End of Secular Consumer Bull Market Signals Ghost Shopping Malls

Economics / Recession 2008 - 2010 Jan 20, 2009 - 02:25 PM GMTBy: James_Quinn

Ghost Malls Coming to Your Town - The illustration of Old West ghost towns is something that every American can relate to. During the great gold rush of the mid 1800's in California, Nevada, and Wyoming towns sprung up out of nowhere to support the gold mining efforts of those looking to strike it rich. General stores, bars, hotels, brothels, and jails appeared out of nowhere based on demand from delusional prospectors hoping to hit the jackpot. Thousands of malls emerged throughout suburban America in the last twenty years as delusional shoppers thought they could spend their way to prosperity and achievement. Both delusions will end in the same manner.

Ghost Malls Coming to Your Town - The illustration of Old West ghost towns is something that every American can relate to. During the great gold rush of the mid 1800's in California, Nevada, and Wyoming towns sprung up out of nowhere to support the gold mining efforts of those looking to strike it rich. General stores, bars, hotels, brothels, and jails appeared out of nowhere based on demand from delusional prospectors hoping to hit the jackpot. Thousands of malls emerged throughout suburban America in the last twenty years as delusional shoppers thought they could spend their way to prosperity and achievement. Both delusions will end in the same manner.

When the gold rush ended as quickly as it started, the artificial demand collapsed and the towns were abandoned. These ghost towns sat vacant for decades, slowly decaying and rotting away. As you drive around today, you notice more and more For Lease signs on vacant retail buildings. Strip malls, inhabited by mom and pop stores, karate studios, pizza joints, and video stores have felt the initial onslaught of consumer deleveraging. As the pace of retailer collapse accelerates in 2009, larger malls will begin to go dark. Once bustling centers of conspicuous consumption and material decadence, built upon a foundation of consumer debt, will become ghost malls. Decaying, rotting malls inhabited by rats, wild dogs, and homeless former retail employees, will be a blight on the suburban landscape for decades.

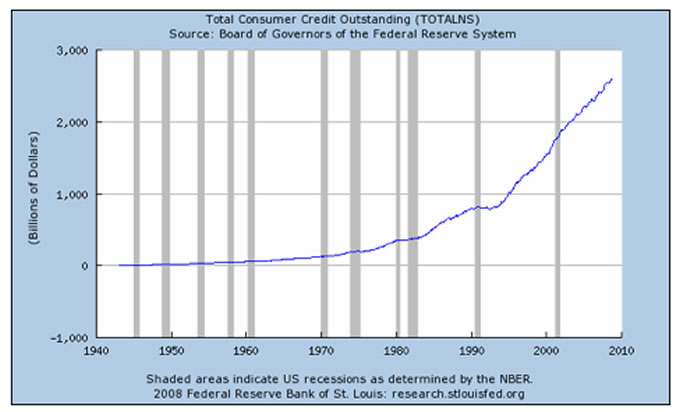

For the last twenty years the American consumers have carried the burden of the world on its broad shoulders. This has been a heavy yoke, but when you take steroids it doesn't seem so heavy. The steroid of choice for American consumers was debt. They have utilized home equity loans, cash out refinancing, credit card debt, and auto loans to live far above their means. It has been a wild ride, but the journey is over. They can't score steroids from their dealer (banks) anymore. The pseudo-wealth created in the last twenty years has begun to unwind, and will increase in speed in 2009.

Average Americans, who saw their faux paper wealth growing rapidly as their home values increased, took advantage of this by refinancing their mortgages and extracting the equity from their homes and spending it. They mined $3 trillion of equity out of their houses. This spending of seed corn led to the vast majority of GDP growth between 2000 and 2007.

Source: John Mauldin

Major Banks offered credit cards using your home equity as a way to pay everyday expenses like groceries, cigarettes, beer, gas and clothes. Eating your house was never so easy. The enormous amount of excess home sales and equity extraction led to titanic demand for home furnishings, remodeling services, appliances, electronic gadgets, BMWs, and exotic vacations. This led to immense expansion plans by retail and restaurant chains based on extrapolation of this false demand.

