FED TAPER CON TRICK, Recession 2022

Stock-Markets / Financial Markets 2022 Jan 29, 2022 - 08:35 PM GMTBy: Nadeem_Walayat

Dear Reader

Did you buy the panic? Or were you scared shitless by the clueless MSM and barely out of puberty youtube clowns into a state of paralysis, missed buying Microsoft for $282, or AMD for $101, Nvidia $226, even Google for $2512? My prospective buying levels mailed to patrons before last Monday's open...

STOCK MARKET CRASH / BEAR INDICATOR TRIGGERED - 103.4% vs 100% = Switched ON!

$4 per month for AHEAD of the curve analysis, no panic here!

My latest timely analysis lays out how to invest in during the panic of 2022, to be soon followed by my next analysis that continues the above trend forecast into the end of 2022.HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

The focus of this analysis is an updated status of my High Risk Bio and Tech Stocks portfolio.

High Risk Bio and Tech Stocks Portfolio Q4 2021 Update

Contents:

Exponential AI Mega-trend

INVESTING PRIORITY

Why Most Investors LOST Money by Investing in ARK FUNDS

ETF BUBBLE Primed to EXPLODE!

INVEST AND FORGET

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

FED TAPER CON TRICK

CP LIE - INFLATION vs DEFLATION

UK Inflation Fraud - Real Inflation is 15%+

The 2% Inflation SCAM, Millions of Workers take the Red Pill

Why Inflation is Soaring

Flip Side High Inflation Winners

Warren Buffetts $130 billion Master Plan

STOCK MARKET CRASH INDICATOR

The Quantum Entangled Stock Market

Unloved Biotech Sector

High Risk Stocks Portfolio

COINBASE $247, Risk 1, P/E 19, +0%

TAKEDA $13.7 - Risk 1, PE 10, -19%

Western Digital $56.7, Risk 2, PE 13, -2%

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

CORSAIR $21.7 - Risk 3, PE 11, -26%

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

RBLX $95. Risk 6, +7%

CRISPR $74, PE 15.3, RIsk 6, -39%

AVIR P/E 30.5 , Risk 9, -71%

APM $1.88, -37%

ACCUMULATING

AI Stocks Portfolio

Limit Orders

Best Stock Investing Platforms

CRYPTO BRIEF

OMICRON a Fuss About NOTHING

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

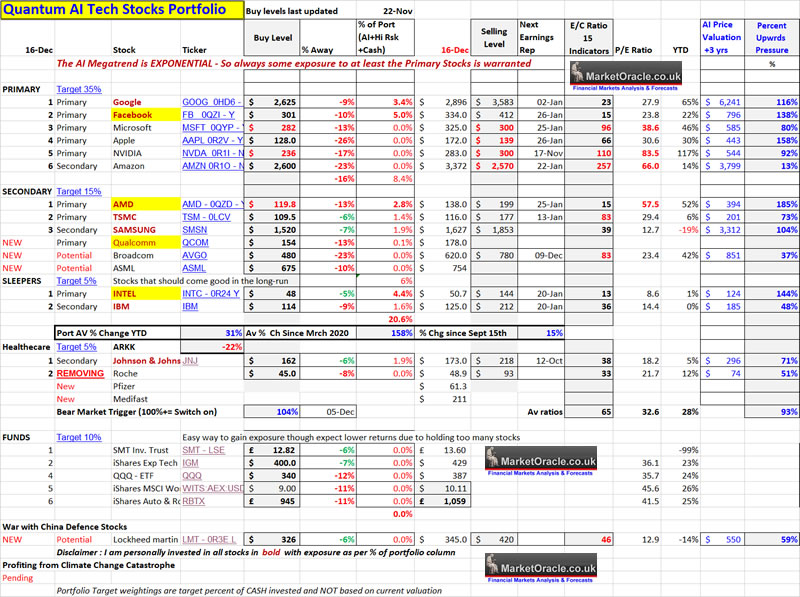

Firstly never forget that the AI Mega-trend is NOT LINEAR BUT EXPONENTIAL where the pandemic has only acted to to accelerate the mega-trend a notch higher. For instance GPT3 (which Microsoft owns) implies autonomous humanoid robots that people can have actual conversations with are just around the corner, we will probably see mass business if not retail consumer devices (robots) within the next FOUR YEARS!

