Why The Aggregator Bank Will Fail

Politics / Credit Crisis Bailouts Jan 29, 2009 - 05:14 PM GMTBy: Submissions

The beauty of capitalism is that the system lets the weak perish and the strong thrive. This is the main reason why the system has worked so well since its inception. Wall Street is a cutthroat place - one of the few places in the civilized world where human beings allow pure unadulterated Darwinism to work. But how can a capitalist system function properly if we are propping up insolvent banks and rewarding those who made the wrong decisions? Many people like to associate nationalization with socialism, but I see it differently. Nationalizing banks is just controlled Darwinism. It's a way of exterminating the dead banks in the least harmful way.

The beauty of capitalism is that the system lets the weak perish and the strong thrive. This is the main reason why the system has worked so well since its inception. Wall Street is a cutthroat place - one of the few places in the civilized world where human beings allow pure unadulterated Darwinism to work. But how can a capitalist system function properly if we are propping up insolvent banks and rewarding those who made the wrong decisions? Many people like to associate nationalization with socialism, but I see it differently. Nationalizing banks is just controlled Darwinism. It's a way of exterminating the dead banks in the least harmful way.

"Everything works much better when wrong decisions are punished and good decisions make you rich."- Anna Schwartz

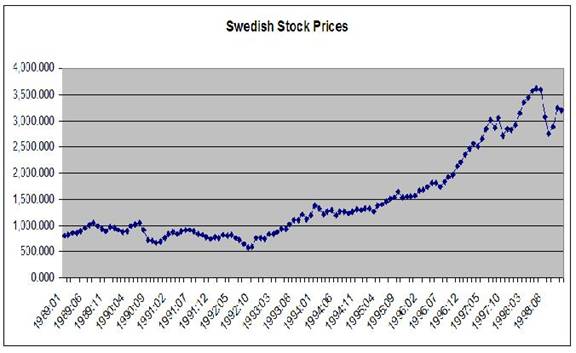

This "aggregator bank," as the early details describe, appears to be hinged on helping the zombie banks survive. This is, in essence, what Japan did. I have maintained since October, that some sort of Swedish approach would be the best approach ( http://pragcap.com/whats-wrong-with-a-swedish-model ). Sweden essentially performed triage on the largest banks in Sweden. If the bank needed government assistance they were nationalized & the equity was wiped out. Sweden did this with minimal moral hazard because they did not attempt to negotiate asset prices as the U.S. government plans to do. If you needed government funding to survive there was no price negotiation. In addition, they made sure that a nationalized bank did not become a government-run bank. A separate authority managed the nationalized banks. Within a few years Sweden's GDP was growing at a steady 3%+ clip and their market rebounded swiftly:

Further complicating this “aggregator bank” idea is future economic growth. This plan to prop up the walking dead might work if the economy rebounds sharply in the coming months. But what if it doesn't? What if things get worse? What if things get a lot worse? Sweden considered the option to defer losses, write-down assets, provide capital and hang on for an eventual rebound (sound familiar?), but they opted against it. If the global economy rebounds sharply, banks will likely start lending sooner, consumers will start borrowing and spending sooner, and the train will get back on the tracks. However, if the economy remains very weak over the coming 18 months it's increasingly likely that these policy actions of rewarding the ignorant will only prolong the problems. Deflationary psychology will set-in and we'll be dealing with the same problems 6 months from now.

The main issue with the "aggregator bank" idea is that it does not solve the problems at hand. The crux of this problem is not liquidity. The two problems behind this crisis are: 1. a lack of faith between banks and consumers & 2. the de-leveraging of everything in the system. I.e., consumers have too much debt and banks are not transparent and therefore not trustworthy. This "aggregator bank" plan solves neither of the above problems. It doesn't guarantee Citibank's (ticker: C) or Bank of America's (ticker: BAC) viability and it doesn't force consumers to borrow.

The lack of leadership in this critical time has been somewhat embarrassing to say the least. Someone with thick skin needs to pick up Paulson's bazooka and start firing it right into the heart of the zombie banks. This crisis is too big and the times are too dire. This reaction of rewarding those who made bad decisions needs to end. Systematic and aggressive triage needs to take place. Equity holders in these bad banks need to be wiped out. You don't negotiate with a dead man just as you don't negotiate with an insolvent institution. We need to eliminate some of these banks from the system and back the strong banks.

Until we do that there will be this underlying uncertainty in the system. If it results in some short-term pain in the markets, so be it. The patient has suffered a massive heart attack and we're trying to perform 5 mediocre operations rather than one superb operation. I say we bite the bullet and perform the superb operation and then get on with the long and inevitable recuperation. We know the problems at hand and we know the cure, but no one has the guts to make the tough decisions. The Swedish Riksbank made the tough decision. Bill Seidman made the tough decision with the RTC. Paulson's bazooka is lying on the ground, but I'm not sure if Barack Obama is strong enough to pick it up and pull the trigger.

Online at www.pragcap.com

Tickers related: DIA, QQQQ, SPY, C, BAC

No positions.

The Pragmatic Capitalist

© 2009 Copyright The Pragmatic Capitalist - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.