Investors Preserve Your Wealth during the Global Banking Crisis

Stock-Markets / Investing 2009 Jan 21, 2009 - 02:06 PM GMTBy: Gary_Dorsch

“Accepting losses is the single most important investment device to insure safety of capital. It is also the action that most people know the least about, and are least likely to execute. The most important single thing I learned is that accepting losses promptly is the first key to success. It's a great mistake to think that what goes down must come back-up,” warned Gerald Loeb, the Dean of Wall Street, in his epic book “The Battle for Investment Survival,” last copyrighted in 1965.

“Accepting losses is the single most important investment device to insure safety of capital. It is also the action that most people know the least about, and are least likely to execute. The most important single thing I learned is that accepting losses promptly is the first key to success. It's a great mistake to think that what goes down must come back-up,” warned Gerald Loeb, the Dean of Wall Street, in his epic book “The Battle for Investment Survival,” last copyrighted in 1965.

“In all cases, where actual losses are involved, I'm inclined to say that when a new investment has shrunk by 10%, it's time to stop, look, and listen. I think it usually ought to be sold-out, and the loss taken. I'm almost inclined to say, dogmatically, sell it out before trying again,” Loeb advised his readers, concerning wagers in the stock market that turn sour, due to unexpected and unforeseen events.

A once-in-a-century financial crisis has brought some of the world's largest banks to the brink of insolvency, and quasi-nationalization, choking-off credit to wide swaths of the private sector, and threatening to throw the world economy into its deepest and longest recession since the “Great Depression” of the 1930's. Global stock markets have been mauled by the fallout from the “credit crunch,” losing roughly $32-trillion of market value from peak levels reached in October 2007.

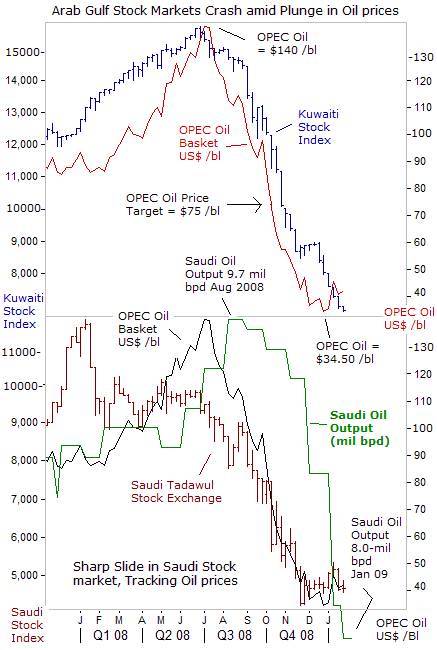

“The Arab world has lost a total of $2.5-trillion in the past four-months, as a result of the global financial crisis,” admitted Kuwaiti Foreign Minister Sheikh Mohammad al-Sabah on Jan 19 th . Declines on foreign stock markets accounted for $600-billion of the losses, while Arab investors were also hurt by sharp declines in oil revenues, declining value of property investments, and other repercussions of the global downturn. Still, ignoring Loeb's empirical rule of limiting one's losses to 10%, when they inevitably arise, due to unforeseen events, was an expensive education.

In the second half of 2008, the OPEC oil reference price plummeted 75% from a record high of $140 /barrel in July, to as low as $34.50 /barrel in December. Persian Gulf property prices also crashed as the credit crisis engulfed the financial markets. Consequently, investor sentiment turned negative and the efforts of Arab Gulf kingdoms to stimulate their economies and boost investor confidence failed. The UAE stock markets absorbed the biggest blow, shedding 72.4%, Saudi Arabia 's TASI lost 56.5%, and Kuwait 's lost 38%, during the past year.

In a desperate attempt to stop the slide in oil prices, Saudi Arabia removed 1.7-million barrels per day (bpd) of oil from the world market in the second-half of last year, to 8-million bpd, and Saudi oil chief Ali al-Naimi said on January 13 th, the kingdom will cut an extra 300,000 bpd of supply in February. But the combination of declining oil prices and production cutbacks is expected to trim OPEC's oil export revenue to $440-billion this year, down sharply from the $962-billion in 2008, when the OPEC cartel raked-in from oil exports, according to the EIA.