My video of 2016 illustrated my expectations for the AI trend trajectory and why I expected this stocks bull market could literally run for decades to come, thus I have sought every deviation from the high as a buying opportunity, so one needs to be very careful to not get carried away by the noise that are flash crashes, recessions and even pandemics in the face of an exponential AI mega-trend.

Where the only solution I could see then as today is for us mere mortals to survive the coming Quantum AI storm is to OWN the technologies, for which we have 2 strategies -

Firstly, to own stocks in key AI Mega-trend drivers that have the greatest probability of achieving superiority in Quantum AI, which has been the focus of my AI Mega-trend investing series of analysis for 6 years now.

Secondly, to immerse oneself in AI technologies so that one can actually understand and be able to profit from machine learning programming. Which in today's age is infinity easier to do given the myriad of development platforms that have emerged over the past decade than when I first approached the subject some 23 years ago! That and today's desktop computers are exponentially more powerful.

Still, for most it's a case of learning what machine learning is, and what AI could become, for we mere mortals lack the critical component of Quantum Computing, so unless one hits lucky in ones application of machine learning, tinkering with AI on ones desktop PC is not going to get you rich so the primary focus should be on investing in the deep pocketed AI tech corps such as Google, IBM, Intel, Microsoft, Facebook etc... who have hundreds of billions at their disposable to drive the exponential trend towards the explosion moment when the Quantum AI is born.

So one needs to guard against becoming distracted by short term stock price noise which just acts to take ones focus away from that which actually matters, the QUANTUM AI MEGA-TREND that silently continues to hum along it's exponential trend trajectory.

Whilst the focus of this article is my first quarterly update on the current state of the HIGH RISK bio and tech stocks portfolio born out of my intent to GAIN exposure to the unloved biotech sector after going on AI tech stocks profiting taking binge during Summer 2021 which was soon joined by a 3 CRASHED chinese tech giants and most recently a sprinkling of small cap metaverse tech stocks. The objective of the high risk portfolio as a whole is to approx X3 to X5 over the next 5 years time i.e. by Summer 2026. Where the winning 10 baggers will offset the losing stocks that go bye bye, whilst I imagine most will show some gains to varying extent.

INVESTING PRIORITY

From time to time I get asked by Patrons what stocks would I prioritise exposure to, so that there is no confusion my priority has stayed fairly constant for a good 5 years now as illustrated by the ordering of ny AI stocks portfolio where as far as I can recall Google has always remained primary, numero uno, and why through thick and thin, even if I thought armageddon was just around the corner, Google has remained a constant in my portfolio and represents the pinnacle of what one would deem to be a PERFECT STOCK. Google is PRIMARY, In fact one could just buy and hold Google and nothing else and likely beat the market!

Whilst all of the other stocks do jiggle around in their positions from time, however the primary AI stocks have remained fairly constant for some time. In fact digging into my article archives here is one of the earliest iterations of my AI stocks portfolio list dating back to October 2016 which has aged well noting that Apple had a stock split so that the un split price now would be about $700!

Top 5 Machine Intelligence Stocks

- Google - $796

- Apple - $109

- Amazon - $776

- Microsoft - $57

- INTEL - $32

So to answer the oft asked question of which stocks to focus on then that is from Google downwards in order of priority.

