The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

Economics / Crack Up BOOM Jun 10, 2022 - 10:12 PM GMTBy: Nadeem_Walayat

Dear Reader

Whilst everyone is rightly focused on the BEAR MARKET that continues to cycle through stocks delivering sharply lower prices (buying opps), and as bad as things are likely to get i.e. this bear market has a lot further to run. Nevertheless there are mega-trends under way (monsters) that likely will deliver new all time highs for all of my primary AI tech stocks, though at that time most folks could have far more to worry about than stock prices.

A Patron asked me recently in the comments:

Deem,do you still think that the year end prices from your Al Tech Stocks - Draw down and Year End Price Forecasts are achievable ? or are you going to revise the year end prices at some point ?

To which I replied:

The thing is there are monsters that can deliver new highs, at the moment the bear tasmanian devil is delivering deep, deep draw downs, unimaginably deep draw downs, I did not see Google 2260 coming, and the bottom could be lower still, but like wise there are monsters that can propel stocks to new highs, inflation is out of control, when the masses realise this a crackup boom can happen, which means what seems impossible today can become possible over a short number of weeks.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

This analysis (The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential) was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Latest analysis include -

- AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

THE INFLATION MEGA-TREND QE4EVER!

A reminder folks that regardless of Fed propaganda and what you read in the mainstream press QE is 4 EVER! Once it starts it will not stop. As I have been iterating for over a decade now as the following excerpt from 3 years ago illustrates (Stock Market Trend Forecast March to September 2019) that CRISIS ARE MONEY PRINTING EVENTS TO CAPITALISE UPON BY INVESTING IN ASSETS THAT ARE LEVERAGED TO INFLATION!

So why has the the stock market soared, what is that the stock market knows that most commentators and economists fail to comprehend? We'll for one thing there are the dovish signals out of the Fed which go beyond a pause in their interest rate hiking cycle in response to a subdued inflation outlook. Similarly the worlds other major central banks have their own reasons to avoid rate hikes, most notable of which is the Bank of England that has been busy propagandising the prospects of a NO Deal Brexit Armageddon in attempts to scare Westminister into avoiding EXITING the European Union in anything other than an ultra soft BrExit.

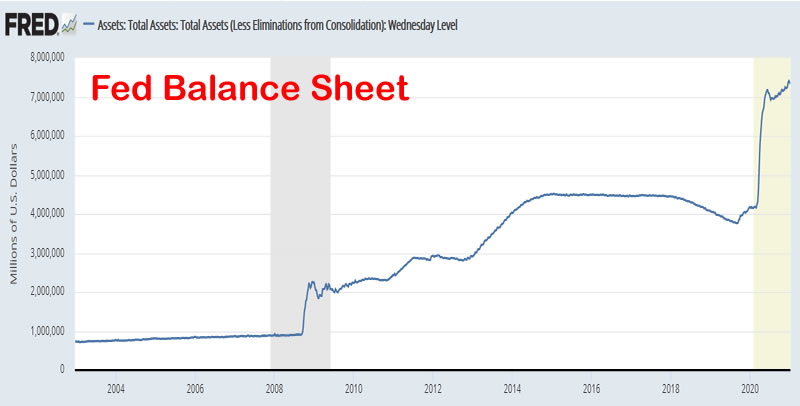

So on face value the stock market is clearly discounting not just a more accommodative interest rate environment but that QE REALLY IS FOREVER! Once it starts it DOES NOT STOP! As evidenced by the Fed's balance sheet first having exploded from about $800 billion to over $4.5 trillion, all to bailout the banking crime syndicate by inflating asset prices such as housing and stocks so as to generate artificial profits for the central bankers banking brethren. But none of this news, for I have written of it for a good 10 years now that QE will never stop as the worlds central banks will repeatedly expand QE to monetize government debt.

So I would not be surprised that WHEN the next crisis or recession materialises, QE will resume, by the end of which the Fed balance sheet will likely have DOUBLED to at least $8 trillion. And it is this which the stock market is DISCOUNTING! Just as has been the case for the duration of this QE driven stocks bull market that clearly paused during 2018 in the wake of mild Fed unwinding of its balance sheet. So forget any lingering Fed propaganda for the continuing unwinding it's balance sheet, the actual rate of of which has slowed to a trickle and thus we are probably near the point when the Fed ceases unwinding it's balance sheet because as I have often voiced that once QE starts it does NOT STOP!