China 's trade surplus climbed 13% to a record $295-billion last year. But Beijing will spend 4-trillion yuan or ($586 billion) of its surplus cash on domestic stimulus projects this year, to cushion its economy from a hard landing. China 's exports, the key engine of growth for its economy, have plunged from a +22% growth rate a year ago to -2.8% in December. One-third of the 45,000 factories in the major export cities of Dongguan, Shenzhen and Guangzhou have shut-down, idling millions of workers, and forcing Beijing to spend more money to create new jobs.

Bonds are Safer than Stocks during Deflation,

According to Mr Loeb, “Successful investing is a battle for financial survival. Investing is fundamentally, an effort to obtain a rental from others, for the temporary use of one's capital. One should attempt to conserve the purchasing power of money, through the purchase or retention of fixed interest and principal obligations (i.e. bonds), including cash and a government promise to pay, only during cycles of deflation, and various forms of equity holdings, only in cycles of inflation.”

Joseph Yam, chief of Hong Kong 's central bank, warned of a second round in the financial crisis on Jan 21 st . “The effect of this round will be even more widespread and have a huge impact on the world's financial markets. We have a difficult year ahead,” he said. Today, central banks are slashing interest rates to historic lows, in a desperate race to head-off the scourge of deflation, favoring high-grade bonds.

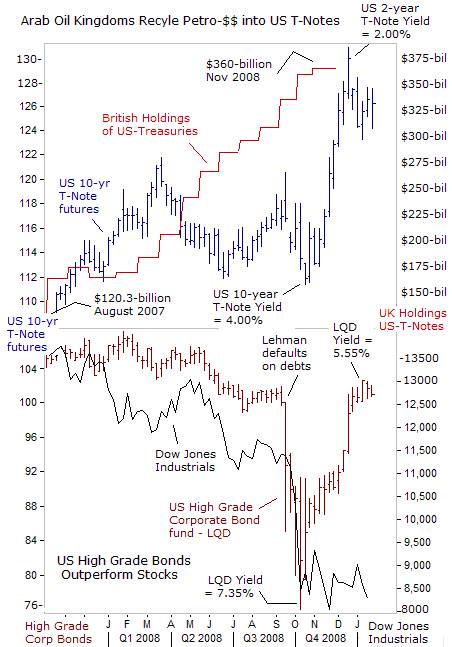

With the US stock market suffering its worst year since the 1930's, the Lehman Treasury bond index posted a gain of 14.6%, its best performance since 1995. Ten-year US-Treasury yields started the year at 4.03% and closed at 2.20%, after trading near 4.11% as recently as October. Practically all of the gains happened in the last two months of 2008, as deflationary signals became more visible.

The two biggest foreign buyers of US Treasuries over the past 15-months have been the Arab oil kingdoms, ($245-billion), and China , ($233-billion). But with dwindling external surpluses, and big economic troubles at home, the Arab oil kingdoms and China 's government could be absent from this year's Treasury auctions. How will the US-Treasury finance the 2009 budget deficit, which could eclipse $2-trillion, including massive bank bailouts and big stimulus packages?

Shell-shocked investors in the US-stock market were badly burned last year, and are now sitting on a record $3.85-trillion in money market funds. However, the Federal Reserve has driven the fed funds rate into a target range of zero to 0.25%, and has vowed to keep interest rates pegged near zero for a long period of time, probably through 2009. Taxable yields on money funds have tumbled to a pitiful 0.60%, after annual operating expenses are deducted.

The idle cash parked in US-money market funds is nearly equal in size to China 's FX reserves and the SWF's of Kuwait and Saudi Arabia combined. Would holders of US-money market funds agree to buy long-dated Treasuries, in order to finance the deficit at historically low interest rates? Or should investors turn to higher-yielding, high-grade corporate bonds, especially for companies with strong balance sheets, and little debt coming due over the next few-years, - a better investment than stocks, if the US-economy is hobbled by an extended period of deflation.

Barclay's High-Grade Corporate Bond Index, (US-symbol: LQD), has recouped most of its losses from the post-Lehman bankruptcy shakeout, including its $5.60 annual dividend payments. Still, buying corporate bonds is not without risk, especially if the Dow Jones Industrials tumble below the November low of 7,500, ushering in a “Great Depression,” and increasing the odds of company defaults. Also, corporate notes might sink under the weight of $2-trillion of fresh Treasury debt this year.