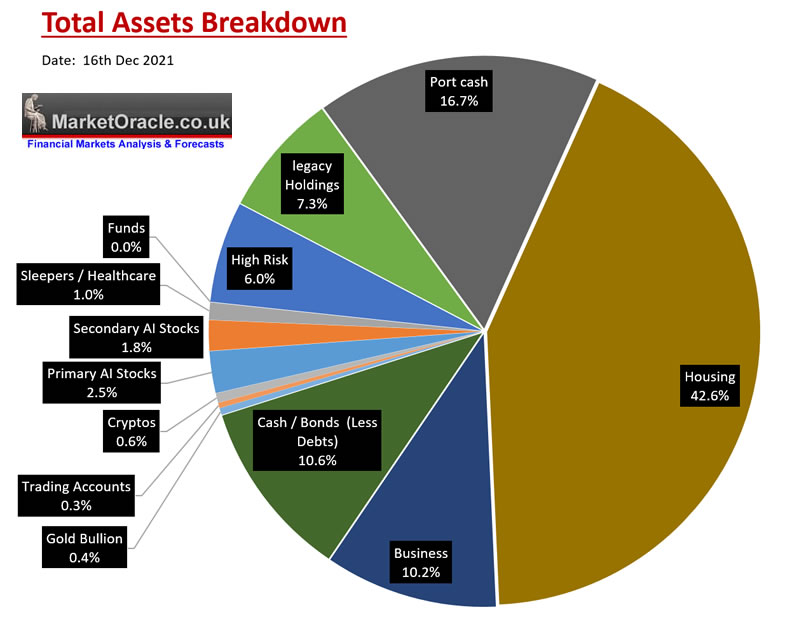

And where I currently stand in terms of exposure to the stock market then here is a full breakdown of my total net assets.

As you can see high risk stocks represent just 6% of my total assets, whilst ALL stocks currently stand at just 18.6%. even after my recent discounted buying spree of Intel, IBM and Facebook. Whilst crypto's that I have been banging on about at great length recently barely nudge past 0.5%. Whilst if I was fully invested in the stock market then my total exposure would rise to about 35% where AI tech stocks would dominate high risk stocks by about 4 to 1.

Therefore for me high risk stocks are just that, high risk long-term investment plays that could pay off, hence why are deemed to be INVEST and FORGET so that once invested and price alerts and maybe a limit orders set then it's time to forget about them and focus on that which actually matters i.e. applying technology that the tech giants are busy inventing such as VR, machine intelligence and processing power.

However, as my articles of the past 6 months have illustrated I am fairly confident that we are heading towards a Financial Crisis 2.0 of sorts that likely will be a multi headed hydra affair as illustrated by the slow motion collapse of the Chinese property market, to the return of inflation which I had been expecting right from the outset since MARCH 2020 when the current phase of rampant money printing began, to the current state of the stock market bubble, where so many investors had been hood winked into investing into garbage stocks such as that which populate Cathy Woods Ark funds!

Why Most Investors LOST Money by Investing in ARK FUNDS

Understand this, it is highly probable that 90% of RETAIL INVESTORs in ARK Funds have LOST MONEY!

LOOK at the volume on the ARKK chart and that tells you when the retail investors were FOMO-ing, then buying the DIPS in ARKK!

Retail investors did NOT invest in 2018, 2019 or 2020, in what at the time were small obscure funds that they would have been totally oblivious to. Instead they FOMO 'd RIGHT at the very end of the ARKK mania which is why I had not even heard of Cathy Wood or ARK until patrons started asking my opinion on her funds in February this year, I took a look and as I said at the time when I looked under the hood I nearly puked!

PURE GARBAGE!

The whole operation stinks of PUMPs and DUMPs! ARKK would buy and then make that buy public and so the pumps begin, then ARKK dumps. However even such manipulation has FAILED to deliver any gains for investors for that is not the purpose of such funds. They exist purely to hood wink retail investors led like lambs to slaughter, stripped of their wealth all whilst Cathy saleswoman of the year Wood continues with her sales pitch where even now despite her funds bloodbath she still rambles off on her delusional fantasy projections of ARKK quadrupling over the next 5 years! That's 80% per ANNUM!

QUADRUPLE she says, ARKK has a mountain of retail investors sat nursing huge losses just waiting for an opportunity to GET out near break even at around the $119 average line, which means it's going to be very hard for ARKK to break through that wall of worried retail investors just waiting for the an opportunity to exit ARKK.

ETF BUBBLE Primed to EXPLODE!

