Corporate Bonds: "The Next Shoe to Drop"

Interest-Rates / Corporate Bonds Apr 29, 2023 - 08:22 PM GMTBy: EWI

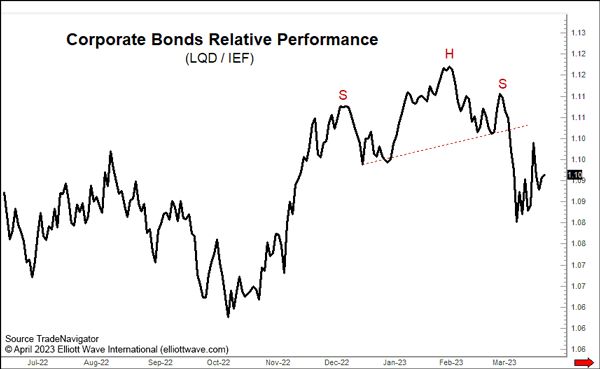

"The neckline has been broken over the last few days"

A "calamity" is likely ahead for corporate bonds, says our head of global research, Murray Gunn.

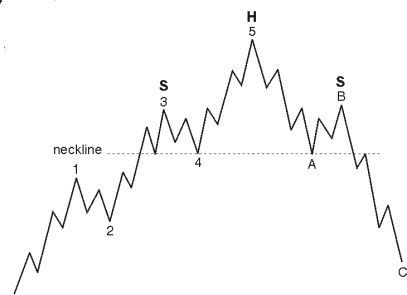

Some of Murray's analysis involves the head and shoulders, a classic technical chart pattern. In case you're unfamiliar with it, here's an illustration along with an explanation from one of our past publications:

A head-and-shoulders is a reversal pattern that consists of three price extremes. Market technicians refer to [them] as the left shoulder, head, and right shoulder. ...it takes a break of the neckline to confirm a reversal... [and it's] not just a bearish reversal formation. Inverted head-and-shoulders mark bottoms.

With that in mind, here's a chart and commentary which Murray provided for the April Global Market Perspective, a monthly Elliott Wave International publication which covers 50-plus financial markets:

The chart ... shows the relative performance of corporate bonds, as proxied by the iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker LQD) versus the iShares 7-10 Year Treasury Bond ETF (ticker IEF). A distinct Head and Shoulders pattern exists where the neckline has been broken over the last few days. The corporate bond market has held in reasonably well over the last year, but we fully expect this sector to be the next shoe to drop.

Don't count on the ratings services to provide timely warnings. In the past, downgraded ratings have sometimes come only after most if not all the damage was done.

Remember Enron? The company still had an "investment grade" rating just four days before it collapsed. Ratings services also missed the 1995 debacle at Barings Bank. Olympia and York of Canada is another historical example: the largest real estate developer in the world at the time had a AA rating on its debt in 1991. Less than a year later, it went bankrupt.

Getting back to the present, Murray Gunn also notes:

When ... corporate loans are re-set this year, there are going to be a few deep breaths being taken, and more than a fair share of tightened sphincters!

And, speaking of chart patterns of financial markets, another way to monitor the bond market is to use Elliott wave analysis.

If you'd like to delve into the details of this method of analysis, read Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

If indeed markets are patterned, and if those patterns have a recognizable geometry, then regardless of the variations allowed, certain price and time relationships are likely to recur. In fact, experience shows that they do.

It is our practice to try to determine in advance where the next move will likely take the market. One advantage of setting a target is that it gives a sort of backdrop against which to monitor the market's actual path. This way, you are alerted quickly when something is wrong and can shift your interpretation to a more appropriate one if the market does not do what you expect. The second advantage of choosing a target well in advance is that it prepares you psychologically for buying when others are selling out in despair, and selling when others are buying confidently in a euphoric environment.

If you'd like to read the entire online version of Elliott Wave Principle: Key to Market Behavior, you may do so for free once you become a member of Club EWI, the world's largest Elliott wave educational community. A Club EWI membership is also free.

Join now by following this link: Elliott Wave Principle: Key to Market Behavior -- get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline Corporate Bonds: "The Next Shoe to Drop". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.