The Hidden Higher Mortgage Lending Charge

Personal_Finance / Mortgages Jun 04, 2007 - 12:08 AM GMTBy: MoneyFacts

Julia Harris, mortgage analyst at Moneyfacts.co.uk – the money search engine, comments:“As more people are struggling to afford the substantial deposits required to take that first step on property ladder, it is commonplace for the mortgage advance to represent at least 90% of the property value for many first time buyers.

Julia Harris, mortgage analyst at Moneyfacts.co.uk – the money search engine, comments:“As more people are struggling to afford the substantial deposits required to take that first step on property ladder, it is commonplace for the mortgage advance to represent at least 90% of the property value for many first time buyers.

“Those borrowing over 90% loan to value will find that many lenders will hit them with yet another fee – a higher lending charge. Research by moneyfacts.co.uk has found 66% of all prime lenders will charge an additional fee for high loan to value mortgages, typically ranging between 7% and 8%, but it can reach as high as 12% in several cases. While a fee may only apply to LTVs in excess of, say 90%, most lenders will back charge this to a lower LTV of,75% to 80%.

“Being subjected to a HLC can prove a very costly addition to the fees already associated with house buying, and can more than wipe out the initial savings made on what was a competitive rate. But don’t be lulled into thinking that, by choosing a lender which does not charge a HLC you will not be faced with higher charges, as it may mean you pay a higher interest rate instead.

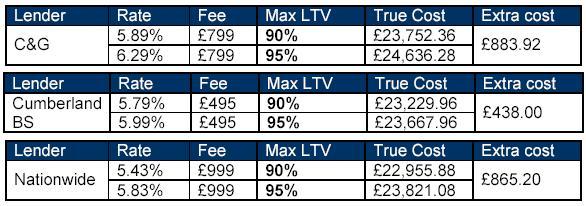

“The example below shows how a rate can increase depending on the LTV, based on 2 year fixed rate deals.

“While the headline rates and the lack of a higher lending charge may attract borrowers through the doors, the amount which they will actually repay could be very different. In the three examples above, in a two-year period this averages an extra £729 interest.

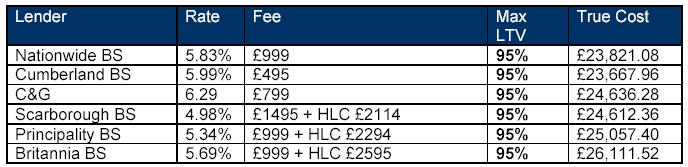

“As the example below shows, paying a HLC is still the more expensive option. Nonetheless, borrowing to a high loan to value, you will incur additional costs by way of increased rates or fees.

“While lenders can argue that HLCs and higher rates are paid for slightly different reasons, it makes no difference to the borrower where the extra costs ends up, either as an insurance or simply to reflect the higher risk. It’s still an additional cost to the borrower.

“So before jumping into a deal just because you won’t pay a HLC, it’s best to check out the full details of the deal. Ensure you know the total cost of your mortgage deal and take account of any fees which may be added to the loan or the term over which you may have to pay the inflated rate.

“Borrowing to high LTVs obviously presents a higher risk to the lender should house prices fall and the borrower finds themselves in financial difficulty. But with a rising housing market the risk must be fairly small, especially as this is backed up by the fact that more lenders prepared to lend 100% of the property price or more.

“Before stepping on to the housing ladder, try to save for a deposit, no matter how small. Having a deposit will open up a vast choice of mortgage products, more competitively priced deals and avoid you having to navigate the extra pitfalls associated with high value borrowing.

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.