$1 TRILLION DOLLARS! That's how much retail investors have plowed into ETF's over the past year! A record amount! Much of which has been piled into the FAANG's and related tech giants such as TESLA. So what happens when they all try and run for the exit at the same time? How will the funds meet redemptions and keep portfolio weights in line with the indices that most passive ETF's tend to track?

FORCED SELLING AND FREEZING REDEMPTIONS!

So I will once more iterate my warning that Funds and ETF's either passive index trackers or those such as ARKK are NOT LOWER risk than holding individual stocks. Instead investors have parked a huge chunk of their wealth in ETF's that likely will be busy engineering a positive public relations picture that is far removed from the reality of said funds true values depending on the algorithms they have in place.

After all it was program selling by funds that delivered my greatest ever one day profit in relative terms on October the 19th 1987 when the 'algorithms' sold stocks in ever increasing waves by the hour right into the close.

Think the same cannot happen again? Maybe not all in one day but we are PRIMED for the same as we got a taste of in March 2020! THAT was program selling spread out over 2 weeks. The only surprising thing is that none of the funds froze but that was before the Fed printed another $4.5 trillion to buy assets and retail investors plowed another $1.5 trillion dollars into ETF's.

A market panic event could easily trigger Forced SELLING and result in FROZEN FUNDS that investor\s will not be able to sell out of until the fund managers say they can by which time the damage will have been done!

This is what I warned of many moons ago of what could happen to ARKK and in fact ANY fund which is why I tend to repeat this warning at least a 2 or 3 times a year. And why so far I have not personally invested in any of the funds listed in my AI stocks portfolio and even if I had my exposure would be very limited .

So once more DO NOT MAKE THE MISTAKE of assuming funds are LOWER risk than individuals stocks, they are NOT, they are HIGHER RISK!

And what's worse now is we have funds of funds that brokers are eager to pitch to their retail clients due to recurring commissions earned, a proverbial merry go around just waiting to IMPLODE!

Don't think it can not happen? We'll I googled just before posting and already hedge funds are FREEZING CLIENT FUNDS! Anchorage capital have SUSPENDED client withdrawals as they prepare to close their fund.

Is this the canary in the COAL MINE of what's going to come in 2022? YOU HAVE BEEN FOREWARNED!

INVEST AND FORGET

Do revisit my original article (How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond ) as to remind oneself of what it means to invest in HIGH RISK STOCKS and WHY the portfolio is supposed to be INVEST and FORGET! Which is how I have been investing in high risk stocks for decades, pick stocks for good reasons and then invest and forget, with price alerts and maybe limit orders to alert me to take action other than that I do not think about them at all!