A permanent psychological change has occurred in American consumers. They have lost $30 trillion in value from their homes and investments in the last few years. No amount of fiscal stimulation will reverse this psychological trauma. The savings rate will increase from 0% to at least 8%. Mike Shedlock recently described the state of affairs. “Peak credit has been reached. That final wave of consumer recklessness created the exact conditions required for its own destruction. The housing bubble orgy was the last hurrah. It is not coming back and there will be no bigger bubble to replace it. Consumers and banks have both been burnt, and attitudes have changed.” Now the impact of a retrenching consumer will be felt far and wide, from Des Moines to Shanghai. Consumer spending has accounted for 72% of GDP. It will revert to at least the long term mean of 65%. David Rosenberg, the brilliant economist from Merrill Lynch, describes will happen:

"This is an epic event; we're talking about the end of a 20-year secular credit expansion that went absolutely parabolic from 2001-2007.Before the US economy can truly begin to expand again, the savings rate must rise to pre-bubble levels of 8%, that the US housing stocks must fall to below eight months' supply, and that the household interest coverage ratio must fall from 14% to 10.5%. It's important to note what sort of surgery that is going to require. We will probably have to eliminate $2 trillion of household debt to get there, this will happen either through debt being written off, as major financial institutions continue to do, or for consumers themselves to shrink their own balance sheets.”

Source: John Mauldin

Every major retailer in the United States has built their expansion plans on an assumption that American consumers would continue to spend at an unsustainable rate. One basic truth that never changes is that an unsustainable trend will not be sustained. That crucial assumption error will lead to the bankruptcy of any retailer that financed their expansion with excessive debt. Warren Buffet's wisdom will be borne out,

“ Only when the tide goes out do you discover who's been swimming naked.”

There are at least 1.1 million retail stores in the United States according to the Census Bureau. There are approximately 1,100 Malls in the United States, not counting thousands of strip centers. These numbers will be considerably lower by 2011. ICSC chief economist Michael Niemira explained, "In the midst of all this doom and gloom, it's hard to imagine it getting better... But keep in mind, what happens in strong downturns is there's a hefty pent-up demand. It's wrong to extrapolate these conditions for the next year or two." Mr. Niemira will be wrong this time. There is no pent-up demand. If the phrase unpent-up demand existed, it would apply today. Americans have bought everything they've desired for the last twenty years. There is no pent-up demand if you own 20 pairs of jeans and 60 pairs of shoes. The over-spending and over-leverage will take a decade to unwind.

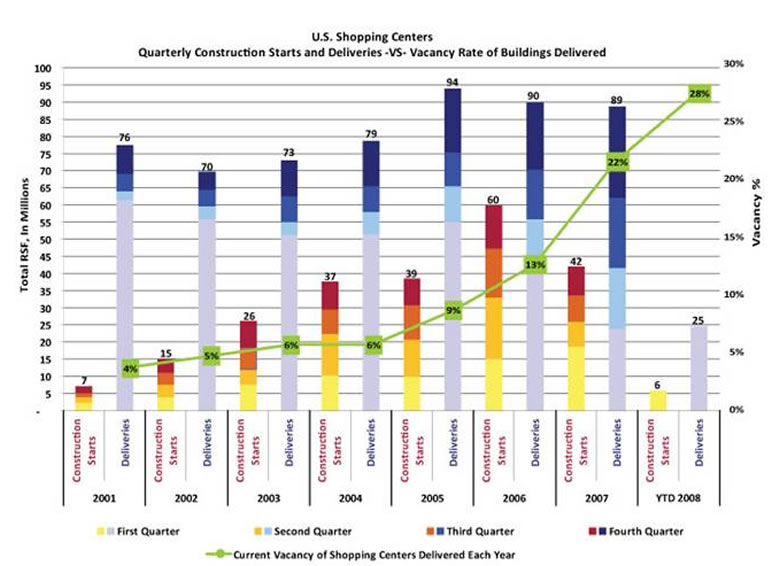

Source: Mike Shedlock

According to the ICSC, about 150,000 stores are anticipated to shut down in 2009, which adds to the 150,000 that closed in 2008 and 135,000 in 2007. Normally, 110,000 to 125,000 new stores open per year. At least 700,000 of retail jobs will be lost. The opening of new stores will grind to a halt in 2009. Some major retailers that have closed or will close include: Circuit City -728 stores; Linens N Things - 500 stores; Bombay Company- 384 stores; Sharper Image-184 stores; Foot Locker -140; Pacific Sunwear - 153. Other large retailers are closing underperforming stores and scaling back expansions plans. By 2011, at least 15% of the existing retail base will have gone to retail heaven. With the amount of vacant stores likely to reach in excess of 200,000 and vacancy rates of new malls already at 28%, there will be no need for the construction of new stores for many years.

