Metals and US Stock Indices Charts Analysis

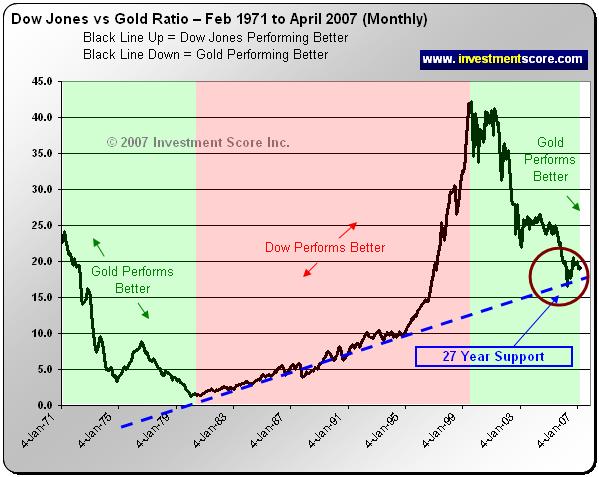

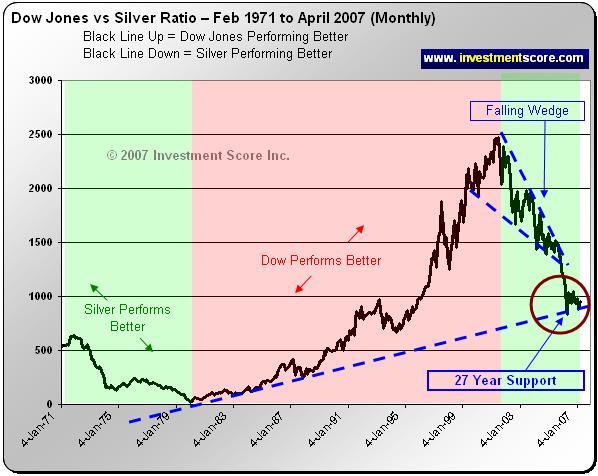

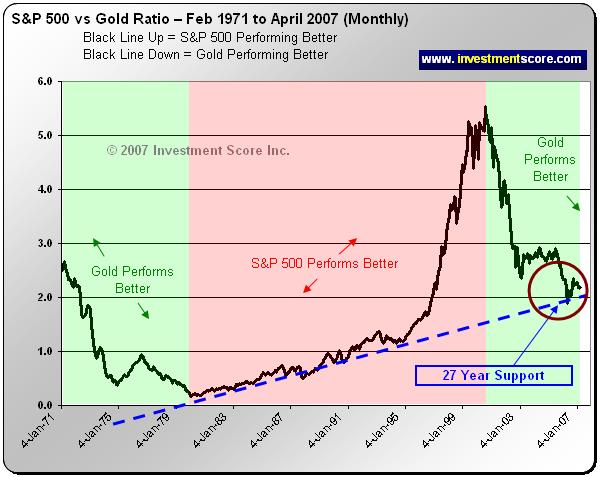

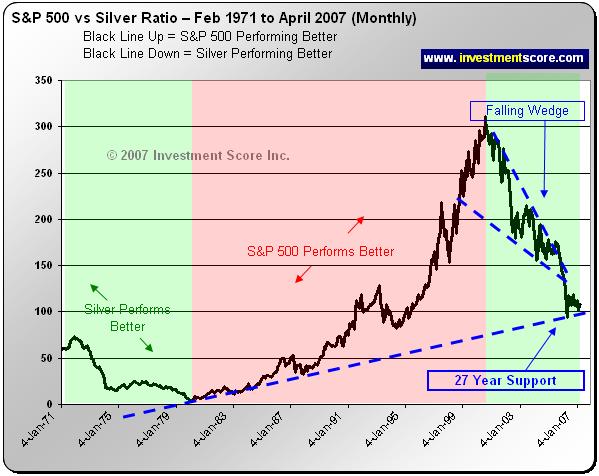

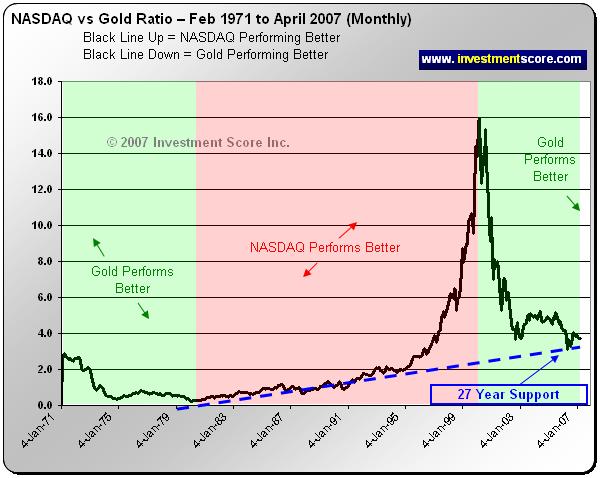