So whatever form the NEXT crisis takes, the Fed will be at hand to print money and double its balance sheet, as it will periodically continue to supports asset prices such as housing which cannot be printed. We'll not until we see start seeing house building 3D printing drones emerge from the machine intelligence mega-trend that will fly around in swarms and erect designer houses anywhere on the planet.

All whilst clueless fools that populate the mainstream press and blogosfear who probably never put their money where their mouths are continue to bang the drums of NON EXISTANT DEFLATION! As I stated in opening line in my January 2010 Inflation Mega-trend ebook (download).

The worlds economies swim in an ocean of inflation that is punctuated by occasional ripples of deflation which is illustrated by the perpetual upward curve of general prices as measured by the Consumer Price Index (CPI). Inflation in the long-run impacts on virtually all commodities and asset prices.

Here's the current state of the Fed Balance Sheet during late 2020 that's looking pretty parabolic, pouring rocket fuel onto the inflation fire.

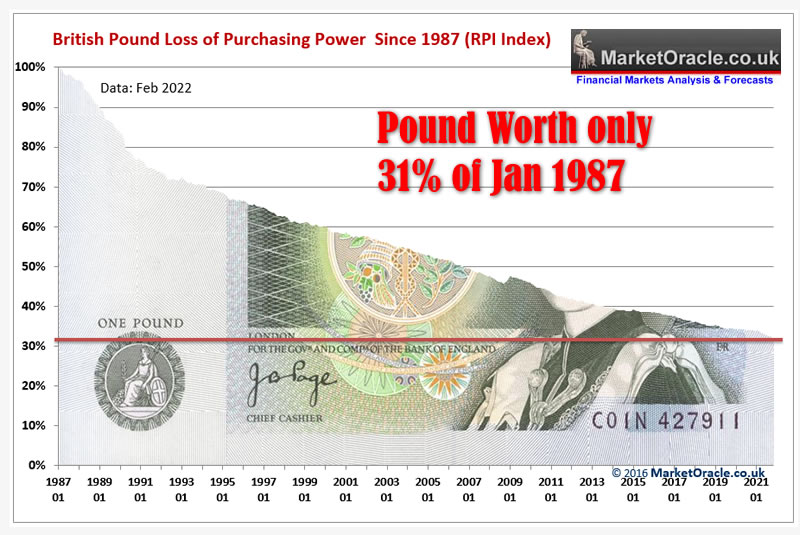

At the end of the day the money printing induced Inflation Mega-trend is the primary mega-trend that people really need to beware of and focused on so as to leverage themselves to this mega-trends consequences which is the loss of purchasing power of all currencies which is why savings should not be viewed as long-term holdings and why the likes of housing should. To further illustrate this point since the Federal Reserve bank came into being in 1913 the US dollar has lost over 96% of it's value! PRICE INFLATION! Which is why you need to hedge or leverage yourselves to MONEY PRINTING INFLATION! This is what the world's central banks do at every crisis, PRINT MORE MONEY that causes REAL INFLATION.

Which means one should take Fed rate hikes to control inflation and Quantitative tightening with a mountain of salt for as was the case in 2018/19 it will prove to be TRANISTORY!

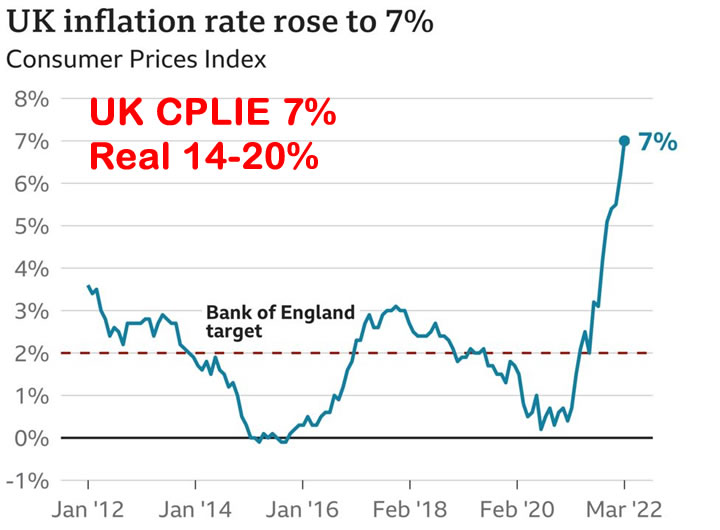

Thus my mantra since rampant QE4EVER money printing resumed in March 2020 was to expect HIGH INFLATION, that eventually started to arrive a year later in March 2021 even on the FAKE CPILIE official measure that significantly under reports real inflation and has accelerated into the stratosphere since.

