Obamanomics Reflating the U.S. Economy Out of Depression

Economics / Economic Stimulus May 29, 2009 - 03:55 AM GMTBy: Ty_Andros

Fingers of Instability, Part II:

Fingers of Instability, Part II:

The Definition of Depression

Obamanomics

The Bomb, er…Bond Market

The Dollar

As the GREAT REFLATION kicks into a higher gear, we are learning the TRUE power of G7 Central Bank printing presses; and the fact that it is awash on a sea of liquidity, the size of which NO ONE actually knows, is making analysis very challenging. Those green shoots about which the media has been talking are nothing more than US Dollars, Japanese Yen, British Pounds, Swiss Francs and now Euros being tossed about and printed like confetti. This newsletter has previously projected the balance sheet of the Federal Reserve would climb from its current level of approximately $2 Trillion plus to over $10 Trillion.

It now appears it has already reached this level and only God knows how much the other G7 central banks have off balance sheet in addition to disclosed quantitative easing. On May 5th, the congressional committee charged with overseeing the financial system was interviewing the Inspector General of the Federal Reserve. Based on a report on Bloomberg, a congressman asked directly if the Federal Reserve was running an off balance sheet operation of approximately $9 Trillion since the banking crisis began 8 months ago. The silence was deafening and was actually the answer. In order to not perjure herself, the Inspector General had only one option: to REMAIN SILENT, as seen in this YouTube video of the hearing, entitled “Is Anyone Minding the Store at the Federal Reserve?”: http://www.youtube.com/watch?v=PXlxBeAvsB8&feature=player_embedded .

Now we know why tangibles, commodities, stocks and everything but overleveraged financial assets are skyrocketing. MONEYPRINTING has entered the TWILIGHT zone and nominal rallies mask the true REAL losses. Everything but PAPER-based assets are repricing to reflect the lower purchasing power of the currency in which they are denominated. Most newly printed money goes into the markets first. The G7 central banks have gone where no man has gone before in terms of the size of the money creation, and the consequences of their actions are predictable: HYPERINFLATION.

So this printed paper is seeking shelter from future episodes of this story which are yet to be written. Accordingly, paper-based assets are breaking down to reflect their diminished value as the bomb, er… bond markets (most tangible markets will have a bid from the private sectors, and the G7 central banks will become the bidders of last resort for SOVEREIGNS) have done a pirouette and head lower (higher yield).

Readers of this newsletter KNOW I have always believed the G7 can PRINT higher GDP in nominal terms, and we shall soon see this. The contempt for common sense in this reflation is astounding in its enormity, even if real GDP is plummeting -- as almost all economic reports are now adjusted to MASK the true nature of the implosion in activity and the rising of inflation. EVERY economic report is becoming more and more a fantasy. The recent monthly employment report without government hiring would have been over 610,000 jobs lost, and that was with the BIGGEST POSITIVE seasonal adjustment ever made for the month of April. Unemployment is NOT getting better, and is set to accelerate to the downside.

I have a question for you. Have any of your day-to-day expenses for food, energy (after the initial plunge in the fall of 2008), electricity, rent, healthcare or anything you actually consume regularly GONE DOWN? Look around you and think about this question carefully. I believe the answer is NO; I know it is for me and for everyone I have asked. The only deflation is in your LONG-only investments and those are now afloat on a sea of printed MONEY. Inflation is on the rise and in an expanding economy is TOLERABLE, but in a contracting economy with falling incomes, it is a CALAMITY.

The Definition of Depression

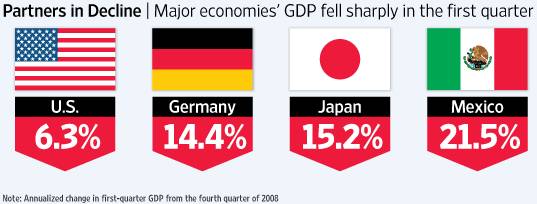

Regardless of what the mainstream media and G7 public servants wish you to believe, the economies of the developed world and much of the emerging world are in a DEPRESSION. What is the definition of a depression? A peak-to-valley fall in Gross Domestic Product (GDP) of over 10%; a GREAT depression is a peak-to-valley fall in GDP of over 25%, and anything less than 10% is a recession. Using these metrics, much of the world is in a depression and headed lower. Let’s take a little tour around the world and see how the different countries stack up:

