Consumers A Paycheck Away From Ruin

Economics / Recession 2008 - 2010 Mar 20, 2009 - 03:50 AM GMTBy: Mike_Shedlock

New surveys show that Consumers are Just a Paycheck or Two Away From Ruin .

New surveys show that Consumers are Just a Paycheck or Two Away From Ruin .

The results of a bevy of surveys found a growing number of consumers are only a couple paychecks away from a household collapse even as many scramble to shore up savings. Rainy-day funds appear to be a distant memory as households burn cash to cover food and energy bills as well as mortgage and car payments.

A large number of households say that even one missed paycheck would spell financial ruin. And even in households that remain well off, the surveys show a festering fear that financial problems are lurking.

"This is flashing so bright red," said Paul Ballew, senior vice president of Nationwide Insurance Co. "Roughly 60% of the population was ill-prepared (financially) before the meltdown."

A MetLife study released last week found that 50% of Americans said they have only a one-month cushion -- roughly two paychecks -- or less before they would be unable to fully meet their financial obligations if they were to lose their jobs. More disturbing is that 28% said they could not make ends meet for longer than two weeks without their jobs.

And it's not just low-income earners who would find themselves financially challenged. Twenty-nine percent of those making $100,000 or more a year said they would have trouble paying the bills after more than a month of unemployment.

Long-term retrenchment

America's Research Group found that nearly 57% of the consumers it polled said they would spend less this year while virtually no one plans to spend more.

But this is not just a one-year thing, according to consumers surveyed by BIGresearch. Nearly 91% said they see this crisis bearing down on their spending decisions -- in effect, their lifestyles -- over the next five years.

Fifty-five percent said they will think carefully before they make a purchase and 51% said they expect to be more price-conscious when buying clothing and food.

"American consumers are hunkered down, bracing for a depression," said Britt Beemer, chief executive of America's Research Group. "The dramatic drops in shopping levels have no match in our database in the last 30 years."

Long-Term Retrenchment

This is a secular shift in attitudes, not a cyclical one. Spending is not returning to levels we saw in recent years. I am still expecting 500,000 or more jobs lost in each of the next two months. Some months of 750,000 losses or more are not out of the question.

Weekly Unemployment Claims Rise

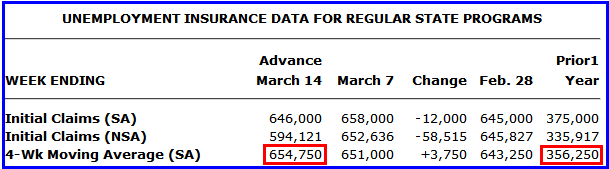

Please consider the latest Weekly Claims Report .

The four week moving average keeps ticking up. A year ago it was a miserable 356K claims. It is nearly double that now. If the survey is correct, half of those face ruin within a month or two.

Bear in mind, it's not just the US that's in trouble.

UK Unemployment Rises Most Since 1971

Inquiring minds are reading British Unemployment Rises Most Since at Least 1971 .

More Britons joined the jobless rolls than at any time since 1971 as the recession destroyed work in factories, building sites and banks.

Claims for jobless benefits rose 138,400 in February to 1.39 million, the Office for National Statistics said today. That's more than the population of Cambridge and compares with the increase of 84,800 forecast by a Bloomberg survey of 20 economists. A broader unemployment measure climbed above 2 million in January for the first time since 1997.

Prime Minister Gordon Brown, who must hold an election by June next year, said the figures were a matter of personal regret. “I don't regard unemployment as a statistic,” Brown said in Parliament in London today after the jobless figures. “This is a matter of personal regret for me and for the entire government.”

How many in the UK are one paycheck from ruin?

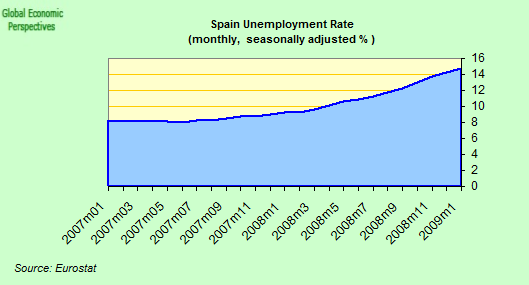

Spain's Unemployment Might Hit 20%

The Fistful of Euros blog has a number of interesting graphs to go along with the article Spain's Unemployment Continues To Climb As The Economy Contracts .