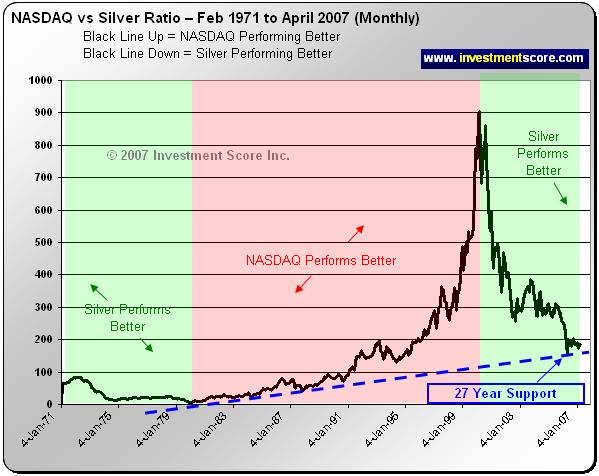

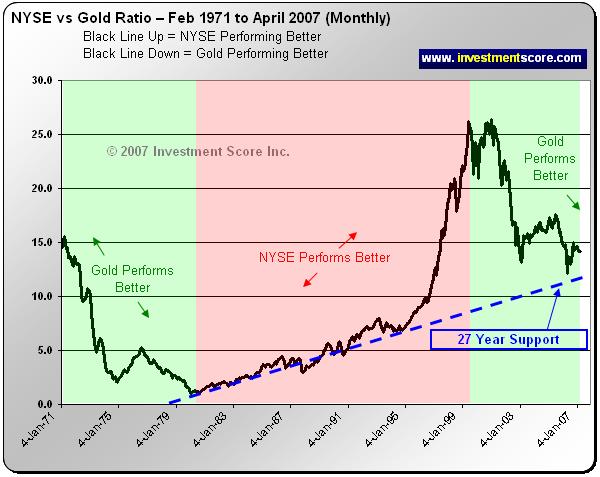

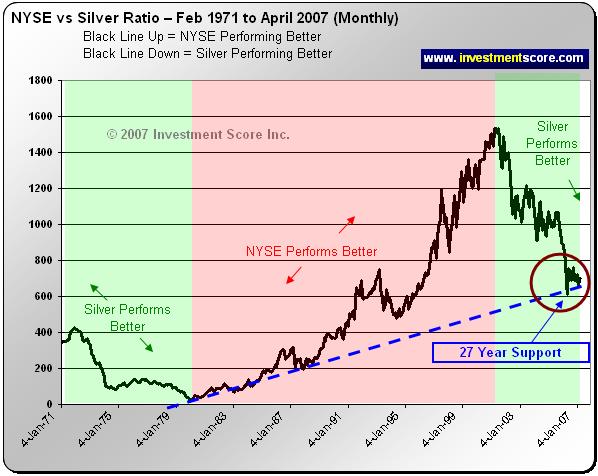

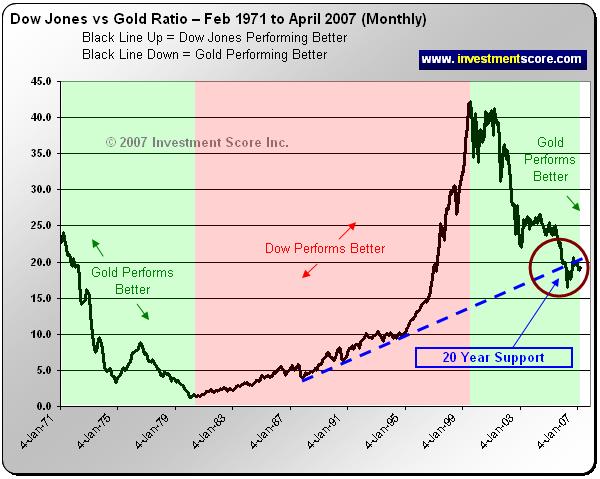

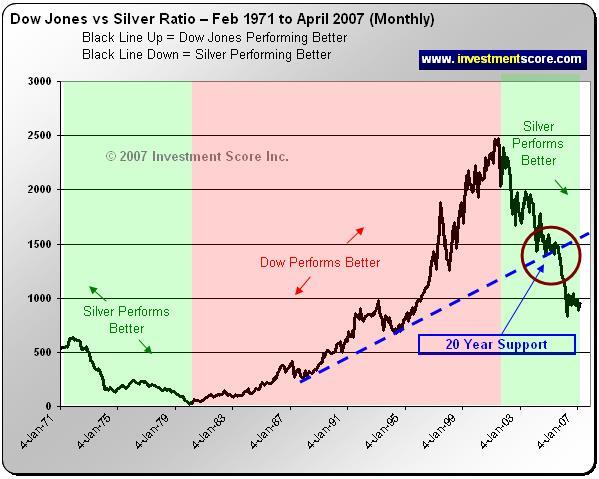

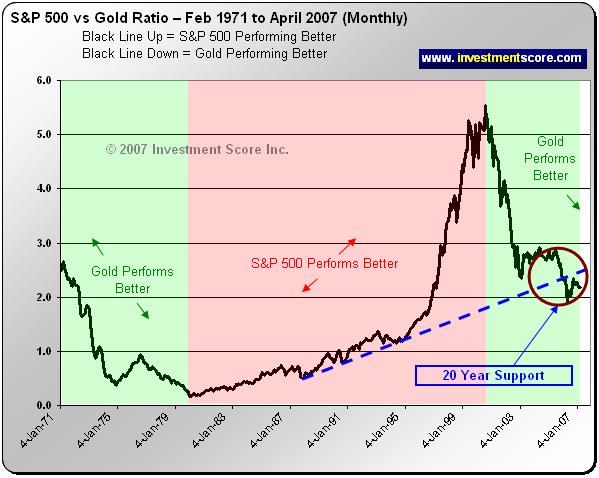

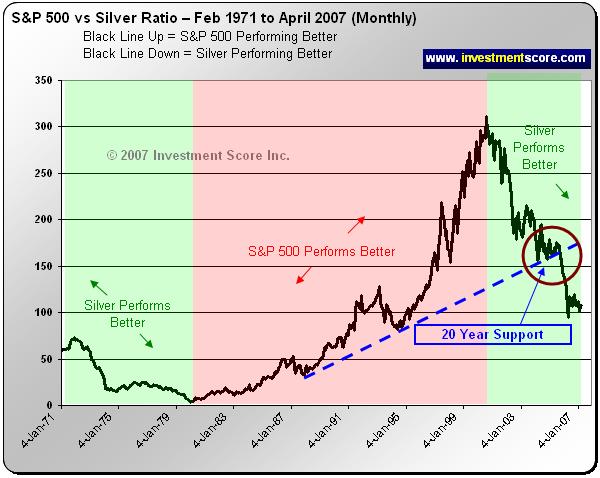

Stock-Markets / Financial Markets May 31, 2007 - 11:40 AM GMTIn this editorial we have incorporated long term charts for gold, silver and the Dow Jones Index with a twenty seven year support line.