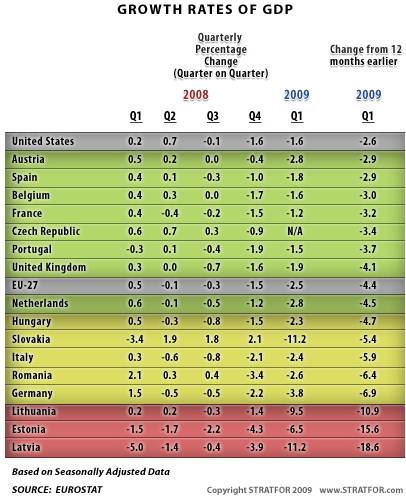

Now let’s take a broader look, courtesy of www.stratfor.com (I urge you to subscribe, I do and it is great):

As you can see, broad declines are underway and it is only a matter of time until they descend into depressions, if they are not already in one. To get to annualized declines just multiply by four. There is no growth in these countries - none, but their borrowing is SKYROCKETING, creating new mountains of unpayable obligations on current and future generations. Additionally, the private sectors are in shock, unable and unwilling to take a risk for fear of government confiscation of any wealth they may create. This decline in incomes spells disaster and the only thing holding it up is the enormous amount of QE (quantitative easing) -- slowing the decline as TRILLIONS of Yen, UK Pounds, Swiss Francs and Euros which are PRINTED OUT OF THIN AIR.

Do not mistake this for capital; it is only an accounting fiction. As purchasing power is sucked out of all the outstanding FIAT currencies and handed to corrupt crony capitalists (AIG, GM, Chrysler, Fannie Mae and Freddie Mac, etc.), corrupt bankers, and OVERPAID AND OVERPENSIONED government employees, the lenders are being slipped devalued Dollars, Pounds, Yen and Euros from the government and from supporters of these corrupt groups. Look no further than the State of California, which will be the first poster child of a defaulting state in the near future. Voters recently STRUCK BACK at irresponsible lawmakers, signaling the coming REVOLT against runaway government growth and spending.

All major municipalities in the United States are functionally bankrupt as well as the states in which they reside. Tax collection and state incomes are off roughly 15 to 20%. Rather than cut budgets and spending increases, they are taxing and feeing anything that moves, putting more nails into the coffins into which their economies are descending. This debacle is being repeated throughout the new EU as well.

In an act of hubris, the US Congress is set to step in and guarantee the borrowing of state and municipal governments since monocline insurers can no longer do so. These governments refuse to do what everyone is doing: CUT SPENDING. And so…

Obamanomics

The Kansas City Star reports (with a straight face):

$100 million upgrade coming to federal building.

Stimulus money to pay for modernization of federal building downtown

More than $100 million in federal stimulus money will be spent on Kansas City’s Richard Bolling Federal Building to modernize its energy system, U.S. Rep. Emanuel Cleaver announced Tuesday.

Construction should begin in about 120 days and will continue through 2014. The federal government expects to save about $45,000 a month with the new energy system. It would take more than 180 years of those savings to pay the cost of the upgrades, but a spokesman for (Rep.) Cleaver said people shouldn’t expect a dollar-for-dollar return on energy conservation investments

The US Rep PROUDLY announced this as some sort of GOOD thing, unable to grasp the disaster this is. BRAIN DEAD. This is what passes for stimulus and good leadership, a few OVERPAID jobs and SUPPLIERS (do I smell earmarks for campaign supporters) which end when the project is finished. FIVE years to COMPLETE the upgrades, that’s probably four years more than it took to originally BUILD the building. Additionally, when interest is added to the $100,000,000 of money that WILL BE BORROWED and has to be PAID back, the ultimate costs will be MANY MULTIPLES of the $100,000,000 when compounding of interest is factored in. This is absurd, immoral, and flat out criminal behavior by our REPRESENTATIVES and the PRESIDENT. Talk about flushing money down a toilet, this is what the administration means when they talk about GOOD PAYING green jobs.

