The Psychology of Investing in a Stocks Bear Market

Stock-Markets / Stock Market 2022 Jul 26, 2022 - 09:14 PM GMTBy: Nadeem_Walayat

Every bull market is followed by a bear market and every bear market is followed by a bull market, where courtesy of the electron and inflation mega-trends the general indices are on an upwards exponential trend trajectory. Thus all bear markets are living on borrowed time and thus ones focus should be on accumulating positions in good stocks i.e. those that actually generate earnings and have good prospects for continuing earnings growth that courtesy of bear market negative sentiment results in prices trading to under value stocks i.e. to under X18 earnings, where everything above X18 is carrying a premium which is why I completely sold out of many stocks last year such as Amazon and Nvidia even though they had yet to peak due to the risks of a valuation reset as I covered in my in-depth analysis of August 2021

AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

Amazon to the MOON 2021! Then what?

YES, Apple, Amazon, Facebook, Google and Nvidia all have highly compelling reasons for why they should all continue keep going to the MOON! But so did all of the tech giants in 2000!

So in some months time we may be living in a completely different world where the likes of Microsoft, Amazon and Apple after a plunge in price have most investors who were happy to pile in at all time highs with their dollar cost averaging mantra are then too scared to either buy or sell as they watch in fear stock market armageddon take place all whilst the MSM, blogosFear and Youtubers reinforce their state of paralysis acting as echo chambers just regurgitating that which others have posted.

As for what I will be doing ? BUYING the PANIC! Even if I turn out to be early because during the mayhem most of the pieces of the puzzle will be unknown.

The thing that most fail to realise about the markets when they look at the price charts is that the fundamentals, valuations etc are SECONDARY! It's investor psychology that drives markets! Drives stock prices to FOMO to the MOON, far beyond the maths, computations, valuation metrics, reasoning, projections of how high stocks could go, literally leave reality behind as they embark on a FOMO assent to heaven with many clamouring to get on aboard the rocket ship, not wanting to hear anything that suggests to expect the opposite i.e. many patrons did not like the fact that I had started selling out of my holdings during the 2nd half of 2021 because they did not want the party to end and thus sought out views that justified the party continuing.

8th Dec 2021

Mr Nadeem

You have sent me yesterday, notice that the market would collapse – so I sold everything. Now you don’t even mention this. Surely you need to follow up on perhaps the most dramatic call in your carreer. Even if just to say sorry – I was wrong. I don’t know if to rebuy now

R...

Humans are creatures of habit, they don't like change. They don't like it when a bull market changes into a bear market or even when a bear market changes into a bull market since they failed to capitalise on the price drops. Hence continue to FOMO into the early stages of a bear market convinced that the final blow off top is just around the corner that they will then sell into just as many highly popular youtubers were posting at the time because no one wants the party to actually end, so it never does as off they go on a tangent looking for patterns to confirm their bias such as the below from November 2021 illustrates.

And the same is true during bear markets, the longer a bear market goes on the more pessimistic investors become! Stocks trade far lower than anyone can imagine and the lower the go the more distant the bear market bottoms become as once more off they go clutching at straws such as what followed the 2000 dot com bubble which therefore implies this bear market is not even half way done! So extreme bullish FOMO of barely 6 months earlier has now been replaced with extreme DOOM, FEARs for another 50% CRASH or even worse hence justifies their ever solidifying view that stocks should NOT be bought just as going into the top when they sought out reasons for why they should continue buying and NOT SELL..

So the psychology of investing ensures that MOST will not buy when stocks are cheap or sell when stocks are expensive, as it is very difficult to do either so one needs to have a plan and be determined to follow it because everything looks easy with the benefit of hindsight but it is NOT at the time! Far from it, it is very difficult to SELL during the FOMO and very difficult to BUY once the BEAR has been going on for while because you WILL NEVER buy the bottom! And so no matter what one pays will be HIGHER than where the bottom will turn out to be and probably by a wide margin.