The only solution one has to preserve ones hard earned wealth is to invest in assets that cannot be easily printed, that's hard assets such as bricks and mortar and a select financial assets such as stocks with strong cash flows trading at fair multiples (most of my AI stocks). What to avoid? the no earnings garbage stocks that populate Cathy Wood's ARKK ETF's and HIGH multiple stocks that are hoovered up the masses like lambs being led to the slaughter during 2020 and where most peaked early 2021, and crash in excess of 50% since though there are still fools that cling on to false hopes of a recovery and thus continue to throw good money after bad into garbage stocks.

However, the rampant money printing path we are on is taking us along an accelerating path towards what Ludwig von Mises some 100 years ago termed as the Crackup BOOM - the END GAME Of RAMPANT MONEY PRINTING!

What is the Crackup Boom?

The crackup boom as theorised by :Ludwig von Mises in the 1920's in the face of Austrian hyperinflation is when the masses wake up to the inflation game the government and the central bank have been playing, that of printing money on an epic scale that devalues the value of fiat currency resulting in ever higher price rise in the shops coupled with increasing lack of supply as prices rise due to producers / sellers inclined to slowdown the process of delivery for higher future prices in response to which the government prints even more money to placate the masses in response to demands the government do something to address the "cost of living crisis".

To quote Von Mises:

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against 'real' goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last.

Now like all mega-trends this is the direction of travel that takes a number of years to unfold, however despite this it will still catch most off guard as most only awaken from their monetary slumber until it is too late to act! The signal for the crackup boom was QE4 of March 2020, during which the Fed balance sheet DOUBLED to monetize US government debt, in advance of which I warned during the quantitative tightening of 2018 that it would prove temporary and that when the next crisis hits the Fed would double it's balance sheet.

The US and most of the West is currently entering the quantitative tightening propaganda phase which as above will be a mere pinprick against the mountain of monetized debt and other assets parked on the Fed balance sheet, where perhaps at most we will see a 10% reduction in the Fed balance sheet down to about $8 trillion all in advance of the NEXT DOUBLING in the Fed balance sheet and with it a DOUBLING in the Inflation rate.

UK Crack Up Boom

The UK is definitely further along the path of a crackup boom! Where prices are rocketing higher, energy prices went up by 40% in April and will likely go ui by another 40% in October!

Many products are disappearing from supermarket shelves such as Wheat based products, sunflower oil, and pasta that supermarkets are RATIONING resulting in panic buying of these items and beyond as prices rocket ever higher, where MSM bombards viewers on a regular basis with the cost of living crisis whilst the government misdirects the population to the War in Ukraine all whilst failing to mention the epic amount of money the Bank of England has printed to monetize UK government debt, the INFLATION smoking gun that most remain blind to !

The crackup boom is an acceleration in the rate of free fall of fiat currency to the extent that the masses lose faith in currency and seek to escape it into any asset that cannot be easily printed such as HOUSING! And stocks that are leveraged to inflation such as that which populate my AI stocks portfolio and of course commodities such as Gold and Silver. Basically anything that cannot be easily printed is sought to escape fiat currency that results in soaring demands for such goods.

Today the escape from the sterling also includes into the US Dollar which has rocketed 10% higher against sterling in less than 2 months which is not due to dollar strength but due to the relative rates of free fall in fiat currencies i.e. like a sky diver sterling is falling at a more rapid pace than the dollar sky diver.

Meanwhile the Bank of England after a year long mantra of temporary high inflation during 2021 and into early 2022 finally confesses that we are headed for 10% inflation. However like most major economies the UK has watered down and doctored official inflation indices to the extent that they under report real inflation by at least 50%. I.e today's CPLIE of 7% using the 1970's methodology would be near 20%!