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

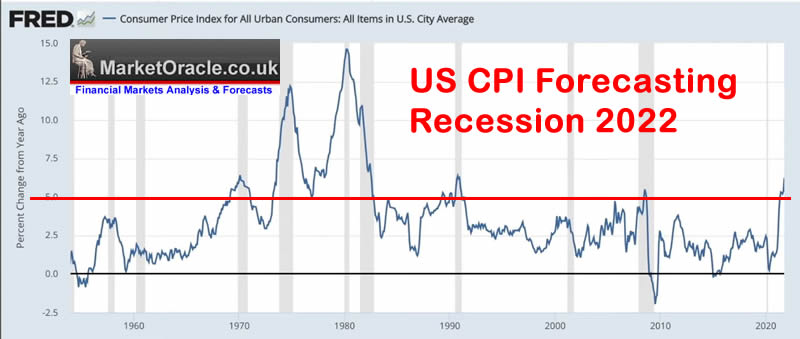

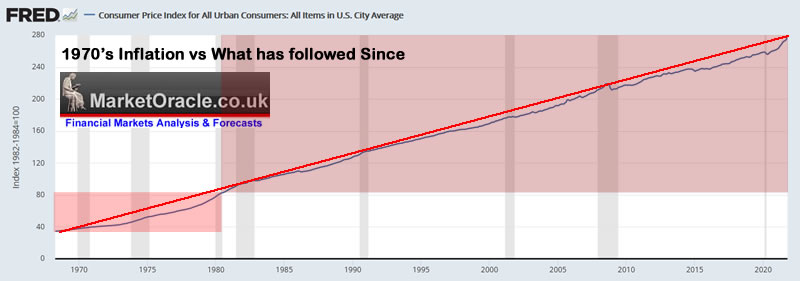

My last article featured an Inflationary indicator pointing to a recession 2022. That latest Inflation data out of the US (6.8%) reinforces what this indicator suggests i.e. US CP LIE inflation is now at it's highest since the early 1980's!.

Graph from previous analysis when US CPI was 6%.

FED TAPER CON TRICK

And just as I expected in response to Transitory Inflation turning out to be PERMANENT the Fed sort of Panics! And is to start tapering this month at twice the preceding taper rate of $15 billion per month, that now rises to soon to rise to $30 billion per month to temporarily halt QE by March 2022 which will be followed by 2 or 3 rate hikes between then and November 2022.

HOWEVER, what about the $9 trillion of QE money printed sat on the Feds balance sheet?

The media whores are going to be obsessed by FED TAPER TALK for months to come which in reality is a BIG FAT FED CON JOB! Because the Fed balance sheet will continue to grow. And so what if the Fed funds rate hits 1%? CPLIE IS 6.8%! REAL INFLATION is probably around 15%!

NOW don't take this as a BULLISH SIGN for the mother of all stock BUBBLES NEEDS about $50 billion per month just to keep it inflated! So come February it WILL start to DEFLATE in a market messy manner much as I expected for volatile stock trend during 2022.

CP LIE - INFLATION vs DEFLATION

US fake CPI inflation soared by it's fastest rate since 1982 to 6.8%. followed by shock horror stories across the MSM of how inflation was hitting ordinary consumers hard!

The value of money is BURNNG. Which despite the massive bull runs in western housing markets and the apparent collapse in Chinese property market, I am finding it very hard to deviate from my bullish stance on housing. I am looking for clues that

a. Chinas property market is actually collapsing\

b. That it will hit the western markets to some degree, After all Zillow say they are selling their properties at a loss.

BUT, the buggers have been printing money an an epic scale! Hence even fake CP LIE is 6.8%!

More in my forthcoming in-depth look at the housing markets. It's just that I am not finding the housing market crash smoking gun, we really could be in for a re-run of the 1970's, persistently high inflation regardless of the mantra that spews from the likes of Cathy Deflationista Woods.

Looking at the CPI chart I just don't get it, how can people continuously bang on and on about deflation. Look we are in a perpetual exponential inflationary mega-trend courtesy of government money printing. I wrote about this at length in my January 2010 Ebook the Inflation Mega-trend (download) and since which the inflationary outlook has remained in force! Many constantly harp on about the Inflation of the 1970's as though we have not had any significant inflation since!

The Fed plays the game of hiding real inflation from the indices i.e. REAL US inflation is at least TWICE CPLIE! In the UK it is about triple!

You know this when you do your weekly shops! I seriously estimate UK inflation to be OVER 15%!

This is why I invested in the high risk stocks portfolio in the first place for after my AI stocks selling binge, I said to myself INFLATION IS GOING TO EAT ALL OF MY CASH, I NEED TO GET REINVESTED ASAP!

1. UNLOVED HIGH RISK BIOTECH STOCKS for the long-run.

2. CRYPTOS! Which additionally are a leaning experience.

3. BUY ANYTHING I WILL NEED FOR THE NEXT 2 TO 3 YEARS!

4. Look to see if I can buy an additional property (too over priced).

Back to point, the High Risk portfolio for me is an INVESTMENT SNACK whilst I wait to repopulate my AI stocks portfolio to get it back to about 20% of all assets form the current 5.6%. So long as everyone understands what the purpose of the high risk portfolio is, which is deploying excess cash to capitalise on anticipated returns in the distant future beyond the time horizons of the financial crisis 2.0, i.e. at least 5 years forward and probably a lot more .