Hence in my experience one should NOT focus on the bottom but on the deviations from the HIGH coupled with that one is buying stocks at a fair valuation. For instance buying a good stock with consistent earnings growth such as Qualcom at a PE of under 15 should be a no brainier, but instead investors who were happy to FOMO into Qualcom at a PE of over 20 are now fearful to accumulate the stock when it is trading at a PE of 12.4 because the worst recession since 1981 sky is about to fall in..

YES A RECESSION IS BREWING! And so Buy the DIP has morphed into SELL THE RALLY even before the recession arrives! THIS IS THE MASS PSYCHOLOGY OF THE MARKETS and why the likes of CNBC is so dangerous! Where FOMO has given way to SELL the RALLIES as they give air time to those with a vested interest in peddling a sales pitch to their own advantage.

The bottom line is as investors we WILL NOT SELL at the TOP or BUY at the bottom, that is a fools errand in trying to do so. All we can know is when stocks are expensive and when stocks are cheap and therefore act accordingly, understanding that when stocks are very expensive ALL of the NEWS is GOOD! And when stocks are very cheap ALL of the NEWS is VERY BAD.

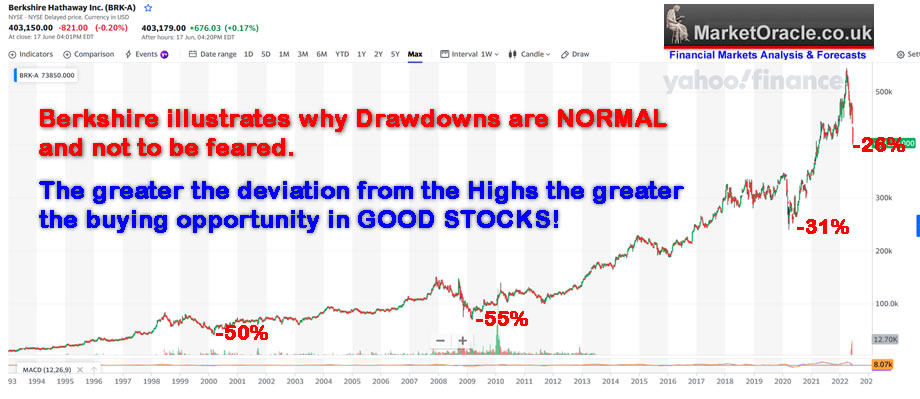

instead most obsess over draw downs without realising that draw downs are NORMAL! And are unavoidable! EVERY stock has had a draw down of 50% or more, EVERY STOCK! Even Warren Buffets Berkshire has at times fallen by 50% over the decades which sends the message that draw downs do not matter. In fact rather then being feared they are your golden opportunities to accumulate! 20% discount (Pfizer), 40% discount (Micron), even at a 50% discount (AMD). That's what draw downs are an opportunity to accumulate more of ones target stocks to distribute during the next FOMO, if one manages not to succumb to the FOMO themselves.

This analysis The Psychology of Investing in a Stocks Bear Market was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis -

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

- The REAL Stocks Bear Market of 2022

Stock Market Pattern 2022

My stock market big picture remains to expect the Dow to target a trend towards a probable bottom by late August / Early September at approx Dow 29,600 So far the stock market has not done anything to negate this scenario and thus remains the direction of travel ahead of my next stock market in-depth analysis.

With the Dow closing Friday at 29,988 we are within touching distance that I now expect to resolve in an imminent summer rally which some patrons took to imply that the low could come early, no I still expect what ever rally morphs over the coming days to resolve in a LOWER low within the expected time window of Late August to early September.

Looking beyond August as I last wrote I doubt that 29,600 would be THE FINAL low which I expect to emerge from within a volatile bottoming trading range into the end of October as the Dow swings through 29,600 several times ahead of probably strong rally into at least Christmas.