That's where we stand in the UK where even FAKE inflation indices are unable to hide inflation.

And how does the Bank of England intend on fighting 10% CPLIE with? On Thursday BoE raised the UK base rate of 1% which had the clueless MSM pundits bleating like lambs of the pain that borrowers would now face with 1% interest rates. They are not even at the level of SHEEP to realise what is actually going on 1% INTEREST RATE rate to fight 10% INFLATION! Are they that dumb to not realise one cannot fight 10% inflation with 1% interest rates?

UK CRACKUP BOOM IS WELL UNDERWAY !

With real Inflation at 14% to 20%, savers are escaping loss of purchasing power by plowing their funds into hard assets such as property, precious metals and stocks!

the crackup boom saw UK House Prices for April 2022 increase by 1.1% to £286,079, up 11% on a year ago, despite rising mortgages rates!

UK House Prices 2022 to 2025 Trend Forecast Conclusion

....<UK house prices forecast patrons only>.....

I would not be surprised if the crackup boom delivers far higher house price inflation than my forecast, all whilst the lemmings in the press are focused on when UK house prices will FALL!

Stocks Bear market? what bear market? The FTSE is close to setting a new all time high! CRACKUP BOOM!

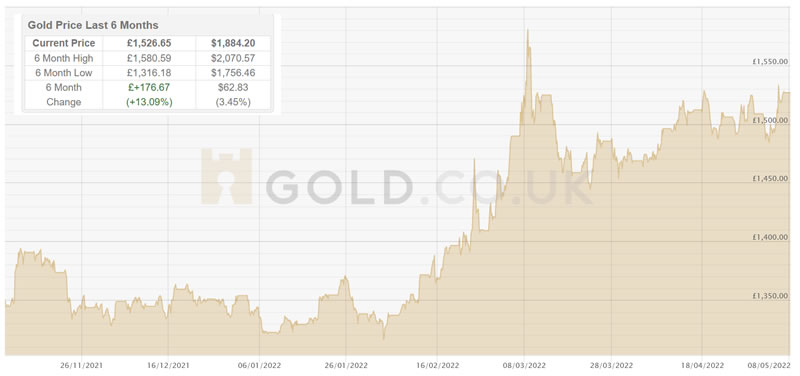

Gold UP 13% over the past 6 months, 17% of the past year. CRACKUP BOOM!

Bank of England warns that the UK is facing recession and 10% CPLIE, 1% Base Interest Rate to fight 10% inflation, £1 trillion of monetized debt, Economy Weakening, soaring commodity prices, shortage of workers,shortages of Goods, used cars selling for more than new, all equal a Crack Up BOOM well underway in the UK!

The US Dollar is in FREEFALL

If you read the MSM financial press you might come away with the impression that the US Dollar is very strong on the verge of breaking out to a 20 year high in USD.

When in fact the exact opposite is true due to the illusion that ALL currencies are in free fall and all you are witnessing in the exchange rates is the relative rates of collapse i.e. the US dollar is collapsing at a slower rate than most other currencies, for instance the British Pound is collapsing at a 10% faster rate than the US dollar and similar is currently true for other major currencies such as the Euro all whilst the the MSM lemmings focus on the red herring which are the rates of exchange instead focusing on the big elephant in the room that is causing the inflation which is the growth in the money supply.