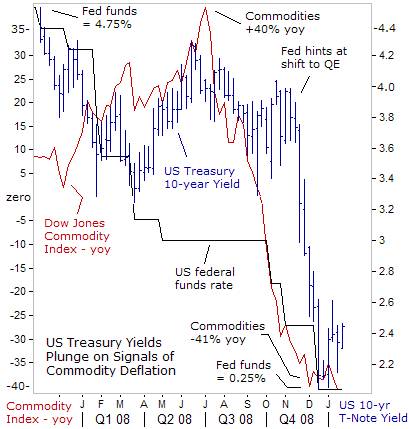

The plunge in the US Treasury's 10-year yield to 2% was preceded by a stunning collapse of commodity markets, especially for base metals and energy. In the span of just six-months, the Dow Jones Index of 19-exchange traded commodities, swung from a annualized +40% gain in July, to a stunning -41% loss in December. Volatile swings in the commodity markets are often seen as leading indicators for producer prices, and ultimately, the consumer price index.

The US-Consumer Price Index (CPI) fell 0.7% in December, the third-straight monthly decline, capping a year in which prices advanced only 0.1%, the weakest 12-month reading since December 1954. Gasoline fell 17.2% and accounted for almost 90% of the decrease in headline CPI. If commodity markets can't recover in a meaningful way in the months ahead, the CPI and producer prices (PPI) would begin to show outright signals of deflation seeping into the broad economy.

On Dec 18 th , Dallas Fed chief Richard Fisher said the US-central bank would take whatever steps necessary to avoid that outcome. “We stand ready to grow our balance sheet even more should conditions warrant. At the current time, the biggest concern is deflation and the Fed can worry about inflation later. We have to do everything we can to lift the economy up and prevent deflation from taking hold.”

On Jan 15 th , Chicago Fed chief Charles Evans said, “With the United States is in the midst of a serious recession, it could be useful to purchase significant quantities of longer-term securities such as agency debt, agency mortgage-backed securities and Treasury securities,” he said. Thus, the Federal Reserve is expected to be the buyer of last resort for the upcoming supply of US-Treasury debt, by running its electronic printing press at billions of dollars per hour. The biggest risk for today's buyer of Treasury-notes is that the Fed might be successful someday, in reviving inflation.

Longer Period of Deflation and Depression ahead,

If a long period of deflation and depression lies ahead, then a best case scenario one might expect is an “L” shaped economic recovery, after stock markets finally reach the elusive bottom. The lethal “credit crunch,” engineered by the top-tier US-banks, has led to the massive destruction of 2.6-million US-jobs, which in turn, is fueling a downward spiral, where unemployment depresses consumer spending, retail sales, and business investment, which in turn, lead to further layoffs.

The US-economy has little chance of a sustained recovery unless President Barack Obama purges the management of the elite banking cartel that has brought this great calamity upon millions of innocent American workers. Former Treasury chief Henry Paulson handed out $200-billion of taxpayer money to the big-banks, with no strings attached, and no stipulations to increase lending to the private sector.

Banks have also raised $115-billion by selling FDIC-guaranteed bonds since Nov 26 th , enabling them to rollover their debts coming due at super-low rates, while leaving the rest of corporate America high and dry, and worried about defaulting on their bonds, in the event of an economic depression. In order to preserve precious cash, companies have resorted to slashing capital spending and their payrolls.

Obama will have a “strong message for the bankers,” adviser David Axelrod said Jan 19 th . “We want to see credit flowing again. We don't want them to sit on any money that they get from taxpayers,” he warned. Obama's approach is in sharp contrast to that of former Treasury chief Paulson, who argued on Jan 12 th , “The banks need to lend. They can't hoard capital. But I do not believe it is proper or right for politicians or the government to tell banks whom to loan to and how to lend,” highlighting Paulson's collusion with the banking elite.

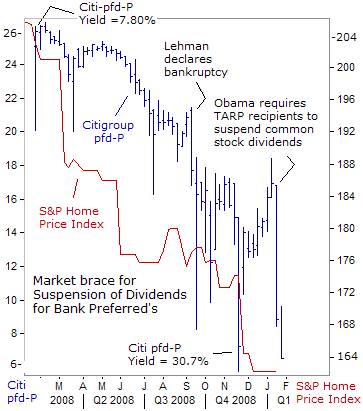

In the first significant crack-down on Wall Street bankers, Obama is ordering the Treasury Dept to limit bank-executives' compensation and dividend payments by institutions that get “exceptional assistance” from the financial rescue fund, said Larry Summers, White House chief economist on Jan 13 th . “Until taxpayer money is paid back, ban dividend payments beyond de-minimis amounts, and put limits on stock buybacks and the acquisition of already financially strong companies.”

