Most Popular Financial and Stock Markets Analysis of 2019

Stock-Markets / Financial Markets 2019 Jan 02, 2020 - 11:55 AM GMTBy: Nadeem_Walayat

Stock Market Trend Forecasts Review 2019

The Stocks bull market is on course to end 2019, it's 11th year up by 24% with the Dow's last close of 28,462 against 23,062 of 31st Dec 2018.

My expectations for virtually the whole of this year has been for the Dow to target a trend towards at least Dow 28k by the end of the 2020, including to expect a Santa rally of sorts to materialise.

1st March 2019 - Stock Market Trend Forecast March to September 2019

Therefore my forecast conclusion as illustrated by the below chart is for the Dow to target a trend to at least Dow 28,000 by Mid September 2019.

Initially the Dow looks set to correct during March to approx 24,500 before rallying to attempt to break above 27,000 during May, a correction from which should set the scene for an eventual breakout to 28,000 by Mid September.

30th Sept 2019 - Dow Stock Market Trend Forecast Oct to Dec 2019

Therefore my forecast conclusion as illustrated by the below chart is for the Dow to target a trend towards Dow 27,500 by the end of this year following a significant correction during October that could see the Dow trade as low as 24k.

(Charts courtesy of stockcharts.com)

23rd Oct 2019 - Dow Stock Market Trend Forecast October Update

Therefore my forecast update as illustrated by the below chart is for the Dow to continue to target a trend to at least Dow 27,500 by the end of this year following a significant correction low that has likely shifted a couple of weeks into Mid November.

Market Oracle Top 10 Most Popular Articles of 2018

1 |

US Dollar Breakdown Begins, Gold Price to Bolt Higher |

Jun 30, 2019 - 06:29 PM GMT By: Jim_Willie_CB

A major breakdown is in progress for the USDollar index. It has broken its intermediate uptrend which began in April 2018. Eighteen months of official rate hikes and tremendous hidden activity with derivative bond purchases, which obscure the absent USTreasury Bond buyers, have finally weighed on the King Dollar. The USEconomy suffers from 20 key breakdown signals, about which the lapdog press refuses to report. The historical tightening has turned into a failed experiment, an attempt to return to normalcy when no such event can possibly occur. Ponzi Schemes cannot be gradually unwound. The USGovt debt has gone past $22 trillion. The USGovt deficit this year is set to surpass $1.3 trillion. The missing money volume for the USGovt, a fat pig exploited by various departments, is conservatively estimated at $21 trillion. The global bond market investors no longer expect the USGovt debt to be repaid, as a failure mindset has crept into the bond arena.

2 |

Market Decline Will Lead To Pension Collapse, USD Devaluation, And NWO |

Sep 10, 2019 - 05:07 PM GMT By: Raymond_Matison

It is the goal of this article to project the current financial, economic, and geopolitical trends to a logical and credible future outcome. Some of these trends such as in demographics have been in motion for decades, while other trends such as those for negative interest rates have been developing for a much shorter time frame. Pension asset accumulation and eventual payout also extend over decades, and therefore are reasonably predictable. Even money and credit creation trends by the FED have been in place for a long period of time. Finally, the extended bubble market in fixed income and equities, in light of slowing economic trends, provides some assurance to future price expectations.

3 |

Markets August 19 Turn Date is Tomorrow – Are You Ready? |

Aug 18, 2019 - 05:54 PM GMT By: Chris_Vermeulen

Our August 19 breakdown prediction from months ago has really taken root with many of our followers and readers. We’ve been getting emails and messages from hundreds of our followers asking for updates regarding this prediction. Well, here is the last update before the August 19th date (tomorrow) and we hope you have been taking our research to heart.

First, we believe the August 19 breakdown date will be the start of something that could last for more than 5 to 12+ months. So, please understand that our predicted date is not a make-or-break type of scenario for traders. It means that we believe this date, based on our cycle research, will become a critical inflection point in price that may lead to bigger price swings, more volatility and some type of market breakdown event. Thus, if you have already prepared for this event – perfect. If this is the first time you are reading about our August 19 breakdown prediction, then we suggest you take a bit of time to review the following research posts.

4 |

The Trump Stock Market Trap May Be Triggered |

Jun 29, 2019 - 03:47 PM GMT By: Barry_M_Ferguson

From the Christian Bible, John 8:32 - Jesus speaking: “If you abide in My word, you are My disciples indeed. And you shall know the truth, and the truth shall make you free.”

So, we have it on pretty good authority, Jesus Christ, that freedom is spawned from truth. If humans want to be free, they must therefore seek the truth.

The current day media, news - sports - financial, has gone full bore communist state mouth piece. They only report what they want us to believe. Deceivers push falsehoods to enhance their own power with the hope of enslaving the masses. The serpent doesn’t use an apple today. The serpent uses the microphone, politicians, entertainers, complete human ignorance, electronic media, and social media for deceit.

5 |

Uber’s Nightmare Has Just Started |

Sep 05, 2019 - 02:38 PM GMT By: Stephen_McBride

“Never get in cars with strangers…”

Did your parents tell you that when you were a kid?

