Euro Hits New Lows, Swiss Franc Bounces: What does it means for Gold and Silver?

Commodities / Commodities Trading Jan 09, 2012 - 11:14 AM GMTBy: Jeb_Handwerger

Commodities In Characteristic Selloff

Commodities In Characteristic Selloff

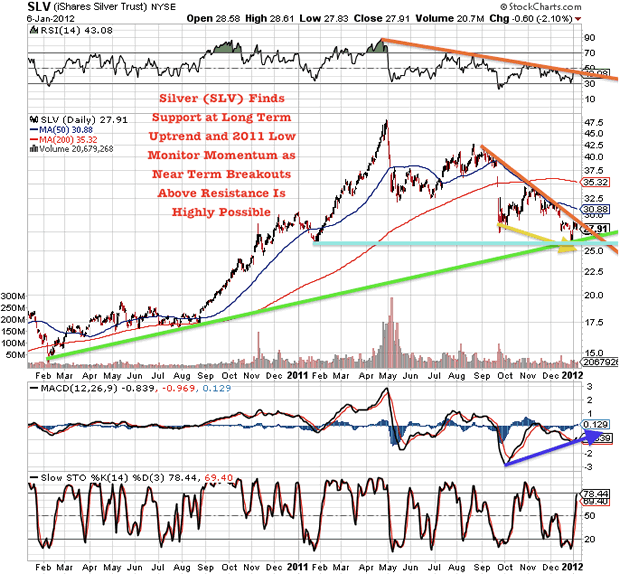

Once again at the end of 2011 we heard the voices of negation sounding the fear of the bursting of the commodities bubble. The naysayers come out with their Cassandra calls whenever commodities go into a characteristic and salubrious selloff. They never really learn to respect the importance of gold (GLD) and silver's (SLV) role in the long range secular multiyear ongoing rise.

We emphasized the importance of avoiding knee jerk reactions when precious metals experience healthy pullbacks. The first week of January 2012 saw commodities (DBC) rising across the board as they return from the premature grave to which the naysayers have assigned them.

One wonders how the short sellers are enjoying this periodic resurrection in vital metals such as gold(GLD), silver(SLV), rare earths (REMX) and uraniums(URA).

Transparent Horizon Of Record Low Interest Rates

Attendant to a new rise in these vital commodities, the economic base should be prepared to receive them. On January 24th-25th the Federal Open Market Committee will be meeting once again in Washington. One of the areas on which they will be focusing is the travails of the U.S. Housing Market and new methods to bring down the high unemployment rate. The Fed is promising a transparent horizon of record low interest rates to provoke the banks to lend money.

It is important that the Eurozone malaise undergo corrective measures in order to restore Europe to health. Recently Christine Lagarde, Head of the International Monetary Fund, has expressed broad generalities toward the need of fiscal reforms. It is hoped that Lagarde will not be a laggard in the birth of the "EuroTarp" by whatever stimuli to be applied.

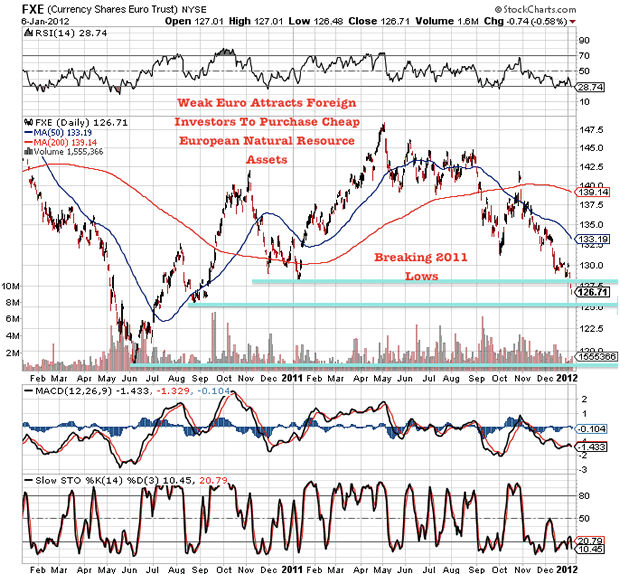

Euro Hitting New Lows

The weak Euro is attracting foreign capital to purchase cheap European natural resource assets. Our research team is looking for undervalued gold assets in the Eurozone as these countries are looking to rapidly develop mines to provide high paying jobs and growth. The Euro has broken the 2011 lows as Merkel and Sarkozy meet to rescue the moribund Eurozone economy.

It is important that a coherent plan of attack be formulated rather than the indiscriminate printing of Euros(FXE), which we are currently witnessing. The Euro is rapidly losing value. This procedure of currency devaluations is counter-productive unless corrective measures are instituted such as serious spending restraints, permanent tax rate cuts and regulatory relief. In plain language, the Europeans and the Americans can't print more dollars (UUP) without building on a base of budgetary restraint.

Recovery In Rare Earths, Uranium and Precious Metals

How does this affect our selected precious metals stocks(GDX), rare earths (REMX) and uraniums(URA)? This week the rare earths are emerging from their second half 2011 slumber. It is felt that they will lead the upcoming recovery. This week certain of the rare earths are producing impressive percentage gains as an augury of things to come.

China is playing a dual role not only for their own domestic needs but in establishing a quota system for exports to other nations. This emphasizes the importance for the West and Japan to establish an independent role in their own destiny. No matter what happens in the pending appeal with China at the World Trade Organization, The West has learned a valuable lesson in geopolitics as the external industrial nations recognize the importance of rare earth independence.

The uranium sector is enjoying a profitable week as well. No other area has had to come up from taking a count so many times. The press has obscured, misrepresented and sensationalized the true story about the role of nuclear energy(NLR) in a modern, industrial world. The media has relegated uranium mining to the status of selling newspapers and TV commercials. The truth be damned. Imagine when the true story is finally told. Not once have the talking heads mentioned that reactors that are being built are portable, economical and safe. The truth can not be suppressed forever.

Swiss Franc Scandal Highlights Investing In Tangible Assets

Important news is just coming over the wire. The Swiss National Bank Chief has resigned in shame after it is revealed his wife was selling Francs (FXF) to buy U.S. Dollars (UUP) long before the central bank sold Francs to slash the value. The Swiss franc is rising against the dollar. One wonders how many others were involved in that trade to push the weak dollar higher?

In conclusion, our sectors and recommendations are once again emerging from their long bases. Reiterating the long ascendance of these sectors especially in light of all the bullish forces, patience is paramount albeit painful. We have been advising our readers that this correction in commodities would be far from terminal and that it represents a classic buying opportunity.

Disclosure: Long GLD, SLV, GDX

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.