Fears that TARP recipients would be forced limit their common stock payouts to 1-penny per share rattled a jittery banking sector. The common stock dividends, if fully paid by US-banks at previous levels, would channel $25-billion to shareholders this year. Taxpayers have been told the bail-out money is necessary to rebuild bank capital, yet a significant portion of the money ended-up in shareholders' pockets, and not to plug-up large holes on banks' balance sheets. Moreover, given their large equity stakes, the directors of the top elite banks would be the beneficiaries of $250 million in common stock dividends.

Fears that Citigroup would be forced to slash its dividend payments sent its preferred series-P share plunging from $18 at the start of the year, to $6.60 today, to yield 30.7-percent. US-home prices have tumbled 23% from their peak, and most likely, the banking crisis won't end, until home prices stop falling. Banks might be holding back as much as 70% of their repossessed homes from listings, in a bid to delay absorbing further losses on their balance sheets.

London Tightens Noose around UK Banking Cartel

The spread of the crisis from the financial sector to the broader global economy is boomeranging on the tight-fisted banks, undermining their investments beyond sub-prime mortgages, to credit card debt, auto loans, commercial real estate and other assets, as unemployment surges and consumers and businesses default on their debt. This, in turn, is rapidly eroding confidence in the solvency of major financial institutions, and fueling a collapse of their share prices.

Despite £500 billion pledged for a bank rescue package in October, the British banking cartel is still not lending at normal levels, and deepening the worst recession since World War II. Seeking to break the stranglehold of the big-4 British banks, PM Gordon Brown's government says it will only insure banks against default on their toxic loans, in exchange for legally binding commitments to make credit more freely available to British businesses and home buyers.

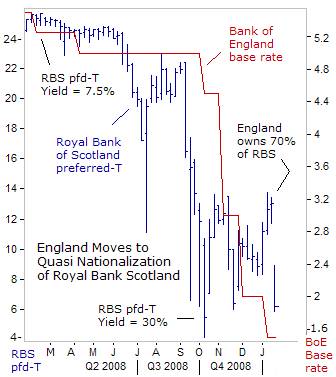

Brown has moved towards the quasi-nationalization of the Royal Bank of Scotland , by converting the government's preference shares into ordinary shares, and increasing the stake in RBS to 70-percent. The government takeover became necessary, after RBS estimated its full-year losses near £28 billion ($41.3 billion), the biggest by far, of any British corporation. This includes a £20 billion write-down of its purchase of Dutch bank ABN Amro and US bank Capital One.

Now, after RBS's shares crashed to 23.1-pence in London trading, it's become an all-but-worthless penny-stock. The incompetent bunglers who drove the bank to ruin have been ousted and future lending will subject to new government guidelines.

RBS's preferred share, series-T, traded in New York , lost half of its value on January 20 th , plunging to $6.60 to yield just under 30-percent, as traders braced for a reduction in dividend payouts. The credit default swap rate on RBS bonds were 30-basis points wider at around 150-basis points, which means investors are paying $150,000 a year to insure against default on $10-million worth of RBS bonds.

While there is a strong moral argument against using taxpayer money to rescue bond holders of troubled banks, the alternative – a default by mammoth global banks, risks a replay of the Lehman Brothers meltdown, but with ten times the firepower, igniting the nuclear $32-trillion credit default swap market, and in a chain reaction, risking another stock market rout of horrific proportions.

RBS's 6.375% note due in 2011 was little changed, in active OTC trading near 100-cents on the dollar, following the UK-government's takeover, despite the meltdown in the bank's common and preferred shares. Bondholders are confident that RBS won't be forced to default on its debt, and that the UK 's bailout package will fall short of full nationalization, although with lots of strings attached.

As part of the second rescue package, to prevent the UK-economy from spiraling into a depression, PM Gordon Brown has been instructed the Bank of England to begin purchasing £50-billion of corporate bonds, and other assets starting on Feb 2 nd , to combat deflation and unblock frozen credit markets. The top-350 UK-companies are scheduled to refinance £210 billion of loans over the next five years.

Initially, the BoE's purchases would be sterilized, with the sale of British gilts. But the latest banking bailout scheme is expected to dig Britain deeper into debt, which could make taxpayers liable for up to an extra £350 billion. When necessary, the BoE has been authorized by the Treasury to begin monetizing the debt, or printing money in order to buy the new supply of gilts.