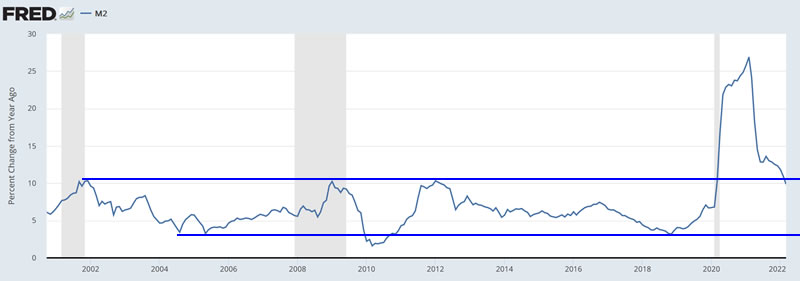

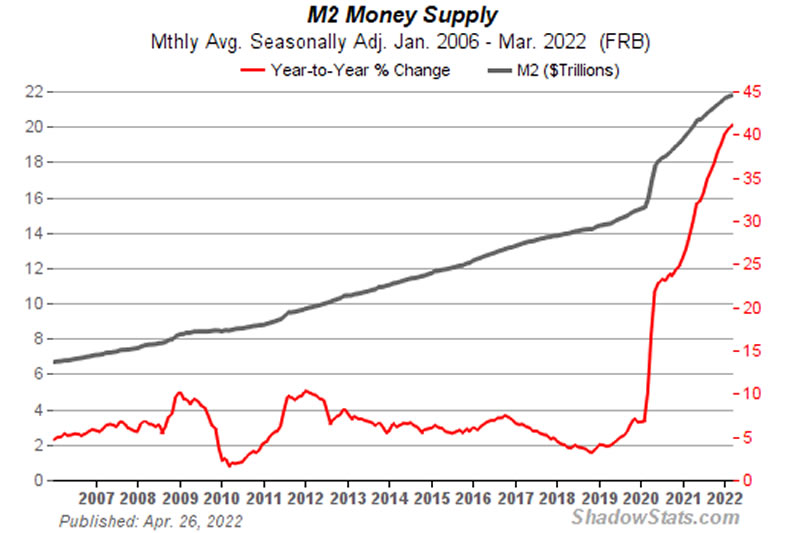

As with everything the Fed has fiddled statistics so as to mask the true rate of money supply growth, which even on official M2LIE peaked at 27% and currently stands at 10%. Whilst real M2 has soared to an annualised rate of 40%? Why because the Fed fiddled the M2 further in May 2020 so as to further HIDE the rate of M2 growth.

M2 is growing at 40% per annum which roughly equates to a a 20% drop in the value of the dollar as the only advantage the US has over other nations is in that it holds the worlds reserve currency which allows the US to manipulate the world economy to the extent that it has, and will likely face less inflationary pain then most other nations as it will be one of the last currencies to go to zero..

And now we are heading tinto an INFLATIONARY RECSSIION which means that the Fed has no choice but to raise interest rates in an hopeless attempt to control FAKE CPLIE inflation, a smoke and mirrors exercise.

The Fed fund rate is at 1% whilst CPLIE is at 8.5% and real inflation is about 16%. The Fed implies that the rates will rise to as high as 3.25%, even if it happens how the hell is 3.25% going to control CPILIE of 10% or real inflation of 20%?

At some point the Fed will throw in the towel and abandon it's 2% CPILIE target and resume QE money printing for what I stated some 13 years ago is that once QE money printing starts it never ends QE is For Ever!

Thus the crackup boom is underway in the US for which there are plenty signs of!

SUPPLY CHAIN WOES are a function of the CRACKUP BOOM!

I am sure you have heard MSM blame high inflation on the supply chain woes. However what the clueless commentators fail to grasp is that SUPPLY CHAIN woes are a FUNCTION of THE CRACKUP BOOM! i.e. holding on to assets that CANNOT be printed!

Supply chain woes ARE NOT GOING TO DIMINSIH instead they are LIKELY TO WORSEN OVER TIME! As the value of goods increase over time, so who would be in any rush to ship goods to consumers in the US when one can gain higher profits by slowing the time frame form production to distribution and sales.

What this means for investors is that they need to pull their noses away from charts of falling stock prices and take a look around them, what is happening to prices in the shops? What is happening to prices everywhere?

Forget what FedLIE and CPLIE and GDPLIE imply for all the statistics are FAKE! For instance the US reported a -1.4% contraction in GDP for Q1 2022, the response form economists (FAKE science) and MSM was that it was a technical drop in GDP and does not really mean anything!

Once upon a time -1.4% is what one would expect to get during a whole recession! Now it's technical drop to ignore all because of CPLIE! We cannot know what real GDP is if the inflation rate used to calc it is FAKE!

What happens to Stocks During a Crackup Boom?