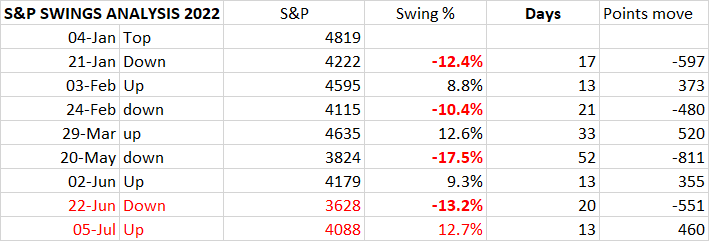

As for what comes next, to elaborate upon what I wrote last week regarding the S&P the S&P is targeting a trend to first support zone of 3875 to 3825 that will likely break given that we are in a bear market to target a trend to a new bear market low of 3730 before embarking on the next bear market rally that will once more resolve in a trend lower to target 3600 by Mid August to early September for the target bear market low." The actual swing down has been deeper to 3628 but nothing out of the ordinary for this bear market that implies to expect a bear market rally to just below 4100, targeting 4088 based on swings analysis.

Thus the S&P either has already bottomed or will imminently do so early next week to target a bear market rally to at least 4088 into early July where the big question mark is can the stock market punch through resistance for a more meaningful rally? So far to date the swings in this bear market have been relatively mild when compared to bear markets of past. Which is either good news or bad news i.e. good in that the declines are orderly, bad in that it could signal the calm before the storm. At this point I still see this as a relatively mild bear market to target a 20% decline on the Dow and so I will use the rally as an opportunity to trim positions. As a rough guide I'll be seeking to trim at between +18% to +25% off the recent lows i.e. trimming AMD on a rally to above $99 whilst I doubt it will punch above resistance at $109. And similar for the other stocks that I have bought heavily into during the past few days.as the AI stocks table illustrates.

