Does Loose Monetary Policy Cause Economic Growth?

Economics / Economic Theory Sep 01, 2009 - 07:23 PM GMTBy: Frank_Shostak

At the Federal Reserve Bank of Kansas City's annual economic symposium, held in Jackson Hole, Wyoming on August 21, 2009, Ben Bernanke expressed satisfaction with the action that his administration undertook to save the financial system. According to Bernanke,

At the Federal Reserve Bank of Kansas City's annual economic symposium, held in Jackson Hole, Wyoming on August 21, 2009, Ben Bernanke expressed satisfaction with the action that his administration undertook to save the financial system. According to Bernanke,

History is full of examples in which the policy responses to financial crises have been slow and inadequate, often resulting ultimately in greater economic damage and increased fiscal costs. In this episode, by contrast, policymakers in the United States and around the globe responded with speed and force to arrest a rapidly deteriorating and dangerous situation.

History is full of examples in which the policy responses to financial crises have been slow and inadequate, often resulting ultimately in greater economic damage and increased fiscal costs. In this episode, by contrast, policymakers in the United States and around the globe responded with speed and force to arrest a rapidly deteriorating and dangerous situation.

Furthermore, argues Bernanke,

Without these speedy and forceful actions, last October's panic would likely have continued to intensify, more major financial firms would have failed, and the entire global financial system would have been at serious risk. We cannot know for sure what the economic effects of these events would have been, but what we know about the effects of financial crises suggests that the resulting global downturn could have been extraordinarily deep and protracted. Although we have avoided the worst, difficult challenges still lie ahead.

As a result of all the swift actions argues the Fed Chairman,

Critically, fears of financial collapse have receded substantially. After contracting sharply over the past year, economic activity appears to be leveling out, both in the United States and abroad, and the prospects for a return to growth in the near term appear good. Notwithstanding this noteworthy progress, critical challenges remain: Strains persist in many businesses and households continue to experience considerable difficulty gaining access to credit. Because of these and other factors, the economic recovery is likely to be relatively slow at first, with unemployment declining only gradually from high levels.

Most commentators are unanimous in their belief that Bernanke's Fed has prevented another Great Depression through swift monetary pumping.

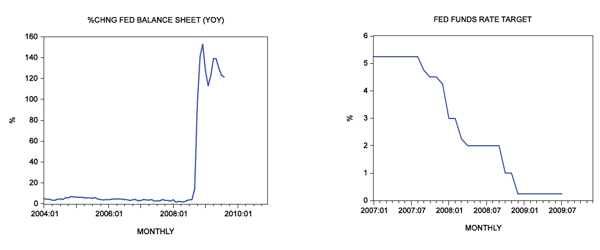

Since September of last year, the yearly rate of growth of the Fed's balance sheet (the pace of money pumping) has accelerated, climbing to 152.8% by December 2008 from 3.9% in August of that year. The federal funds rate target was lowered almost to zero from 5.25% in August 2007.

Figure 1

Can Money Pumping Stimulate Economic Growth?

According to Bernanke — and most economic experts — when an economy falls into a recession, the central bank can pull it out of the slump by means of money pumping. This way of thinking implies that money pumping can somehow grow the economy.

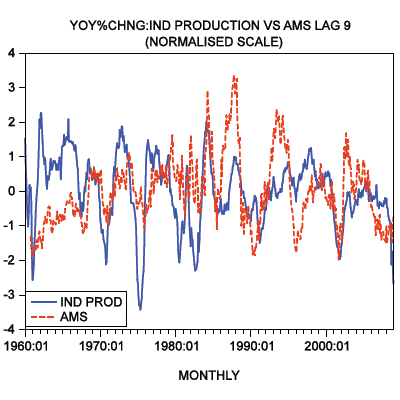

Indeed, US historical evidence supposedly does show that loose money policy seems to work. For instance, between 1960 and 2008 it took on average about nine months before increases in money supply caused increases in the rate of growth of industrial production (See Figure 2.)

Figure 2

The question is, how is this possible? After all, if printing money can grow the economy, then why not to print plenty of it and cause massive economic growth? By doing that, central banks could have by now created an everlasting prosperity for every individual on the planet.