Go back and read what I wrote in my original articles of why I am investing in these high risk stocks and why they are invest and forget, because

a. I expect there to be a great deal of volatility.

b. I want to focus my time and energy on both gradually rebuilding my AI stocks portfolio as valuations moderate AND try and capitalise on the Financial Crisis 2.0.

The same is true for crypto's to a lesser extent i.e. again the deployment of excess cash on a high risk asset class, because at the end of the the day I DON'T WANT TO HOLD CASH BECAUSE THE CROOKS IN THE GOVERNMENT AND CENTRAL BANK WILL STEAL IT'S PURCHASING POWER!

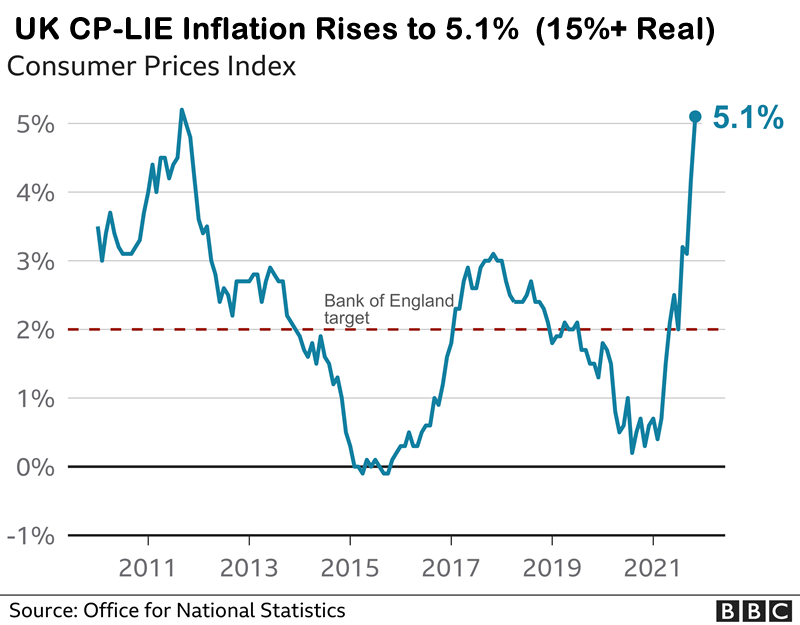

UK Inflation Fraud - Real Inflation is 15%+

5.1% BANG! Real Inflation is TRIPLE UK CP-LIE so at least 15%!

The Bank of England usually tends to play follow the Fed leader but this time hiked rates from 0.1% to 0.25% Thursday to curb inflation, 0.25%, are the MPC smoking crack cocaine or something? UK inflation is 5.1% and they lift rates to 0.25% CPI LIE! UK base rate at 0.25% IS A FRAUD ON WORKERS AND SAVERS! What difference to the stealth theft of purchasing power does a rate hike to 0.25% make, even to 0.5%? NONE! The banking crime syndicate is well supported with artificial profits that have continued to be banked as bonuses for over a DECADE! And now the crooks have found a new device to extract wealth from ordinary folks - FATCA so as to make citizens jump through hoops to prove they really are who they are all the way towards freezing their funds on account!