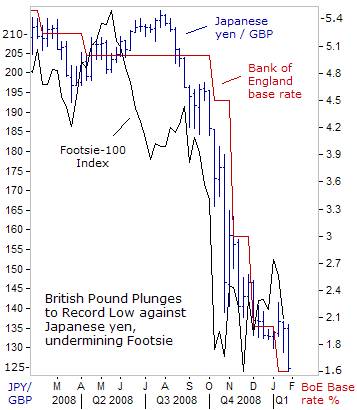

Sterling plunged deeper into a black hole on the foreign exchange markets this week, as traders anticipate a further reduction in the BoE's base rate, possibly to near zero-percent, and an explosive surge in the UK's M4 money supply, which is already expanding at a 16.4% annualized clip. The BoE has slashed it base rate by 350-basis points since October to a record low of 1.50%, pulling out all the stops to stop the slide in the UK-housing and stock markets.

Yet the BoE's rapid-fire rate cuts have back-fired on the central bank, by crushing the value of the British ounce to 124-yen, and all-time low, which in turn, has fueled the unwinding of “yen-carry” trades, and the dumping of UK-listed shares, by powerful Japanese speculators. There is a real danger in the devaluation in sterling becoming a full-blown crisis, and a headache for gilt holders.

Roughly £484-billion off the value was wiped-off of Britain 's top-100 companies in 2008, and UK home prices fell an average 18.9%, the largest in a calendar year, reducing the average home value to £159,896. Furthermore, the big-4 British banks have a combined loan book of more than £6 trillion, more than four times Britain 's annual GDP of £1.3 trillion, and a collapse of this sector, can deal a punishing blow to the broader economy. Combined with a sharp slide in global commodities, a view of a deflationary depression in Great Britain has emerged.

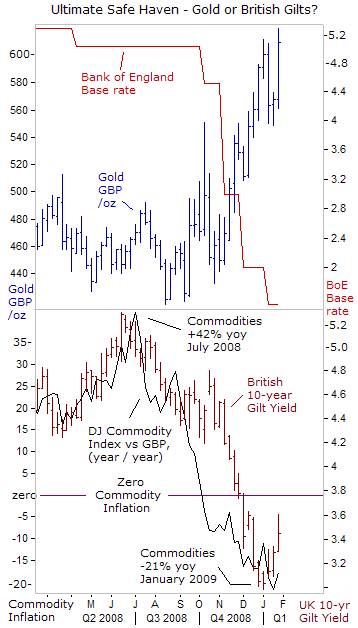

The speculator's first instinct was to jump into British gilts, guaranteed by the BoE's printing press, as a “safe-haven” from the global meltdown storm. Mirroring the sharp slide in base metals, crude oil, and grain markets, yields on the UK 's 10-year gilt plummeted from as high as 5.20% in July to a record low of 3-percent in December. Yet counter-intuitively, one is surprised to learn, that the best performing asset in times of a deflationary depression was the ultimate hard currency, - Gold, perceived as a hedge against inflation, and safe-haven in times of turmoil.

London gold appreciated to all-time highs as the British-ounce lost its purchasing power against the Euro, Japanese-yen, and US-dollar. Prior to the second rescue package for UK-banks, gilt issuance was expected at 146.4-billion pounds ($222-billion) this year. But now, there is no ceiling on government borrowing, with sterling under heavy speculative attack, dealing the gilt market its first significant set-back in four-months, and lifting 10-year yields to as high as 3.60% this week.

London gold is perched above 600-pounds per ounce, while UK banking shares have been bludgeoned amidst a mass flight from the sector, on fears that RBS and other banks, such as Barclays, could find themselves controlled by the state. If the BoE is successful at some point, under the QE framework in reviving inflation in the UK-economy, gilts would continue to lose purchasing power to the yellow metal.

Japan's Keidanren requests Increase in Yen Supply

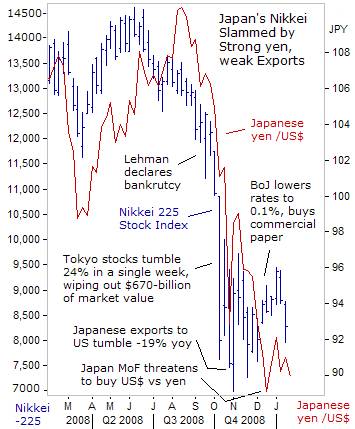

Until recently, Japan 's economy was relatively immune from the turbulence in credit markets. But the picture changed dramatically after the collapse of Lehman Brothers. Both exports and industrial production have collapsed, and the dire situation is expected to persist over the next several quarters. “This recession is a synchronized recession so I don't think the trajectory of the Japanese economy is much different from the rest of the world,” said BoJ chief Masaaki Shirakawa on Dec 14 th .

