Core Inflation Rises but Fed Is Going to Cut Rates. Will Gold Gain?

Commodities / Gold & Silver 2019 Jul 17, 2019 - 08:34 AM GMTBy: Arkadiusz_Sieron

The combination doesn’t feel right. Actually, something stinks – just what is it exactly? Payrolls were strong, while core inflation rose. Nevertheless, the Fed signaled it’s going to cut interest rate. Our shiny yellow friend, can you help us make sense of it all?

The combination doesn’t feel right. Actually, something stinks – just what is it exactly? Payrolls were strong, while core inflation rose. Nevertheless, the Fed signaled it’s going to cut interest rate. Our shiny yellow friend, can you help us make sense of it all?

Is Really Inflation Muted? Core CPI Rises

The CPI rose 0.1 percent in June, by the same amount as in May, the government said on Thursday. However, the core CPI, which excludes food and energy prices, jumped 0.3 percent following a previous increase of 0.1 percent. So, the core rate scored the biggest gain in a year and a half, which suggests that the Fed’s fears about tame inflation might be exaggerated.

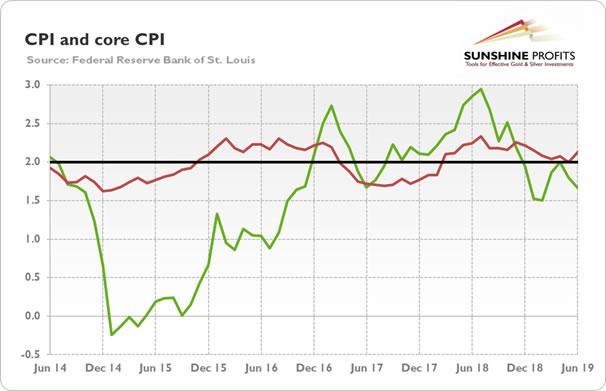

More importantly, over the last 12 months, consumer prices increased 1.6 percent, compared to 1.8 percent jump in May. It means that annualized inflation has softened further. But, again, the index for all items less food and energy edged up from 2 to 2.1 percent. It shows that the muted overall inflation resulted from the falling gasoline and oil prices, not from a weakness in the aggregate demand or something else. As the chart below shows, the core CPI is now again above the Fed’s target.

Chart 1: CPI (green line, annual change in %) and core CPI (red line, annual change in %) over the last five years.

Maybe this is because we are not working at the central bank, but we struggle to see why lower energy prices should be negative for the economy and the reason for the Fed to adopt a more accommodative monetary policy. Shouldn’t the central bank focus on core inflation, which strips out volatile food and energy prices? After all, this is what the FOMC does when the prices go up, but apparently it does not work the same way both ways.

Something Is Not Quite Right, Mr. Powell

Wait a minute. The recent nonfarm payrolls were strong, so the labor market remains healthy. The overall inflation is 1.6 percent, while the core index is 2.1 percent, and the Fed is signaling a cut in the federal funds rate at the end of this month? Just how does it all go together? We are not the only ones who ask this question. On Thursday, Senator Toomey asked Chairman Powell what the heck is he doing, given the fundamental strength of the economy.

Powell said that the U.S. economy was hit by a severe “confidence shock” in May from which it has only partly recovered, but only after the Fed “stepped forward”, announcing that it is ready to act if needed. Our heroes!

It might be the case, of course. However, we see a few other possible explanations why the Fed is likely to cut interest rates despite the fundamental strength of the economy. The first is the simplest: they are just a bunch of doves, especially after Richard Clarida joined the Board of Governors. So they want the Fed to be always accommodative and muted inflation readings are a great excuse. If true, that would be great for gold. The more dovish the U.S. central bank, the better the prospects of the yellow metal.

Second explanation is that the U.S. central bank got joined at the hip with the Wall Street. So it must do whatever the markets tell them to do. It is plausible explanation, but the markets expected higher interest rates for years during the ZIRP period, and the Fed did not do anything about it.

The third potential reason is the poor economic outlook outside the U.S. America’s economy might be great, but – given the international role of the greenback – the Fed is the central bank for the whole globe. Remember taper tantrum? Maybe the cost of dollar liquidity got too high and the Fed had to react, to avoid global turmoil. Powell admitted in his testimony before the Senate that his main concern was the poor outlook for manufacturing “around the globe.”

Last but not least, the U.S. central bank might know something us, mere mortals, are not aware of. Maybe the Fed officials saw the recessionary signals, so they decided that a preventive cut in interest rates is in place? We informed our Readers about the inversion of yield curve immediately when this happened. And now it turns out that the Fed has also acknowledged it. This is at least something the recent FOMC minutes suggest:

Many participants noted that the spread between the 10-year and 3-month Treasury yields was now negative, and several noted that their assessment of the risk of a slowing in the economic expansion had increased based on either the shape of the yield curve or other financial and economic indicators.

Implications for Gold

What does it all mean for the gold market? Whatever the reason, the Fed became more dovish despite core inflation being still around the target, which is a fundamentally bullish factor for gold. Of course, the expectations of the interest rate cut are already priced in, but the new climate sounds supportive for the gold market. We mean here the inverted yield curve and the resulting expectations of the upcoming recession. Remember the pre-Great Recession period? In 2006, the yield curve inverted and the Fed cut interest rates in 2007. It did not prevent the financial crisis from unfolding, and gold shined. In the upcoming edition of the Gold Market Overview, we will write more about the inversion of the yield curve and the 2007 Fed cut – stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.