Hey, Remember About Gold Price’s Powerful Reversal?

Commodities / Gold & Silver 2023 Dec 22, 2023 - 10:08 PM GMTBy: P_Radomski_CFA

Gold price has been falling in today’s pre-market trading, but… Given the recent (HUGE!) weekly reversal, does it really surprise anyone?

The Historical Context

Well, it might surprise those that easily forget what happened in the previous weeks and focus on just the day-to-day price swings, but the truth is that the context provided by previous weeks, months, and years (and the performance of other markets!) matters a lot.

I previously wrote about some details coming from the broader perspective and some from the immediate-term analysis, and all that remains true. The recent weekly reversal was so huge that its impact on the next weeks really needs to be kept in mind at all times. It’s not likely that a daily price moves in any direction (especially that gold is lower today…) would invalidate the implications of the powerful weekly (!) reversal.

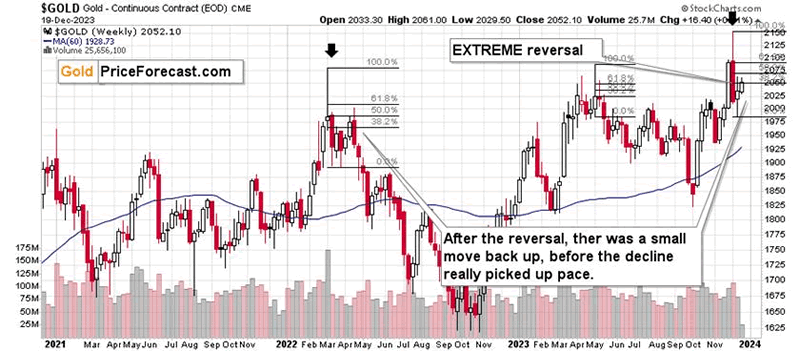

In case that massive reversal seems like a distant memory, here’s a reminder of what happened.

Gold soared above $2,100 only to plunge to almost $2,000, and in happened on huge volume. This was the most profound weekly reversal in years. It was similar to the reversal that we saw in May 2023 and the one from March 2022, and they both started big declines.

The same is likely this time.

This means that this and last week’s moves higher were just a small rebound before the decline’s continuation.

This is particularly likely given the fact that both previous weekly reversals were followed by some kind of bounce before the decline really picked up pace. In 2022, it took several weeks before the second (lower) top formed, and in May 2023, the corrective upswing was over within a week. Right now, we’re 1.5 weeks after the reversal, which means that the decline could start any day now.

Also, please note that in 2022, gold corrected over 50% of the initial decline before finishing the rebound, and in May 2023, gold corrected slightly over 61.8% of the initial decline before moving south. This means that the size of the rally that we just saw is nothing extraordinary. In particular, it doesn’t mean that gold rallied so much that it invalidates the immensely bearish implications of the recent weekly reversal.

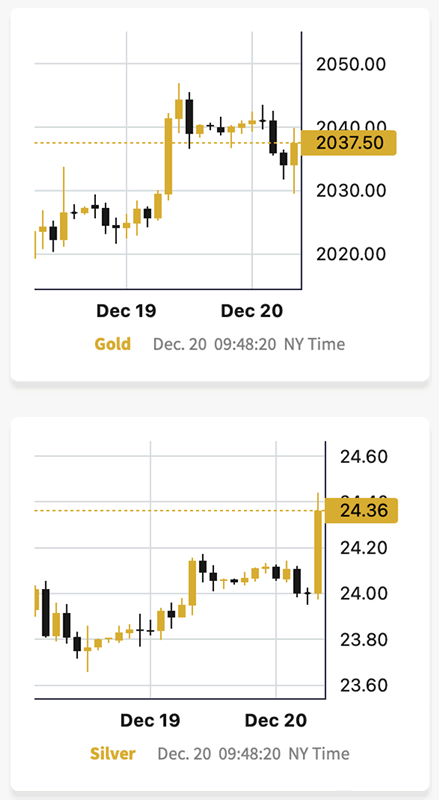

On a very short-term basis – the intraday basis – we see that silver just outperformed gold, which very often precedes sizable declines.