For most commentators, the arrival of a recession is due to unexpected events such as shocks that push the economy away from a trajectory of stable economic growth. It is held that shocks weaken the economy, i.e., lower economic growth. We suggest instead that, as a rule, a recession or an economic bust emerges in response to a decline in the rate of growth of money supply.

Typically, this takes place in response to a tighter stance of the central bank. As a result, various activities that sprang up on the back of the previously strong rate of monetary growth — usually these emerge on account of a loose monetary policy by the central bank — come under pressure.

Note that these activities cannot fund themselves independently. They survive on account of the support that the increase in the money supply provides. The increase in money diverts to them real savings from wealth-generating activities. Consequently, this weakens wealth-generating activities.

A tighter stance by the Fed and the consequent fall in the rate of growth of money undermines various false activities. This precisely is what recession is all about. Recession, then, is not a weakening in economic activity as such, but rather is the liquidation of various non-productive activities that sprang up on the back of an increase in the money supply.

Why the GDP Framework Presents a Misleading Picture

Government statisticians present economic growth in terms of monetary expenditure data, such as gross domestic product (GDP) and industrial production. These indicators are designed in line with Keynesian thinking that spending equates to income — hence, more spending leads to a higher national income and therefore to a higher economic growth.

On this logic, a tighter monetary stance by the Fed leads to slower economic growth, while increases in the money pumping produce higher economic growth. A stronger rate of growth in the money supply leads to a stronger pace of expenditure, and therefore an increase in national income. The increase in overall income in the economy leads to a higher rate of growth in terms of GDP.

We suggest that in reality the exact opposite actually takes place. Printing more money weakens the wealth generators' ability to grow the economy, while a decline in the rate of growth of the money supply strengthens their ability to grow the economy.

Once the central bank raises the pace of money pumping in order to lift the economy from a recession, it arrests the demise of various false activities. It also gives rise to new false activities. An outcome of so-called economic "growth" here is thus nothing more than the strengthening of wealth consumers and a renewed pressure on wealth generators. All of this undermines the process of wealth generation and weakens the true economic growth.

Real Savings Fund Economic Activity

Irrespective of whether an activity is productive or nonproductive, it must be funded. At any point in time, the number and the size of activities that can be undertaken is determined by the available amount of real savings. From this we can infer that the overall rate of increase in productive and nonproductive activities as a whole is set by the rate of expansion in the pool of real savings.

Observe that this runs contrary to the GDP framework, where the pace of monetary expenditure — i.e., money pumping — sets the pace of so-called economic growth. This common line of thinking, however, doesn't make much sense. After all, individuals (whether engaged in productive or nonproductive activities) must have access to real savings in order to sustain their life and well being.

Money as such cannot sustain individuals; it can only fulfill the role of the medium of exchange. According to Rothbard,

Money, per se, cannot be consumed and cannot be used directly as a producers' good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing.[1]

As long as wealth producers can generate enough real wealth to support productive and nonproductive activities, loose-money policies will appear to be successful. (Observe that loose fiscal policies are similar to money policy, since they also impoverish wealth generators.)

Over time, a situation may emerge where — as a result of persistent loose monetary and fiscal policies — there are not enough wealth generators left, as they have been badly damaged by loose policies. Consequently, generated real savings are not large enough to support an increase in economic activity. Once this happens, the illusion of loose monetary policy is shattered , and real economic growth must come under pressure.

(Under such conditions, it would be difficult to show economic growth even in terms of GDP. The only reason why GDP might "grow" in such an event would be through the employment of misleading price deflators.)

The government attempt to boost the rate of growth of GDP by raising its expenditure must also fail if the supply of real savings is dwindling. After all, government activities also require real savings. (Remember, every activity, irrespective of whether it is productive or nonproductive, must be funded).

If the government persists with its aggressive stance, it will only make things much worse, as it continues to deprive funding from wealth-generating activities. Likewise, if the Fed accelerates its monetary pumping while the pool of real savings is declining, it runs the risk of severely damaging the pool of real savings even further.

It is clear, then, that those commentators who subscribe to the view that the acceleration of money pumping can fix things hold that something can be created out of nothing.

From all of this, we can deduce that there is no such thing as stimulatory policies that can grow the economy. Neither the Fed nor the government can grow the economy. All that stimulatory policies can do is to redistribute real savings from wealth producers to nonproductive activities. And these policies encourage consumption that is not supported by useful production.

