Stock Market US China Trade War Panic! Trend Forecast May 2019 Update

Stock-Markets / Stock Markets 2019 May 10, 2019 - 10:43 AM GMTBy: Nadeem_Walayat

Just as the mainstream media had gotten used to the stock market rallying towards new all time highs into the end of April. Suddenly, out of the blue TRADE WAR PANIC hits the markets and apparently is responsible for the ongoing downturn in the US and world general stock market indices. This illustrates the way the mainstream media tends to work where the big news story of the day is used to explain the direction of a market, with the same news usually spinned as an explanation for either when the market goes up or down! And Mays big news story to explain the downswing is the latest saga in the US / China trade war, namely increased tariffs from 10% to 25% to kick on $200 billion of Chinese goods today (Friday 10th May) triggered by China trying to pull a fast one on the US by backtracking on earlier promises, which illustrates that NO ONE can trust what China says, not even the worlds Super Power!

Just as the mainstream media had gotten used to the stock market rallying towards new all time highs into the end of April. Suddenly, out of the blue TRADE WAR PANIC hits the markets and apparently is responsible for the ongoing downturn in the US and world general stock market indices. This illustrates the way the mainstream media tends to work where the big news story of the day is used to explain the direction of a market, with the same news usually spinned as an explanation for either when the market goes up or down! And Mays big news story to explain the downswing is the latest saga in the US / China trade war, namely increased tariffs from 10% to 25% to kick on $200 billion of Chinese goods today (Friday 10th May) triggered by China trying to pull a fast one on the US by backtracking on earlier promises, which illustrates that NO ONE can trust what China says, not even the worlds Super Power!

What's actually surprising is how clueless the mainstream financial media truly is in terms of what drives markets and trends, well it shouldn't be so surprising given that the media is basically populated with journalists trained to churn out highly convincing polished commentary even if it is usually of no practical value.

So the mainstream media still fails to understand that the Trade War with China is a PERMENENT FIXTURE, as part of a mega-trend of the worlds existing super power (United States) in conflict the emerging super power (China) that will ultimately result in outright military conflict.

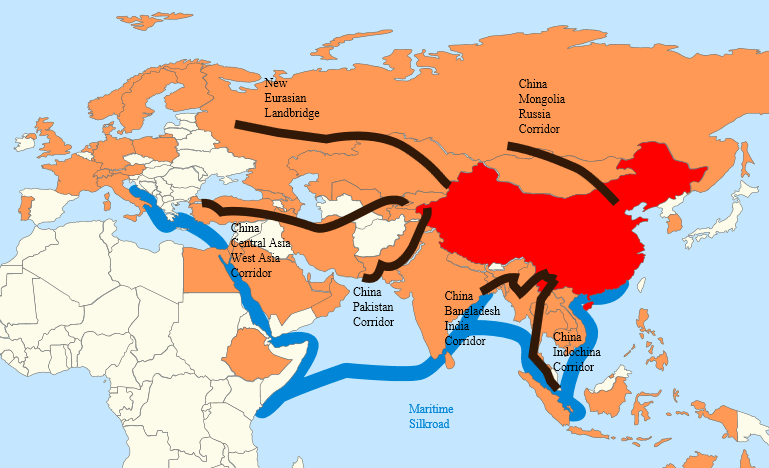

China is busy building the infrastructure for it's Empire right across the world, fundamental to which is the One Belt Road and deep sea ports. That includes nations such as Pakistan (Gwadar) as China effectively lays down the blue prints for its Empire, which just as the British Empire went from a series of trading companies to outright colonialism and theft of territory then so will China's trade roads and ports form the basis of a future Chinese military empire.

Now none of this is new of what Trump has done and what China is doing in the South China Sea, as in two pieces of in-depth analysis I set forth what I expected to follow in the US China War Mega-trend posted BEFORE Trump took office which are just as valid today as when first posted for the TREND firmly remains in the forecast direction! Trade, Economic, Cyber, Market, Corporate, Territory, Nuclear!

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

- 04 Jan 2017 - CIA Planning Rogue President Donald Trump Assassination? Elites "Manchurian Candidate" Plan B

The Trump war with China is now into it's third year, and still the mainstream press remains largely clueless at to what is actually going on and its consequences, which is why they keep getting caught out by surprises!

Furthermore despite what transpires today we still have many speculating on who is the winning and losing this trade war when it has always been crystal clear right from the outset that China most definitely WILL LOSE the Trump Trade War as my following video from mid 2018 illustrates

Maybe the United States will snack on Iran before it gets going with countering the Chinese militarily threat, wrap up loose ends so to speak for its Gulf petrodollar client states .

And this is what China is seeking to replicate across Asia, Middle East, Africa and even Europe with fools like the Italian Prime Minister bending over backwards to welcome their future colonial masters. So there will be many US-China flashpoint's over the coming decade as China seeks to displace the United States all the way back to the Americas.

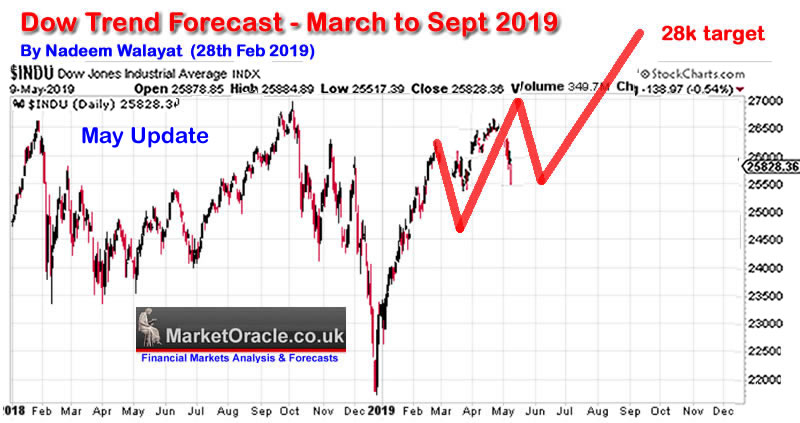

Stock Market Trend Forecast 2019

My in-depth analysis posted on the of 1st March 2019 Stock Market Trend Forecast March to September 2019 concluded in the following trend forecast for the Dow to achieve at least 28,000 by Mid September 2019.

At the update of April 7th update (https://www.patreon.com/posts/stock-market-dow-25930920) the stock market was running ahead of the forecast by some 700 points.

When I warned to expect the stock market to converge towards my trend forecast rather than continue trending higher.

However, with stocks approaching resistance at previous all time highs I consider the most probable outcome is for the Dow is to converge towards my trend forecast during the remainder of April.

Which brings us to the present:

Technical Analysis

The rest of this analysis has first been made available to Patrons who support my work: https://www.patreon.com/posts/stock-market-us-26752779

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

April Analysis:

- US House Prices Trend Forecast 2019 to 2021

- Bitcoin Price Trend Forecast 2019 Update

- Stock Market Dow Trend Forecast - April Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

May Analysis Schedule :

- Stock Market Trend Forecast Update

- Machine Intelligence Investing stocks sub sector analysis

- UK Housing market ongoing analysis.

- Gold / SIlver trend forecast update.

- China Stock Market SSEC

And ensure you are subscribed to my FREE Newsletter to get this analysis in your email in box (only requirement is an email address).

Your analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.