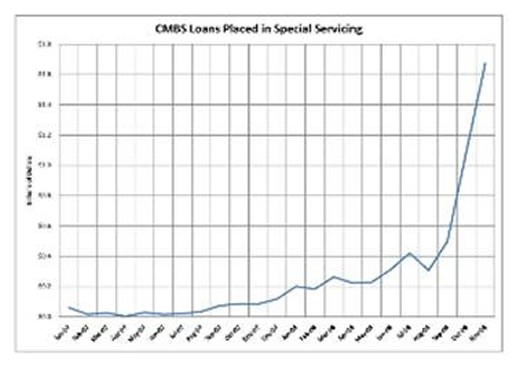

Most of the retailers that are closing, lease their locations from mall developers like General Growth Properties, Simon Properties, Mills Corp., Pennsylvania REIT, Vornado Realty Trust. These developers have a quadruple whammy hitting them in 2009. Many borrowed heavily to finance massive mall expansion. The term of these loans were generally five to seven years. The Wall Street wiz kids and their CDO machine generated the vast preponderance of financing in the last five years. According to commercial real estate expert Andy Miller, the collapse will come more rapidly than the residential collapse.

“By contrast, in the commercial world, the properties are fewer and much bigger. For example, you may have ten properties in a commercial pool that ultimately works its way into CDOs. Those loans are huge. You may have a shopping center loan in there for $25 million and an office building loan for $30 million dollars. As a result, if you have a default on just one of those loans, you can effectually wipe out all of the subordinate tranches. And that is why when you see the problems begin to appear on the commercial front, it's going to be a much quicker sort of devolution than we saw on the residential side. In the commercial world, most of the financing that happened outside of the apartment business was done by conduits, and there are no more conduits left, and conduits were doing the stupidest loans you could find. They were doing an advertised 80% loan-to-value, which was usually more closely aligned to a 100% loan-to-value. They were dealing with no coverage. They were all non-recourse loans. Many of them were interest-only loans. Those loans are now gone. You can't refinance them, and if you could, the terms would be onerous.”

Source: Mike Shedlock

Billions of debt needs to be refinanced in the next two years and there is no one willing to make those loans. The major mall developers are so terrified they have made an all out press to get their fair share of the TARP. As retailers go bankrupt, vacancy rates have reached 9.4% for shopping centers, according to CoStar Group. With virtually no demand, rental income is plunging. With cap rates eroding and operating expenses going up, a perfect storm will hit mall developers in 2009. The negative feedback loop will accelerate as the year progresses and will spiral out of control by late 2009 and early 2010. The negative feedback loop will lead to major developer bankruptcies and ultimately to Ghost Malls, particularly in the outer suburbs. The positive feedback loop that got us here, made people feel wealthy, smart, and overconfident. It was awesome! The negative feedback loop is going to suck. The collapse of developers will result in more major write-offs by regional banks that financed their expansion. This go around, many smaller regional banks will feel the major pain. The U.S. taxpayer will be required to step up to the plate again and assume financial responsibility for their own lack of spending. Talk about screwed if you do, screwed if you don't.

Mall owners and commercial developers are on the brink of bankruptcy. Commercial developer CB Richard Ellis didn't sound too optimistic in a recent 10Q filing:

We are highly leveraged and have significant debt service obligations. Although our management believes that the incurrence of long-term indebtedness has been important in the development of our business, including facilitating our acquisitions of Insignia and Trammell Crow Company, the cash flow necessary to service this debt is not available for other general corporate purposes, which may limit our flexibility in planning for, or reacting to, changes in our business and in the commercial real estate services industry. Notwithstanding the actions described above, however, our level of indebtedness and the operating and financial restrictions in our debt agreements both place constraints on the operation of our business.

As Americans realize that they don't “need” a $5 Starbucks latte, IKEA knickknacks, Jimmy Cho shoes, Rolex watches, granite counters, and stainless steel appliances, our mall centric world will end. Major mall anchor retailers Macys, JC Penny, and Sears are in for a heap of trouble in the next few years. As low prices become the only factor that drives retail sales, retailers will have minimal profits in the future, further restricting expansion and renovations.

Mall developer General Growth Properties which owns or operates 200 malls added $4 billion of debt in the last three years and is teetering on the brink of bankruptcy. Simon Properties, which owns or operates 320 malls, added $3 billion of debt in the last three years and will be greatly affected by the coming downturn. Many smaller developers will be in even more dire straits. With shrinking cash flow, looming debt refinancing, and dim prospects for a resumption of conspicuous consumption, Mall developers are destined for a bleak future. Picture Clint Eastwood from his spaghetti western days riding a horse through the middle of your local mall with tumbleweeds blowing past the vacant KB Toys and Victoria Secret.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.