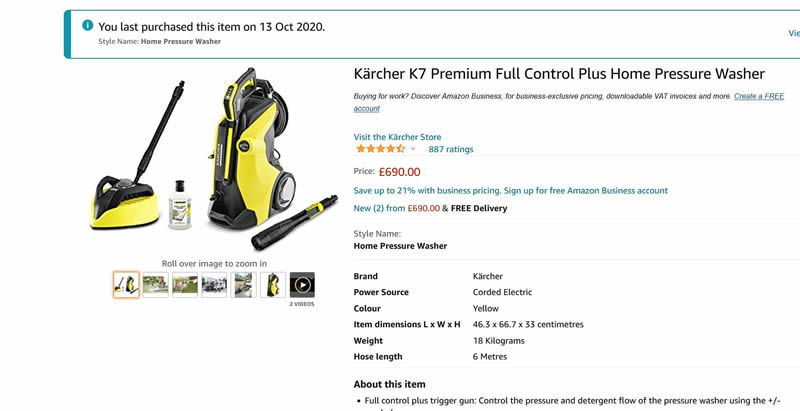

For most of 2020 and the whole of 2021 I have been warning that high inflation was on it's way which is why I went on a buying spree during Q3 2020 into Q1 2021 buying everything I could possible need during 2021 and well into 2022 from new computer systems, hardware, components, gadgets, materials, even a new sofa suite, because I knew that high inflation was coming and virtually everything would be marked significantly higher.

For instance I bought a Karcher K7 pressure washer in October 2020 during Amazon's prime day event for £340 which had been discounted from the then normal selling price of £425. Guess how much the current price of the K7 is ?

£690, more than double that which I paid! Real Inflation is HIGH and it is only going to get worse, all whilst the central bankster's fiddle their inflation indices by trying to exclude everything that has gone up so that as if by magic CPI can resolve to 2%, when in reality UK inflation is near 20% and US inflation is at least 10%!

The 2% Inflation SCAM, Millions of Workers take the Red Pill

HIGH INFLATION has been with us for over a year and it is only getting worse! As a rough guide X2 official CPI in the US and X3 official CPI in the UK for a more realistic view of the current real rates of inflation as most people experience. At the end of the day CPI inflation is one of the many propaganda tools that the government uses to keep the public docile. For if people truly understand what the real rate of inflation was they would soon be in revolting against the system of slavery that they are born into. Instead they lap up the persistent insidious brain washing of which CPI inflation is a core part of.

Just ask yourselves how much has your monthly shop gone up over the past year? I would happen to guess it's a lot more than the 5% that official inflation suggests it has gone up! More like 30%! See the smoke and mirrors game that they are playing? If the masses actually understand that inflation over the past 5 years has been over 100% rather than 15% then the whole system would collapse as people would demand that their pay and benefits rose in line with the real rate of inflation i.e. 10% to 20% per annum not the 2% to 3% they have been getting and with it would explode each nations debt mountains even further that would send interest rates soaring as investors would demand higher yields where those nations who borrow heavily in foreign currencies would default on their debts and governments would have no choice but to borrow else would risk a debt deleveraging collapse of the whole system.

As my following video from February illustrates there is NO FREE LUNCH!

In fact the pandemic allowed millions of Britains wage slaves a take the blue pill and realise the extent to which they were slaves with many refusing to return to work as lockdown's end instead requesting that they be allowed to work from home, if not quitting their jobs as I covered in my recent video of why many workers are refusing to go back to work.

This is why I have NO CHOICE BUT TO TAKE RISKS with my capital for the alternative is CERTAIN THEFT of purchasing power of all hard earned savings! Which is THE primary reason why I started to accumulate high risk stocks and then CRYPTOS during Summer 2021. For if there was no inflation risk then I would probably have bided my time for better opportunities but knowing what I know, I know I cannot allow myself to be exposed so heavily to cash that the Government is stealing through it's stealth inflation tax.

Why Inflation is Soaring

We'll what do you think was going to happen when Western governments LOCKED DOWN populations for most of 2020 and for large parts of 2021, where the manufacturers expected a sharp drop in demand and thus cancelled their orders for parts, effectively putting the supply chains in deep freeze whilst at the same time people were PAID to sit at home and do nothing but to go online and gamble on the stock market and crypto's that was fed by QE sending household wealth soaring. So he have HIGH DEMAND and LOW SUPPLY!

Then throw in the black swan of the semi conductor shortages that are at the core of most high cost products such as cars which in significant part was due to demand for GPU's for crypto mining so that even with the likes of TSMC running flat out cannot meet demand and it will take several more years to build new chip fab's.

We see this playing out most notable in the auto sector with the sale of new cars crashed in Europe by an average of 20% year on year, not due to lack of demand but due to lack of supply, they just don't have the chips and other parts to finish the cars!

