What UK CPI, RPI and REAL INFLATION Predict for General Election Result 2019

ElectionOracle / General Election 2019 Dec 05, 2019 - 06:13 PM GMTBy: Nadeem_Walayat

It's the economy stupid! The party in government tends to lose elections to the opposition on the basis of where the economy stands at the time of the general election. So whilst Boris Johnson's "Get Brexit Done" headline grabbing mantra sounds like it could deliver the Tories enough votes to win. However, if the economy is on the slide then all slogans and promises will be ignored, much as was the case for Theresa May's 2017 all about getting Brexit done election campaign.

So the focus of this analysis is where the economy stands and it's direction of travel relative to where economy stood in the run up to the June 2017 General Election as one of the 9 key election forecasting lessons learned from the outcome of the 2017 general election.

UK General Election Forecast Analysis

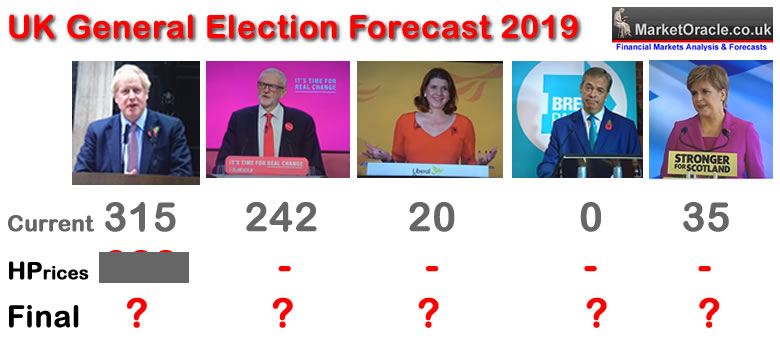

The aim of this series of analysis is to further fine tune my core election forecast based on the single most accurate predictor of UK general elections, house prices momentum that concluded in a forecast of xxx seats first made available to Patrons who support my work on the 24th of November 2019.

- UK House Prices Momentum General Election Core Forecast

- Labour vs Tory Manifesto Voter Bribes Impact on UK General Election Forecast

- What the UK Economy Predicts for General Election 2019

- Marginal Seats, Social Mood and Momentum Election Impact

- Opinion Polls and Betting Markets, UK General Election Forecast Conclusion

My last analysis on the Manifestos pushed the seats forecast in favour of the Labour party, putting the Tory seats tally stands at xxx ahead of my final forecast that I aim to complete several days before polling day (12th December).

What the economy Predicts for the UK General Election 2 of 5

- UK Economy - GDP Growth

- UK INFLATION - CPI / RPI / REAL

- UK Unemployment Fake Statistics

- REAL TERMS AVERAGE EARNINGS

- UK General Election Tory Seats Projections

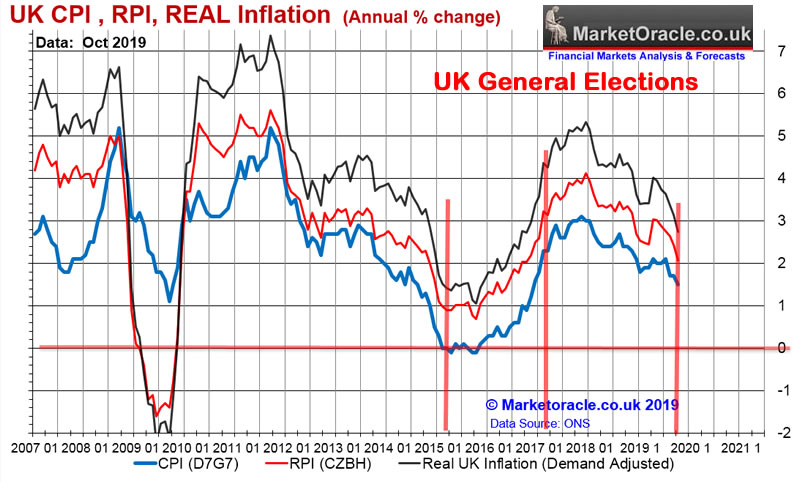

UK INFLATION - CPI / RPI / REAL

The primary remit of the Bank of England is price stability, one of keeping UK CPI inflation at 2%, the closer the rate is to 2% the more successful the Governments inflation policy is deemed to be. Despite the fact that CPI inflation tends to grossly under report REAL inflation, which is why most people prefer the RPI measure that the government has been gradually phasing out over the past decade and where the most recent announcements are to even change its methodology to the point where it closely matches CPI.

So I have always taken the official inflation indices with a giant pinch of salt which is why I constructed my own demand adjusted inflation indices that aims to provide an inflation measure more inline with with the actual experience of most people. And thus should give a more reliable view on where voters stand in terms of their actual inflation experience as opposed to manipulated government statistics.

2015

As is the case with most fake statistics that they tend to throw up anomalies that don't reflect reality. Which was the case in the run up to the 2015 General Election where the ONS was reporting negative CPI of -0.1%. Meanwhile the more reliable RPI was suggesting an inflation rate of 1%. Whilst REAL inflation was at 1.5%. Furthermore the trend was for falling inflation. Thus RPI and REAL inflation were signaling economic competence to the electorate for which David Cameron was rewarded with an 'surprise' increased majority.

2017

The Inflation indices were rocketing higher In the run up to the 2017 General Election with CPI at 2.9%, RPI at 3.7% and REAL Inflation nudging 5%. Which were thus SCREAMING economic incompetence. So much for "Strong and Stable"! More like "Weak and Feeble". And so Theresa May paid the price for inflationary incompetence.

2019

Current CPI stands at 1.5%, RPI 2% and Real Inflation at 2.8%. With the trend downwards. Thus signaling economic competence to the electorate. So a vote winner for Boris Johnson, signaling better than 2017 but worse than 2015.

The rest of this analysis in my Forecasting the UK General Electon series has first been made available to Patrons who support my work:What the UK Economy Predicts for General Election 2019

- UK Economy - GDP Growth

- UK INFLATION - CPI / RPI / REAL

- UK Unemployment Fake Statistics

- REAL TERMS AVERAGE EARNINGS

- UK General Election Tory Seats Projections

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.