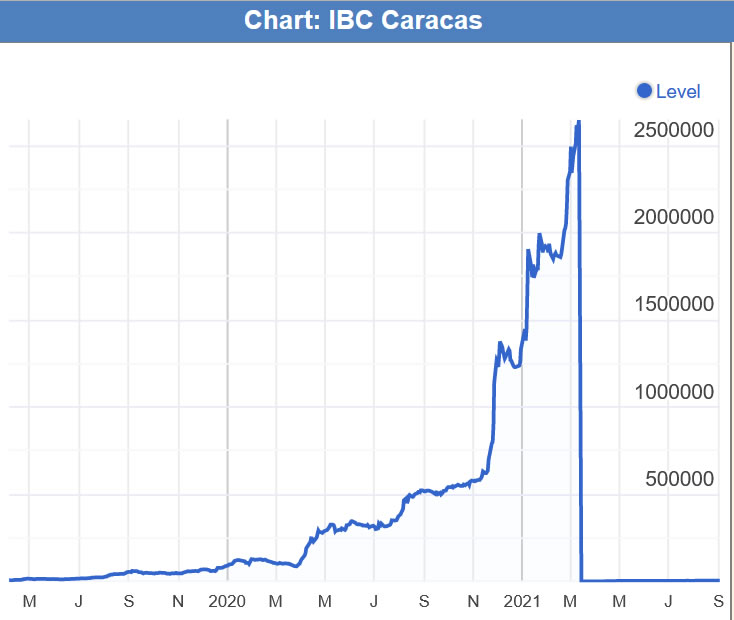

We have a good example in Venezuela for what happens to stocks during a crackup boom. Note that the stock market did not CRASH after the peak, instead, Venezuela knocked 6 zeroes off its currency in October 2021, so the Venezuela stock market crackup boom still continues!

You think it cannot happen to the Dow, S&P and Nasdaq? We'll its already been happing, just at a slower pace!

Venezuela is the crackup boom final destination for all stock market indices.

Crackup Boom - What's the Most Probable Outcome?

At this point in time I do NOT see the West going down the route of Venezuela, instead we will continue to have stubbornly high inflation for likely the whole of this decade which will continue to weigh down heavily on those assets that do badly during times of high inflation i.e. bonds, cash products, high multiple stocks, no earning stocks, so I don't think Cathy Woods mantra of 5 years time horizon for her funds to to X4 from $90 (now $45) is going to come true. ARKK in 5 years time will probably be were it is trading at today.

Whilst everything that cannot be printed os is leveraged to inflation and so should beat CPILIE, which should be reflected in the general indices.

So I expect crackup boom trend to continue which will leave many confused as governments and central banks adjust their propaganda and lift their inflation targets from 2% to perhaps 4% to normalise high inflation. Though most people will get poorer as their earnings will not be able to keep pace with real inflation, whilst those who saw it coming or at least recognised what the early counterintuitive market moves implied and acted should not only be protected from the worst ravages of the crackup boom but prosper to great extent. For instance one of the reasons why I am buying US stocks and not touching much cheaper UK stocks is because sterling is in a long-term downtrend against the Dollar i.e. collapsing at a faster rate than the dollar. Which is what I have experience during this bear market i.e.the bulk of my buying has been between GBP 1.31 and 1.36. Therefore today's GBP of 1.235, is some 6% to 10% lower. Thus buying Google today at $2300 is the same as buying Google at $2600 during late January whilst at the same time the whole portfolio priced in sterling gets a 10% boost.

(The above was an excerpt form my forthcoming US House Prices Trend Forecast in-depth analysis)

SILVER CRACKUP BOOM ACCMULATION OPPORTUNITY

Invest in that which cannot be printed! Silver fits that bill which unlike Gold is slow to take off, but when it does rockets higher on hyper FOMO!

It's been a while since I last looked at Silver but given the dynamics of where we sit then the price pattern looks to be at an opportune point to accumulate at for the eventual probable break higher to new all time highs i.e. to above $50.

The Silver price has been stuck in a trading range for nearly 2 years pending a probable eventual breakout higher. Currently Silver is trading towards the bottom of the range i.e. at support along at $22. Similarly the MACD is once more at a level that has coincided with bottoms. However a break below $21,40 would imply a trend lower to $19 which given continuing US Dollar risk is possible if not probable. Therefore any accumulation at $22 would need to allow for a possible break of $22 to target $19 and possibly as low as $17. Which implies a safer entry would be to wait for confirmation of the $22 low on break above the nearest short-term high which currently sits at $23.35 to target the top of the trading range at $28 which is as far as technical analysis can take us as Silver could continue to trade within $28 to $22 range for sometime until the eventual breakout higher, though the more time Silver spends trading within this range then the more powerful will be the resulting breakout which given the INFLATION fundamentals should be higher rather than lower.

