Mega Trends Suggest Investors Being Over Weight Emerging Markets

Stock-Markets / Emerging Markets Jun 14, 2009 - 04:35 AM GMTBy: Richard_Shaw

Everybody has a different stock / bond /cash allocation that is best for them. Whether the selected equity allocation is high or low, we think over-weighting emerging markets and under-weighting developed markets within the allocation is the better long-term strategy for long-term investors — except for investors currently relying on, or about to rely on, their portfolios for life style support for whom the volatility may not be appropriate.

Everybody has a different stock / bond /cash allocation that is best for them. Whether the selected equity allocation is high or low, we think over-weighting emerging markets and under-weighting developed markets within the allocation is the better long-term strategy for long-term investors — except for investors currently relying on, or about to rely on, their portfolios for life style support for whom the volatility may not be appropriate.

Much is being made of the fact that the key US equity indexes are near or slightly above their year-end 2008 level. That is clearly better than not, but year-end 2008 was at a sorry level compared to year-end 2007.

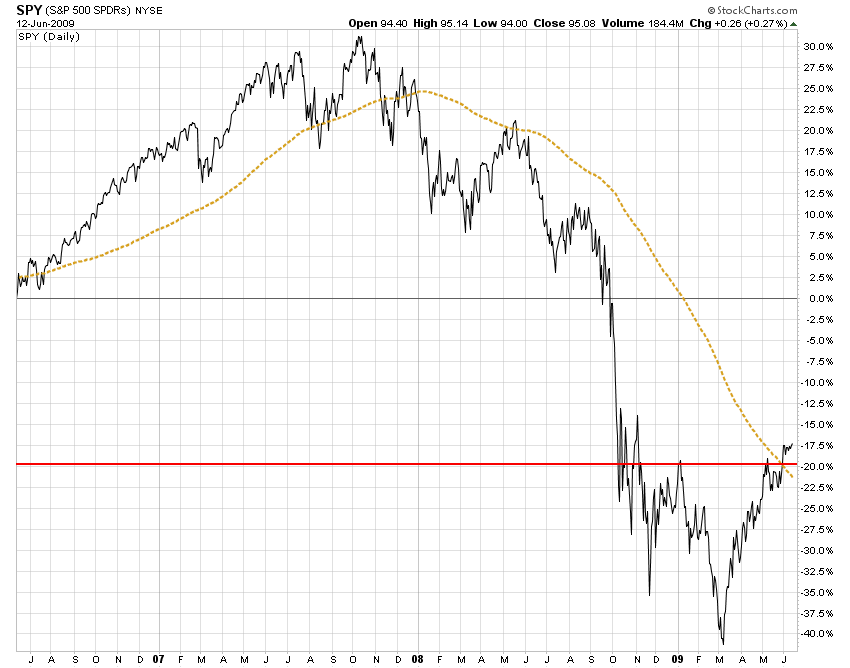

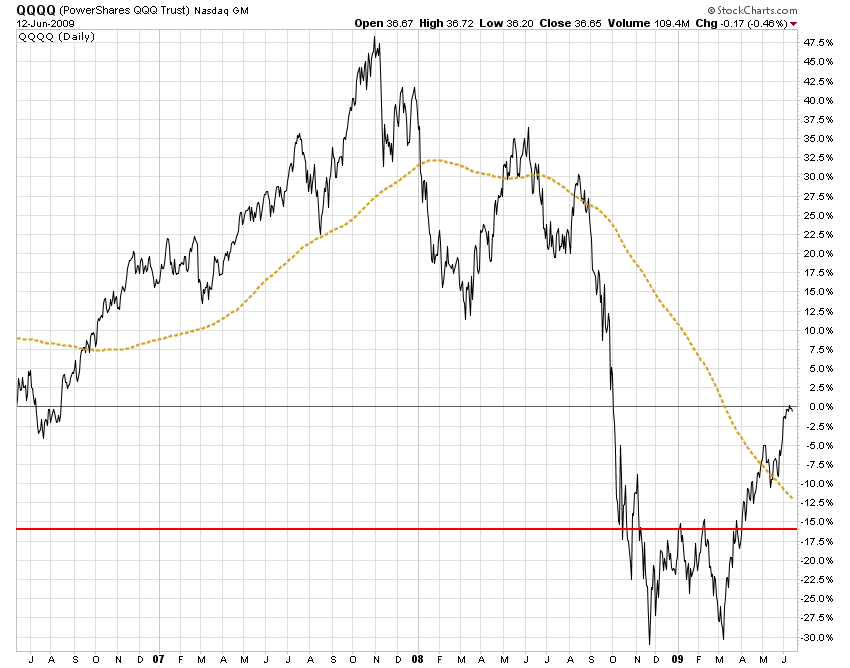

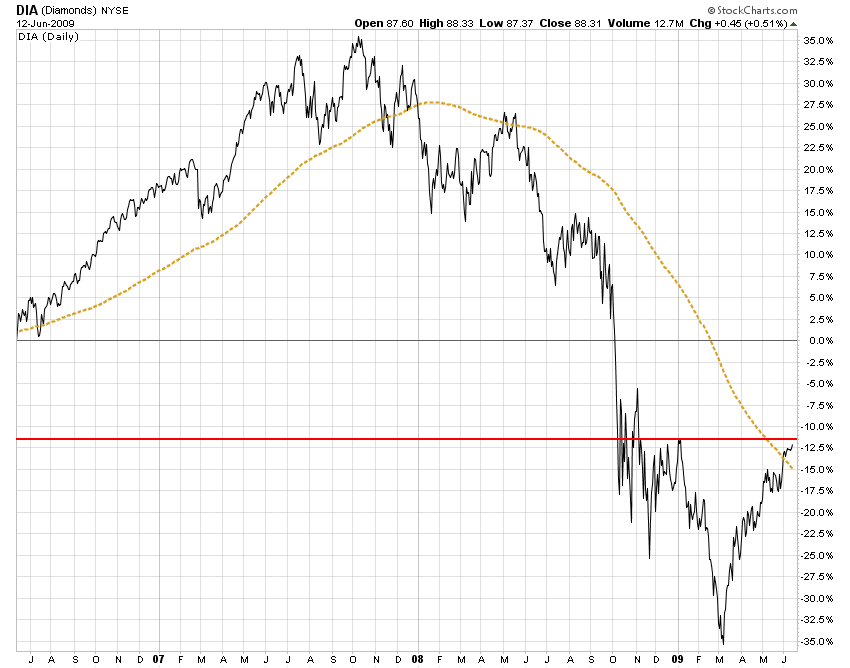

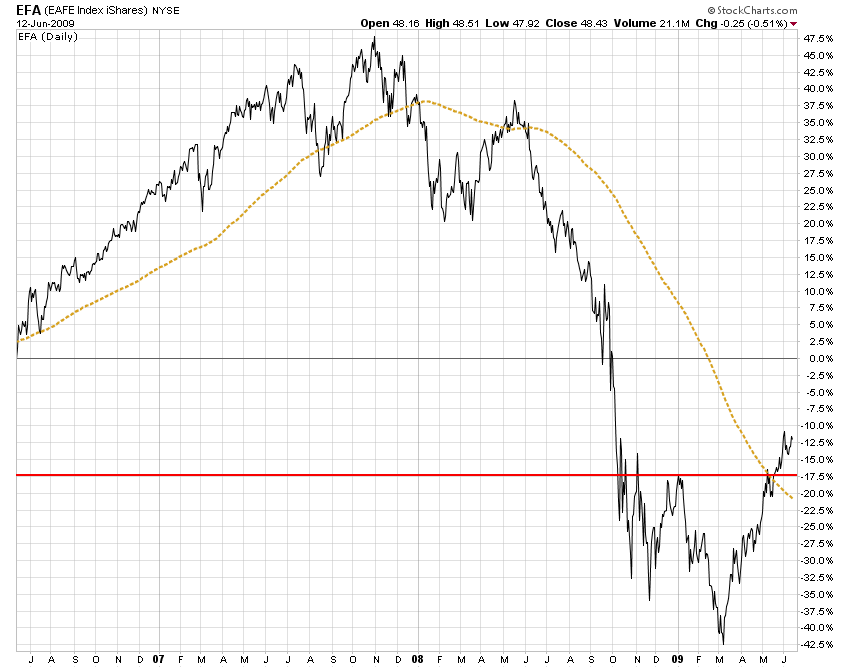

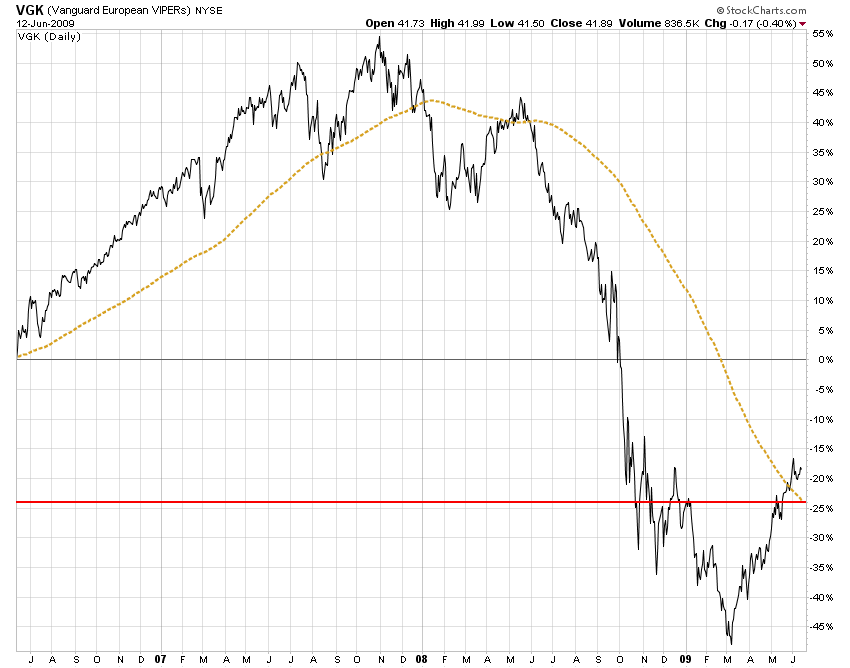

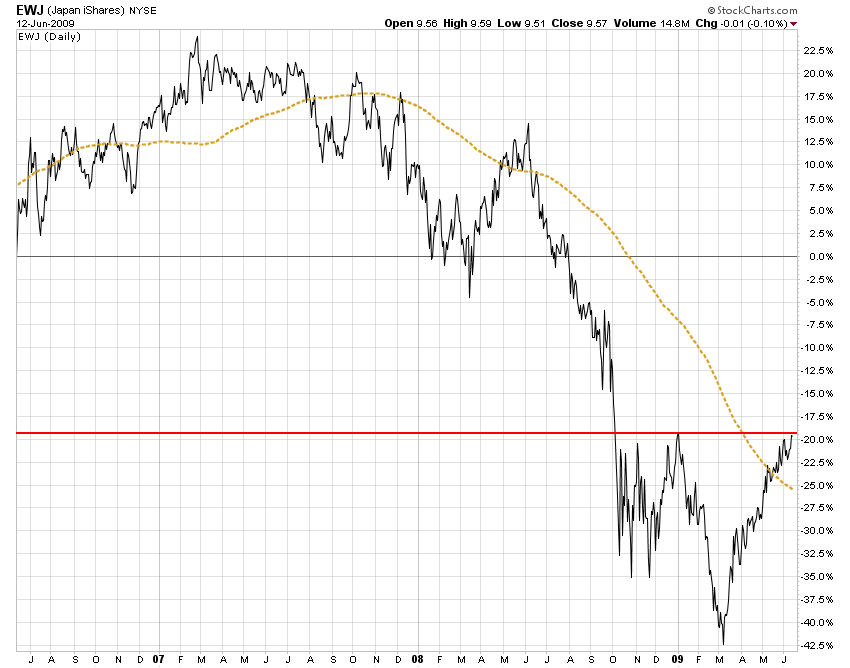