This means that the bearish indications come not just from the long-term charts but also from the very short-term ones.

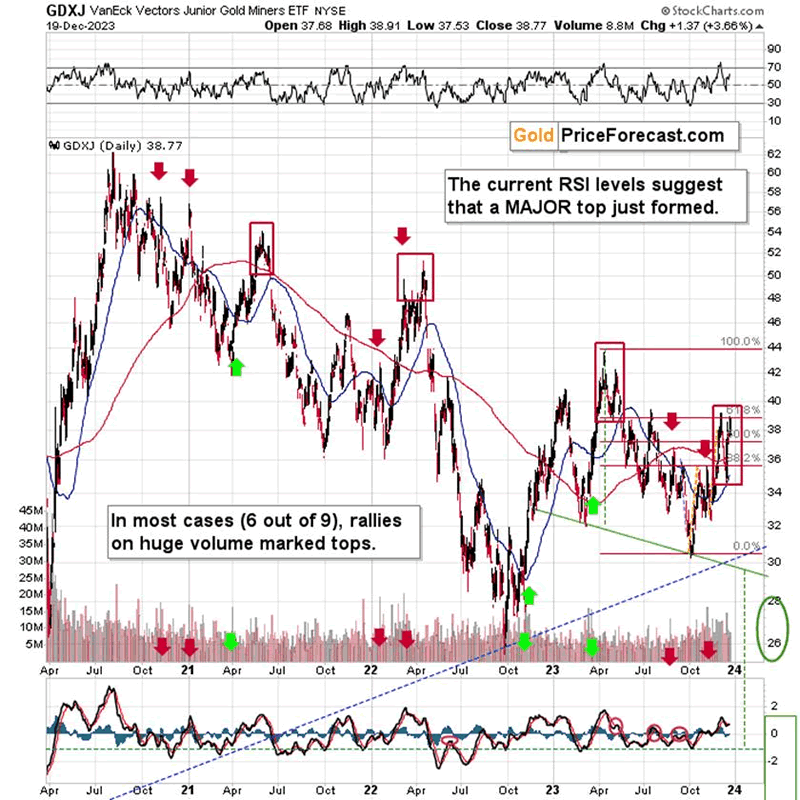

- What about the junior mining stocks? Didn’t they rally too much recently to still be considered bearish?

No.

Analyzing Recent Trends

Please take a look at the areas that I marked with red rectangles. They mark important tops in the GDXJ ETF. In those cases, junior miners topped by first declining somewhat, then correcting, and then sliding without looking back. In two out of three cases, the second (final) top was below the initial one, and in the remaining case (in early 2022), the second (final) top, was slightly higher than the initial one.

So, is seeing the GDXJ close to the previous top (but still below it) a bullish game-changer? Absolutely not.

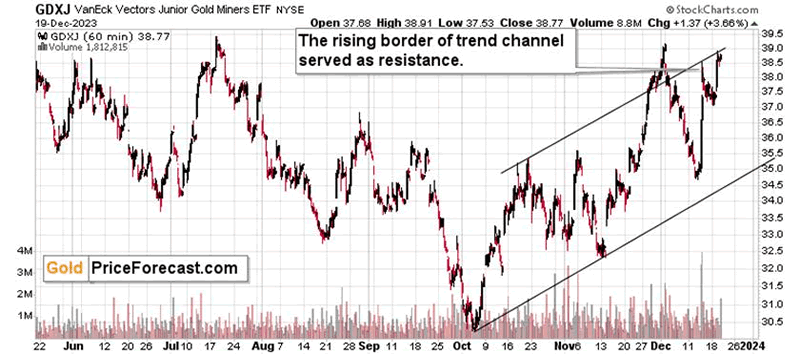

It’s not even a game-changer when we zoom in.

The junior mining stocks simply moved to the upper border of its rising trend channel without breaking above it.

The previous highs provide resistance, so it’s unlikely – especially given gold’s weekly reversal! – that a really big and sustainable rally would materialize here.