In Summary

Silver is at the opportune level of $22 for long-term accumulation that first targets the top of the range at $28 and then on a breakout higher to ultimately target the previous all time high of $50.

However, there is a real risk of the Silver breaking below support of $22 to first target $19 and then $17 a risk that is a function of the strong US Dollar. So if the Dollar continues to strengthen then such a breakdown would become inevitable. Personally I have held an investment position in Silver for over 5 years waiting for that inevitable spike to $50 and have no plans to add more. For investing exposure to SIlver there is the SLV ETF and SSLN ETC.

For a trading position I would wait for further price action to confirm the bottom at around $22 before entry to target a trend to first $26 and then the top of the range at $28.

AI stocks Portfolio Current State

The crackup boom ensures that low multiple high cash flow stocks will continue to be repriced higher as store of value and I would not be surprised if there comes a time when there is panic buying of the likes of Qualcom, Micron and WDC amongst many others on my list as investors flee collapsing towards zero fiat, which is not even on the radar of most market commentators today but is a trend that is bubbling away under the surface. So my focus remains to KEEP CALM AND CARRY ON ACCUMULATING QUANTUM AI TECH STOCKS AS THEY DEVIATE FRROM THEIR HGIHS TO FAIR VLAUTIONS a balancing act of not wanting to over pay but at the same time aware that the CRACKUP boom could at any time ignite panic buying, so lets hope not too many people clock on to what is actually going on lest the bear market ends too soon for my objective of reaching 85% invested is achieved (current 66%).

The smart money will be buying the good AI tech stocks during the sell off. Where the four stocks that I am itching to accumulate are Apple, Microsoft, Nvidia and Broadcom. Whilst Nvidia has full led my original price objective of trading below $190, hence my exposure has risen to 17%, however with earnings report just around the corner could deliver a panic event that see's a sharp drop to as low as $99. Microsoft and Apple remain pending significantly lower prices to deliver any sort of valuation that justifies significant exposure.

Last week I nudged my Max exposure lower for Amazon, AND this week I upped it by about 10% for TSMC, AMD, AMAT, LAM and Qualcom. i have also added a new column that shows my target percent of portfolio. for instance my target percent for Google is 6.6% of my portfolio, current 3%, so position size is near 50%.

Table Big Image - https://www.marketoracle.co.uk/images/2022/May/AI-stocks-portfolio-7th-may.jpg

Select Cheap Stocks

Qualcom - $140.6 - PE 14.5 - EGF +18%, 80% invested, Buy zone $134 to $123. I am seeking to buy more between $132 and $123 as I don't see much lower prices ahead for this cheap stock.

AMD -$95.3 - PE 27.9, EGF +33% - 73% invested. Great earnings report (as expected). Buy zone is $90 to $82 I am seeking to buy more at $85 and $80

TSMC - $91.6 - PE 20.1, EGF +23%, 80% invested - Onwards into the future, 2nm in 2025, 1nm node chips will come on stream 2027. Buy zone is $90 to $80. I am eager to buy more exposure with limit orders at $85 and $80.5.

AMAT - 112.5 - PE 15.3, EGF +3% - 90% invested. Buy zone $110 to $102. My nearest limit order is at $102.

Lam Research - 478.3 - P/E 14.9, EGF 5%, 73% Invested. Buy zone 448 to 386. My nearest limit order is at $408,

INTC - $44 - P/E 13.8, EGF -30%, 106% Invested. Intel is in a long-term trading range of $65 to $43, currently trading near the bottom of the range. Buy zone is $4 to $39.

Facebook - $204 - P/E 15.4, EGF -18%, 134% invested. 15X earnings! It's not going to get much cheaper than where it sits today. Buying Zone is $192, to $178. Yes there is a 'chance' of a spikes lower in follow the market moves, but the main trend should see Facebook continue to build a base between $230 and $190 in advance of an assault on $300 later THIS YEAR!

