Why Silver is Set for a Great Year

Commodities / Gold & Silver 2009 Feb 05, 2009 - 12:42 PM GMT Sean Brodrick writes: Boy, I wish I had a time machine. I wouldn't have to go far — just back a few months to buy silver at under $9 an ounce (a 38% discount to recent prices) and gold at under $715 (a 27% discount to recent prices).

Sean Brodrick writes: Boy, I wish I had a time machine. I wouldn't have to go far — just back a few months to buy silver at under $9 an ounce (a 38% discount to recent prices) and gold at under $715 (a 27% discount to recent prices).

Well, I do have the next best thing, though — a list of undervalued gold and silver miners that are trading at dirt-cheap valuations to their gold reserves.

These miners are leveraged to the price of precious metals. They've been beaten down, and they could rebound hard. Why?

|

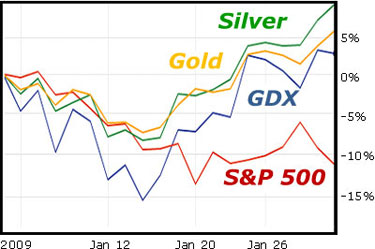

- Gold and silver have outperformed other investments by a wide margin recently. In January, we saw gold climb nearly 5% and silver jump 11%.

- The GDX, an ETF that tracks a basket of precious metals miners, managed a gain of 3%. That's pretty darned good considering that the S&P 500 tumbled nearly 12% during the month!

And yet there are miners that are trading as if gold is priced around $500 an ounce and silver is at $8.

What gives?

It's simple: Investors who are frightened by the global credit crunch have stampeded out of the mining sector. And that means a lot of undervalued stocks have been dumped on the ground and trampled underfoot.

I think those investors will be coming back … a move that could send precious metals stocks soaring! That's because unlike many other parts of the economy, demand for precious metals seems to be increasing in these turbulent times. And many of the companies that mine them are trading at bargain prices.

I talked to a lot of CEOs at the recent Vancouver Resource Investment Conference, and I heard one tale of hardship after another. Over the summer, their share prices were pummeled, and the prices they received for the gold and silver they mined went down even as their costs went up.

But I came away thinking that the crunch they experienced this past summer may have been the best thing that could happen to them … and now …

It Opens the Door to Extraordinary Profit Potential for Nimble Investors …

Let me give you an example using a miner that's like the kind that appear in a special report I sent to my Red-Hot Global Small-Caps subscribers last week …

|

| Great Panther had high hopes in May. But then the price of silver cratered — dropping from over $18 in May to under $9 in October. Ouch! |

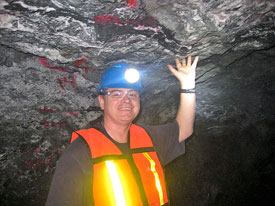

Great Panther is a Canada-based miner working in the historic silver mines of Guanajuato, Mexico. It also has a silver-gold-lead-zinc mine, Topia, in Mexico. I visited their Guanajuato project last May, and Bob Archer, Great Panther's CEO, showed me around.

Great Panther had high hopes in May. But then the price of silver cratered — dropping from over $18 in May to under $9 in October. Ouch!

At the same time, the price that Great Panther received for zinc and lead — also cratered. Yet the price it was charged by the smelter went up 150%. To make matters worse, electricity costs went up by 50% at Guanajuato.

Similar problems smacked silver miners all across Mexico. “It was kind of a perfect storm,” Bob told me last week. “It killed a number of smaller operations.”

This convergence of factors pushed Great Panther into crisis mode. Bob and his team took a long, hard look at the Topia Mine. There were operations there that didn't make sense with $9 silver.

“We looked at each of the working areas and asked: ‘Is it making money right now?'” Bob recalls. “If the answer was ‘no,' we shut it down.” In all, 10 of 14 mining projects at Topia were temporarily shut down.

Management passed some of the pain down the line by renegotiating mining contracts. Cut-off grades were raised, such that Great Panther now mines higher-grade material. All of this helped lower their costs.

At Guanajuato, Great Panther went to a flexible schedule that allowed it to run the plant during days when electricity was cheaper, saving the company $20,000 a month. Bob's team was also able to get better terms from another smelter.

All the pain paid off. And Great Panther was able to slash its costs by close to 30% over a three-month period. End result: Bob and his team turned things around.

“We went from 14 to four mines at Topia, and now we're back up to 12,” Bob said. Thanks to the higher grades being mined, Bob expects the same production of silver from Topia in 2009 as in 2008.

The company's production in 2008 was a record 1.81 million ounces of silver equivalent (1.21 million ounces of silver, 6,300 ounces of gold, 876 metric tonnes of lead and 1,074 metric tonnes of zinc) which is 35% higher than 2007.

A combination of slashing costs and rising silver prices has made both of Great Panther's mines profitable again. And the company should go from a cash cost of $11.30 per ounce last year to under $8 an ounce this year.

Great Panther also recently did a private placement to raise over $1 million in cash. It's not alone — a lot of gold and silver miners, big and small, have raised money recently either through financing deals or share issuance.