Then there is the other black swan that is particularly hitting Europe, ENERGY PRICES! The UK Wholesale Gas price is up 700% on the YEAR! Forcing many energy providers to go bust, which now includes mine! ZOG ENERGY, walking away and dumping me onto EDF at a starting 100% price hike!

So what effect are the likes of tapering and interest rate hikes going to have on supply driven inflation? They could make matters even WORSE i.e. result in pushing inflation higher by putting manufacturers and transporters under added pressure thus resulting an a reduction in SUPPLY!

A prefect storm where the tools being used DO NOT SOLVE the problem of what is driving inflation! Because there is no quick solution as it will take years for the TSMC and Intel amongst others to build new chip plants. And as a multitude of failed chinese chip manufacturers illustrates it is very hard to enter the cutting edge chip manufacturing world hence why the likes of Nvidia and AMD are not going down the chip fab route in fact AMD ditched their Chip fab over a decade ago because trying to keep pace with TSMC and Intel would have bankrupted them.

So who are the current Top 5 Chip Fab corporations?

1. TSMC - 55% market share.

2. SAMSUNG - 17% market share.

3. United Microelectronics Corporation - 16% market share

4. Global Foundries - 7% market share.

5. China’s Semiconductor Manufacturing International Corporation (SMIC) - 4% market share.

Whilst Intel up until it's recent announcement only made chips for itself but will now invest an extra $20 billion to build two foundry's to rival that of TSMC's. And if Intel were included in this list it's market share would be about 15%, neck and neck for second place with Samsung.

Flip Side High Inflation Winners

And the winners are - ALL THOSE WHO HOLD A LOT OF DEBT!

That's from homeowners with long-term fixed rate mortgages all the way upto the Government that just loves inflation to eat away at the value of their debt mountain!

Though remember one needs to be able to service the debt as interest rates rise. But they have to rise a hell of a lot to get anywhere near the inflation rate!

Unfortunately I am averse to borrowing money and so I am unable to capitalise on this upside to inflation. The last time I had sizeable borrowings were in the pre-financial crisis era when I would do STOOZING, which is balance transferring borrowings on introductory 0% credit cards and putting the funds into savings accounts and then moving the balances to new cards as the 0% fixes came to an end. In this way I had built up near £100,000 in stoozed savings earning me over 4% per annum, free money! But it all ended with the financial crisis following which the banks started charging a 3% balance transfer fee and well savings interest rates became a joke!

The rest of this analysis has first been made to Patrons who support my work -

High Risk Bio and Tech Stocks Portfolio Q4 2021 Update

Contents:

Exponential AI Mega-trend

INVESTING PRIORITY

Why Most Investors LOST Money by Investing in ARK FUNDS

ETF BUBBLE Primed to EXPLODE!

INVEST AND FORGET

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

FED TAPER CON TRICK

CP LIE - INFLATION vs DEFLATION

UK Inflation Fraud - Real Inflation is 15%+

The 2% Inflation SCAM, Millions of Workers take the Red Pill

Why Inflation is Soaring

Flip Side High Inflation Winners

Warren Buffetts $130 billion Master Plan

STOCK MARKET CRASH INDICATOR

The Quantum Entangled Stock Market

Unloved Biotech Sector

High Risk Stocks Portfolio

COINBASE $247, Risk 1, P/E 19, +0%

TAKEDA $13.7 - Risk 1, PE 10, -19%

Western Digital $56.7, Risk 2, PE 13, -2%

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

CORSAIR $21.7 - Risk 3, PE 11, -26%

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

RBLX $95. Risk 6, +7%

CRISPR $74, PE 15.3, RIsk 6, -39%

AVIR P/E 30.5 , Risk 9, -71%

APM $1.88, -37%

ACCUMULATING

AI Stocks Portfolio

Limit Orders

Best Stock Investing Platforms

CRYPTO BRIEF

OMICRON a Fuss About NOTHING

My analysis schedule includes:

- Stock Market Trend Forecast 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst contemplating his net big buys in the coming week, perhaps Google at $2442?

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.