These days, people get in cars with strangers all the time... only they use a smartphone “app” to match them with a specific stranger to drive them around.

As you may have guessed, I’m referring to Uber, the world’s biggest ride-sharing company.

It’s like a taxi company except it doesn’t own any cars. It doesn’t employ any drivers either. Instead, it runs an app that connects drivers with people who need a ride.

6 |

Fed Too Late To Prevent A US Housing Market Crash? |

Aug 21, 2019 - 04:43 PM GMT By: Chris_Vermeulen

Real Estate is one of the biggest purchases anyone will make in their lifetime. It can account for 30x to 300x one’s annual income and take over 30 years to pay off. After you’re done paying for your property, now you have to keep paying to maintain it and to support the property taxes to keep it. What has happened to the US Real Estate market since the 2008-09 global credit market collapse and is the US Fed behind the curve?

7 |

Land Rover Discovery Sport Oil Service Interval at 12,000, 14000 or 21,000 Miles? |

Apr 29, 2018 - 10:09 AM GMT By: N_Walayat

Land Rover's sales pitch is that the Discovery Sport's first service is due at 21,000 miles or 2 years, thus saving owners on expensive services. That and their service packs only tend to cover for 1 service every 2 years which may be the reason for the 21,000 miles service sales pitch. Unfortunately on the one hand there's the sales pitch and then there's the reality of what to actually expect when owning and driving a Land Rover Discovery Sport as there exists a wide gap between the two.

8 |

Stock Market Crash Black Swan Event Set Up Sept 12th? |

Sep 12, 2019 - 01:42 PM GMT By: Brad_Gudgeon

Gold has firmed above $1300 in recent days and is holding comfortably above $1300 for now. We think the market will break to the upside sometime this year. The question is when. Here are 3 things to watch that will tell us if Gold is on the cusp of that break-out soon or later.

First, keep your eye on Gold’s close at the end of next week. It’s not only the end of the week and month but also the end of the quarter. While Gold has traded above $1350 multiple times in the past two years, it has not made a quarterly close above $1330 since 2012. Since this is a quarterly time frame, we would need to see a close above $1340 or even $1345 to mark a significant breakout. If Gold can make such a close next Friday then the odds are good that it could break above $1375 fairly soon.

9 |

Gold Price Trend Forecast 2019 Current State |

Oct 30, 2019 - 02:55 PM GMT By: Nadeem_Walayat

The gold bull run of 2019 peaked early September at $1566, up over 25% on the year! Which will likely have encouraged many prominent gold bugs to get carried away with various headlines of Gold heading for $5000, $10,000 and beyond. However, since it's peak the Gold price has been drifting lower at a shallow pace to it's last closing price of $1491, still up over 19% on the year. So is this a correction in a bull market or marks the end of Gold's bull run for 2019?

10 |

2019 From A Fourth Turning Perspective |

Jan 01, 2019 - 03:52 PM GMT By: James_Quinn

“An impasse over the federal budget reaches a stalemate. The president and Congress both refuse to back down, triggering a near-total government shutdown. The president declares emergency powers. Congress rescinds his authority. Dollar and bond prices plummet. The president threatens to stop Social Security checks. Congress refuses to raise the debt ceiling. Default looms. Wall Street panics.” – The Fourth Turning – Strauss & Howe

Stock Market Analysis 2020

This is my overall outlook for what to expect for 2020, i.e. that seeks to answer whether the Dow will end the year higher or lower and by roughly how much. Which I will follow up with a series of in-depth pieces of analysis that typically conclude in 2-3 month trend forecasts, similar to that for 2019, with the first detailed trend forecast to be completed during January.

But first an overall road map of what to expect for 2020!

REMEMBER QE IS FOREVER!

My consistent message since QE money printing began a few weeks prior to the birth of this stocks bull market in March 2009, my message has been that once QE money printing starts then it NEVER ENDS! So LEVERAGE once self to the perma money printing INFLATION MEGA-TREND. Invest in assets that are LEVERAGED TO INFLATION.

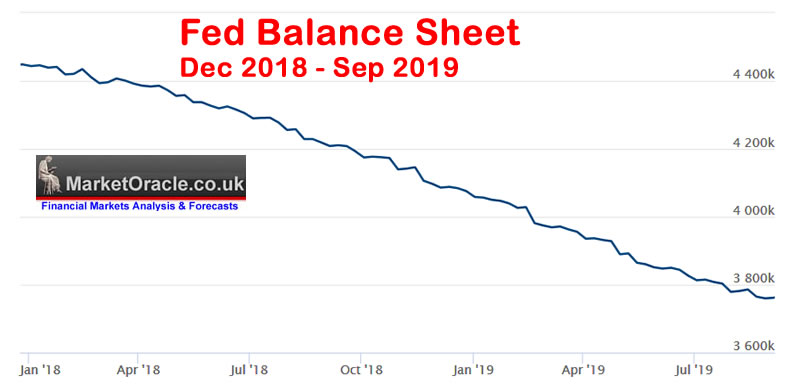

And so it has been for the whole of 2019, even in the wake of the Fed's apparent unwinding of its balance sheet from about £4.4 trillion down to $3.75 trillion as the below graph illustrates -

April 30th 2019 - US House Prices Trend Forecast 2019 to 2021

QE4EVER!