The Fed's Loose Monetary Policies Have Weakened Wealth Producers

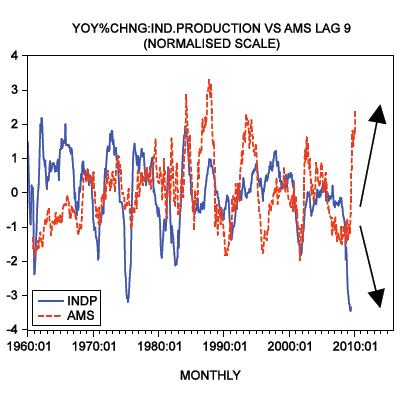

As a result of all the massive pumping by the Fed, the yearly rate of growth of our monetary measure AMS jumped from 0.7% in May 2007 to 14% by July.

Yet, despite all of this pumping, the growth momentum of industrial production remains in free fall. (Note the massive gap between the growth momentum of AMS and the growth momentum of industrial production in Figure 3.)

Figure 3

This very large gap raises the likelihood that the pool of real savings could be in trouble. If what we are saying is valid, then true, real economic growth is likely to struggle in the months ahead. (Remember, without a growing pool of real savings no economic growth is possible.)

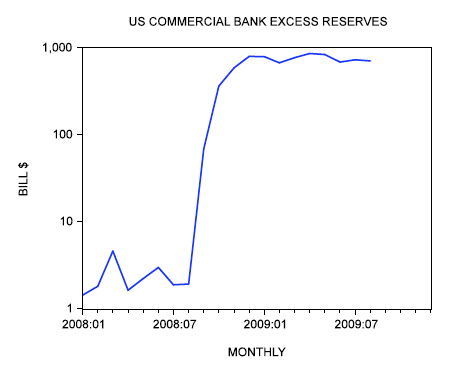

As a rule, monetary pumping "works" through the commercial bank expansion of credit. The increase in commercial bank reserves on account of the Fed's pumping gets amplified by means of credit expansion. At present, banks are finding it more attractive to sit on the massive pile of cash reserves rather than lend them out. So far in August, bank excess reserves stood at around $700 billion — against $1.9 billion in August last year.

The banks are still in the process of trying to fix their balance sheets. They are also having trouble finding viable borrowers — i.e., wealth generators. All of this raises the likelihood that the process of wealth formation is itself in trouble.

Figure 4

Observe that if the pace of wealth generation had been rising, banks would have been very active in securing for themselves a growing slice of the expanding real wealth.

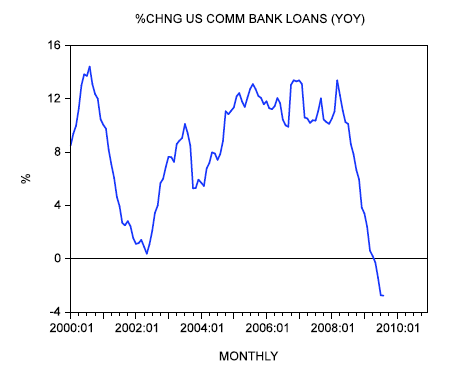

Obviously, banks could become very active by pushing lending to non-wealth-generating activities. However, this is not likely to happen soon, given that banks have already accumulated a massive amount of bad-quality assets. The latest data indicates that banks are still very tight. Year-on-year commercial bank lending has fallen by 2.8% so far in August after declining by 2.7% in July. (See Figure 5.) This was the fourth consecutive monthly decline.

Figure 5

Conclusions

At the Kansas City Fed's annual economic symposium, the chairman of the Federal Reserve expressed his satisfaction with the action that his administration undertook to save the financial system. Historical evidence supposedly supports the view that loose monetary policy can pull the US economy out of recession.

However, we suggest that so-called economic growth in response to loose policy, as reflected in terms of data such as GDP and industrial production, simply mirrors the monetary expenditure rate of growth — and not true, real economic growth. Since these indicators reflect monetary expenditure, the more that money is pumped by the Fed, the larger the so-called economic growth is going to be.

Over time, a situation can emerge where, as a result of persistent loose monetary and fiscal policies, there are not enough wealth generators left. Consequently, generated real savings are not large enough to support an increase in economic activity. In this situation, neither loose monetary policy nor loose fiscal policy can "work." We suspect that such a situation may be developing now.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See his article archives. Comment on the blog.![]()

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.