Iraq Quadruples Gold Reserves In Two Months - First Time In Years

Commodities / Gold and Silver 2012 Dec 21, 2012 - 07:02 AM GMTBy: GoldCore

Today’s AM fix was USD 1,648.25, EUR 1,246.97 and GBP 1,014.56 per ounce.

Today’s AM fix was USD 1,648.25, EUR 1,246.97 and GBP 1,014.56 per ounce.

Yesterday’s AM fix was USD 1,667.00, EUR 1,259.25 and GBP 1,024.96 per ounce.

Silver is trading at $29.89/oz, €22.73/oz and £18.49/oz. Platinum is trading at $1,551.25/oz, palladium at $673.00/oz and rhodium at $1,040/oz.

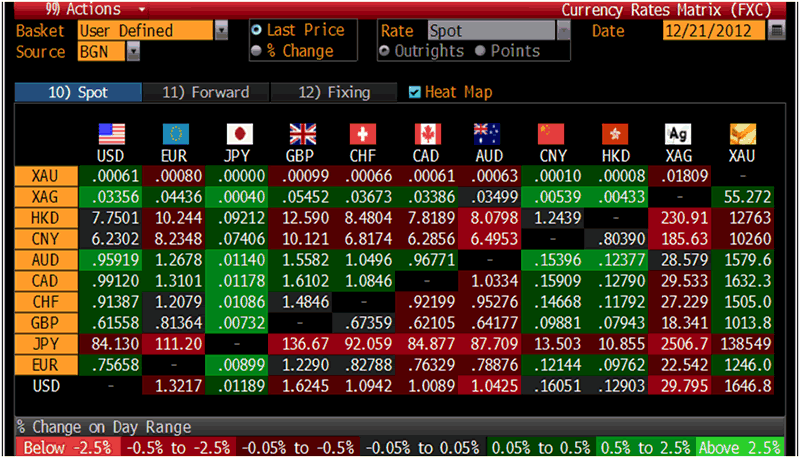

Cross Currency Table – (Bloomberg)

Gold was down $20.60 or 1.23% in New York yesterday and closed at $1,648.70/oz. Silver dropped to as low as $29.592 and finished with a sharp loss of 3.66%.

Gold is marginally lower in dollars today and on course for its largest weekly drop since June (-2.6%), as COMEX speculators continue to have the upper hand over store of wealth buyers including central banks.

Prices fell below $1,650 an ounce on Thursday for the first time since August despite strong fundamentals which have not changed.

Gold has come under pressure from heavy liquidation by hedge funds and banks on the COMEX this week. The unusual and often 'not for profit' nature of the selling, often in illiquid Asian trading, has again led to suspicions of market manipulation.

Short sellers, technical and momentum traders have the upper hand and are pressing their advantage in these less liquid holiday markets. Nervous longs are being stopped out through stop loss orders and concerns regarding the clear downward short term trend.

The recent drop in the gold price has resurrected physical purchases in the market keeping premiums steady at $1 to $1.10/oz above London prices.

"Definitely, there's physical buying. It's from all over the place. Physical dealers are buying" a physical trader in Singapore told Reuters.

Despite the recent weakness, bullion is 5.6% higher this year in dollar terms and barring a massive year end sell off looks set for a 12th annual gain.

The standoff between the White House and Congress over the 'fiscal cliff' turned into a public relations crisis last night when John Boehner, Republican House Speaker, was humiliated by not being able to gain enough support to secure passage of his own bill.

Gold will be supported by the strong likelihood that central banks will continue buying bullion after data showed Brazil boosted its reserves for a third month, Russia continued to diversify into gold and Iraq entered the gold market for the first time in many years and quadrupled their gold reserves in just two months.

Brazilian holdings expanded the most in 12 years, rising 14.7 metric tons in November. The nation’s holdings doubled since August. Russia’s bullion reserves increased by 2.86 tons to 937.8 metric tons in November.

Central banks have bought 426.5 tons of gold so far this year.

