenspan back out of retirement to save the day and work a bit of the old “Maestro” magic again? It might be poetic justice to let him now “reap what you sow”.

Time Running Out.

Prechter fears there will be “no place to hide” in the next severe leg down. So what is his survival strategy?

“In a bear market, some will slowly catch on to how much safer (and much more fun) it is to just stand on the sidelines... the more capital they will conserve and the smarter they will look at the bottom when the genius of getting out ... is finally recognized.

...anyone who has been dragging his feet and has still got the bulk of his savings in the banking system, particularly the U.S. banking system, it's getting almost too late to act. You need to move very quickly to get the bulk of your savings out of the weaker banks...ideally...you should own U.S. Treasuries directly in a money market fund...don't sit around until it's too late...finding yourself at the back of the line in front of your bank”.

Worst Deflation in Generations?

Robert Prechter has long been a lone voice in the wilderness warning of an imminent deadly deflationary collapse into global recession/depression rather than an extended hyperinflationary blow-off (despite the frantic efforts of desperate central bankers to inflate money supply). Now it seems respected financial guru Richard Russell (Dow Theory Letters) has similar concerns;

“...the markets are telling us to prepare for hard times, and a global spate of the worst deflation to be seen in generations ...sophisticated money is cashing out, raising cash, preparing for world deflation. This is why gold has been sinking...why stocks have been falling. What I see is a coming world deflation. What's the best stance in a deflationary situation? Lots of cash...US Dollars and US Treasury paper”.

All the best, Joe.

www.lifetoday.com.au

Copyright © 2008 Dr William R Swagell

Disclaimer: This newsletter is written for educational purposes only. It should not be construed as advice to buy, hold or sell any financial instrument whatsoever. The author is merely expressing his own personal opinion and will not assume any responsibility whatsoever for the actions of the reader. Always consult a licensed investment professional before making any investment decision.

Dr William R Swagell Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.