Brexit - Gold Note - Brexit Facts - Ramifications for UK, Ireland, EU - Conclusion

Commodities / Gold and Silver 2016 Jun 24, 2016 - 11:43 AM GMTBy: GoldCore

We have seen record online sales for this time of day and the phones are ringing off the hook. It is nearly all buying with a preference for gold over silver. We may have to restrict trading to existing clients if we continue to see this level of demand.

We have seen record online sales for this time of day and the phones are ringing off the hook. It is nearly all buying with a preference for gold over silver. We may have to restrict trading to existing clients if we continue to see this level of demand.

We are seeing more selling then expected and seeing some clients choosing to take profits after the very sizeable short term capital gains.

We had already increased bullion inventories to record levels and we are confident this will lead to a sustained increase in coin and bar buying in the coming months.

Facts

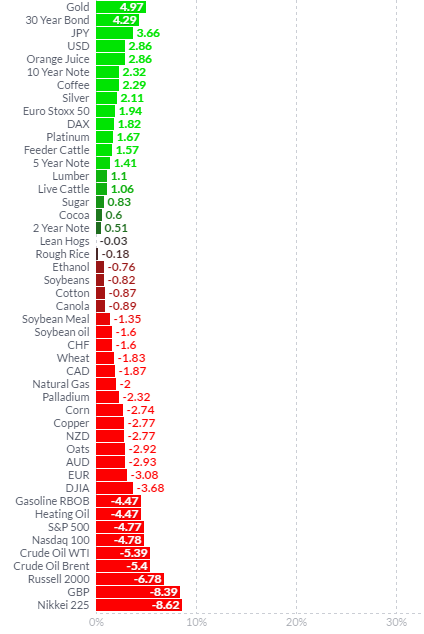

- Sterling and euro have fallen sharply on fx markets

- Gold surged 20% in sterling to £1,105/oz

- Gold now 14% in higher in GBP, 8% in EUR and 5% in USD

- Stocks globally are down sharply - FTSE down 9%

- European stocks down sharply - Euro Stoxx 50 Futures collapsed over 11% at the open

- Bank shares are down 20% to 25%

- Cameron has resigned - adding to uncertainty in markets

- Record online sales at this time of day for GoldCore

- Nearly all buying with a preference for gold over silver

- Some selling - with some investors choosing to take profits after sizeable short term gains

Ramifications

- There is the real risk of contagion in the EU

- UK leaving the EU increases the risk of the EU disintegrating as it greatly increases the risk of France, Italy, Spain, Netherlands and Greece following the UK

- This poses risks to the "single currency," the euro as these nations may revert to their national currencies

- Still fragile UK, French, Italian, Spanish, Greek and Irish banks are coming under pressure

- The uncertainty and shock is likely to undermine business and consumer confidence and likely lead to a recession in the UK and will likely impact an already vulnerable Eurozone and global economy

- Central banks are likely to embark on further QE and further devalue currencies in order to prevent recessions

UK

- The UK is likely to enter recession which will lead to further QE and see sterling devalued more over the long term

- The UK total debt to GDP ratio is over 450% which also poses severe risks the economy and sterling

- UK banks remain vulnerable and in the event of contagion will likely see bail-ins and deposit confiscation

- British people, companies etc are very exposed to sterling. One way to hedge and protect against that risk is to diversify into physical gold and silver.

Ireland

- The sharp fall in sterling versus the euro is likely to lead a serious fall in Irish exports to the UK which will impact jobs and the Irish economy. This combined with already heightened global risks may lead to a recession in Ireland - impacting the Irish stock and property market

- Longer term the euro looks very vulnerable and may collapse as warned of by Soros and many others

- Irish banks remain vulnerable and in the event of contagion will likely see bail-ins and deposit confiscation

- Irish people, companies etc are seriously exposed to the euro. The way to hedge and protect against that risk is the diversify into gold.

Conclusion

- The Brexit vote underlines the importance of owning gold as vital financial insurance in these uncertain times. The degree of risk means that investors should consider having higher allocations of 15% to 20% to gold.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.