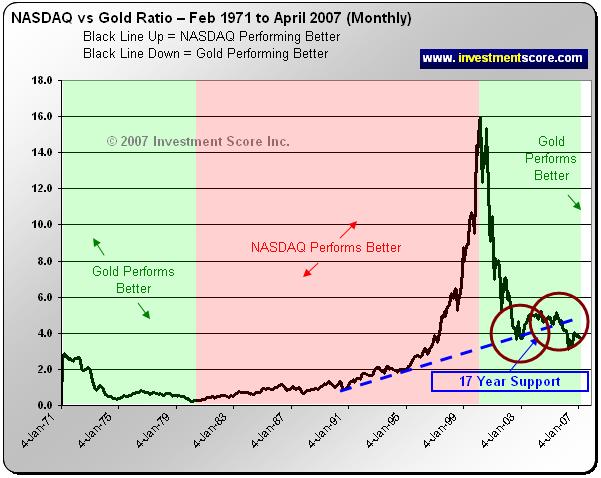

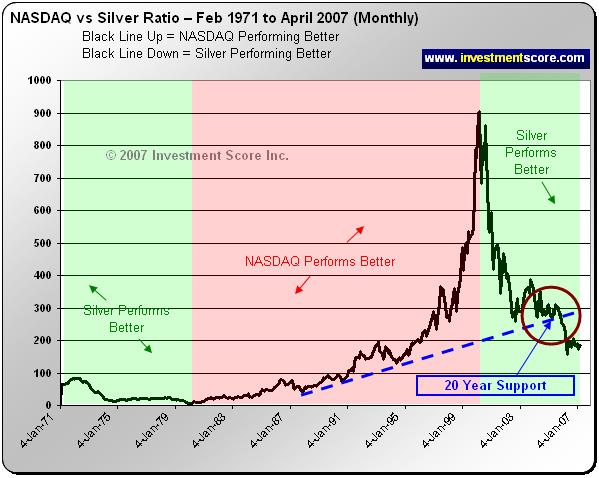

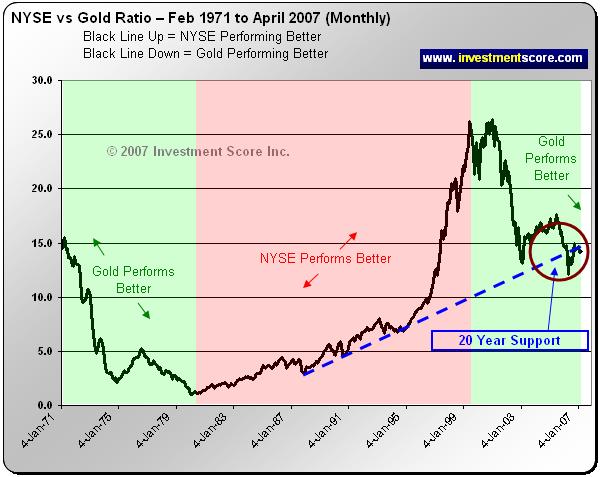

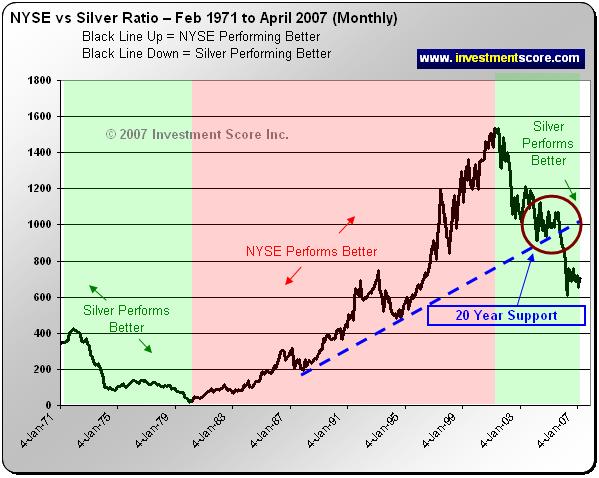

In the below charts you will notice:

