Agri-Stocks and Agri-Food Prices: Both Strong

Commodities / Agricultural Commodities Jan 09, 2017 - 12:02 PM GMTBy: Ned_W_Schmidt

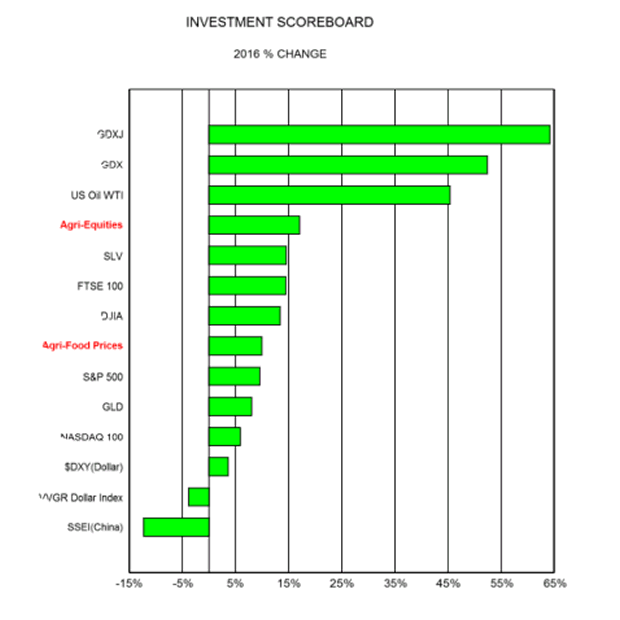

When has food been more valuable than technology? Aside from all of history, that was especially true in 2016. Chart below is our Investment Scoreboard for 2016. In it are portrayed the returns for a variety of important market measures. Gold stocks, Silver, oil, and Agri-Equities clearly owned the year. Agri-Equities, number four in chart, substantially outperformed most of the equity markets. In 2016 food was clearly more valuable than those tired, old, over owned technology and internet stocks as indicated by the NASDAQ 100 being far down in the list.

When has food been more valuable than technology? Aside from all of history, that was especially true in 2016. Chart below is our Investment Scoreboard for 2016. In it are portrayed the returns for a variety of important market measures. Gold stocks, Silver, oil, and Agri-Equities clearly owned the year. Agri-Equities, number four in chart, substantially outperformed most of the equity markets. In 2016 food was clearly more valuable than those tired, old, over owned technology and internet stocks as indicated by the NASDAQ 100 being far down in the list.

Commodities clearly were the strength in markets during 2016. As we observed above, that commodities performed substantially better than the NASDAQ 100 is a development that should be especially noted. Consensus view at this time a year ago was to avoid commodities and look to stocks such as those that dominate the NASDAQ 100. The 2016 consensus view was a classic example of why one might want to avoid investing in the consensus.

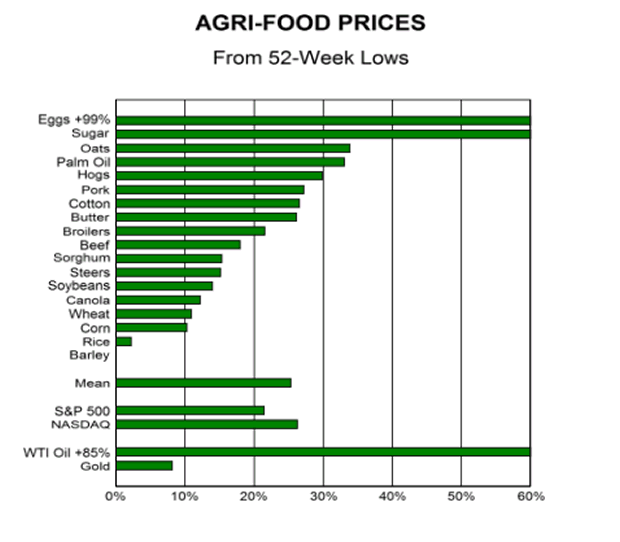

Agri-Food prices also had a good year. Seeing no reason to argue with a rule that supports our opinion, we accept common view that a 20% or more rise from an important low suggests that a new Agri-Food bull market might be emerging. The Agri-Food Price Index made an important low in first week of October. From that low, the index rose 24% to a new 52-week high. Latest value for that measure is 21% above the low.

Strength is also observable at the individual Agri-Commodity level. The average gain for 18 Agri-Commodities from their respective 52-week lows is 25%. While averages can mask some wide variations in the data, 9 of 18, or 50%, are 20% or more above their 52-week lows. That phenomenon is shown in chart below.

Why have Agri-Food Prices risen so strongly? While record harvests have occurred in some parts of the world, demand has continued to rise. Demand is a crucial part of pricing, and perhaps too much ignored by many commodity analysts. According to the USDA, during the two years ending in crop year 2017(August), total consumption of grains will have risen by 3.3%, or 83 million tons. That tonnage increase is a third larger than entire U.S. wheat crop. Increased global Agri-Food consumption in any period of time continues, becoming part of the permanent base of consumption to which will be added any future increases.

Best measure of expanding demand for Agri-Foods is imports as they represent unmet domestic demand. Imports of wheat, for example, are the difference between domestic consumption and domestic production. Imports are accomplished by purchases in global grain markets from nations producing a domestic surplus. As wheat is not a collectible, nations do not import it unless someone wants to eat it. And note, once a nation is hooked on imported food that will be the situation forever.

In chart to right are portrayed, by crop years, global imports of rough grains, soybean, wheat, and rice. As can be observed, demands on global grain markets have continued to grow. Last bar is our forecast for imports of those grains in 2026.

Most of this expected growth is to come from India, Africa, and other developed nations, as well as China continuing to expand imports. India, due to rapid economic growth, will likely expand imports by 70-80 million tons over the next decade. Food imports of developing nations are growing rapidly as their economies keep developing. Hottest corn import markets are Sub Saharan Africa(#1), Southeast Asia(#2), and North Africa(#4). One of the questions the world will have to answer in the next decade is how the rising demand for food from India and Africa can be met and/or what price will be required to meet that demand.

Diversification remains one of the most powerful tools available to investors. As history has shown, Agri-Commodities should be part of that diversification. As demand for Agri-Commodities is global as people in every country eat each day, total risk of portfolios will be reduced and returns should be enhanced. And note, we have never had to worry about a battery within an apple exploding.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.