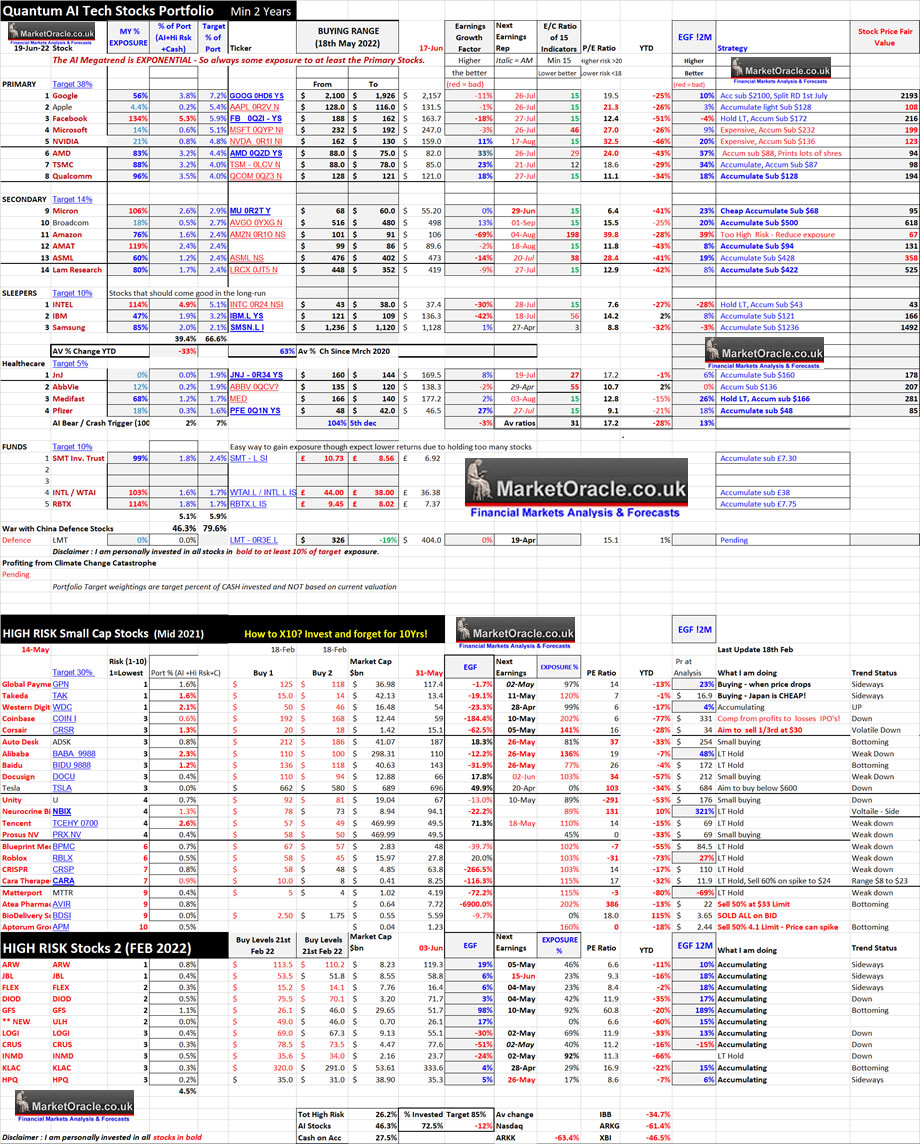

AI STOCKS PORTFOLIO - BUYING THE RATE HIKE PANIC

The greater the deviation from the high the greater the buying opportunity being presented and last week we saw some massive deviations to NEW LOWS! and so I HIT the BIG BUY BUTTON on my Keyboard several times which brings me to 72.5% invested, 46,3% AI, 26.2% high risk and 27.5% in cash on account. Last week I bought across the board and came tantalisingly close to making a big buy of Broadcom though at $490 it was just $10 above my $480 big buy target price and so I only bought small. AMAT busted through 100% exposure to sit at 119% invested. Qualcom is near 100% invested. AMD's 65% invested of a week ago now stands at 83%. Micron busted through 100% to 106%. I even added some Samsung and to 2 of the 3 funds. The only stocks I did not add to are those that patrons tend to most ask after Apple, Microsoft and Amazon all of which remain over valued.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Jun/AI-stocks-portfolio-17-big.jpg

In terms of the AI stocks portfolio as a whole, average P/E is 17.2, EC 31, EGF -3%, EGF12M is 9%. Exclude Amazon and P/E is 16.1, EC 22, EGF 0%, EGF12M is 12%. so the portfolio as a whole is in a very robust state. Much better than the general indices i.e. the Nasdaq is on a PE of 19.6, S&P 18.6, and Dow 17. And even better when factoring being under weight the high PE stocks such as Microsoft, Apple, and Nvidia.

Broadcom $498 - Firing on all cylinders - P/E 15.5, EGF 13%, EC15 , EGF12M +20%, Fair Value $618. Broadcom is cheap and I want to buy big at at $480, in the meantime I accumulate small sub $500, my exposure is now 18%. Whilst a bear rally would target $586.

Pfizer $46.5 - Firing on all cylinders - P/E 9.1, EGF 27%, EC15 , EGF12M +18%, Fair Value $85. The stock price has held up well so only light buying so far as I eye $43 and lower for big buys. Whilst a bear rally would target $54. In the meantime I continue to accumulate small.

QCOM $121 - Firing on all cylinders - P/E 11.1, EGF 18%, EC15 , EGF12M +18%, Fair Value $194. My exposure has now jumped to 96%, so I am near fully invested having reached the bottom of it's buying range. I will probably continue to buy small if the stock continues to fall.

Google $2156 - P/E 19.5, EGF -11%, EC15 , EGF12M +10%, Fair Value $2193. Is showing relative strength by failing to make new lows that would have triggered a big buy. My exposure has only grown slowly to currently stand at 56% as I continue to accumulate. I expect the next rally to be strong which could see Google break above $2390 to trade back over $2500 to possibly as high as $2600.

