War! Good or Bad for Stocks?

Stock-Markets / Investing 2019 May 17, 2019 - 10:20 AM GMTBy: EWI

Take a look at stock market behavior in times of war... and peace

By Bob Stokes

After the U.S. recently announced new sanctions against Iran, tensions have escalated between the two countries.

USA Today reported (May 7):

The Pentagon is rushing additional military muscle, including B-52 bombers, to the Middle East to counter Iranian threats to U.S. troops on the ground and at sea.

Of course, it's always best when military conflict can be avoided because as U.S. President Abraham Lincoln said in an 1864 speech:

War at the best, is terrible ...

How true. Yet, shifting to the financial arena, what can stock market investors expect during times of war? Is war also "terrible" for market participants?

Some market observers believe so and argue that war diverts resources from productive enterprise. Others posit that war is good for stocks and the economy because the government forks over big money to companies to produce war materials.

So, who has the winning argument?

Well, among many countries in the world, the U.S. has been fortunate to have not had an international military conflict on its soil in the 20th century. If it did, the outcome for the U.S. economy and stock market may have been different. But as it stands, we looked at the path of U.S. stock prices during World War I, World War II, the Korean War and the Vietnam War to see if we could find any consistent correlations.

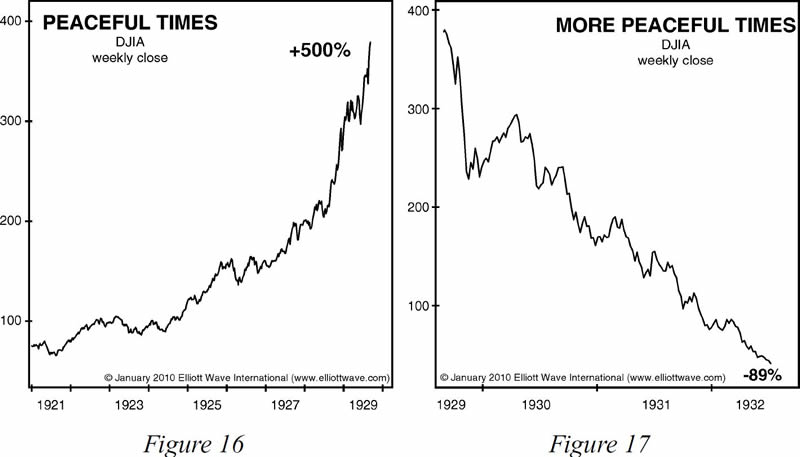

These four charts from Robert Prechter's 2017 book The Socionomic Theory of Finance show you what our research revealed:

Figure 12 shows a time of war when stock prices (normalized for inflation) rose, then fell; Figure 13 shows a time when they fell, then rose; Figure 14 shows a time when they rose throughout; and Figure 15 shows a time when they fell throughout the hottest half (1965-1975) of a twenty-year conflict. Who wins the war doesn't seem to matter. A group of allies won World War I as stock values reached fourteen-year lows; and nearly the same group of allies won World War II as stock values neared fourteen-year highs.

In other words, no consistent correlation was found between the performance of the stock market and war.

But, how about during times of peace?

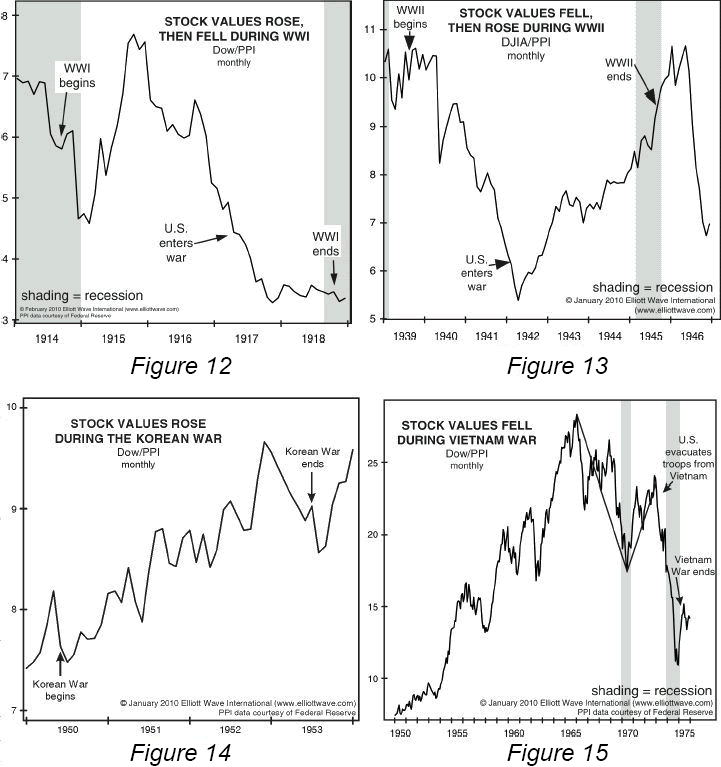

Here are two more charts from The Socionomic Theory of Finance:

Figure 16 provides an example from the 1920s in which stock prices seemingly benefited from peaceful times. The Dow rose over 500% in just eight years as peace mostly reigned around the globe.

Figure 17, however, shows that in the three years immediately thereafter, peace likewise mostly reigned around the globe yet stock prices fell more than they had risen in the preceding eight years!

So, despite assumptions to the contrary, the evidence shows that there's no consistent relationship between U.S. stock prices and peace -- or war.

For other widespread beliefs about the stock market that are simply not supported by the evidence, see our free report, "Market Myths Exposed".

EWI is the world's largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.