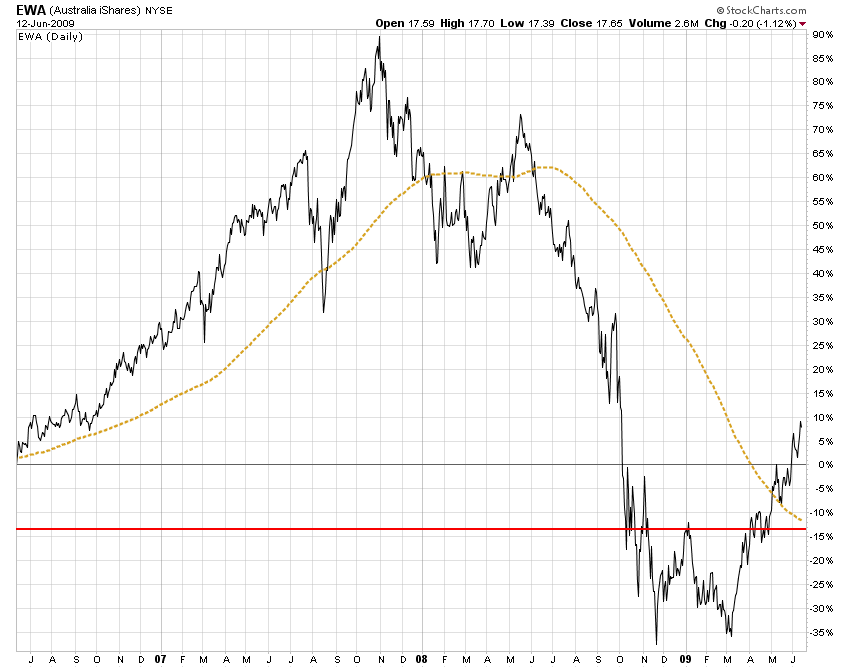

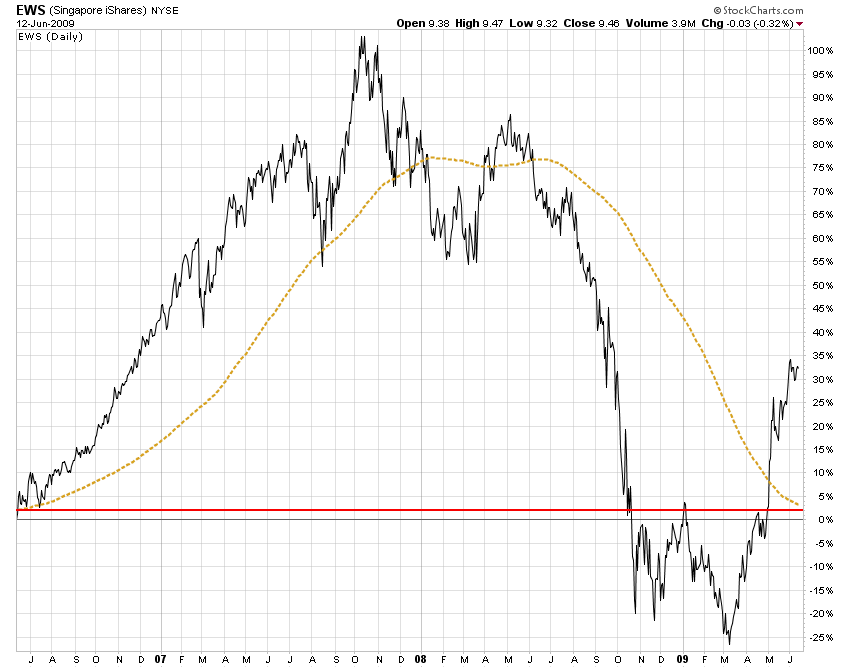

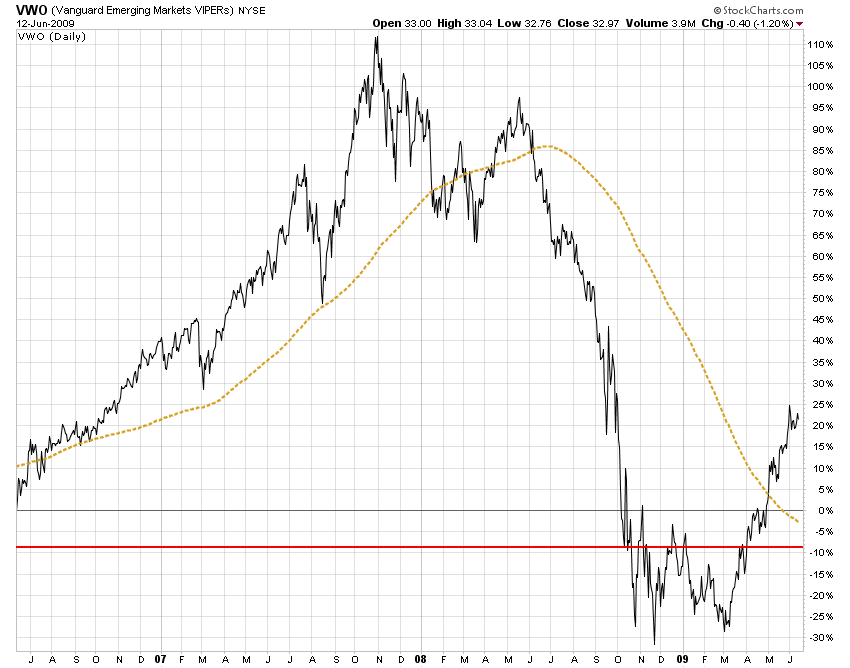

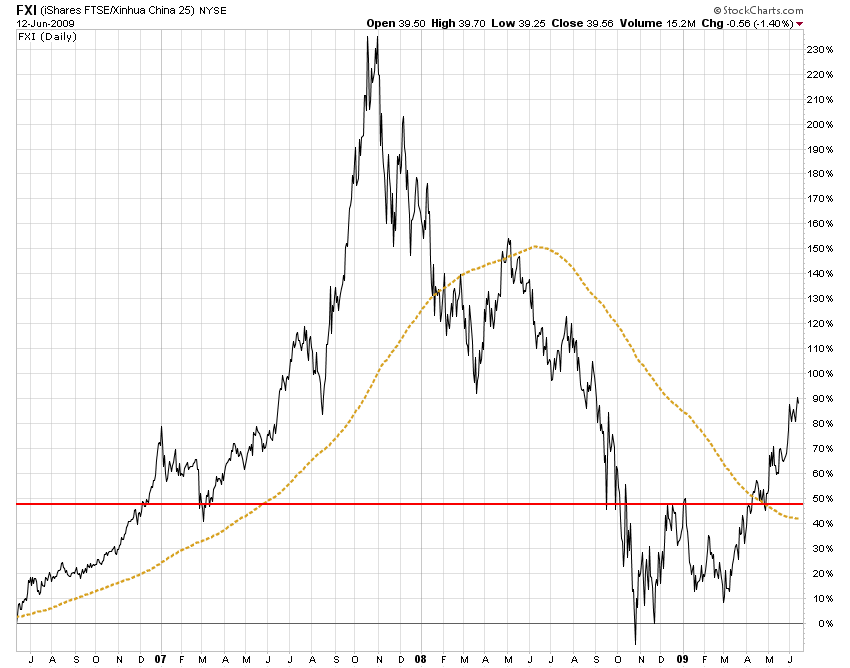

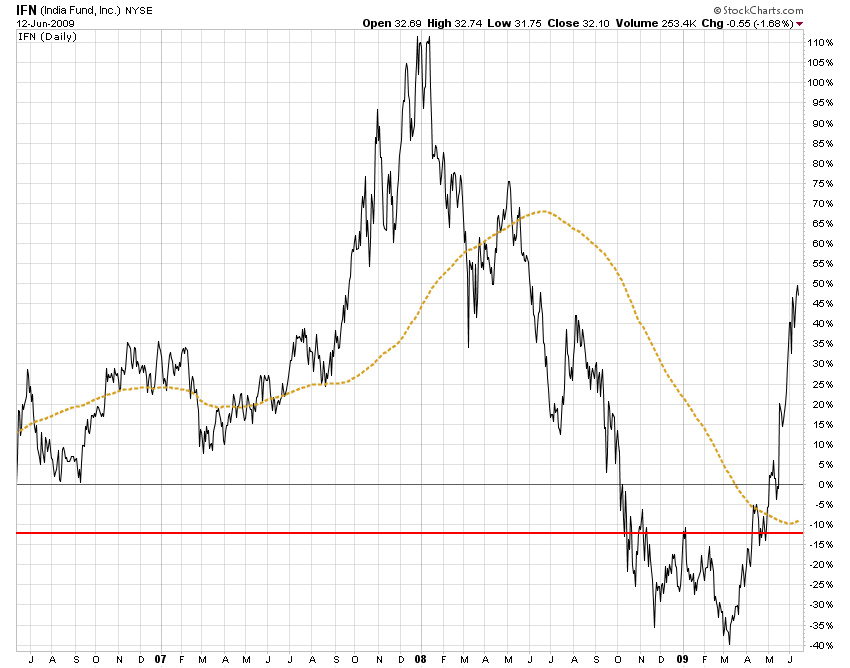

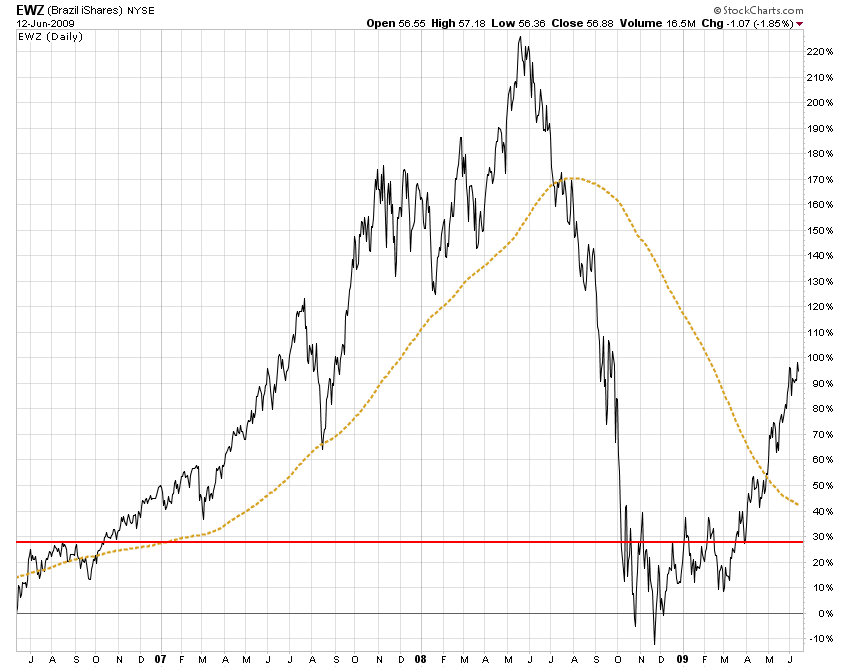

These charts may help keep wider perspective. They are three-year daily percentage performance charts that also show the 200-day simple moving average (a commonly used measure of the primary trend) and the year-end 2008 level.

The first thing you may notice is that exceeding year-end 2008 is far from where we once were both on the high and low side. In most instances the primary trend is still down (only India shows a little curl up recently by its 200-day average).