Is there anyone that puts a pencil to these things? Just think about the thousands of other STIMULUS projects just like this one slated throughout the country! These are malignant debt bombs producing very little and we will pay for them forever – they call this stimulus; IT IS DEBT SLAVERY! This is an example of what was in the stimulus bill that NO ONE HAD THE CHANCE TO READ and it is the epitome of consuming more than you produce. It will reduce our standard of living for generations. These are BRAIN DEAD morons lacking in any common sense and who actually have contempt for it. Furthermore, this is how recessions become depressions, and why the bond vigilantes are ON THE MOVE… They will print this money. Let’s PRAY they stop this insanity…

God help us all…

The Bomb, er…Bond Market

Public borrowing is SPIRALING OUT OF CONTROL and with plummeting incomes, the question ‘from where the money will to come’ quickly arises. Western governments face over $12 TRILLION of new debt issuance at RECORD low interest rates (punishing lenders and savers), and they are searching desperately for new patsies to fund their GRAND plans of spending and borrowing their way back to prosperity. How absurd. It has never happened in history and it is NOT going to happen today. The tops are in the G7 long ends of the bond markets. Let’s take a quick peek at three of the biggest bond markets: the US, UK and German 10-Years on monthly charts since the lows at the turn of the century in 2000:

US Ten-Year Notes

As you can see, this chart is solidly on a sell signal! RSI (relative strength) is now poised to fall below neutral at 50 and the slow Stochastics and MACD have already delivered their message of momentum and failing internals, as bearish divergences can be seen. Had the meltdown not occurred in the fall of 2008, a double top would have been seen, with 2003 being the other top. Just last week, the Federal Reserve sought offers for their purchase of $7 Billion worth of US Notes and received $45 Billion worth of offers. Now we know they are going to step off their purchases, as was TELEGRAPHED in the release of the fed minutes.

On Thursday of last week, the credit agencies put Britain on negative credit watch, and Bond king Bill Gross said it was only a matter of time until the US followed. Stocks, Bonds and the Dollar promptly declined in a chorus; a rare occurrence indeed. In a seminal piece of detective work, Gary Dorsche pins the tail on the false and misleading TREASURY’S International Flows data. It APPEARS this data is now being DOCTORED just as much as all the rest of the economic data from the government, exposing government corruption on the amount of QE that is actually taking place. Undoubtedly, these purchases are taking place in the off-balance sheet Federal Reserve operations.

10-Year Gilts

Over $160 Billion of new issues are scheduled for the last week of MAY 2009, and $1 Trillion of new issuance by the fall of 2009.

The 10-Year Gilts are echoing the breakdown in the US Notes, with a broad double top clearly visible. Plummeting RSI and Sell signals in the Stochastics and MACD signal the top is in the UK.

German Bunds

And the German Bunds make it UNANIMOUS. I did these charts over the Memorial Day Weekend and the rout has continued. The G7 central banks and public servants are about to get a BIG DOSE of medicine from the BOND vigilantes, just as Bill Clinton did when he tried to embark on a reckless spending spree. IT’S ONLY THE BEGINNING…

In a fabulous interview with Dallas Federal Reserve president Richard Fisher at www.WSJ.com (I urge you to read it the full interview, it contains so much truth.) In it he outlines the absurd future for the US and its UNPAYABLE OBLIGATIONS. In between politically correct garbage about fighting inflation, he lays out the future quite clearly:

“But he says the longer-term debt, particularly the Treasuries, is making investors nervous. The looming challenge, he says, is to reassure markets that the Fed is not going to be "the handmaiden" to fiscal profligacy. "I think the trick here is to assist the functioning of the private markets without signaling in any way, shape or form that the Federal Reserve will be party to monetizing fiscal largess, deficits or the stimulus program."

![[Richard Fisher]](/images/2009/May/stimlulus-29_image011.jpg)

The very fact that a Fed regional bank president has to raise this issue is not very comforting. It conjures up images of Argentina. And as Mr. Fisher explains, he's not the only one worrying about it. He has just returned from a trip to China, where "senior officials of the Chinese government grill[ed] me about whether or not we are going to monetize the actions of our legislature." He adds, "I must have been asked about that a hundred times in China."

