Gold Question

Commodities / Gold & Silver 2009 Jul 01, 2009 - 07:01 AM GMTBy: Ronald_Rosen

Hi Captain Ron,

Hi Captain Ron,

Thanks for the hand-holding during these tough times!

However, I can't help thinking if the general market is to plunge from here, what can stop gold from being dragged down by the deflationary force, (just as what occurred in 2008) especially when I see silver is particularly weak, and the commercial shorts are still up to their necks?

Would this also imply gold may still be in consolidating mode until winter 2009?

I am certainly still in the long PM Camp, but shivering....

Thank you for your kind words!

Regards,

H. W.

ANSWER

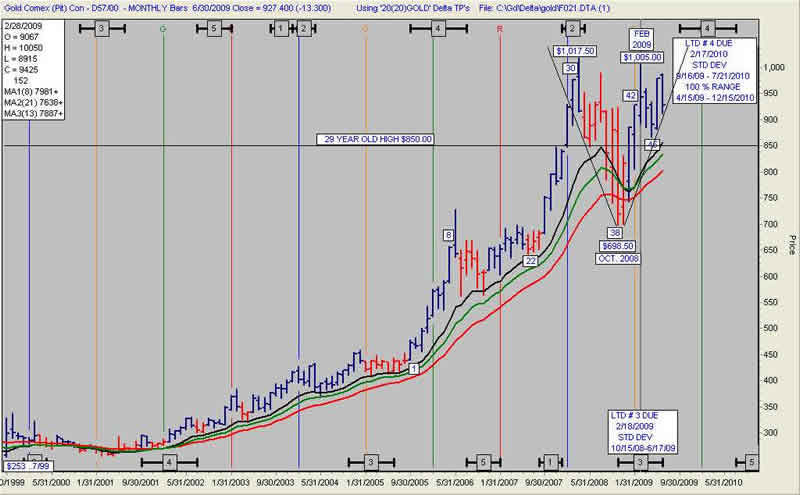

This is another situation where Delta Turning points are not only a great timing tool but also a most soothing potion for our nerves. We know that LTD # 3 low arrived in Oct. 2008 at the $698.50 low. This was the reason for, “…just as what occurred in 2008.” We know that LTD # 4 high must be the highest high after the LTD # 3 low. The earliest that LTD # 4 high can arrive is the 100% arrival time of 4/15/09, shown on the chart. Therefore, we know that the high at LTD # 4 high has not yet arrived. We also know that the high at LTD # 4 high must be higher then the high of $1,005.00 achieved in Feb. 2009. The reason for this is the fact that the high at $1,005.00 arrived in Feb. 2009. That is two months prior to the 100% time of arrival for LTD # 4 high. Thanks to Delta we know that in spite of any negative talk, news, or threats aimed towards gold by any nation or collection of nations, Mother Nature, who rules the Sun, the Moon and the Tides, is telling us, “Regarding your gold investments - sleep well, rest comfortably, and fear not. The high for gold has not yet arrived.” There is no tool but Delta that can provide the nerve soothing answer that you request.

H. W., you have that tool. I suspect that in time, after you see it work over and over again, you will trust it and any shivering will disappear.

Ron R.

GOLD MONTHLY

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

Ron Rosen and Alistair Gilbert

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.