The second thing you may notice is the superior performance of emerging markets versus the US, European and Japanese stock markets. We included Singapore and Australia as key developed Asia markets, ex Japan. They are also attractive, emerging market related countries that have outperformed the US, Europe and Japan YTD.

While the fact that emerging markets are ahead of developed markets this year is not sufficient to justify long-term over-weighting, it is certainly suggestive of the thesis. More importantly, we subscribe to the Mohamed El-Erian / Mark Mobius / Jim Rogers concept that emerging markets are “where it’s at”, where it’s going and where it will be for a long time going forward.

Goldman Sachs makes similar projections about long-term GDP, where they expect emerging market economies to displace key developed markets in terms of their size rankings. Specifically, they expect China to have a larger GDP than the US by 2027.

In our view, the massive changes in the structure of the US economy arising out of the recent credit crisis, the political opportunism that has followed, and the unprecedented US debt that has resulted will only accelerate and assure the relative out-performance of non-US markets over the long-term.

The US is in for a long workout period trying to overcome its new debt load, and find a new equilibrium for the dynamics of all the changes to rights and processes that have occurred and are expected to occur within the economy. Emerging markets will get less boost from US consumers, but they have created some internal consumer momentum of their own that can carry them forward while financially exhausted US consumers struggle and readjust.

We have been recommending for several years, that within whatever equity allocation you may have, if you are a long-term investor not currently or soon living through withdrawals from your portfolio, you should consider substantially over-weighting emerging markets and under-weighting developed markets.

We have no idea whether stock markets are likely to retrench from here, and if they do, emerging markets would probably fall harder as they have risen more. However, over the long-term, we believe they will substantially outperform the US, Europe and Japan.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.