In today’s Financial Times in an editorial entitled “Exploding Debt Threatens America”, Fisher is echoed by John Taylor of The Taylor Rule:

Drawing by Ismael Roldan

Richard Fishers

“I believe the risk posed by this debt is systemic and could do more damage to the economy than the recent financial crisis… Income tax revenues are expected to be about $2,000bn that year, so a permanent 60 per cent across-the-board tax increase would be required to balance the budget. Clearly this will not and should not happen. So how else can debt service payments be brought down as a share of GDP?

Inflation will do it. But how much? To bring the debt-to-GDP ratio down to the same level as at the end of 2008 would take a doubling of prices. That 100 per cent increase would make nominal GDP twice as high and thus cut the debt-to-GDP ratio in half, back to 41 from 82 per cent. A 100 per cent increase in the price level means about 10 per cent inflation for 10 years. But it would not be that smooth – probably more like the great inflation of the late 1960s and 1970s with boom followed by bust and recession every three or four years, and a successively higher inflation rate after each recession.”

There is NO doubt the legislation will be MONETIZED. NEVER IN HISTORY has it NOT BEEN MONETIZED. What investor in their right mind would step in front of these freight trains? Capital losses are guaranteed, rising debt service is set to OVERWHELM government budget deficits and its ability to repay, as well as start in motion monetization on a scale of which no one can conceive, and which is at hand and underway in the G7. The G7 central banks will inevitably become the bidders of last resort. It’s Bombs, er … BONDS away. The rallies in the credit markets are close to their demise; a crash looms. Of course the Chinese are not the only ones thinking these things, and so…

The Dollar

The Dollar has broken down, signaling the next episode of debasement that is about to unfold as the current US Congress and Executive Branch embark on the LEGISLATION of the collapse of the US Dollar and ECONOMY. Currently, 50 cents of every dollar is slated for borrowing to fund the current deficit and the absurd new entitlements, bailouts of BANKRUPT institutions and the energy industry takeover known as CAP and TRADE. Cap and Trade has FAILED miserably in the EU, but no one on Capitol Hill is bothered by this because it is actually the taxman in disguise. And who in the nation’s capitals doesn’t like new moola to spend?

Take a look at a monthly chart of the Dollar since its highs in 2001:

Monthly U.S. Dollar Since 2001

A perfect Fibonacci Retracement from the highs in 2001 with monthly RSI plummeting - but still at a neutral reading, and stochastics and MACD on FRESH sell signals.. The Dollar and the United States are not friendly to capital and it is exiting the US rapidly. In a recent missive from my friend Dennis Gartman (www.thegartmanletter.com I strongly recommend the Gartman letter), he states the obvious, as seen from abroad:

“THE DISDAIN FOR THE DOLLAR CONTINUES UNABATEDLY as it has moved materially lower against every one of the currencies in our price matrix listed here each day, save for the Chinese Renminbi. Further, even there the dollar is only stable; certainly it is not strong. There are any number of reasons for the dollar’s continued pummeling but we shall posit that first and foremost is the growing disdain for the Obama Administration’s abrogation of contracts on nearly all fronts. At the moment, however, the dollar came under, and remains under, material pressure when Mr. William Gross of PIMCO said that it seems but a matter of time until the US loses its AAA credit rating. Once that statement was made by an international investor of the renown of Mr. Gross, all bullish dollar bets were off, and all bearish dollar bets were ramped up.

Simply put, the world of capital sees the decisions coming out of Washington in recent weeks as an attack upon itself. Capital sees the Administration forcing General Motors to fire its executives and wonders when Washington will focus its attention upon foreign capital. Capital sees the decisions to capriciously close hundreds of auto dealerships, without just compensation and at the same time putting the owners of those dealerships in jeopardy and wonders, “When shall Washington turn its attention upon us?” Capital sees the Obama Administration has moving to raise taxes, closing supposed “loopholes,” attacking domestic businesses, and wonders, “When are we next?” Rather than risk the wrath of a left-of-centre regime, capital is fleeing and looking for safer harbors elsewhere around the world. Can it be blamed for doing so? No, it cannot be. Indeed, capital that does not look for safer harbors is capital badly managed.”

Thank you, Dennis. I might add that the backbone of America is made of entrepreneurs and small business. Most of them are living in fear and in a fetal crouch, looking for a hole to climb into and something to cover themselves as a shield from the onslaught from Washington that anyone can see coming. Growth in income comes from a growing PRIVATE sector, NOT growth in government as many public servants believe. NO ONE in the US is starting a new business except crony capitalists who are on the government’s purchasing lists, and then they get the business sent to them through EARMARKS!!!