Spanish unemployment shot up again in February to 3.48 million in February, whilst consumer confidence took another knock amidst fears Spain's jobless would now hit 4 million as early this summer, and maybe 4.5 million, or nearly 20% of the workforce.

The latest unemployment data show that the number of unemployment benefit claimants rose by 154,058 in February, down from last month's increase of 198,838, but still nearly four times the 40,000 increase in Germany which has almost twice the population, and where the economy is apparently contracting at an even more rapid rate.

Those interested in Spain can click on the above link to find a nice collection of 20 charts on various things.

How many in Spain are one paycheck from ruin?

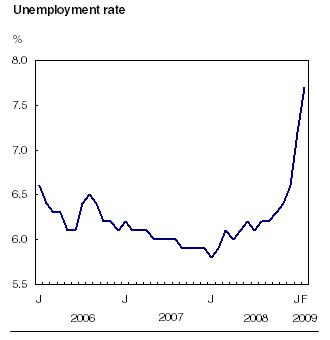

Canadian Unemployment Soars

Please consider the latest release from the Canada Labour Force Survey .

Employment fell for the fourth consecutive month in February (-83,000), bringing total losses since the peak of last October to 295,000 (-1.7%). The February employment decrease pushed the unemployment rate up 0.5 percentage points to 7.7%.

All of the employment losses in February were in full-time (-111,000), while part-time employment edged up slightly. This continues the downward trend in full-time employment observed since October. Part-time employment has shown only a marginal increase over the same period.

In February, the largest decline in employment occurred in Ontario (-35,000), followed by Alberta (-24,000) and Quebec (-18,000).

Men aged 25 to 54 were particularly hard hit by February's employment decline (-66,000). Since the start of the labour market downturn, employment among core-age men has fallen by 170,000 (-2.7%).

Employment among 15 to 24 year-olds also continued to trend down in February (-29,000). This latest decline brings total losses since October to 104,000 (-4.0%), the fastest rate of decline of all age groups. The unemployment rate for youths was 14.2% in February, up 2.0 percentage points from last October.

A decrease of 43,000 in construction accounted for over half of the employment decline in February. There were also losses in professional, scientific and technical services; educational services; and natural resources. The only industries with gains in February were manufacturing and agriculture.

How many in Canada are one paycheck from ruin?

I think you get the idea. No matter where you go in this world, increasing numbers of people are one or two paychecks from ruin.

Central Banks In Panic Mode

Barrack Obama, Gordon Brown, Ben Bernanke, Alistair Darling, and misguided politicians everywhere are all attempting to stimulate lending when stimulated lending is what got us into the mess.

The sole exception is John Key, New Zealand's prime minister who courageously and correctly says "You Can't Spend Your Way Out of the Crisis." For more on John Key's stance please see In Search Of Common Sense .

Hyperinflation?

No, this madness is nowhere close to causing hyperinflation. You do not get hyperinflation with this much consumer and corporate debt when unemployment is soaring globally, overcapacity is rampant, and wages are falling. Please see Fiat World Mathematical Model for more details.

Global Debt Destruction Continues

Yesterday, Kevin Depew on Minyanville offered his thoughts on yet another Options Expiration Bernanke Bombshell. Let's tune in.

Just wanted to drop in a quick note about the Fed decision to purchase Treasuries. It is hoped by the Fed and the market, as evidenced by the jump in stocks, that the decision to purchase Treasuries "help improve conditions in private credit markets." But it won't. What it has done is punished government bond bears and injected some additional volatility into equities ahead of expiration. At the end of the day, all that is really taking place is the issuance of more debt to make up for the debt that is being transferred away from people who don't want it anymore.

This will not solve the key issues driving the deflationary debt unwind; a global reduction in time preferences and the global destruction of debt.

Bingo. Time preferences have changed (people are saving not spending). Furthermore, rising unemployment everywhere suggests that borrowed debts cannot and will not be paid back. This debt destruction still exceeds printing, and printing still exceeds lending.

All that Bernanke specifically (and central bankers in general) are likely to accomplish is to delay the destruction of debt at taxpayer expense, and thus delay the recovery. There is no Keynesian free lunch, and no hyperinflation on the horizon either.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.