A reminder folks that regardless of Fed propaganda and what you read in the mainstream press QE is 4 EVER! Once it starts it doesn't stop. As I iterated 2 months ago in my stock market analysis at the start of March (Stock Market Trend Forecast March to September 2019)

So why has the the stock market soared, what is that the stock market knows that most commentators and economists fail to comprehend? We'll for one thing there are the dovish signals out of the Fed which go beyond a pause in their interest rate hiking cycle in response to a subdued inflation outlook. Similarly the worlds other major central banks have their own reasons to avoid rate hikes, most notable of which is the Bank of England that has been busy propagandising the prospects of a NO Deal Brexit Armageddon in attempts to scare Westminister into avoiding EXITING the European Union in anything other than an ultra soft BrExit.

So on face value the stock market is clearly discounting not just a more accommodative interest rate environment but that QE REALLY IS FOREVER! Once it starts it DOES NOT STOP! As evidenced by the Fed's balance sheet first having exploded from about $800 billion to over $4.5 trillion, all to bailout the banking crime syndicate by inflating asset prices such as housing and stocks so as to generate artificial profits for the central bankers banking brethren. But none of this news, for I have written of it for a good 10 years now that QE will never stop as the worlds central banks will repeatedly expand QE to monetize government debt.

So I would not be surprised that WHEN the next crisis or recession materialises, QE will resume, by the end of which the Fed balance sheet will likely have DOUBLED to at least $8 trillion. And it is this which the stock market is DISCOUNTING! Just as has been the case for the duration of this QE driven stocks bull market that clearly paused during 2018 in the wake of mild Fed unwinding of its balance sheet. So forget any lingering Fed propaganda for the continuing unwinding it's balance sheet, the actual rate of of which has slowed to a trickle and thus we are probably near the point when the Fed ceases unwinding it's balance sheet because as I have often voiced that once QE starts it does NOT STOP!

So whatever form the NEXT crisis takes, the Fed will be at hand to print money and double its balance sheet, as it will periodically continue to supports asset prices such as housing which cannot be printed. We'll not until we see start seeing house building 3D printing drones emerge from the machine intelligence mega-trend that will fly around in swarms and erect designer houses anywhere on the planet.

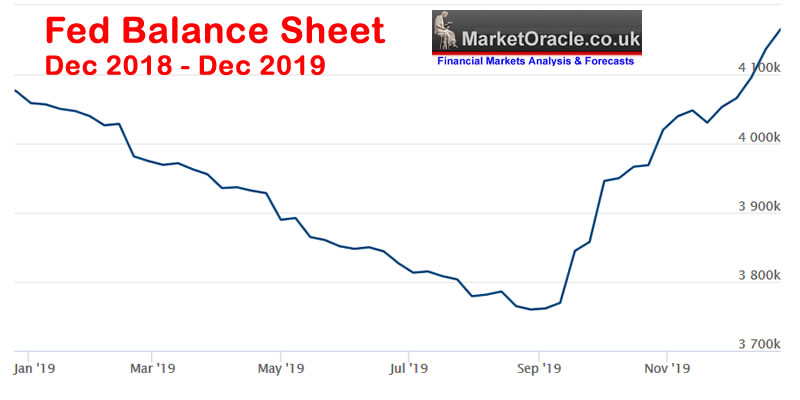

So it was only a matter of time before the Fed started the printing presses rolling once more and this without any obvious reason to do so, other than that the Fed MUST avoid any chances of a recession during an election year which is precisely what the Fed has now succeeded at doing!

RAMPANT MONEY PRINTING that makes a mockery of the propaganda of Fed unwinding QE that many swallowed for much of 2019. What this means is that there is NOT going to be a recession in 2020! So you can forget about all of the recession noise in the mainstream media of recession risks for stocks.

Long-term Trend Analysis

The rest of this analysis has first been made available to Patrons who support my work: Stock Market Trend Forecast Outlook for 2020

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Also immediate access to my just completed analysis that lists potential buying levels for the Top 15 AI Mega-trend stocks. Where the main thing is for investors to HAVE EXPOSURE to the AI sector! Because without any exposure your not riding the AI train and so unless you are prepared to immerse yourself in AI, i.e. trundle along to the many AI platforms out there such as by Google. Microsoft or Elon Musk's OpenAI then your only real way to capitalise on the AI mega-trend is buy OWNING AI stocks.

This graph further illustrates the magnitude of the change currently under way, where just 2 primary AI stocks, Apple and Microsoft are now worth more than the entire German stock market!

AI Stocks 2019 Review and Buying Levels Q1 2020

And my next analysis is already underway that I am to complete within the next few days.

- British Pound trend forecast

- Gold / Silver Updates

- UK Housing market series

- Stock Market Trend Forecast 2020

- Machine Intelligence Investing stocks sub sector analysis

- US Dollar Index

Your Analyst wishing ALL a Happy and Prosperous New Year!

By Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.