As Ernest Hemingway once said:

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

Government DOES NOT create income; it takes it from the productive and misallocates it to boondoggles such as green energy (a disaster at least ten times greater than ETHANOL), Cap and Trade (the taxman in disguise), 90% expansion of government in 10 months and UNIVERSAL health care. If you think things are expensive now, wait until you see the printing presses really get rolling. And since there is not enough money in the world to finance the legislation now being enacted, the money WILL BE BORROWED from the FED and printed, or sent to you in NEW TAXES (do you feel like a patriot?) The bill will be sent to you, your children, their children and anyone that holds an IOU known as US Dollars, by FISCALLY and MORALLY bankrupt public servants and their “something for nothing” constituents and campaign contributors. This is not a recipe for a strong country, rising incomes or currencies. The US Dollar is the most inflated currency in history and its demise is inevitable and inescapable. They will print it until it is…

In conclusion

The news was just released that General Motors will require approximately another $18 Billion BEFORE entering bankruptcy, and an additional $70 Billion total to be rescued. That comes to a tidy $213,000 for every job saved, that is, if no one is laid off. So each layoff just jacks up the bill per job saved. In healthcare, preserving the final six months of life is OVER 30% of annual healthcare expenditures, living on BORROWED time as they say. LOANING money to DEAD companies is the same; they will still die, but the bills will be enormously HIGHER. Can you say FREDDIE, FANNIE, AIG, Citigroup, Chrysler, General Motors, state and municipal governments (California is only the first of DOZENS to follow)?

Public servants are creating the “perfect storm” of corruption and LEGISLATED economic suicide to cover their power and money grabs TO SAVE YOU. In a repeat of the Stimulus and Spending Bill’s treasonous fiduciary collapse, the new 900 page CAP and TRADE and Climate Legislation was passed out of the committee WITHOUT ANYONE HAVING READ IT. It was probably written by radical environmentalists and AL GORE.

The NAKED corruption within the Washington beltway is BREATHTAKING, and it is aided and abetted by the MAINSTREAM media MARXISTS who cover it up and sweep it UNDER the RUG by not reporting ANY of it. Helping them PREY upon the dumb-downed PUBLIC, it is no wonder liberal broadcast and print media are dying. They don’t report the news and when they do, it is their opinions and spin masquerading as the FACTS. BLIND ideologues living a fantasy of past greatness and a Marxist future full of sugar plums and tooth fairies.

The GANG of 535 in Washington PROPOSED a NEW NATIONAL sales tax today to pay for “change we can believe in”, a new bill to taxpayers and future generations for the medical expenses of 47 million people. I pay $1200 a month for healthcare for myself, my wife and my son. Multiply that by 47 million; it isn’t pretty, it’s fiscal and moral bankruptcy. Every level of government is RAISING taxes to PRESERVE what they believe to be ESSENTIAL services and NEW INVESTMENTS, aka “government boondoggles”, always threatening to reduce your safety before they reduce the millions of non-essential expenses. The tea parties have just started.

The financial industry is STILL insolvent. This fool’s gold rally was engineered by Bernanke, Geithner and the media to suck a COOL hundred billion dollars worth of NEW patsies into buying new stocks and bond issuance. This covers the unfolding demise with ignorant investors’ reckless belief in CNBS and the mainstream cackle about the positive health of banks. The Public Private Investment Program (PPIP) is actually considering letting the banks buy their own TOXIC assets using taxpayer money. Selling it to themselves with YOU footing the risk. The regulation of the toxic assets and OVER-THE-COUNTER Derivatives, which Treasury Secretary Geithner has proposed, was written on WALL STREET. The corruption going on between the Beltway and the banking and broker industry is unbelievable.

Put on your helmets and buckle your seat belts, the GREEN SHOOTS thrill ride is cresting and the next down move on the roller coaster is about to begin. By December, new lows and new woes will be your companion. Just keep in mind, these are opportunities for PREPARED investors. Don’t miss the next edition of Tedbits’ “Fingers of Instability” series…

Don't miss the next issue of Ted bits. Subscribe. It's free, at: www.TraderView.com

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.