What Investors and Traders Should Be Doing About the Stock Market’s Strange Behavior

Stock-Markets / Stock Market 2021 May 22, 2021 - 10:22 AM GMTBy: Stephen_McBride

Today, I’m going to answer a question that’s likely on your mind. It’s about the stock market’s recent strange behavior and the one thing ALL investors and traders should be doing about it.

Today, I’m going to answer a question that’s likely on your mind. It’s about the stock market’s recent strange behavior and the one thing ALL investors and traders should be doing about it.

You see, one of the very first stocks I ever recommended just reported phenomenal earnings. Sales jumped 37%. The company acquired a record number of customers, and it forecasts great sales again next quarter. What do you think happened to the stock price? We’ll come back to this in a moment.

I’m talking about The Trade Desk (TTD)

We don’t own the stock in any of our premium advisories at RiskHedge. But I highlighted the stock multiple times back in 2018, when it was trading for less than $100/share.

It soared to over $950—making it the first 10-bagger I ever recommended publicly. In short, TTD runs a “stock exchange” for digital ads. The company helps advertisers buy the right ads on the internet—and business is booming. In 2020, marketers spent a record $4.2 billion on its platform. And the number of firms buying over $1 million worth of ads has more than doubled.

And as I mentioned, it just reported blowout earnings. Now, normally, great earnings = a higher stock price for TTD.

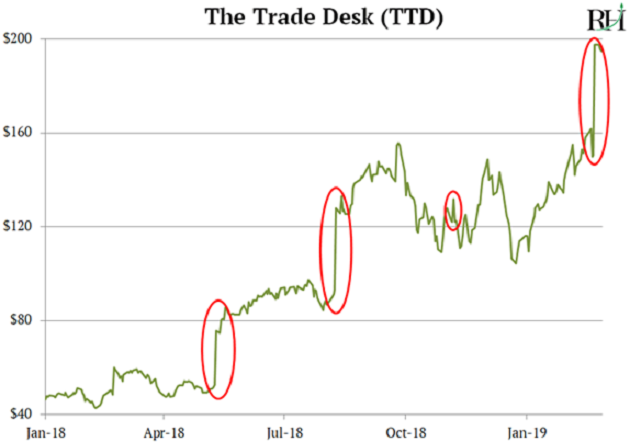

You can see what I mean in the chart below. It covers a period from 2018–2019 when I was recommending the stock. The red circles mark the days that TTD announced quarterly financial results.

As you can see, three of the four announcements produced giant spikes in the stock price, including a 31% gain on February 21, 2020. But this time, the exact opposite happened.

TTD dropped 26% on Monday after reporting great earnings

That’s right. The company knocked earnings out of the park, and its stock lost a quarter of its value. And TTD’s not the only company falling after reporting great earnings.

Peloton’s sales more than doubled—its stock dipped 15%. Craft marketplace Etsy achieved its best quarter ever, recording 135% sales growth, and the stock has slumped to its lowest levels since last December. Telehealth pioneer Teladoc grew revenues 151%, and the stock dropped to its lowest levels since before the COVID pandemic. Growth powerhouses Amazon, Microsoft, and Apple also reported record earnings recently. Yet, their stocks dropped.

This shines a light on the type of market we’re in right now. 2020 was one of the best years in history for fast-growing companies. COVID lockdowns jabbed a big syringe of growth into practically every tech company.

With gyms shut, folks cycled Peloton bikes in their living rooms. Instead of sitting in waiting rooms, Americans “visited” doctors online through Teladoc. Zoom meetings replaced boozy work lunches with colleagues.

But as America reopens, investors have turned sour on fast-growing tech stocks. It doesn’t matter if a company posts record earnings or not. In this irrational market, my message is simple: Don’t focus on the earnings results. Instead, pay very close attention to how a stock reacts to earnings.

In my experience, the market’s reaction to results matters more than anything else in the short term. That’s especially true when the reaction isn’t what you’d expect. If a stock falls on bad earnings, that doesn’t mean much. That’s what’s “supposed” to happen.

But when a company posts great results and its stock falls, that’s a warning sign. It’s strong evidence the stock will struggle for the next couple of weeks or months. And right now, many growth stocks are flashing this warning sign.

Does that mean you should sell your weakest stocks today?

That depends on how you answer this question: Why did you buy the stock in the first place? Did you buy it because it’s a great business that can compound your money for the next 20 years?

If so, and it reported great results, and nothing about the company has changed, don’t sell it. Instead, consider buying more. After all, you’ll be buying more of a great company, at a better price, than you could’ve a month or two ago.

But not all stocks are meant to be held for years. Maybe you bought the stock as a trade, and you intended to cash out within weeks or months for a quick profit.

In that case, you should seriously consider selling a stock that plunges on great earnings. After all, it was a trade. You aren’t married to the stock. You’re just dating it.

My suggestion: Dump it and move on. You can always get back in later when an uptrend reestablishes itself.

I want to be 100% clear

My research shows we’re firmly in a bull market for stocks. There’s zero evidence that the volatility we’re seeing in growth stocks is anything more than a passing storm. One that’s hitting last year’s biggest winners—growth and tech stocks—the hardest. So, what actions are we taking in our premium services?

In Disruption Investor, I focus on larger, safer disruptor stocks that can help us build lasting wealth. Because most of these stocks are long-term plays, we’re using this volatility to accumulate more shares in world-class disruptors.

In Disruption Trader, my co-editor, Justin Spittler, and I go for quicker profits in fast-moving growth stocks. In the last couple of weeks, we’ve been closing out weaker trades and taking some risk off the table. We’re also being extremely selective in entering new trades until the volatility passes.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.