TARGET STOCKS

Nvidia $185, PE 48.4, EGF 19%, 17% invested, Buy zone is $174 to $132..I continue to lightly accumulate Nvidia each time I see the stock trade to a new low, so that no matter what happens I will have at least some exposure to Nvidia with it's next earnings report on 26th May and depending on the mood of the market Nvidia stock price could crash all the way to UNDER $100 a share! Currently my big buy order is at $133, but I will probably put in additional big buy order at around $100 just in case Nvidia's stock price CRASH to under $100 materialises. In the meantime I continue to accumulate small, with nearest buy order at $172.1. My target is to get to at least 25% invested.

Apple $157.3, P/E 25.5, EGF -1%, 2.5% invested. Apple is point blank refusing to drop, the stock is NOT CHEAP which I suspect is down to the smart money accumulating, My long standing buying levels are 140 and 128 where I have intended to do most of my buying, However I now aim to accumulate small sub $148 so as to gain some exposure, nearest small buy is at $144, with my big buys sub $132. My target is to get to at least 20% invested.

Microsoft $275, P/E 30.1, EGF -3%, 14% Invested. Microsoft is even more over priced than Apple, but again the smart money sees more in this tech giant than I do. Buying zone is $262 to $228. My nearest limit orders are at $258 and $244.

AVGO - $580. P/E 19.,5, EGF +13%, 9% Invested, Buying zone is a wide $558 to $480. This stock has repeatedly found support at it's 200 day moving average ($557), a break below which could result in a sharp drop lower, earnings are due on the 2nd of June so as that date draws nearer the stock price could become more volatile. My limit orders are at $524 and $489.

MORE STOCKS

GOOGLE $2313 - P/E 20.9, EGF - 11%, 48% invested. I still think Google has more downside, the potential to slide to under $2000. Buying zone is $2260 to $1986. My nearest buy limits are at $2228 and $2116. My target is to get to about 70% invested in numero uno.

ASML $551, PE 32, EGF +18%, 51% invested - Not cheap but makes the machines that make the chips. Buying zone $528 to $502. My nearest limit order is at $488. My target is to get to about 66% invested. I have limit orders at $503 and $452.

Amazon $2295 - P/E 43, EGF -68% - 52% Invested (reduced target exposure), Buy zone $2180 to $1860, My limit orders are at $2146, $2012 and $1852. Not much more buying for me in Amazon, target is about 1.7% of portfolio as this stock could surprise to the downside i.e. it could even crash all the way to $1000, though with heavy support ahead at $1700.

Cathy Wood ARKK INSANITY There is NO Coming Back!

I really feel sorry for investors who have got sucked into ARKK hype for as they obviously failed to realise that she was just spouting a total load of BS and so got sucked into the ARKK hype sales vortex, reminds me of people who are brainwashed into buying Timeshare apartments that they come to regret for the rest of their lives! Which is the case with ARK! ARK K is NEVER coming back to it's highs let alone X4 over the last 5 years! which is what I have repeatedly warned as my December video in response to her then latest hype videos illustrates. At the time ARKK was around $95 and she was spouting it would X4 over the next 5 years. Today ARKK is trading at $45, that's a 50% drop from what I forecast to expect would happen to ARKK by now 5 months ago, and down 71% from it's high!

When ARKK was trading at over $100, I half jokingly said I would seek to buy ARKK at below $20. We'll it looks like it won't be long before I take a small punt on ARKK at around $17.

Remember this is an ETF NOT an STOCK, it takes a special type of insanity to produce such an outcome. INSANE! So heed my warnings stay away from the turd stocks, that's no earnings garbage and tread very carefully with any high multiple stock, you really need to have a good understanding of any company trading above X20 earnings else be prepared to lose everything above X15 earnings as multiples contract.

The bottom line is if you are sat looking at stock charts then you are looking in the wrong direction, a CRACK UP BOOM is underway a tide that lifts ALL boats as currencies crash towards ZERO and thus there will be huge puzzlement and confusion when certain stock prices seemingly inexplicably start to rocket higher for no apparent reason. For instance many will say how the hell did Nvidia go from a low of say $140 to once more trade to a new all time high? Which of course will become obvious why with the benefit of hindsight as the fools (economists) will once more do their rounds on MSM to explain why it was in hindsight inevitable.

I saved the H word until last - HYPERINFLATION!

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My latest analysis includes -

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

- AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your 65% invested analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.