Uber’s Nightmare Has Just Started

Companies / Self Driving Cars Sep 05, 2019 - 02:38 PM GMTBy: Stephen_McBride

“Never get in cars with strangers…”

“Never get in cars with strangers…”

Did your parents tell you that when you were a kid?

These days, people get in cars with strangers all the time... only they use a smartphone “app” to match them with a specific stranger to drive them around.

As you may have guessed, I’m referring to Uber, the world’s biggest ride-sharing company.

It’s like a taxi company except it doesn’t own any cars. It doesn’t employ any drivers either. Instead, it runs an app that connects drivers with people who need a ride.

Since 2009, Uber has grown into a hundred-billion-dollar company. It’s become so big and popular that it’s hard to imagine the world without it.

Hardly anyone “takes a taxi” anymore. Everyone “Ubers”…

The most-hyped IPO since Facebook…

After years of extraordinary growth, Uber launched an IPO on May 10.

An IPO, as you may know, is when a company first sells shares in the public markets. It marks the first time individual investors can buy the stock.

Uber’s debut on the stock market was one of the most hyped financial events since Facebook went public in 2012.

It was on every financial TV. The headlines screamed “this is the next Facebook.”

Everyone was talking about it… I even heard stories of people putting half of their savings in this single stock.

I understand, Uber is a colossal technology company that has become part of everyone’s lives.

It has changed the way we commute. It even disrupted culture.

Who would have thought we would take rides from strangers in their personal cars on a regular basis?

But while Uber is a disruptive company, it’s a terrible business… and its stock is a horrendous investment.

You don’t need a master’s degree in business to understand this…

Every business has to eventually make more money than it spends. Period.

Yes, you can sacrifice profit to win customers at the beginning… but eventually you have to make money to cover your expenses and reward investors.

The thing is, after 10 years, Uber is still highly unprofitable. Worse, its losses are growing at astronomical levels.

Last year, it lost $1.8 billion… while last quarter, it lost a whopping $5 billion.

To put this in perspective…

In its IPO, Uber raised $9 billion…

… five of which it has already burned. IN A SINGLE QUARTER.

As I wrote in May, Uber loses 25 cents on every dollar it brings in and an average of $1.20 on every ride.

It’s burning money so fast that it lost more in the nine months leading up to the IPO than Amazon did in its first seven years!

Now, here’s simple math.

If you are losing money as a business, you have two options: cut your expenses or raise prices.

Uber’s biggest expense is driver pay. It pays back to drivers about 80% of all the money it generates.

That means to turn profit, Uber has to cut driver pay… or raise its fares.

And as I’ll explain, neither is possible.

Days before Uber’s IPO, Uber drivers boycotted the company and turned off the app…

They marched the streets in protests demanding higher pay and better working conditions.

Uber drivers now earn an average of $10 to $12 an hour in the US after expenses, according to researchers.

No surprise they are unhappy. The current pay is almost on par with the federal minimum wage.

Uber has no room to cut driver pay. Its drivers would just quit or migrate to Uber’s competitors.

Now, if you are losing money and can’t cut your expenses, your only option is to raise prices.

The problem is Uber is in a stalemate position where it can’t hike its fares.

A never-ending price war with Lyft…

The US is Uber’s biggest and most profitable market. But here, it has one big challenge.

You’ve probably heard about Lyft, Uber’s biggest competitor in the US.

These two companies have battled each other in price wars for years to undercut taxi fares and steal customers from each other.

It’s estimated that they’ve lost a combined $13 billion… and both still have no roadmap to profitability.

In other words, Uber is locked in a price war with Lyft.

As I’ll explain later, the moment Uber raises fares, its customers will switch to Lyft or another competitor.

But Uber’s problems with the competition don’t end here…

Uber can’t keep up with cutthroat competition overseas…

Another way Uber could raise its profits would be to grow globally.

But here, Uber’s prospects look even grimmer.

Bolt, an Estonia-based ride-sharing company, is quickly taking over Europe. In a lot of European cities, it’s a #1 ride-hailing app already.

It’s a heavy blow to Uber’s growth potential in Europe.

For example, London has been one of the biggest, most profitable markets for Uber. For years, Uber enjoyed zero serious competition in this city. Now it has Bolt.

Elsewhere Uber has already lost the battle with local competitors:

It has exited Russia after losing the battle with Yandex.Taxi…

It has exited China after losing the battle with DiDi…

And it has exited Southeast Asia after losing the battle with Grab and Go-Jek.

Southeast Asia accounts for more than 70% of the global ride-sharing market.

And these competitors are not just a local problem. Just like Uber, they have set their sights on the global market.

Take Brazil, where Uber boasts an 80% market share. It could be a money-making machine for Uber. And yet, the company bleeds money in Brazil because it’s fighting a price-war with China’s ride-sharing giant DiDi.

It’s a race to the bottom, which forces Uber to keep prices low and marketing expenses high.

Uber customers don’t care about Uber…

Would you take a ride with Uber if it cost twice as much as Lyft? That’s how much Uber needs to raise its fares to start earning money.

Probably not…

That’s because Uber’s app is no different from its competitors. It has no customer loyalty whatsoever.

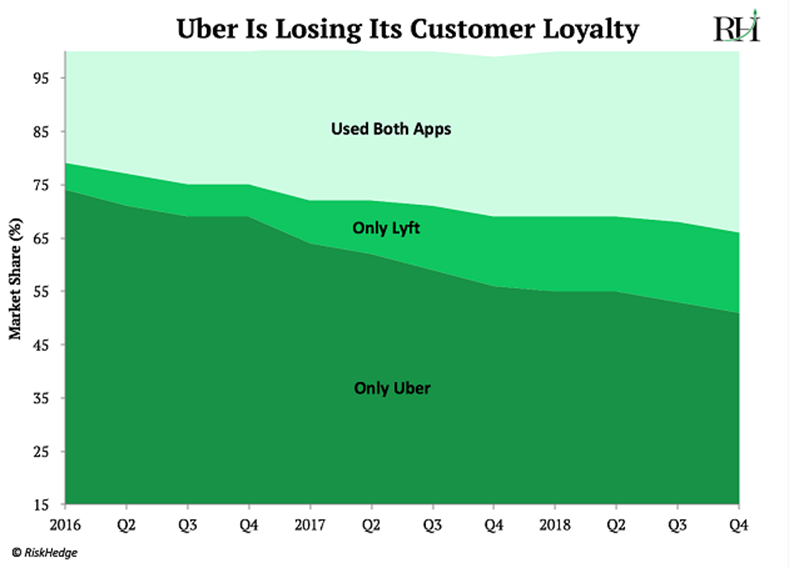

In fact, more than 34% of people in the US who use ride-hailing services use both apps, Lyft and Uber. That’s up 50%+ from two years ago, according to Vox.

Many people switch back and forth between Uber and Lyft, choosing whichever one offers a better price at the moment.

And with its fierce competitors charging about the same or lower fares, this makes it impossible for Uber to raise prices.

Meanwhile, Uber is losing its market share not only globally but also in the US, as you can see in the above chart.

Let me say this one more time: It’s a race to the bottom.

Uber is worth no more than $20/share

Uber is currently trading for 4X sales. In short, this means Uber's value is 4X greater than its annual sales.

For perspective, that’s more expensive than Amazon or Apple.

My research shows 3X sales is a fair price, if we are really generous.

The problem is, at 3X sales, Uber is worth no more than $20 to $22/share. And that’s currently 30% below its price.

That’s where I see the stock going in the coming years.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.