Is Stock Market Selling Madness About Over?

Stock-Markets / Stock Market 2021 May 16, 2021 - 06:55 PM GMTBy: Monica_Kingsley

The inflation scare amplified by CPI data has died down yesterday a little. Buying returned into the S&P 500, lifting Nasdaq ever so little too. VIX steeply rejected moving higher, and looks ready to decline today, but the put/call ratio doesn‘t share the optimism as obviously the bearish scenarios, powered by the inflation scare forcing a deflationary outcome in an overleveraged financial system is emboldened by the downfall‘s steepness since Monday and ineffective attempts to coutner it on Tuesday. While one swallow doesn‘t make a summer, the technical picture in the hardest hit tech is gradually improving, worthy of benefit of the doubt while you dance close to the Nasdaq exit door.

Credit markets have crucially improved, with the junk corporate bonds leading the way, and value stocks being soundly bought again. All it took was a decent daily stabilization in long-dated Treasuries coupled with an intraday upswing attempt – no issue that it fizzled out before the close, apparently. The markets are coming to terms with higher inflation, and the commodities hit starting with lumber, stretching to copper, and eventually also oil and soybeans yesterday, would likely recover – first those that hadn‘t been all that overheated.

The Fed isn‘t serious about fighting inflation, otherwise it wouldn‘t be rolling out the speaking procession on an almost daily basis. Occam‘s razor at work:

(…) all we‘re experiencing now, is:

(...) a risk-off move driven by the growing inflation threat – the market is getting attentive again. How long before it forces the Fed to talk, act and not play ostrich? The evidence isn‘t strong thus far, but there is a lot of time left till the Jun Fed meeting. Needless to say, bold moves would crater risk-on assets, which is why I‘m not expecting any real action yet with the 10-year yield...

… at 1.66% only, which by no means serious enough to spur the Fed into action.We‘ve been there already, and as stated, 10-year yields above 2% would start to bite stocks, but it‘s only higher levels that would force the Fed into action and pegging them in the 2 to 2.5% range. We‘re far away from that, these are just (mild) birthing cramps, a premature alarm. We‘re still in a reflation – so far.

Gold and miners resilience leading to further upswings, is on – and it seems that precious metals would lead select pockets of commodities (yes, silver looks ready to do that job, and that extends to the so far still range bound silver miners one day too) higher as we keep transitioning to a higher inflation environment for months already:

(…) With high inflation already here (don‘t look for too much relief once the low year-on-year comparison base is history), real rates are turning more negative – and nominal ones aren‘t yet catching up onto what‘s coming. Seriously, I don‘t know why majority of market participants have been caught this much off guard by the inflation data, which is the basis of cost-push inflation I had been talking quite many times already.

Negative real rates would start supporting the metals increasingly more as the decoupling from nominal yields gathers more steam. The precious metals upleg is still in its early stages, and about to add more to my open gold profits.

Crude oil would be positively affected by the anticipated rebound in commodities from the weekly setback, as these would balance out the rising yields in a way, and would do well past reflation time. Right on cue, my new oil position is already profitable.

Bitcoin had a high volatility day yesterday, but closed almost where it opened. Tentative signs of stabilization and accumulation are here, and Ethereum isn‘t wasting time in returning to growth, which is a positive signal for the best known crypto.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

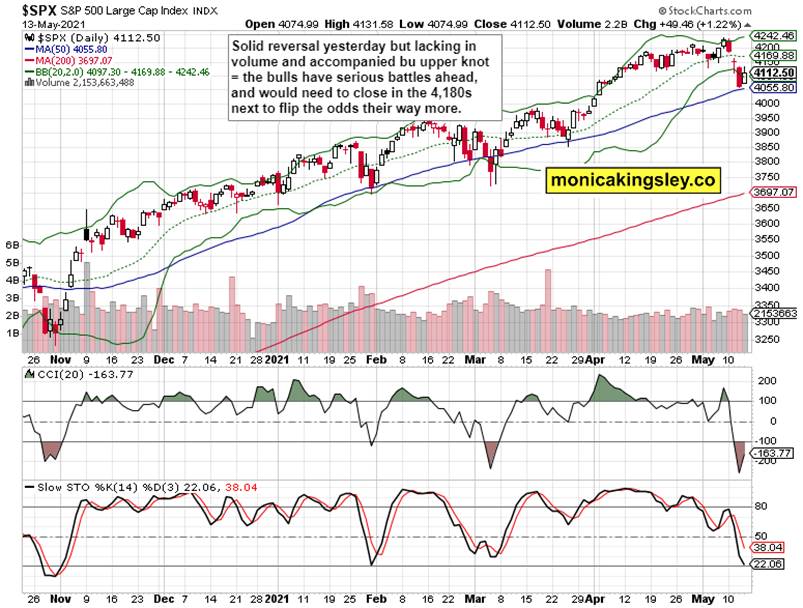

S&P 500 Outlook

S&P 500 recovered, but it‘s all about volume and the upper knot pointing to stiffer headwinds just next.

Credit Markets

- High yield corporate bonds (HYG ETF) made a steep and credible recovery, and the investment grade ones didn‘t perfom all too badly either upon the daily TLT „miracle“.

Technology and Value

Tech recovery left much to be desired, and the long upper knot isn‘t appetizing. Obviously much depends upon the next TLT and inflation expectations moves, but $NYFANG seems to be readying a temporary respite next. Given how value performed yesterday, that would be overly positive for the S&P 500 as the index needs to be firing on both cylinders to make real progress.

Gold, Silver and Miners

Gold and miners keep trading in harmony, and new precious metals upswing is in the making. See how little an TLT uptick coincided with that turn.

Silver daily downswing might not appear to confirm the bullish assessment, but I think that‘s a daily occurence only.

Crude Oil

Crude oil dipped a bit too far yesterday, but doesn‘t appear to be breaking down. I look for more backing and filling before the upswing resumes.

Summary

S&P 500 bulls are getting to (and should) flex some muscles, and not muddle through in the 4,130 ramge for too long. The weak retail sales aren‘t exactly a positive catalyst but at least it puts to rest the misguided notions of the Fed springing to action.

Gold, silver and miners are well positioned for the upswing resumption, and much of the downside indeed appears to be in already.

Crude oil meandering goes on, but without bearish overtones – the chart remains bullish.

Bitcoin has started to timidly repair the damage inflicted while Ethereum is back to growth already. The leading crypto‘s position still remains murky at the moment.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.