Indeed, precious metals miners have shown that they are one group that is still able to raise money even when banks are sitting on their hands for most borrowers.

Bob admits to losing a lot of sleep when the price of silver cratered — it wasn't just his company at stake, but the families of all his workers depended on him finding a way to make it viable. Now, he's feeling much better. “We're going to come out of this a much stronger and more efficient company. A year or two down the road, we may look at what we experienced as one of the best things that ever happened to us.”

|

| Great Panther keeps finding new veins to add to its mineral resources. |

Here Are Some Other Things I Like About Great Panther …

1) Great Panther keeps adding to its resource. Last month, it announced it discovered new, high-grade zones of mineralization along existing veins in the Topia Mine.

2) As for reserves and resources, Great Panther has the following at Topia:

- Silver — 2.54 million ounces in the measured and indicated category and 10.5 million in the inferred category.

- Gold — 4,600 ounces measured and indicated, 22,482 inferred.

- Lead — 17.7 million pounds measured and indicated, 96 million pounds inferred.

- Zinc — 16.3 million pounds measured and indicated, 149 million pounds inferred.

Meanwhile, the company hasn't yet submitted a report on the resource at Guanajuato. A non-compliant estimate was prepared for the previous mine operators, establishing a resource of approximately 24 million ounces of silver equivalent. Though non-compliant, Great Panther considers the estimate to be relevant, and is using it as a guideline in conducting its own work to delineate a new resource. However, there is no guarantee that such a resource will be delineated.

“We will likely develop enough for a five year mine life and each year, just replace what we mine,” Bob told me. “This is an industry standard for underground mining. Given the 400-year history at Guanajuato and the fact we have traced the ore to 600 meters depth, I am not concerned about running out of ore any time soon.”

3) Great Panther's known ounces are probably just the tip of the iceberg, especially when you take into account it has other properties, like its silver-rich Mapimi Project with a resource base of 28.6 million ounces. And it probably has the potential for more than 100 million ounces of silver equivalent, spread across its various projects.

4) Great Panther has 86.7 million shares outstanding, or 96 million fully diluted. So it potentially has more than one ounce of silver for every share, and those shares are trading under 40 cents each. Sure, pounds in the ground aren't priced the same as pounds in a vault. But with a potential resource base of more than 100 million ounces, this company's shares shouldn't be this cheap.

5) Its management has shown it has the ability to adapt to bad times, and probably come out even stronger.

6) If base metals prices bounce back next year — which could certainly happen — lead and zinc credits could drive costs much lower and light a fire under its stock. And Great Panther has extra capacity it is not using but will bring online when silver prices go higher. I think it could probably double its production over a two-year time period.

Caution Flags …

There are caution flags on this stock. It trades under a buck. It has average share volume of 307,000 shares per day — more than many of its peers, but a lot less than the large-cap companies I usually write about in Money and Markets . So, its share price could be very volatile. And Great Panther isn't one of the cheapest-cost miners around. Furthermore, if silver prices go lower again, this stock and other silver miners could be negatively impacted.

That said, Great Panther is profitable, it is adding to its resource and it is a very well-run company.

Is Silver on the Launch Pad?

Now for the best part — I think silver could outperform gold this year.

It's easy to see why gold is outperforming. The global financial system is in crisis. And gold has a superior reputation as an insurance policy compared to silver. So, gold is holding up very well. It's only 12% off its high of last year, while silver is down about 42% from its high.

But you saw the chart of how silver has outperformed gold in the past month. That's because silver acts like gold on steroids: It falls further and faster than gold, but that means it can rebound even faster.

And silver is undervalued compared to gold …

In the first half of 2008 an ounce of gold bought between 50 and 55 ounces of silver. In October and November this ratio moved out to 84 silver ounces to one gold ounce and has now moved back to 72. I think this ratio will return to the more historic 50-55 level.

Now, let's also factor in how 80% of silver is mined as a byproduct of other metals mining. Many base-metal mines are being shut down or production cut back — tin, copper, zinc, and so on. This should reduce the supply of newly mined silver in 2009, even as investor demand is ramping up.

Sure, silver is an industrial metal as well as a base metal, so a global recession is reducing demand for silver in industrial applications. But if investor demand heats up for silver the way it's heated up for gold, it could overwhelm any drop in industrial demand.

I think gold should have a great year. I also think silver could have an even better one. And that should be a good environment for stocks like Great Panther.

Join Me in Phoenix

I'll be attending and addressing the Cambridge House Resource Investment Conference and Silver Summit in Phoenix, Arizona on February 21 and 22. It should be educational, interesting and fun. If you're going to attend, I have a gift for you — a special code that should get you a discount on the price of your ticket.

It would cost you $25 at the door to attend this conference, but you can attend for free by signing up in advance with the code: PHX09SB. You can sign up for the conference by pointing your web browser here: http://www.cambridgehouse.ca/phoenix.html .

Yours for trading profits,

Sean

P.S. If you like what you're reading here, check out my Red Hot Energy and Gold blog at http://blogs.moneyandmarkets.com/red-hot-energy-and-gold/

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.