Dow 19,20,21….Faster, Faster!

Stock-Markets / Stock Market 2017 Mar 03, 2017 - 03:40 AM GMTBy: Doug_Wakefield

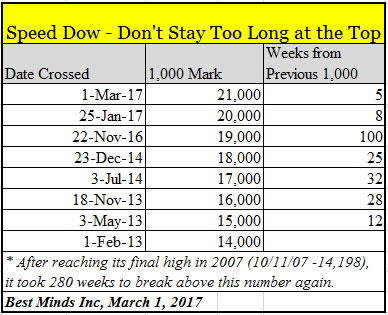

Aren’t you glad that the Dow leaped to 21,000 today. I mean, just three weeks ago its low for the day was 20,015. In fact, on November 22, 2016 the Dow crossed 19,000 for the first time.

Aren’t you glad that the Dow leaped to 21,000 today. I mean, just three weeks ago its low for the day was 20,015. In fact, on November 22, 2016 the Dow crossed 19,000 for the first time.

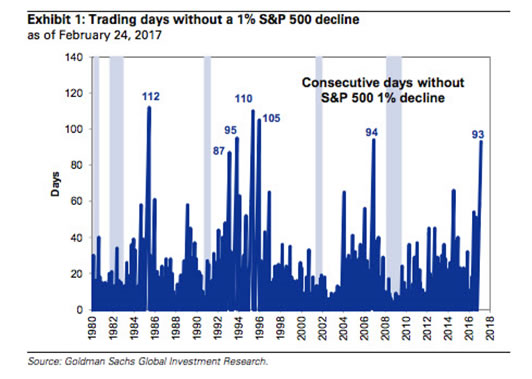

Yet why the hurry to get in now? The 8 year US “QE assisted” bull market has yet to see a 20% decline since 2008. In fact, since the Feb 11, 2017 low, the S&P 500 hasn’t had a weekly decline (Fri to Fri close) of even 2.5%. Even based on Goldman Sachs’ recent research we know the S&P 500 has not seen a 1% decline over the last 96 days, a feat only topped 3 times since 1980, none since 2000.

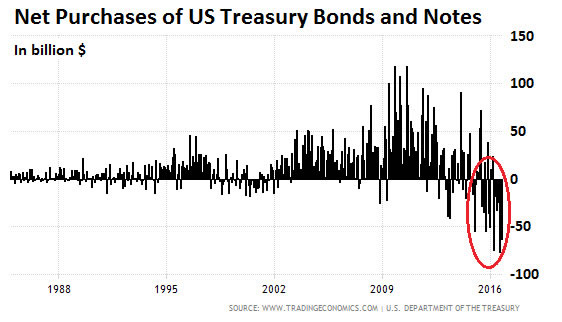

I know, we continue to hear as Americans we can spend and borrow trillions – temporarily of course – from other nations to spend on our infrastructure and military since foreign nations have shown no limit to their appetite for our treasuries.

[Source – Foreigners Are Dumping Treasuries as Never Before, Wolf Street, 12/15/16]

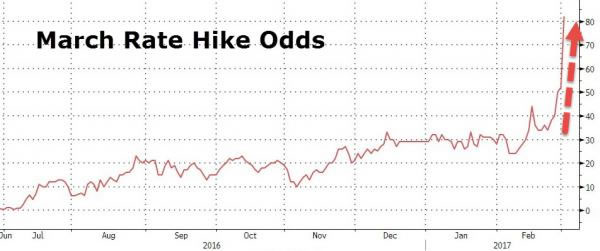

As investors and traders we have forgotten the historical and fundamental reality that if borrowing costs rise across the world this impacts cash-flows from governments to businesses to consumers which ultimately affects stock prices.

[Source – 30Y Yields Spike Tops 3% As March Rate Hike Odds Spike Above 80%, ZH, March 1 ‘17]

With historical examples of the consequences of bubbles removed, it doesn’t matter how we explain the quick gains. Experience is the only thing that matters. It is better to keep thinking of the “certainty” of more winnings from the bubble than the severe changes from former bubbles.

The fundamental myth that central banks must continue to foster, is that bubbles are hard to spot and debt fueled booms do not lead to debt crisis busts. Yet even the central bankers bank warned the global public of what we are facing as we start March 2017 when the Dow reached 17,000 in the summer of 2014.

An organization representing the world's main central banks warned on Sunday that dangerous new asset bubbles were forming even before the global economy has finished recovering from the last round of financial excess.

“The temptation to postpone adjustment can prove irresistible, especially when times are good and financial booms sprinkle the fairy dust of illusory riches,” the report said. “The consequence is a growth model that relies on too much debt, both private and public, and which over time sows the seeds of its own demise.” [Central Bankers, Worried About Bubbles, Rebuke Markets, NY Times, 6/29/14]

Will we read in the future, “Central bankers warned of finance excess, illusory riches, and trusting in too much debt before the global financial bubble collapsed”? Should someone inform the President of the Federal Reserve of Minneapolis, Neel Kashkari, that his recent statement that “we are keeping our eyes open for asset prices to try and look for signs of bubbles” reveal he needs to read the plethora of warnings in global banking reports for more than two years now? Maybe after this 13 month stock bull he should talk with former President of the Federal Reserve of Dallas, Richard Fisher who stated in January 2016, “We front- loaded an enormous stock rally”?

So when is enough, enough? When will more and more central bankers admit that THEY have and continue to be the root cause of a system that “relies on too much debt” and short-termism? When will the industry and public at large admit we have been here before, only with far less debt?

Time To Plan for The End of a Bubble?

Best Minds Inc has a new website and blog. Check out www.bestmindsinc.com for free blog and paid research newsletter. 2017 will bring significant opportunities and significant losses.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.