Amazon $106 - Flirting with its buying range of $101 to $91. I am 76% invested (remember I reduced max exposure), so I am in no rush to add unless I see the low 90's. Technically a bear market rally is first targeting $128, on break of which could send Amazon to $144 where I would probably trim back to 50% invested as Amazon is one stock that I don't entirely understand i.e. I don't see much upside potential and hence view it more as a range trading stock. So can still be profitable to hold as long as one remembers to RANGE trade i.e. I will probably sell ALL of my holding should I ever see $3400 again as I did last year.

I continue to accumulate the other stocks stocks such as AMD, TSMC, Lam in line with my buying range as they make new lows. Whilst Micron has busted below it's range to $55 which prompted me to buy big and increase my exposure beyond 100% and the same with AMAT. Should I see AMD go below $80 then I will likely buy big and take my stake beyond 100% given that in growth terms it is the strongest stock on my list i.e. if any stock is going to have a big earnings surprise than that stock will be AMD.

And I have continued accumulating into the Feb 2022 high risk stocks with my exposure now in GFS at 105% of target and the rest as indicated in the table.

TARGET STOCKS PENDING BIG PRICE DROPS

NVIDIA $159 - P/E 32.5, EGF +11%, EC15 , EGF12M +20%, Fair Value $123. Now trades at well under half it's high! My exposure is still pretty light at 21% as I seek much lower prices, below $132 for a big buy given that I expect a slowdown in earnings and thus future growth for a year or so that should eventually be reflected in a lower stock price i.e. 32X earnings is still too high. Trend wise Nvidia targets $195 and then $224.

APPLE $131.5 - P/E 21.3, EGF -1%, EC15 , EGF12M +3%, Fair Value $108. Apple remains stubbornly above my buying range so I have bought nothing, even if it fell to say $120 I would probably not buy much, maybe increase my exposure from 4.4% to about 16%. The stock remains over priced where once the dust settles we could easily see Apple trade to below $110.

MICROSOFT $247 - P/E 27, EGF -3%, EC 46, EGF12M 9%, Fair Value $199. Everyone is eager to get a piece of Microsoft but it could easily fall to under $200. So I am lowering my buying range for Microsoft to $232 to $199. Where I seek sub $220 for any significant buying, hence my exposure to MSFT remains low at 14%.

ASML $473 - P/E 28.4, EGF -14%, EC 38, EGF12M 19%, Fair Value $358. The ASML nut finally cracked and the stock price fell into my buying range of $476 to $402 so I increased my exposure to 60% Though I seek the bottom of the range ($402) for a big buy given that the stock trades well above fair value of $358, which could be the ultimate fate for ASML. In terms of a rally, the stock looks weak, so might not travel higher than about $580.

US Housing Market Analysis

Under going revisions and tweaking in the wake of changes in key drivers such as mortgate rates that wil continue trending higher from the current 30 year at 5.8% to probably 7% by the end of this year. Hopefully Patrons heeded took note of my view whenever I was asked to seek to fix mortgages for as long as possible since well before the mortgate rates started to rise at the start of this year.

Though remember investor psychology applies just as much to the housing market as to the stock market, so take the time to put yourselves into boots of prospective home buyers, holders and sellers. What is your frame of mind? I would happen a guess it would be focused on runaway INFLATION, and so if one is looking to buy then ones money is fast losing it's purchasing power. Whereas if one is considering selling then where is one going to stuff ones money after one sells? Investor psychology regardless of the fundamentals suggests actual nominal falls in average US house prices are very unlikely no matter what the talking heads are spouting as they mistakenly look back at the financial crisis and what happened at that time when rates last rocketed higher before the collapse.

This analysis The Psychology of Investing in a Stocks Bear Market was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis -

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

- The REAL Stocks Bear Market of 2022

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 90%

- Global Housing / Investing Markets - 60%

- Stock Market Trend forecast into End 2022 - 0%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the panic analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.