Especially given what’s happening in the USD Index.

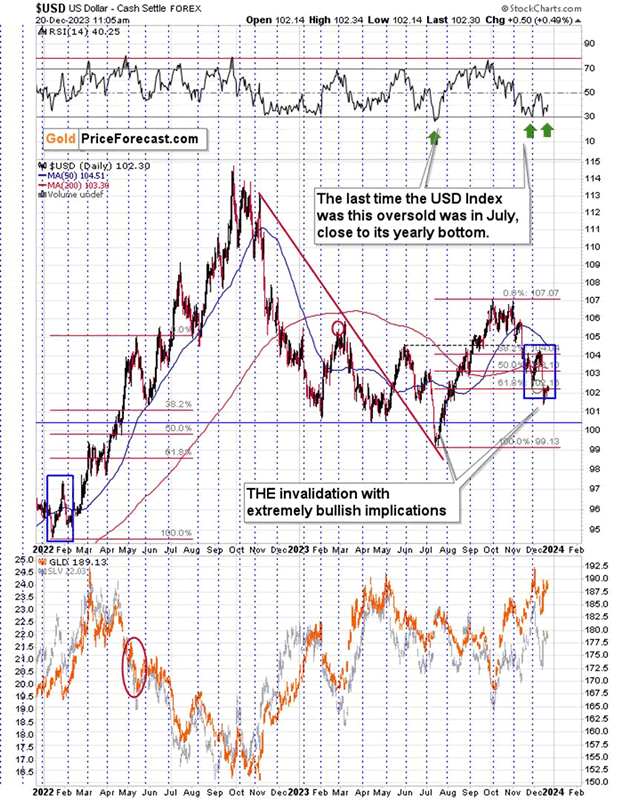

And what’s happening there is that we saw a comeback above the 61.8% Fibonacci retracement level based on this year’s rally. This serves as the final confirmation that the bottom is indeed in.

The RSI at 30 indicated it, but the breakdown’s invalidation confirms it. This bullish outlook (which is bearish for the precious metals market) is also confirmed by the USD Index’s long-term chart, but I already wrote about it yesterday, so I don’t want to repeat myself here.

Now, before summarizing, I’d like to touch on two markets that also provide extra context for the precious metals market: stocks and crude oil.

As you know, I’m commenting on the stock market every now and then, but I’m not providing trading indications for it specifically because that’s not the area where I have the greatest experience. That’s why I’m using stock market charts and USDX charts not for trading those assets but as supportive indications of the main analysis that I’m conducting on the precious metals and mining stock charts. There are others, for example, Paul Rejczak, who specialize in this (stock market) area.

Paul opened his long positions on Feb. 27, 2023 (with S&P 500 below 4,000) and is now considering closing them. I also think that stocks are extremely overbought here and, thus, likely to decline shortly, especially since they just approached their previous all-time high.

A decline in stocks is likely to trigger a decline also in junior mining stocks – that’s the part of the precious metals market that is most linked with the performance of stocks. By the way, the fact that junior miners were weak relative to gold over the medium term despite the stock market’s strong performance is simply another indication that the miners don’t want to move higher, and that the recent rallies were simply counter-trend rallies, nothing more.

The rest of the precious metals market is likely to decline along with stocks, too (like they all declined in 2020, for example), but junior miners are likely to be affected to the greatest extent.

The above doesn’t mean that all stocks would be likely to decline, though. This is the case as far as copper stocks are concerned, for example, but the situation in oil stocks is a bit different. They have their own specific technical set-up that could take them higher regardless of stock market’s decline – Anna described it in advance in late November in her Oil Trading Alert.

So, yes, while I continue to think that the biggest trading opportunity is still in junior mining stocks, naturally, there are also other opportunities out there.

All in all, the outlook for the precious metals market remains strongly bearish and the potential for our current trading positions in junior mining stocks remains enormous.

Today's article is a small sample of what our subscribers enjoy on a daily basis. They know about both the market changes and our trading position changes exactly when they happen. Apart from the above, we've also shared with them the detailed analysis of the miners and the USD Index outlook. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.