- Dividing two markets together to create a ratio helps us determine which market is outperforming the other market. For example, in the chart above, when the black line heads higher, the NYSE is outperforming Silver and when the black line heads lower Silver is outperforming the NYSE.

- We used several US stock markets to give an overall picture of what is generally happening to US stocks when compared directly to silver and gold. Or conversely, what is happening to silver and gold in comparison to US stock markets.

- Each chart has a very long term support line of about 27 years. In technical analysis support lines are important as they usually represent key areas of support and resistance. When the price of a market approaches a support line it will regularly cause a market to pause or bounce higher. This support line represents a "line in the sand" where investors are ready to buy back a market as it hits this key psychological barrier and possible opportunity to make money. Often support lines are reached after long, aggressive price declines are ready for a key point to either rest or bounce off of it. We believe markets do not move in a straight line and therefore key turning points such as support lines are often used for counter rallies.

Also, as a general rule, the longer the line of support has been in place the more significance it carries. For example, a support line that has been in place for a few days is much less important than a support line that has been in place for a few years or in this case decades.

Additionally, in technical analysis, once a key support line has been broken that same line now becomes a line of resistance. What was once an invisible floor and barrier to the downside now becomes a ceiling and barrier to the upside. Once a support line is clearly broken the trend usually continues lower and the new resistance is not easily broken to the upside.

You may be wondering if these markets are landing on a key line of support that has existed for 27 years, why wouldn't these ratios bounce off of this support and start a new prolonged advance.

In the financial markets anything can happen. We think that the ratios will likely bounce off of these key lines of support. In fact you will notice that many of them have already bounced a few times along the line of support. But we believe that investing is about probabilities. Based on our observations of historical major market movements we have devised a set of guidelines to assist us in our investment decisions. We believe major market trends are like large swinging pendulums with huge momentum as massive amounts of capital flow from one asset class to another. In our opinion one major market trend will not end until an extreme is met in the direction traveled. You will notice the major trend from about 1980 to 2000 was for US stocks to outperform commodities. We now believe that major trend has reversed and will accelerate when these twenty seven year support lines are breached.

To help illustrate other key lines of support we have provided a second set of charts.

In the above set of charts you will notice:

- In most of the charts the falling ratios paused on the key twenty year support lines. Notice how many of them bounced for many months as the psychological barrier held as support for the declining ratio? The support line was a resistance area but not a launch pad for a new major advance.

- In most cases once the support line is clearly broken that line becomes resistance and the ratio does not break back through to the upside.

- The same question asked about the twenty seven year support line could be asked in regards to this twenty year support line. If a support line has been in place for twenty years why wouldn't that line of support hold and provide a base for a new US equities advance? History now tells us that the twenty year line of support was merely a place of rest or support to slow down the ratios decent before it headed lower to the twenty seven year support lines.

From a very short term perspective, a stronger stock market with softer, performing commodities is not a shock to us. After a great start to what we think is a major commodities bull market, we expect periodic slow downs, pull backs and breaks. We recognize that markets do not move in a straight line and expect corrections when market sentiment and enthusiasm gets overheated. When we keep the big picture in perspective, our investment decisions become easier and less stressful. When we look at the long term trends, the day to day price movements become nearly irrelevant. In the short term we may be experiencing a strong stock market with weaker commodities, but in the big picture the trend is clear in our opinion. We expect the twenty seven year support lines to be breached and once this occurs, we expect commodities to advance quickly. This is why we have been positioning ourselves in silver investments.

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.