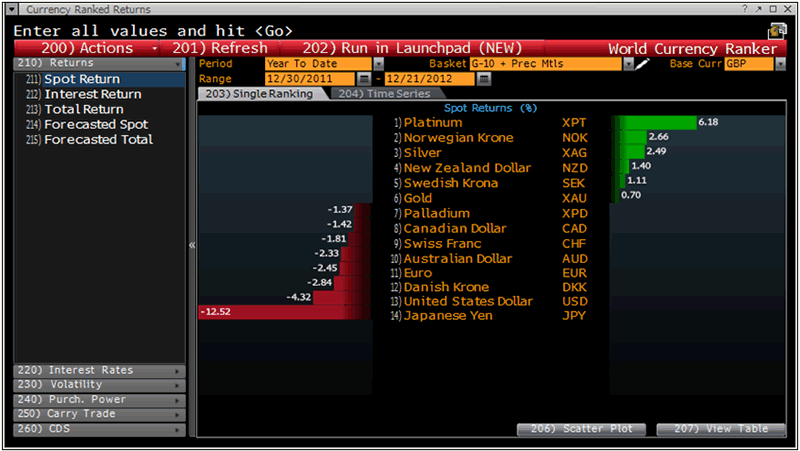

Currency Ranked Returns, GBP – (Bloomberg)

Iraq quadrupled its gold holdings to 31.07 tonnes over the course of three months between August and October, data from the International Monetary Fund showed on yesterday.

The IMF's monthly statistics report showed the country's holdings increased by some 23.9 tonnes in August to 29.7 tonnes.

That was followed by a 2.3-tonne rise in September to 32.09 tonnes and then a cut of 1.02 tonnes in October to 31.07 tonnes. There was no data for November.

It is Iraq's first major move in years to bolster its gold reserves.

More recently, Brazil raised its gold holdings by 14.68 tonnes, or 28 percent, in November, bringing its bullion reserves to 67.19 tonnes.

The addition comes on the heels of an even bigger increase in October when the South American country added 17.17 tonnes to its reserves. In September, it increased holdings by 2 tonnes.

Meanwhile Turkey cut its gold holdings last month by 5.84 tonnes to 314 tonnes from October. The country allows commercial banks to use gold as collateral for loans, and changes to its balance sheet are often connected to such activity.

Belarus upped its reserves by 1.39 tonnes to 42.7 tonnes, while Russia, which had both bought and sold gold on a number of occasions this year, increased its holdings by 2.86 tonnes to 937.8 tonnes.

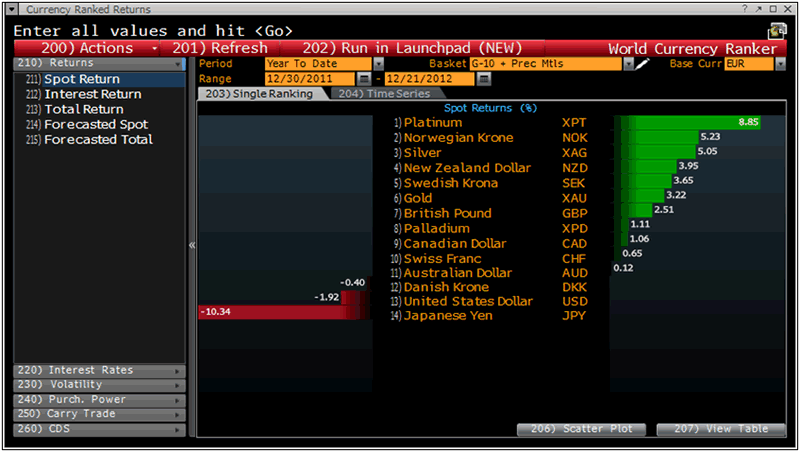

Currency Ranked Returns, EUR – (Bloomberg)

The central bank of Iraq’s quadrupling of gold reserves is important as there are many oil rich nations in the world with sizeable dollar and euro currency reserves and only a small allocation to gold by these central banks alone could lead to higher gold prices.

The smart money will continue to dollar cost average and buy gold on dips.

For the latest news and commentary on financial markets and gold please follow us on Twitter.GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.