Despite claims that Japan was well positioned to weather the crisis, the world's second largest economy is rapidly being dragged into the financial and economic tsunami sweeping the globe. Japan 's stock market has been rattled by extraordinary volatility, hitting a 26-year low, and tumbling by a record 42% last year. Japan is heavily dependent on exports, particularly to China , Europe, and the US , where the economies are sliding into a depression or major slowdown.

A major factor undermining Japanese exports is the strength of the yen against all major currencies. In the past three months, the yen has appreciated 19% against the dollar, 32% against the euro and 35% against the British pound. A significant factor in the rise of the yen is the un-raveling of the “yen-carry” trade, involving massive investments in global stock markets, estimated at $1.5-trillion to $6-trillion in size. The trade was a favorite of hedge funds and speculators when stock markets were climbing, but now hastily stampeding out of risk for the safety of cash.

Over the past two decades, Japan 's major banks worked hard to purge their balance sheets of huge quantities of bad debt. They also had little exposure to the US sub-prime crisis. But the collapse of the Tokyo stock market has opened up the first cracks in Japan 's banking system, which previously appeared to be rock-solid. Analysts believe that a drop in the Nikkei below 10,000 points would trigger stock losses affecting the Tier-2 capital of Japan 's mega-banks. The sharp fall below 8,000 could impact the more critical Tier-1 capital reserves.

The dip below 8,000 triggered a political panic in Tokyo , prompting the authorities to introduce a series of emergency measures aimed at shoring-up the stock market before the carnage unleashes a domino collapse of the nation's weaker banks. “The fact is, every day, I am looking at market developments with a sense of alarm and urgency,” said Japanese Finance Minister Shoichi Nakagawa on Dec 29 th .

Japan has approved a record 88.5-trillion yen ($980-billion) budget for the year beginning April 1 st , and new debt issuance will hit 38.1-trillion yen ($425-billion). That would lift Japan 's outstanding public debt to about 785-trillion yen ($8.72- trillion) by the end of next March, or roughly 190% of the nation's gross domestic product, the highest among major industrialized nations.

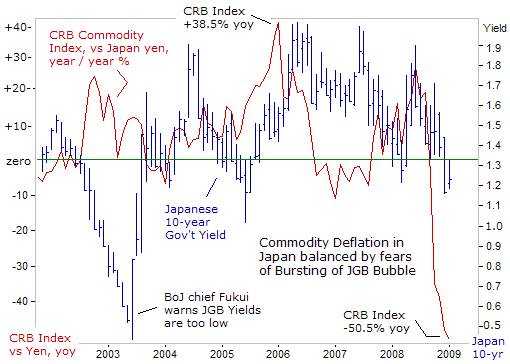

Yet despite the highest debt to GDP ratio in the world, Japan 's 10-year bond yield is hovering near 1.20%, its lowest levels in nearly four-years, linked to the collapse in commodity prices and the strength of the yen. The CRB's Commodity Index, when measured in yen, is 50% lower than a year ago, portending a serious bout of deflation for Japan 's economy in the months ahead.

Yet JGB traders appear skeptical about pushing 10-year yields below 1.20%, mindful of the bursting of the JGB bubble in 2003, when yields tripled from a record low of 0.50%, to as high as 1.60% within three months, and leading to huge losses. On Jan 21 st , Japan 's biggest business lobby, the Nippon Keidanren, called on the BoJ to intervene in the foreign exchange market to weaken the yen, and buy assets such as corporate bonds and stocks to boost the local economy.

Japanese investors seeking higher yields in foreign bond markets, such as in Australia and New Zealand have been brutalized in recent months, with the Aussie dollar and NZ kiwi losing roughly 45% of their value against the yen, to their lowest levels this decade. Yield hungry Japanese investors might have been better off, staying put in the abysmally low yielding JGB's, while avoiding huge losses in the foreign currency and global stock markets. Such is the dilemma for today's investor, trying to navigate through the stormy seas of a treacherous banking crisis.

This article is just the Tip of the Iceberg of what's available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.