Silver Investing When Everyone Else is Panicking-Party Time…. Let's Celebrate!

Commodities / Gold & Silver Oct 31, 2008 - 08:14 AM GMT

When it comes to investing, does the title “Party Time…. Let's Celebrate!” sound counter intuitive right now? This title is the most opposite/contrarian and therefore it is likely the most appropriate title we could think of at this time. Why?

When it comes to investing, does the title “Party Time…. Let's Celebrate!” sound counter intuitive right now? This title is the most opposite/contrarian and therefore it is likely the most appropriate title we could think of at this time. Why?

Valuable stocks and investments are on sale! Note that we did not say all stocks are on sale but “valuable” stocks and investments are on sale. In fact they are available for potentially ‘ fire sale ,' ‘ everything must go ,' rare ‘ clearance ' kind of sale prices. Who's getting out of the stock business by clearing out their inventory of stocks? We think it is the leveraged public and institutions. Who is buying these stocks? Answer, the same elite “rich” who keep getting richer as they pursue the opportunities created by the panic selling.

It is times like these that an investors self proclaimed, contrarian principles are truly tested. It is when everyone is panicking, selling and running for the hills that it is hard to buy in true contrarian style. We believe this is why only a few brave investors are able to make fortunes in these markets.

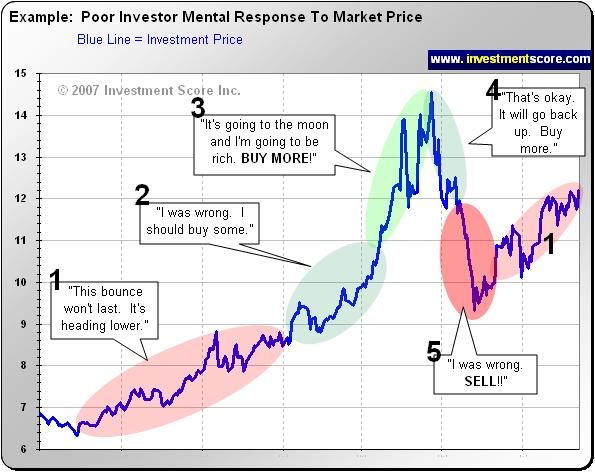

The following chart illustrates what we believe is the emotional response of the average investor to a rising investment.

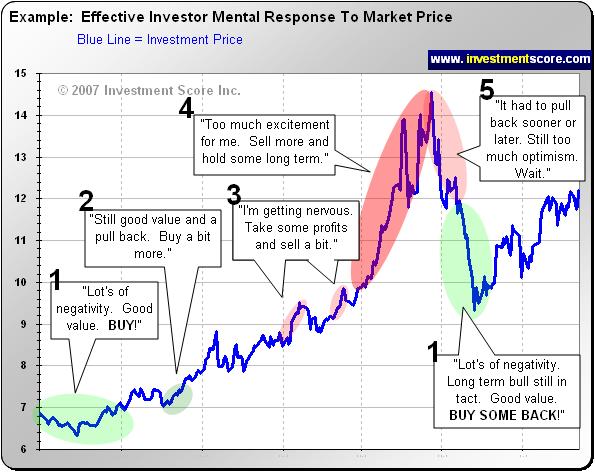

The next chart illustrates how a profitable investor likely views a rising stock price.

The key difference in the two examples of an investor's response to a price rise is:

The Effective investor gets nervous as the price rises and interested when

the price drops while conversely the poor investor gets interested as the price

rises and nervous when the price drops.

Maybe it is time to party because prices and public sentiment has fallen a lot. Perhaps it is time to cautiously deploy new capital into the financial markets; but where?

During times like these we focus on the following:

• We believe markets are cyclical and not linear. Overall most stocks will not go to zero and high value stocks will likely rise again.

• We also believe that when extreme panic and fear are prevalent in the general public, it may make sense to cautiously take new positions in investments that have good value.

• What is good value? In the long term, what investments are undervalued relative to other investments? What asset classes are experiencing a major bull market pull back and what asset classes are experiencing a major bear market crash?

The bottom line is that we believe commodities are in a major bull market as funds flow away from investments people “want” and into assets people “need” such as commodities like silver and gold.

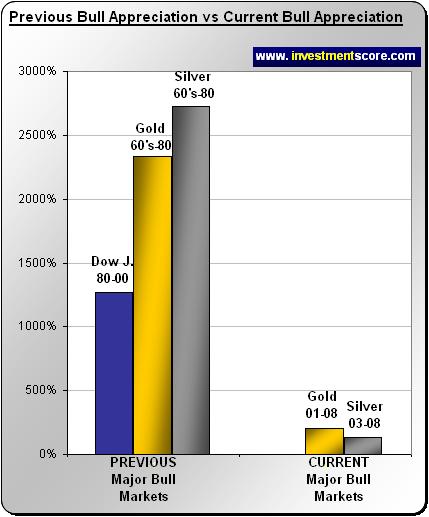

We believe that commodities and in particular silver and gold are undervalued relative to paper assets. Stocks were in a bull market for twenty years from 1980 to 2000. The Dow Jones climbed roughly 13 fold as it marched higher year after year. Since 2000 it has struggled as it trades sideways and capital flows out of stocks and into commodities such as silver and gold. Commodities were in a bear market for 20 years until roughly 2000 when they started a new mega bull trend. But bull markets typically don't end in eight years and they don't usually end with public mass skepticism or with only a 4 fold increase. If we compare the bull market in gold and silver to the 1970's bull market and the 2000 bull market in the Dow Jones, we can see that there is likely much further to run both in terms of time and appreciation.

Also, commodities such as silver and gold currently have high demand and are reported to be in tight supplies. Physical silver and gold products are currently selling at significant premiums as retail precious metals products are difficult to find. When credit markets are imploding and major companies are going bankrupt, tangible assets such as precious metals may be viewed as a safer alternative for preserving wealth. In addition, our Custom built Long Term Timing Charts show us that capital has been flowing out of other asset classes and into precious metals.

When this pessimism passes and stocks once again head higher, we think precious metals related investments will do better than yesterday's favorites such as technology and financials etc. Currently, we believe that all signs point to a bull market pull back in precious metals creating an opportunity for a long term investor. To be clear we are not suggesting that all stocks are created equal and all investments will climb after this pessimism passes. We are also not suggesting investors throw caution to the wind and jump into the market with both feet. It may be likely that lower prices across the board are still ahead of us. The world may also be headed directly into extreme economic pain and hard times. Caution is strongly warranted.

However, given the above comments, we believe it may make sense to use a contrarian investment strategy and deploy new capital into high value investments while everyone else is panicking. After all, many high value investments are on sale… Wooo Hooo!

At www.investmentscore.com we use big picture, custom built timing charts to help guide us in our investment decisions. If you would like to learn more about our investment strategy and sign up for our free newsletter, you may do so at www.investmentscore.com .

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.