Gold Shines as the Economic Outlook Darkens

Commodities / Gold & Silver 2023 Dec 01, 2023 - 11:10 PM GMTBy: Submissions

While looser monetary policy may seem bullish in the short term, the medium-term ramifications could upend the yellow metal.

Recession Pessimism Ahead

The ‘bad news is good news’ trade continues to dominate the financial markets, as weaker economic data is perceived as bullish for risk assets. In a nutshell: if the Fed pivots and ends QT, all of investors’ problems will disappear. However, while the narrative has helped gold, an ominous economic backdrop should result in much lower prices in the months ahead.

For example, S&P Global released its U.S. Composite PMI on Nov. 24. And while the overall data was somewhat mixed, the last piece of the recession puzzle has begun to take shape. An excerpt read:

“U.S. companies lowered their workforce numbers during November for the first time in almost three-and-a-half years. Although only fractional, employment tipped into contractionary territory following the first drop in service sector headcounts since June 2020. Manufacturers, meanwhile, recorded back-to-back declines in staffing numbers.

“Businesses commonly mentioned that relatively muted demand conditions and elevated cost pressures had led to lay-offs. Other companies noted that hiring freezes were in place amid pressure on margins.”

Thus, while we warned repeatedly that higher long-term interest rates were poised to erode consumer demand, a slowdown in the U.S. labor market should continue for the foreseeable future. And as that occurs, investors’ pivot optimism should turn to recession pessimism.

Remember, rate cuts have been historically bearish, as they typically occur alongside severe economic contractions. And with the crowd pricing in a perfect soft landing, a major surprise should unfold, which is highly bearish for silver, gold and mining stocks.

More Red Flags

Despite investors’ belief that the Fed will pull off the perfect landing (it never does), boom and bust cycles have played out plenty of times throughout history. And with the ominous data hiding in plain sight, it’s likely only a matter of time before investors’ confidence turns to doubt.

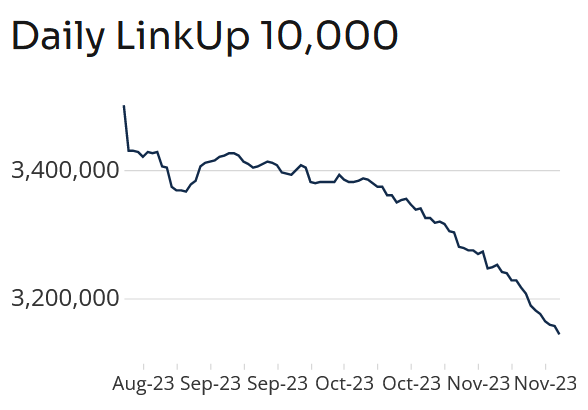

LinkUp’s employment index tracks the hiring intentions of the 10,000 largest employers with the most U.S. job openings. And with the metric suffering a serious slide, it’s no wonder crude oil has come under pressure.

Please see below:

To explain, the blue line above tracks LinkUp’s employment index over the last 100 days. If you analyze the sharp deceleration, you can see that hiring intentions collapsed as long-term interest rates soared. Moreover, while the crowd continues to celebrate the drawdown (pivot hopes), a continued crash should lead to a Minsky Moment in 2024.

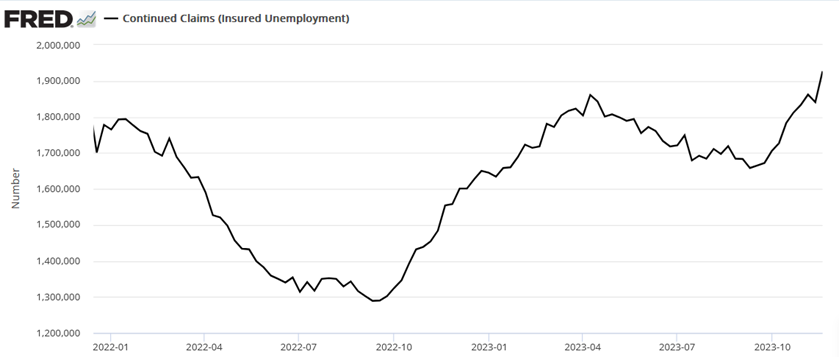

As further evidence, continued unemployment claims have risen materially, which adds further fuel to the bearish thesis. The metric measures the number of Americans who have filed for unemployment more than once.

Please see below:

To explain, the sharp rise on the right side of the chart highlights how continued unemployment claims have surpassed their 2022 and 2023 highs. And again, it’s no coincidence the recent surge occurred alongside the rise in long-term interest rates. As a result, the fundamentals continue to unfold as expected, and a recession should be the next catalyst that hammers risk assets and uplifts the USD Index.

Finally, with U.S. mortgage rates following Treasury yields higher, the housing market remains highly unaffordable for most buyers. And with pending home sales in crash mode, demand remains another casualty of the Fed’s inflation fight.

Overall, the ‘bad news is good news’ narrative has been a boon for the S&P 500. Yet, risk assets are known to place hope before reality, which often leads to sharp reversals when the latter prevails. Consequently, we believe the real drama is yet to come, and mining stocks should suffer profoundly if (when) a recession arrives.

To avoid missing important inflection points, subscribe to our premium Gold Trading Alert. Our expert technical analysis has allowed us to profitably trade in and out of positions on several occasions and has resulted in an 11-trade winning streak. And with future volatility poised to create even more prosperous opportunities, there has never been a better time to become a member.

By Alex Demolitor

Alex Demolitor hails from Canada, and is a cross-asset strategist who has extensive macroeconomic experience. He has completed the Chartered Financial Analyst (CFA) program and specializes in predicting the fundamental events that will impact assets in the stock, commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found above represent analyses and opinions of Alex Demolitor and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Alex Demolitor and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Alex Demolitor reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Alex Demolitor Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.