Four Reasons Why a US China Trade Deal Isn’t Coming This Weekend…

Stock-Markets / Protectionism Nov 28, 2018 - 04:03 PM GMTBy: Graham_Summers

Stock markets are rallying today on the belief that somehow the US and China will sign a trade deal at the upcoming G-20 meeting.

Stock markets are rallying today on the belief that somehow the US and China will sign a trade deal at the upcoming G-20 meeting.

Investors are buying this narrative despite the facts that…

1) The Trump administration has already admitted that a deal is highly UN-likely.

2) The Trump administration has also admitted that the next round of tariffs (25%) will hit in January (meaning no deal by then).

3) The US and China have yet to reach ANY kind of remote agreement on anything. Indeed, they don’t even appear to be openly negotiating at the moment.

4) Large-scale trade deals that resolve decades-old structural issues between the two largest economies in the world do NOT get resolved by a 1-on-1 face to face meeting that lasts a few hours.

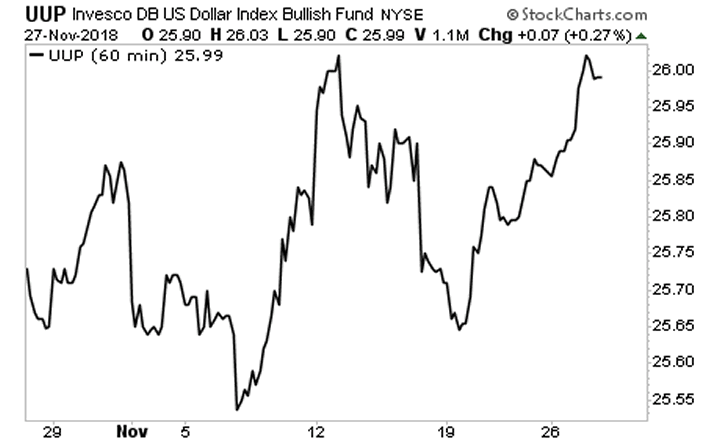

If you think I’m being overly negative, take a look at the currency markets.

The currency markets are the largest, most liquid markets in the world. Collectively they trade $5-$6 trillion PER DAY. As such, these markets are the first to note macro shifts.

With that in mind, the $USD has erased the initial drop that occurred when President Trump first started talking about a trade deal. The $USD is now re-challenging the recent highs.

Put another way, the currency markets are “buying” the notion of a trade deal one bit.

Let me ask you, who’s got a better grip on what’s happening in the world… the mainstream media or the currency markets?

Better yet, which would you rather base an investment decision on… the largest, most liquid markets in the world… or the mainstream media?

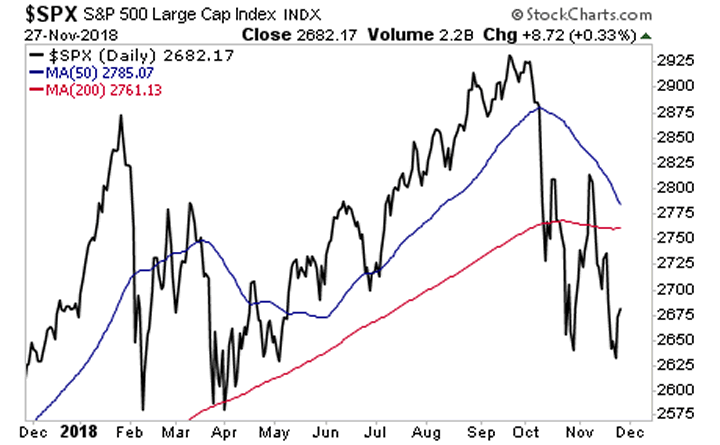

Also… if stocks really believed a trade deal was coming… wouldn’t they have at least reclaimed their 200-DMA?

The next leg down hits soon. And when it does, we’re going to new lows.

If you are not already preparing for this, NOW is the time to do so.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.